TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

WHEN ARE WEEKLY OPTIONS AVAILABLE?

by Amanda Harvey

When are weekly options available? The answer commonly given to this question is that weekly options are listed each Thursday, and expire the Friday of the following week.

This is actually not correct. Weekly options are listed on Thursdays, but the expiration date is typically six weeks from the time of listing.

WHEN ARE WEEKLY OPTIONS AVAILABLE? WHY THE MISCONCEPTION?

A common misunderstanding about weekly options is that each option only exists for a week, but the name actually has a different meaning. The expiration dates available for weekly options are each week, with the exception of the third Friday of each month, which is expiration date for monthly options. In fact, another name for weekly options is weekly expiration options.

The way in which these options are truly “weekly options” is that they offer a choice of expiration dates that, combined with monthly expiry options, provide an expiration date every week of the year.

WHEN ARE WEEKLY OPTIONS AVAILABLE? (LISTING AND EXPIRATION)

New weekly options are normally listed on a Thursday, for the expiration date 6 weeks from the following day. There are no weekly options expiring on the third Friday of each month, as this is the expiration date for monthly options. Because of this, whether or not a new weekly option is listed on any given Thursday depends on whether the Friday six weeks from the day after is a weekly expiration date or not.

WHEN ARE WEEKLY OPTIONS AVAILABLE?

AN EXAMPLE SHOWING HOW TO CHECK

Let's take an example. Today is July 19, and I am planning to buy a weekly option on APPL so I want to check on the range of available dates. The first thing I do is go to Yahoo Finance and type APPL into the search bar.

Then I click on “Options” as shown below.

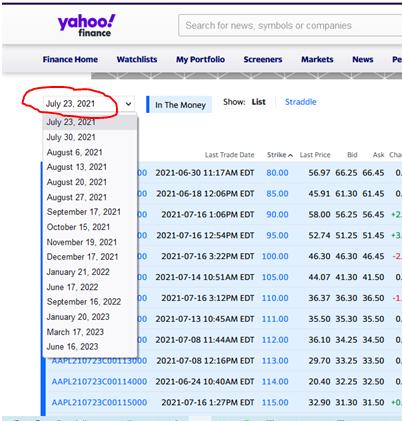

On the top right, there is a drop-down menu of dates.

WHEN ARE WEEKLY OPTIONS AVAILABLE?

INTERPRETING THE EXAMPLE

This list of dates shows the next expiration date for this option first, followed by the subsequent dates. By looking at this information I can see that there is an Apple weekly option available for this Friday, July 23. It is the fourth Friday of the month, which means that it is a weekly expiration option, as the monthly option for July expired the previous Friday, July 16.

Depending on the catalyst (such as an earnings report) I am looking at as a reason to enter the trade, maybe an option contract that expires in five days gives me enough time to execute the profitable trade that I am planning to make.

DECIDING WHICH EXPIRATION DATE TO TAKE

If the catalyst is an event a little further away, I might look at a weekly option that has later expiry date. However, I also keep in mind that buying a contract with more time before expiration generally means paying a higher premium. It may be wise to wait until closer to the date on which the anticipated price movement will occur, and buy a weekly option with just enough time before expiration, rather than buying it earlier at a higher price.

Going back to our example, the selection of dates following the most immediate choice are July 30, August 6, August 13, and August 27. The list of dates also shows August 20, but this is the expiration date of the monthly option.

The dates shown after the end of August are for monthly options, and then followed by long-expiration options into 2023, as weekly options beyond August have not been listed at the time of this example.

WHEN ARE WEEKLY OPTIONS AVAILABLE?

THE LATEST TIME TO BUY

Weekly options, as with other options contracts, are available to be bought until the day before, or even the day of, expiration. Whether it is possible to buy and then sell a weekly options contract on the day of expiration depends on the guidelines of each broker.

WINNING WITH WEEKLYs

When trading weekly options, you need up-to-the-minute knowledge of the events affecting the market, as well as an understanding of which weekly options to trade, how much to pay for these trades, what strategies to use, and when to enter and exit each trade.

If this sounds like a lot of work to you, don’t worry! Our membership service does all of this for you, so join us today, and start winning with weeklys.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from When Are Weekly Options Available?