TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Affirm Holdings:

Strong Growth, Profitable Momentum,

and a Winning

Options Trade

Friday, September 05, 2025

by Ian Harvey

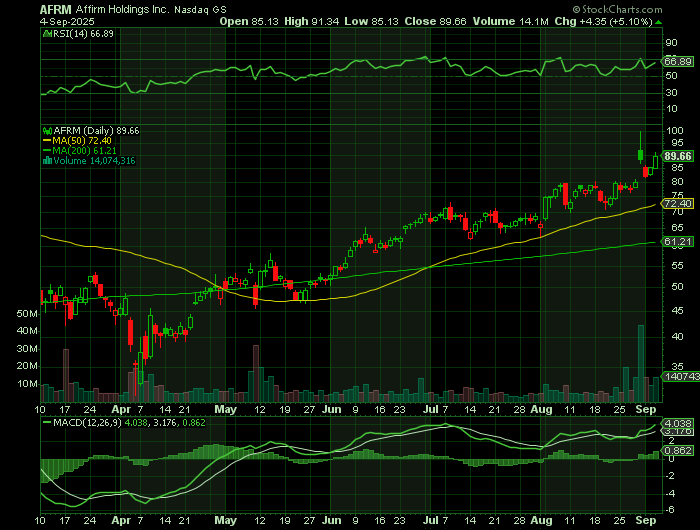

Affirm Holdings (AFRM) has delivered strong financial results, turning profitable for the first time and reporting 44% GMV growth alongside 33% revenue growth.

A Weekly Options USA call recommendation surged 103% in just three days as analysts raised price targets, reflecting growing confidence in Affirm’s outlook.

With expanding adoption of its BNPL services and the Affirm Card, Wall Street sees continued momentum ahead.

Join Us and Get the Trades - More

setups coming... Stay tuned!

Why the Recommendation Was Made

Weekly Options USA recently recommended a call option on Affirm Holdings, Inc. (NASDAQ: AFRM), and the reasoning behind it was clear. Affirm has become a leader in the Buy Now, Pay Later (BNPL) market by offering transparent, fixed-term installment loans and expanding its reach with innovative products such as the Affirm Card and high-yield savings tools. With a strong network of merchants across industries and disciplined underwriting practices, Affirm continues to strengthen its position in the fintech space.

The company’s financials provided a strong case for optimism. In Q4 2025, Affirm reported a 44% year-over-year increase in Gross Merchandise Volume (GMV) to $10.4 billion, and revenue grew 33% to $876 million. Most notably, the company turned profitable, reporting GAAP net income of $69.2 million, compared to a $45 million loss a year earlier. For fiscal 2025, Affirm achieved its first-ever full year of GAAP profitability, with $52 million in net income on revenues of $3.2 billion.

Customer loyalty and product stickiness also factored into the recommendation. With 23 million active users and a 95% repeat usage rate, Affirm is not just growing but building a highly engaged base of consumers who continue to rely on its services. The rapid adoption of 0% APR loan products and strong growth in Affirm Card GMV further highlight the company’s ability to attract high-quality customers and expand into new areas of consumer finance.

The Result: A 103% Gain in 3 Days

The trade proved to be a huge success. Shares of Affirm surged following strong earnings and a wave of analyst upgrades, pushing the recommended weekly call option up 103% in just three days. Analysts from leading firms expressed growing confidence in Affirm’s outlook.

Mizuho boosted its price target to $108 while maintaining an Outperform rating, RBC Capital lifted its target to $97 from $75, and Stephens raised its target to $93 from $69. UBS also increased its target to $85. These moves followed Affirm’s standout earnings beat, where the company reported revenue of $876 million versus expectations of $837 million, and adjusted EPS of $0.53 versus $0.43 expected. Adjusted EBITDA of $245 million nearly doubled estimates.

The strong results and analyst upgrades sent shares to new 52-week highs, validating the call option recommendation. Weekly Options USA subscribers who acted on the trade saw their position more than double in value in just days — a testament to both the company’s momentum and the timing of the recommendation.

Analysts’ Thoughts and Future Potential

Wall Street sentiment remains broadly positive on Affirm. Out of nearly 30 analysts, the consensus rating is a “Moderate Buy,” with the majority leaning bullish. Bank of America recently raised its price target to $94, Barclays lifted its target to $80, and Zacks highlighted Affirm’s projected 400% earnings growth in fiscal 2026, alongside expected revenue growth of nearly 20%.

The Affirm Card is another growth lever, with GMV rising 132% year-over-year and 2.3 million active cardholders. Analysts see this as a powerful tool to extend Affirm’s reach beyond BNPL and into the broader payments ecosystem. Combined with disciplined underwriting, expanding merchant partnerships, and international growth plans, Affirm has multiple catalysts to sustain momentum into 2026.

Conclusion

Affirm Holdings has proven that growth and profitability can go hand in hand. Its strong earnings, expanding customer base, and innovative product suite are drawing both consumer and investor confidence. With analysts raising price targets and another options trade potentially in the making, Affirm remains a compelling story in fintech.

Weekly Options USA’s call trade has already delivered an impressive 103% gain in three days — and given Affirm’s trajectory, further opportunities may soon follow.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from Affirm HOLDINGS

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.