TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

SNAP Inc Stock

Price Falls After Meta Earnings Miss!

Exiting

Before Earnings Pays-Off!

And, “Weekly Options USA” Members are Up 214%

Using A Weekly put Option!

Don’t

Miss Out On Further Profit!

Friday, February 04, 2022

by Ian HarveyShares of Snap Inc (NYSE:SNAP) took a dive Thursday due to Meta Platform missing earnings expectations. However, this provided a great exit time for Members to profit.

And, “Weekly Options USA” Members, are up 214% using a weekly put option!

Don’t

miss out on further profit!

Snap Inc. (NYSE:SNAP)

Shares of Snap Inc took a dive Thursday due to Meta Platform missing earnings expectations.

Investment bank KeyBank analyst Justin Patterson, announced Thursday morning that it is cutting its price target on Snap stock by more than half, and it pointed to Meta Platforms' earnings report as part of the reason. Despite maintaining an overweight rating on the stock, it sees "ongoing ad measurement headwinds" driving shifts out of social media, and warns that Snap will also suffer "margin pressure from investment."

Shares of Snap fell more than 19.4%.

Here is an article we wrote on Monday, January 31, 2022.....

“Snap Inc. Earnings Expectations!”

Members

Profits on the SNAP Trade Explained.....

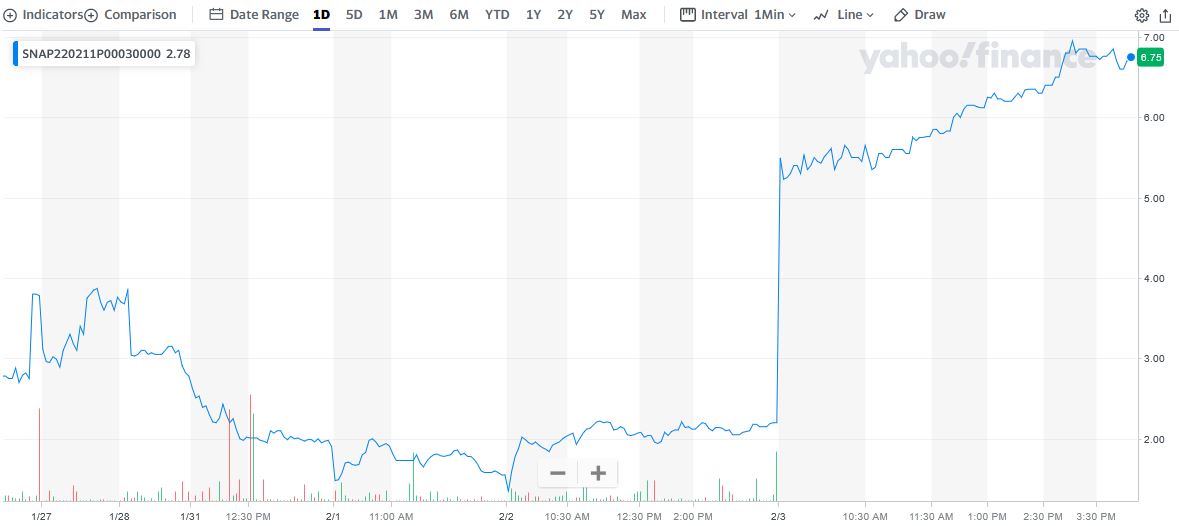

Weekly Options USA Members entered this trade on Monday, January 31, 2022 for approximately $2.21; and the stock struggled to make headway throughout the week.

However, due to Meta stock crashing, Snap Inc stock also fell in sympathy – which provided Members to exit with a decent profit on Thursday!

As at the end of trading yesterday members were up 214%.

In other words, 1 SNAP option contract would have returned 474% potential profit for an outlay of $221.

To view the actual trade sent to members CLICK HERE.

About Snap.....

Snap Inc

engages in the operation of its camera platform.

Its products

include Snapchat, using the camera and editing tools to take and share Snaps,

Friends Page, which lets users create and use Stories, Groups, Video and Chat,

Discover for searching and surfacing relevant Stories, Snap Map, which shows

friends, Stories and Snaps near the user, Memories, for saving personal

collections, and Spectacles, wearable sunglasses capable of taking Snaps and

interacting directly with the Snapchat application. The firm's primary source

of revenue is advertising.

The company was founded by Frank Reginald Brown IV, Evan Thomas Spiegel, and Robert C. Murphy in 2010 and is headquartered in Santa Monica, CA.

The Influencing Factors For A Successful SNAP Inc Trade…..

Besides Meta’s drastic report, social media stocks, which derive almost all their revenue from advertising, have been under pressure ever since Apple (AAPL) made changes in late April to its smartphone operating system.

KeyBanc Capital Markets is also cautious on social-media stocks following Meta’s report, cutting its price targets on Snap Inc. The firm sees “ongoing ad measurement headwinds driving shifts out of social.”

KeyBank says that it worries investors won't pay as high a multiple for Snap's sales. Patterson said he sees headwinds, including ad measurement driving shifts away from social, vertical headwinds, and margin pressure from investment.

The analyst also cautions that the extent of margin risk could be a new sentiment overhang but believes valuation multiples have swung significantly, which will leave room for the company's earnings results to be "less bad."

Other concerns are…..

Summary.....

After market close Thursday Snap Inc presented its earnings, which, for the first time in its 11-year corporate history, the company behind Snapchat had a quarterly profit.

In the fourth quarter of 2021, Snap Inc turned a profit using GAAP measures. Snap earned $23 million in the quarter, compared with a loss of $113 million in the fourth quarter of 2020.

Snap’s quarterly revenue, meanwhile, grew 42% year over year to $1.3 billion.

Unlike Facebook, daily users on Snap Inc increased, by 24% from the year-ago quarter to 319 million.

Also, Snap came out with quarterly earnings of $0.22 per share, beating the Consensus Estimate of $0.09 per share.

“Snapchat is clearly not as prone to the ‘TikTok effect’ as Meta,” said Insider Intelligence principal analyst Jasmine Enberg, who noted much of the app’s growth came from India, where TikTok is currently banned.

The news came amid a tumultuous week for social media stocks. Snap stock price was up more than 20% in after-hours trading.

Therefore…..

Exiting the trade before the earnings, when in decent profit, certainly paid off!

We Have Had A Successful SNAP Inc Trade With A Put Option!

What Further SNAP Inc Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from SNAP Inc