TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, January 31, 2022

Weekly Options Trade – QUALCOMM, Inc. (NASDAQ:QCOM) Calls

Thursday, February 03, 2022

** OPTION TRADE: Buy QCOM MAR 04 2022 200.000 CALLS - price at last close was $7.55. (However, this stock is down pre-market by 3.70% at the time of writing; therefore, you should find a much cheaper entry price - adjust accordingly)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $10.50. (50% Profit if a $7.00 entry price)

Include a protective stop loss of $2.80. (60% loss based on $7.00 entry price)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

It's been a tough start to the year for many of the best tech stocks, hurt in part by a sharp rise in the 10-year Treasury yield as the Federal Reserve gets ready to hike interest rates.

QUALCOMM, Inc. (NASDAQ:QCOM), the biggest maker of chips that run smartphones, slipped in late trading after efforts to expand beyond its main business were hampered by chip shortages in the latest quarter.

Qualcomm’s fiscal first-quarter results sent the shares down about 2.3% in late trading, despite the company giving an upbeat forecast for the current period. Revenue will be $10.2 billion to $11 billion, Qualcomm said, compared with an average analyst estimate of $9.59 billion. Earnings will be at least $2.80 a share, well ahead of the $2.48 projection.

Qualcomm chips are appearing more in tablets, virtual-reality headsets and wearable devices. In industrial applications, the company’s products can be found in energy metering, warehouse logistics systems and retail point-of-sale equipment.

Like many other chipmakers, Qualcomm outsources production to companies such as Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. A surge in demand has left these foundries unable to keep up. Amon has said that he expects to be able to get more supply in the second half of 2022.

The company is unique in the industry because a large chunk of its profit comes from technology licensing. Makers of phones pay to use Qualcomm’s technology, regardless of whether they buy its chips, because the company owns patents that cover some of the fundamentals of mobile communications.

Qualcomm said Wednesday that Android devices -- rather than Apple -- fueled its sales gain in the smartphone market.

Revenue has

the potential to top $46 billion by fiscal year 2024, Qualcomm Chief Financial

Officer Akash Palkhiwala said at a company event late last year. That was above

analysts’ projections at the time.

About Qualcomm…..

Headquartered in San Diego, CA, Qualcomm Incorporated designs, manufactures and markets digital wireless telecom products and services based on the Code Division Multiple Access (CDMA) technology.

It operates through the following segments: Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL), and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and system software based on technologies for the use in voice and data communications, networking, application processing, multimedia, and global positioning system products. The QTL segment grants licenses and provides rights to use portions of the firm's intellectual property portfolio. The QSI segment focuses on opening new or expanding opportunities for its technologies and supporting the design and introduction of new products and services for voice and data communications.

The company was founded by Franklin P. Antonio, Adelia A. Coffman, Andrew Cohen, Klein Gilhousen, Irwin Mark Jacobs, Andrew J. Viterbi, and Harvey P. White in July 1985 and is headquartered in San Diego, CA.

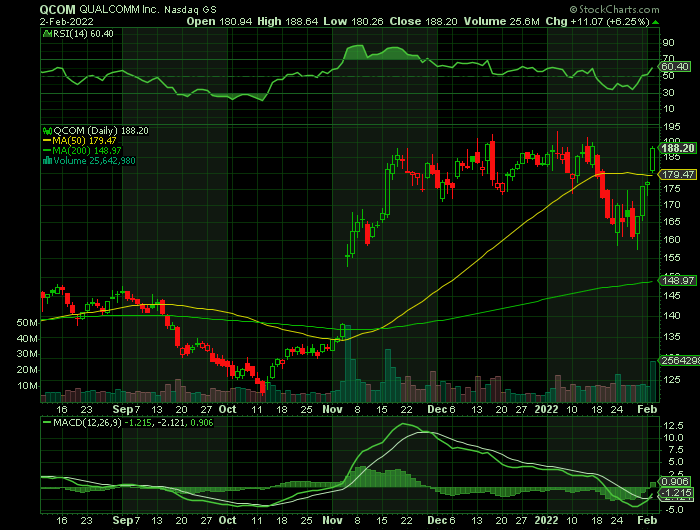

During the regular session Wednesday, Qualcomm stock jumped 6.3% to close at 188.20.

major CatalystS for This OPTIONS Trade.....

Networking chipmaker Qualcomm has added about 14.5% to its share price over the past 12 months, but it has been a struggle. In mid-October, the stock price was down 27.5%. Since then, the stock is up 43.5% and even posted a new 52-week high in early January before the tech stock sell-off began.

Earnings.....

Qualcomm came out with quarterly earnings of $3.23 per share, beating the Consensus Estimate of $3.01 per share. This compares to earnings of $2.17 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 7.31%. A quarter ago, it was expected that this chipmaker would post earnings of $2.26 per share when it actually produced earnings of $2.55, delivering a surprise of 12.83%.

Over the last four quarters, the company has surpassed consensus EPS estimates four times.

Qualcomm posted revenues of $10.71 billion for the quarter ended December 2021, surpassing the Consensus Estimate by 2.45%. This compares to year-ago revenues of $8.24 billion. The company has topped consensus revenue estimates four times over the last four quarters.

"Our record quarterly results reflect the strong demand for our products and technologies," Chief Executive Cristiano Amon said in a news release. "We are at the beginning of one of the largest opportunities in our history, with our addressable market expanding by more than seven times to approximately $700 billion in the next decade. Our one technology roadmap positions us as the partner of choice for both mobile and the connected intelligent edge."

China Smartphone .....

The company has benefited from the exit of Huawei Technologies from the smartphone market, which has led other Chinese phone brands - including Xiaomi, Honor and Oppo - to turn to Qualcomm for their chip needs.

"Android is driving the growth," Qualcomm chief financial officer Akash Palkhiwala told Reuters. In the first quarter, handset revenues rose 42% year-over-year to $6 billion, driven by greater than 60% growth in revenues from Snapdragon chipsets for Android devices.

The shifting Chinese market had given Qualcomm "tremendous opportunity... and we're capitalizing on it," said Palkhiwala.

He said during an earnings call that the second half of the fiscal 2022 year is "shaping up" like the second half of fiscal 2021, with "very strong year over-year-growth rates."

Net income in the first quarter rose to $3.69 billion, or $3.23 per share, from $2.51 billion, or $2.17 per share, a year earlier. Palkhiwala forecasted over 30% of non-GAAP EPS growth in the third quarter.

Other Influencing Factors.....

The chip giant's Nov. 3 earnings report turned a lot of heads. Strong results fueled a breakout from a 40-week consolidation. QCOM held gains after that and made an initial stand at its 10-week line in January, but support eventually gave way. With the stock market in a correction, QCOM has been consolidating gains above the 150 level, which happens to correspond close to QCOM's 200-day moving average.

In early November, QCOM reported quarterly profit that jumped 76% from the year-ago quarter. Revenue increased 12% to $9.34 billion, helped by a 56% jump in smartphone chip sales. Revenue guidance for the current quarter was also strong at $10 billion to $10.8 billion, above the consensus at the time of $9.68 billion.

Qualcomm's Internet of Things business, which provides low-power chips to connect devices to the internet, also showed strong growth, with revenue up 66% to $1.5 billion.

Its sales of radio frequency (RF) front-end chips, required to connect to 5G networks, grew 45% to $1.24 billion. The company expects to provide chips for as many as 550 million 5G smartphones in 2022, down slightly from prior guidance.

Qualcomm sees big growth ahead as the company branches out into new markets targeting automobiles, PCs, mobile computing and the metaverse. Qualcomm thinks its market capitalization can go from $200 billion currently to around $700 billion in just a few years.

Analysts.....

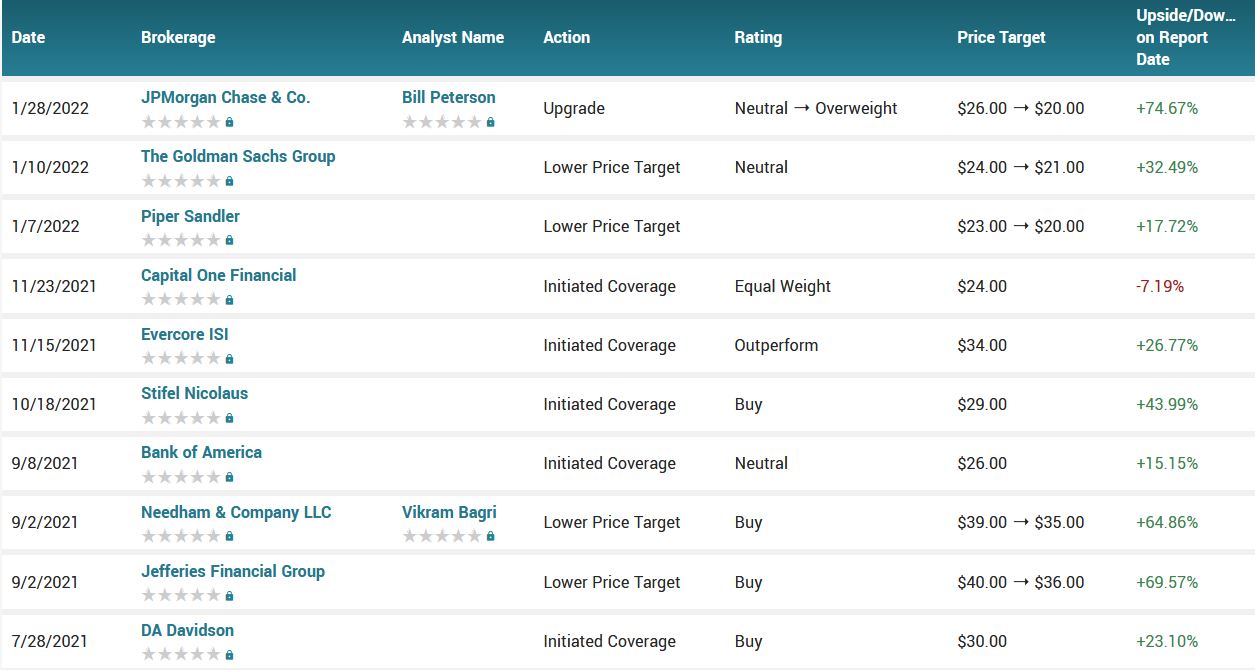

JPMorgan analyst Samik Chatterjee reiterated an Overweight rating on Qualcomm Inc (NASDAQ: QCOM) with a $225 price target, ahead of the company's fiscal Q1 results. The price target implies an upside of 28%.

The analyst sees a favorable setup saying Apple Inc's (NASDAQ: AAPL) print points to solid demand for Qualcomm's largest customer.

The combination of supply chain easing, share gains with android customers, favorable pricing trends, as well as growth drivers from non-smartphone end-markets will enable Qualcomm to deliver above-seasonal and better than expected revenue in fiscal Q2.

He believes the shares are positioned as a top pick "with earnings upside and inexpensive valuation."

As well, Futurum Research Principal Analyst Daniel Newman says Qualcomm is “firing on all cylinders” with record earnings.

Its growth across industries and strong demand, sales boosts, and supply chain constraints in the chip space is excellent.

According to the issued ratings of 21 analysts in the last year, the consensus rating for QUALCOMM stock is Buy based on the current 9 hold ratings and 12 buy ratings for QCOM. The average twelve-month price target for QUALCOMM is $183.95 with a high price target of $225.00 and a low price target of $137.00.

Summary.....

Still, Qualcomm shares fell about 6% in after-hours trading as the results were overshadowed by Facebook owner Meta's weaker-than-expected profit and forecast.

However, this result is improving as we get closer to the trading session today.

Weekly Options Trade – ChargePoint Holdings Inc (NYSE: CHPT) Calls

Wednesday, February 02, 2022

** OPTION TRADE: Buy CHPT MAR 04 2022 14.500 CALLS - price at last close was $1.16. (However, this stock is moving up pre-market – adjust accordingly)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $2.30. (100% Profit)

Include a protective stop loss of $0.45. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Volatility is way up. January brought us a market correction to start out 2022 – but then the last three trading sessions saw impressive daily gains. Investor sentiment is getting a boost from a generally positive earnings season, but Dubravko Lakos-Bujas, JPMorgan's global head of equity research, has identified some additional support for the markets.

“[The] Fed is likely to strike a more dovish tone relative to extreme investor expectations, which could trigger an equity rebound. Expectations are so hawkish at this point, we believe the bar for a positive surprise from the Fed at the current juncture is fairly low,” Lakos-Bujas noted.

The stock analysts at JPMorgan are following the strategy team’s lead, and finding stocks with a bullish outlook going on from here. One such stock is ChargePoint Holdings Inc (NYSE: CHPT), a leader in the EV charging network ecosystem in both the US and in Europe.

ChargePoint had a good year last year, as far as the top line shows. Revenues rose in 2021, and the 3Q results – the last reported – came in at $65 million, for a 79% year-over-year increase. In the wake of the strong revenue result, the company raised its full-year 2021 revenue estimate to the range of $235 million to $240 million, a 3.2% increase at the midpoint.

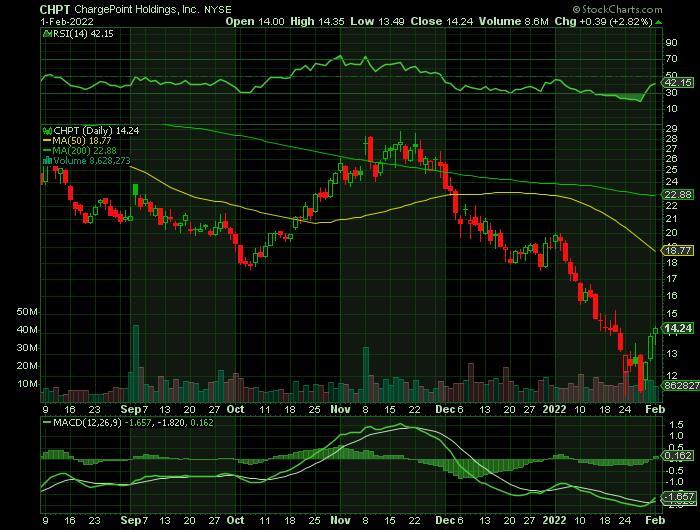

Despite rising sales, ChargePoint’s stock is down. The shares were volatile in 2021, but the falling-off trend was clear – and CHPT is down 63% in the last 12 months.

However, Monday saw ChargePoint close the day nearly 10% higher. Shares of the operator of an electric vehicle (EV) charging network benefited from an award from a notable U.S. consulting company.

About ChargePoint…..

The transition of Switchback Energy Acquisition (NYSE:SBE) fulfilled its purpose as a special purpose acquisition company (SPAC) and ChargePoint Holdings Inc (NYSE: CHPT) went public on March 1. So now, the company is trading on the New York Stock Exchange as CHPT stock.

CHPT stock used to be SBE stock. And since it was a SPAC stock, it stayed close to the $10 level for a number of months in 2020.

Switchback shot up by more than 250% in 2020. And ChargePoint distinguishes itself as one of the oldest and largest electric vehicle charing networks out there. ChargePoint’s 5,000+ commercial fleet customers include more than three-fourths of the Fortune 50 companies, and its 163,000+ networked charging points give it a 70% market share in the North American and European networked EV charging markets.

Once the public learned that Switchback was planning to merge with a company involved in the electric vehicle sector, the bulls really started charging ahead.

They ran the share price up to a 52-week high of $49.48 on Dec. 24 of 2020. However, SBE/CHPT stock started to decline after that.

major CatalystS for This OPTIONS Trade.....

ChargePoint has built an extensive EV charging network across North America and is now expanding in Europe.

It focuses on developing software-led charging solutions which it provides to customers to provide charging wherever they may need it. It complements its offering with robust cloud and subscription-based software services.

Customers join its charging network and can seamlessly scale their EV adoption anytime. With this distinct growth strategy, ChargePoint has rapidly expanded its reach and effectively secured its position as the leading end-to-end solution provider for EV charging, leading to its place as the first publicly traded charging company with a global footprint.

Frost & Sullivan.....

Frost & Sullivan, named ChargePoint the winner of its Best Practices Market Leadership award in Europe's EV charging market on Monday.

Frost & Sullivan was impressed that ChargePoint has carved out the highest market share on that continent, out of the more than 18 charging companies it surveyed.

ChargePoint said in a press release touting its award that Frost & Sullivan believed it "offers a robust portfolio of hardware, software, and support services catering to commercial, fleet, and residential EV customers."

The company is indisputably a major player in these relatively early days of EV charging networks. It has over 163,000 charging points that are operational; of these, 45,000 are in Europe, an important market for the company.

"ChargePoint's brand strength, product differentiation, customer ownership experience, and successful growth strategy cement its position as a market leader and will continue to strengthen its brand and presence in the EV charging space," explained Prajyot Sathe, Research Manager. With its strong overall performance, ChargePoint earns the 2021 Frost & Sullivan Market Leadership Award.

JPMorgan’s Viewpoint .....

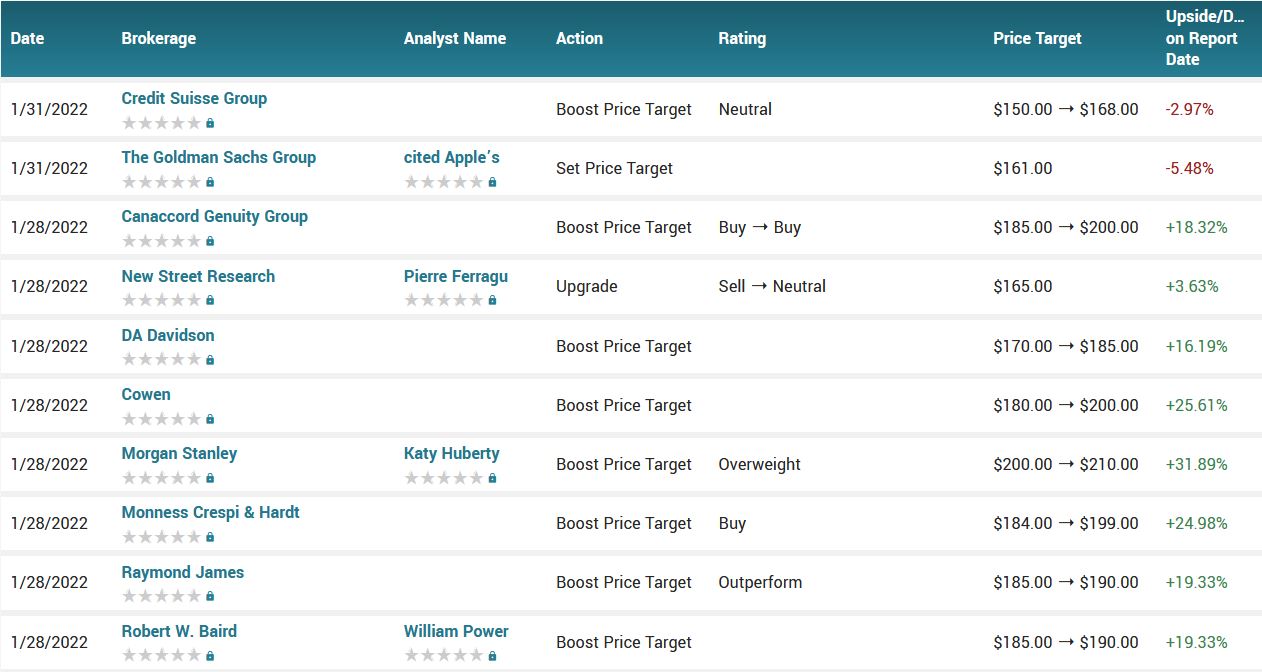

JPMorgan’s Bill Peterson sees several reasons for investors to assume a turnaround for ChargePoint, and writes that the current pullback equals an opportunity.

“We have developed more confidence around the ChargePoint story. Given the stock’s recent pullback, we see a good opportunity for investors... Specifically, the company is well-positioned to benefit from growth in all customer verticals in the US, and increasingly so in Europe…. we think investors may be too pessimistic on ChargePoint’s expenses and path to profitability; for us, the added investments in its go-to market efforts are key to seed the company’s target markets. Thus, the reward should be strong, sustainable growth with an expanding customer base,” Peterson wrote.

"We anticipate ChargePoint driving significant growth over the next 5-10 years, with revenues outpacing the growth range of EVs in the US and Europe driven by new opportunities in commercial and fleet operations," stated Peterson.

He added that the company's "software and services business provides ChargePoint an attractive recurring revenue model."

These comments support Peterson’s upgrade of CHPT from Neutral (i.e. Hold) to Overweight (i.e. Buy), and his $20 price target shows his confidence in a 40% one-year upside potential.

Earnings.....

ChargePoint is

expected to report its next quarterly earnings results on Tuesday, March 1st.

Based on analysts' forecasts, the consensus EPS forecast for the quarter is $-0.19.

Brokerages expect ChargePoint to post sales of $76.23 million for the current fiscal quarter. Eight analysts have provided estimates for ChargePoint’s earnings. The lowest sales estimate is $73.30 million and the highest is $78.48 million. The firm

Analysts expect that ChargePoint will report full year sales of $237.91 million for the current fiscal year, with estimates ranging from $235.00 million to $240.15 million. For the next year, analysts forecast that the business will report sales of $379.73 million, with estimates ranging from $350.70 million to $406.68 million.

Analysts.....

According to the issued ratings of 15 analysts in the last year, the consensus rating for ChargePoint stock is Buy based on the current 5 hold ratings and 10 buy ratings for CHPT. The average twelve-month price target for ChargePoint is $30.40 with a high price target of $46.00 and a low price target of $20.00.

Summary.....

Both in operational and fundamental terms, the company continues to grow robustly in its clear ambition to achieve scale.

Making it more attractive is that ChargePoint stock's forward price-to-sales (P/S) ratio has fallen to nearly 11 from more than 28 in July last year. The ratio is also lower than ChargePoint's average ratio of 19 in the last year.

ChargePoint's ratio compares favorably with its peers Blink Charging and EVgo, though it's higher than Volta's ratio.

The stock’s 50-day moving average price is $18.87 and its 200 day moving average price is $21.36. ChargePoint has a 12-month low of $11.21 and a 12-month high of $43.00.

Weekly Options Trade – Apple Inc. (NASDAQ:AAPL) Calls

Tuesday, February 01, 2022

** OPTION TRADE: Buy AAPL MAR 04 2022 175.000 CALLS - price at last close was $5.40. (adjust accordingly – up to $5.80 OR even market price)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $10.80. (100% Profit)

Include a protective stop loss of $2.20. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Over the years, Apple Inc. (NASDAQ:AAPL) has captivated consumers with its sleek devices, cultivating an incredible brand image in the process. But the company is more than trendy products. Its iOS operating system strategically reinforces its brand authority, creating an ecosystem that's hard to replicate. Unlike Android, iOS is closed-source, meaning third-party manufacturers cannot integrate the software into their own devices to provide an Apple-like experience at a lower price point. That gives Apple significant pricing power and a great degree of control over its ecosystem.

To that end, Apple's lineup of trendy devices -- iPhones, iPad, Macs, and various wearables -- creates two opportunities for monetization. The first is by selling the devices themselves, and the second comes from providing services to those devices. That comprises payments services like Apple Pay, cloud services like iCloud, and App Store purchases, which itself includes subscription services like Apple Fitness+, Apple TV+, and Apple Arcade.

Despite supply chain headwinds, Apple delivered strong growth on both sides of its business in the most recent quarter.

Mac has been on a tear since the pandemic took hold and lockdowns, work-from-home, and online schooling became a thing. Apple CEO Tim Cook addressed the strong sales during the company's first-quarter earnings call in response to a question from Cross Research analyst Shannon Cross.

"Mac set an all-time revenue record at $10.9 billion for the quarter. That was up 25%. And as you point out, the last six quarters for the Mac have been the top six revenue quarters of all time," he said. "And what's further very good about this is, we set all-time revenue records in Americas, in Europe, and the rest of Asia Pacific. And we set a December quarter record in Greater China. And so it's not narrowed to a particular geographic area that we're doing well in. It's almost -- about almost across the board."

Shares of Applehave outperformed the S&P 500 over the past year (+27.8% vs. +19.3%), with the block-busted December-quarter results expected to help sustain the stock's momentum despite the ongoing market volatility.

major CatalystS for This OPTIONS Trade.....

Earnings.....

Apple reported its December 2021 quarter results after the markets closed last Thursday, January 27.

Apple posted a record set of Q4 FY’22 results, with Apple revenues rising by about 11% year-over-year to $123.9 billion and earnings expanding by about 25% to $2.10 per share.

Although Apple had warned back in October that the ongoing chip shortage was likely to hurt holiday sales, it fared better than expected as all its products, barring the iPad, saw sales grow.

While iPhone sales expanded by about 9% to $71.6 billion, led by the launch of the new iPhone 13, the Mac business saw sales rise almost 25% with the launch of the new high-end MacBook Pro laptops, and continuing demand from the work from home trend.

Apple’s services business also continued its stellar performance, with revenue growing by a solid 24%, driven by the app store and a rising number of subscriptions on its platform. Apple now has 785 million paid subscriptions on its platform, up by around 165 million from last year.

Iphone .....

At the Worldwide Developer Conference in June 2019 the Cupertino, Calif.-based company began offering Mobile Device Management. The software tool lets IT managers assign a corporate Apple ID that lives side by side with an employee’s personal ID; has a cryptographic separator for personal data; and limits the device-wide capabilities. The latter is perfect for employees who decide to bring their own devices to work. The response has been remarkable.

When large companies offer devices to employees, iPhone is the overwhelming smartphone of choice. Although the device commands only 15% of the global smartphone market, its use in the corporate world is without rival. From Capital One (COF) and International Business Machines (IBM), to Procter of Gamble (PG), iPhones are ubiquitous across the Fortune 500. It all makes good sense.

iPhone is considered a premium device. Getting one for work is a perk for employees. It’s also an easy sale to employers given iPhone’s reputation for longevity, software updates and privacy.

Then there is the halo effect.

iPhone is the center of the Apple ecosystem. iPads, Mac computers, Watches and AirPods all work seamlessly within the iPhone platform.

Personal Computer Sales.....

Before the pandemic, personal computer (PC) sales declined steadily from a peak of 365 million globally that year to a low of 260 million in 2018. That number jumped a bit to 263 million in 2019, but 2020 represented a true comeback as 275 million PCs were sold.

That's a bounceback, but it's still well off the 365 million peak. However, it does return the industry to roughly where it was in 2007. Sales, of course, recovered because the Covid-19 pandemic increased demand.

More people worked from home and kids had remote school. Those two things forced a lot of families to buy new computers since multiple members of the household needed access to a PC at the same time.

This led to a bump in sales for Apple's Mac that has been sustained for quite a while.

In-House Chip Production.....

While the pandemic has pushed PC sales up overall, Cook does not think that's the main driver for Mac sales. Instead, the CEO credits his company taking chip production in-house in order to improve performance.

"The response is very much because of M1. And we got even more response with the MacBook Pro that we launched in the -- during the Q1 time frame," he said. “[It's] both the upgraders, which we had a record number of upgraders for the December quarter, but also in markets like China -- six out of 10 sales are people new to the Mac. And so it's powered by both upgraders and switchers."

The CEO also noted that consumers really like the new computers and that could further drive sales.

"Customer satisfaction is off the charts. And so what I see this as is a product that will be very successful in a number of different markets from education to business, to the creative industry and in all geographic markets," he said, "We're not limiting ourselves."

Supply Chain Issues.....

Cook expects Apple's supply chain challenges to improve in the coming quarters. That should allow the tech giant to sell even more phones and computers and broaden its installed base of users, which already stands at an incredible 1.8 billion devices.

Analysts.....

Morgan Stanley’s Katy Huberty applauds “one of the cleanest quarters in recent memory,” particularly noting the strong growth displayed by the Mac and Services. The analyst says the results “illustrate the strength and stability of Apple's product and services ecosystem, a clear differentiator in a more difficult market environment.”

That is particularly evident when coupled with the “stronger-than-anticipated” March quarter guide, which the company delivered despite the ongoing - albeit easing - supply constraints, and hard-to-match year-over-year comps.

By Huberty’s calculations, the March quarter outlook will lead to revenue growth of around 5% year-over-year. This suggests a sequential growth drop of 24%, which is better than “pre-COVID seasonality” of -31%. “Importantly,” says Huberty, “This also takes into account continued chip shortages, which we see as a potential source of upside in the event supply improves more than expected.”

What this indicates is that despite the continued headwinds, management expects the current quarter’s performance to be “above seasonal strength.”

On top of that, there’s the June quarter’s anticipated launch of the iPhone SE3, which is likely to provide a boost in F3Q quarter as well. As such, Huberty increased her FY22 revenue growth forecast from 6% year-over-year to 8%.

Taking a step back, Huberty believes the results will probably “refocus investors on the longevity and durability of Apple's 1.1 billion, and growing, user base.” Factor in a “robust innovation engine,” for which over the next 3 years, the 5-star analyst anticipates R&D will increase at a 17% CAGR and provide the basis for a “growing pipeline of new products and services.” This all implies there still is plenty of room to grow both hardware and services spend per user.

Therefore, Apple remains Huberty’s “top pick for 2022” with an Overweight (i.e., Buy) rating and a new price target of $210 (up from $200).

According to the issued ratings of 32 analysts in the last year, the consensus rating for Apple stock is Buy based on the current 6 hold ratings, 24 buy ratings and 2 strong buy ratings for AAPL. The average twelve-month price target for Apple is $188.77 with a high price target of $210.00 and a low price target of $155.00.

Summary.....

Despite its $2.8 trillion market cap, Apple is well positioned to create wealth for shareholders. Its tremendous brand authority should fuel consumer demand and its expanding services business should help the company better monetize its installed user base.

Also, with Wall Street feeling skittish about unprofitable growth stocks, now looks like a good time to add Apple -- a company that generated $93 billion in free cash flow over the past year.

Apple Inc. has a twelve month low of $116.21 and a twelve month high of $182.94. The company has a quick ratio of 1.00, a current ratio of 1.04 and a debt-to-equity ratio of 1.48. The company has a market cap of $2.85 trillion, a P/E ratio of 28.94, a price-to-earnings-growth ratio of 2.26 and a beta of 1.20. The business’s fifty day moving average is $170.65 and its 200-day moving average is $156.05.

Weekly Options Trade – Snap Inc. (NYSE:SNAP) PUTS

Monday, January 31, 2022

** OPTION TRADE: Buy SNAP FEB 11 2022 30.000 PUTS - price at last close was $2.78. (adjust accordingly – up to $3.20 OR even market price)

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at $5.50. (100% Profit)

Include a protective stop loss of $1.10. (60% loss)

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point – I am not pushing for 100% unless I feel that it has the legs to accomplish this!)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

The end of 2021 and the initial trading days of 2022 have been rough for tech stocks. The prospect of multiple interest rate hikes has investors fleeing to risk-off assets, including stocks. And that means some of the biggest tech stocks may have further to fall.

But for growth investors, tech remains the sector to be in. Some appealing stocks have dropped 50% or more from their 2021 highs. That means it’s inevitable that some savvy buyers will be moving in to buy their favorite names at a discounted price.

However, price doesn’t always equal value. Some stocks have sold off and may never recover their previous level. Those are tough lessons for investors to learn.

Snap Inc. (NYSE:SNAP) may not be quite in this category, but will continue to flounder in the near future.

This may be apparent when Snap reports earnings on Thursday, this week.

And, as mentioned last week....

With the S&P 500 sliding more than 10% from recent records – NOW fallen further, bears from the likes of Mizuho International Plc and Bank of America Corp. warn of fresh selling to come as growth momentum eases just as the Federal Reserve amps up borrowing costs.

“There’s probably more downside over the next few months as the market adjusts to the reality of the Fed removing accommodation, earnings slowdown and much less federal stimulus,” said Ed Clissold, the chief U.S. strategist at Ned Davis Research, who late last year predicted a double-digit drop in stocks and today is warning of a correction on the order of 20% from the early January peak.

Investors are coming to terms with a more hawkish Fed that won’t step in to smooth over every market hiccup. They expect policy makers to plow on with higher rates, with a quarter-point hike in March and close to a full percentage point rise for the whole of 2022.

For many, the direction of travel is troublesome for rate-sensitive investing styles.

“We can see this downward pressure on the equity markets being relatively sticky unless there is a catalyst for a much less hawkish Fed and general global central bank reaction,” said Peter Chatwell, head of multi-asset strategy at Mizuho. “The market stress scenario is what we think is happening now.”

Fears of a conflict added to concerns that a years-old bubble in tech will finally burst as the US Federal Reserve puts up interest rates and scales back massive pandemic stimulus.

Stocks which have benefitted from the long era of cheap money and the rise of remote working suffered badly ahead of an apparent return to normal life.

Worries over the market were underscored by purchasing managers’ index data that showed US economic activity slowed during January.

Analysts at investment bank Jefferies said the sell-off may signal markets expect the US will enter a recession. John Canavan from Oxford Economics said the sell-off “highlight[s] the risks of an aggressive Fed”.

The Federal Open Markets Committee is expected to continue a shift towards tighter policy at its Wednesday meeting.

The deteriorating backdrop is starting to show on quarterly earnings reports, which have so far served as reassuring beacons against any doomsday predictions.

After unprecedented successive jumps in earnings growth, the guidance from S&P 500 companies so far for the months ahead is “disappointing” and the information offered by managers in earnings calls is “concerning,” according to a note by Goldman Sachs Group Inc. strategists on Monday.

“The froth is coming out of an equity market that simply got too extended on valuation,” Mike Wilson, a long-term bear at Morgan Stanley, wrote Monday.

A “rocky” stretch for U.S. stocks is far from over, with the tech-heavy Nasdaq indexes poised to fall into bear markets thanks to the Federal Reserve’s newfound zeal to undercut inflation, according to Jeremy Siegel, finance professor at the Wharton School of the University of Pennsylvania.

The long-time market watcher said he expects more than four interest-rate hikes this year, a risk that “equities are not really priced for.” He sees a 20% decline in the Nasdaq 100 from the November record, implying a more than 7% fall from current levels.

“I don’t think the pain is over yet,” Siegel said.

A host of technical signals also suggests that more volatility may be coming. Siegel sees more fundamental challenges ahead, from the Fed struggling to snuff out price pressures to the spreading omicron variant undercutting first-quarter economic expansion.

About Snap.....

Snap, Inc.

engages in the operation of its camera platform.

Its products

include Snapchat, using the camera and editing tools to take and share Snaps,

Friends Page, which lets users create and use Stories, Groups, Video and Chat,

Discover for searching and surfacing relevant Stories, Snap Map, which shows

friends, Stories and Snaps near the user, Memories, for saving personal

collections, and Spectacles, wearable sunglasses capable of taking Snaps and

interacting directly with the Snapchat application. The firm's primary source

of revenue is advertising.

The company was founded by Frank Reginald Brown IV, Evan Thomas Spiegel, and Robert C. Murphy in 2010 and is headquartered in Santa Monica, CA.

major CatalystS for This OPTIONS Trade.....

Expected Earnings.....

Snap Inc. will report earnings at on Thursday, February 3, 2022, after the market closes.

Wall Street expects flat earnings compared to the year-ago quarter on higher revenues when Snap Inc. reports results for the quarter ended December 2021, on Thursday, February 3, 2022, after the market closes.

The consensus earnings estimate is for $0.10 per share on revenue of $1.20 billion; but the Whisper number is lower at $0.09 per share.

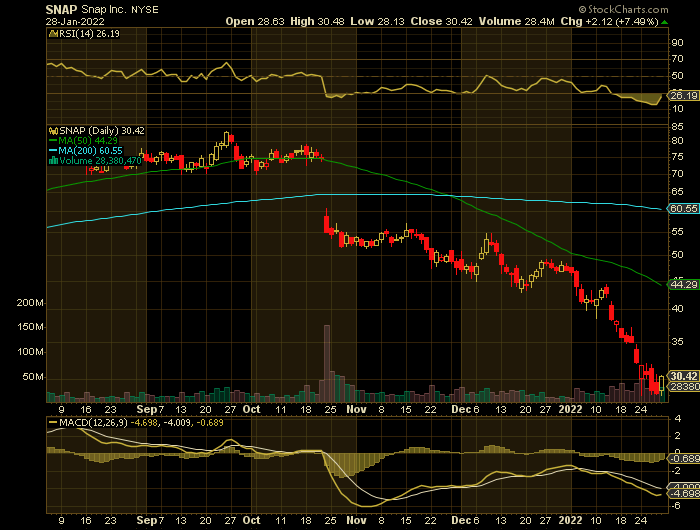

Consensus estimates are for year-over-year earnings growth of 42.86% with revenue increasing by 31.68%. The stock has drifted lower by 48.2% from its open following the earnings release to be 50.4% below its 200 day moving average of $61.36.

For the last reported quarter, it was expected that Snap would post earnings of $0.06 per share when it actually produced earnings of $0.17, delivering a surprise of +183.33%.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

Equities

research analysts at Truist Financial issued their Q2 2022 earnings per share

estimates for shares of Snap in a research note issued to investors on

Wednesday, January 26th. Truist Financial analyst Y. Squali expects that the company

will post earnings per share of ($0.05) for the quarter. Truist Financial also

issued estimates for Snap’s Q3 2022 earnings at ($0.02) EPS, Q4 2022 earnings

at $0.04 EPS, FY2024 earnings at $1.10 EPS, FY2025 earnings at $2.02 EPS and

FY2026 earnings at $3.14 EPS.

Federal Reserve Action.....

Stocks are being stung by the larger shift toward safe havens as markets prepare for the Federal Reserve to start raising interest rates. Higher rates weigh particularly hard on the valuations of growth stocks, and that’s adding to already existing concerns about patent longevity, drug-pricing reform and tougher merger rules.

Privacy Issues.....

Apple rolled out changes a few quarters back giving users more control over how their activity could be tracked by advertisers. Multiple social-media companies called out the move as a headwind shortly after the rollout, and there is worry about Snap’s ability to navigate the new terrain.

There seems to be little evidence of progress on combating Apple’s privacy changes to the identifier for advertisers, or IDFA, since Snap reported third-quarter results.

Social-media companies need to build or promote alternate measurement capabilities that will allow advertisers to gauge the effectiveness of their ads, but Snap was initially too reliant on an Apple measurement tool that is proving to be ineffective.

The difficulties brought on by Apple’s ad changes could impact Snap’s ability to hit its multiyear revenue growth target of at least 50%.

Rise of TikTok.....

The continued rise of TikTok is a concern. Both TikTok and Snap compete for more “experimental” ad budgets, and many agencies plan to “materially increase” their spending on TikTok in the next few years. Additionally, TikTok’s growing popularity ultimately could limit Snap’s user-growth opportunities.

Wedbush Comments.....

Multimedia instant messaging app Snap Inc. does not evoke enough confidence to stay bullish on its stock, according to Wedbush analyst Ygal Arounian.

Ygal Arounian downgraded Snap shares from Outperform to Neutral and reduced the price target from $56 to $36.

Snap's revenue growth faces risk from a trio of factors, Arounian said in a note.....

- The social media platform has made little progress against Identifiers for Advertisers, or IDFA, since the company reported its third-quarter results, the analyst noted. IDFA is a random device identifier assigned by Apple, Inc. (NASDAQ:AAPL) to a user's device.

- This has the biggest near- and potentially mid-term impact on Snap's ability to get back to 50%-plus revenue growth, the analyst said.

- The company is facing difficult comparisons against the stellar growth seen in fiscal years 2020 and 2021, Arounian noted.

- The analyst also sees competitive factors increasing, particularly from TikTok. TikTok and Snap share very similar audiences, putting the latter's engagement/time spent and ad dollars at risk, the analyst said. The Chinese app is gaining traction with advertisers, which could put pressure on Snap's budgets.

Wedbush, therefore, is more cautious on a risk/reward basis, particularly in an environment where high growth risk multiples are under duress.

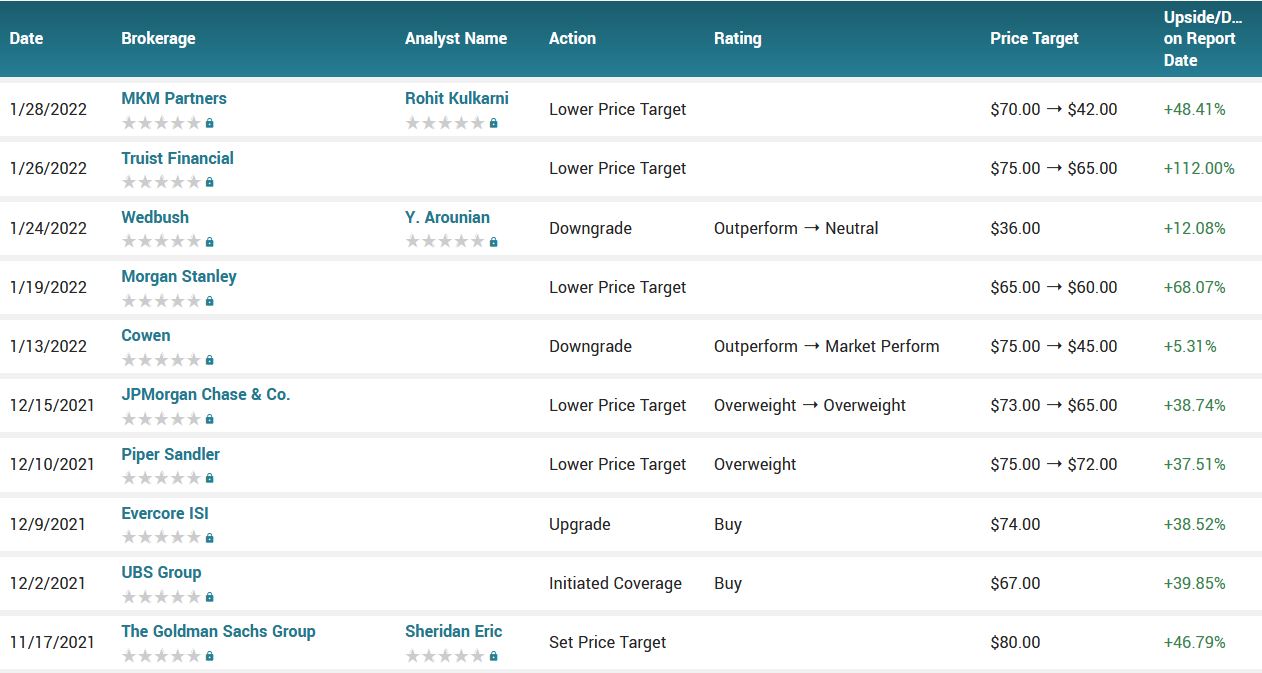

Other Analysts.....

Snap had its price target decreased by equities research analysts at MKM Partners from $70.00 to $42.00 in a research report issued to clients and investors on Friday.

Snap had its price target reduced by equities research analysts at Truist Financial from $75.00 to $65.00 in a research report issued to clients and investors on Wednesday.

According to the issued ratings of 32 analysts in the last year, the consensus rating for Snap stock is Buy based on the current 7 hold ratings and 25 buy ratings for SNAP. The average twelve-month price target for Snap is $72.53 with a high price target of $104.00 and a low price target of $36.00.

Summary.....

Jefferies analysts said the current selloff is lasting longer than past ones -- and that may mean it will take more time for investors to regain their confidence.

Snap has a 52 week low of $28.02 and a 52 week high of $83.34. The company has a quick ratio of 5.53, a current ratio of 5.53 and a debt-to-equity ratio of 0.65. The company has a fifty day simple moving average of $43.83 and a two-hundred day simple moving average of $60.28. The firm has a market capitalization of $48.97 billion, a P/E ratio of -72.43 and a beta of 1.07.

Back to Weekly Options USA Home Page