TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Amazon.com, Inc. (NASDAQ: AMZN)

Weekly Options Trade Delivers 318%

Gain

as Analysts Turn Even More Bullish

Thursday, November 05, 2025

by Ian Harvey

This article highlights Amazon.com, Inc.’s recent performance and the success of a Weekly Options USA trade that delivered a 318% gain.

It details why the trade was recommended, the financial and strategic factors behind Amazon’s strong results, analysts’ bullish outlook, and the continued confidence driving a new trade recommendation.

Join Us and Get the Trades - More

setups coming... Stay tuned!

Why the Recommendation Was Made

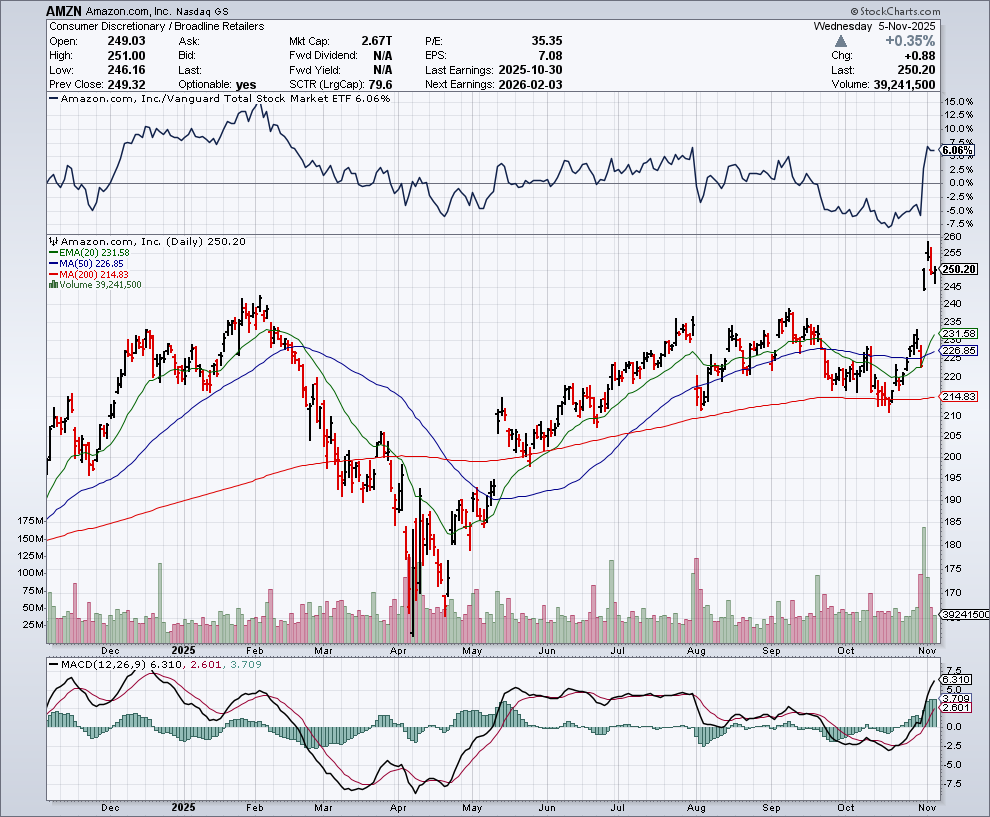

Weekly Options USA identified Amazon.com, Inc. (NASDAQ: AMZN) as an outstanding opportunity for a call option trade on September 30, 2025. The trade recommendation — AMZN October 31, 2025 $235 Calls at $4.85 — was based on strong fundamental and technical indicators pointing toward continued upside momentum in the stock.

At the time, Amazon was exhibiting powerful growth trends across its e-commerce, cloud, and digital services segments. The company’s robust quarterly performance underscored that view, with earnings per share of $1.68 exceeding consensus estimates by $0.37 and revenue of $167.7 billion — a 13.3% year-over-year increase. A return on equity of nearly 24% highlighted its operational strength and efficiency.

The dominant performance of Amazon Web Services (AWS) — which continued to outpace competitors — was a key factor in the recommendation. AWS’s leadership in cloud computing, combined with Amazon’s deep integration of artificial intelligence through its Bedrock platform and generative AI partnerships, positioned the company for sustainable long-term growth.

Weekly Options USA also cited Amazon’s innovations in e-commerce, including same-day grocery delivery and new consumer-focused partnerships, as catalysts for increased revenue streams. Analysts’ optimism reinforced the bullish case, with 47 out of 50 giving Amazon a Buy or Strong Buy rating at the time, and several major firms lifting price targets above $300. Institutional ownership exceeding 72% provided further evidence of broad-based confidence in Amazon’s future.

Result: A 318% Return for Weekly Options USA Members

The trade proved exceptionally profitable. As Amazon’s stock climbed to $254.00 — near its 52-week high of $258.60 — the recommended call options surged in value, producing a 318% return. This gain reflected not only Amazon’s powerful quarterly results but also renewed investor enthusiasm following several pivotal developments.

Amazon’s third-quarter performance exceeded already high expectations. Revenue reached $180.17 billion, a 13.4% year-over-year increase, while earnings per share of $1.95 beat estimates by $0.38. The company’s net margin of 10.54% and return on equity of 23.84% demonstrated continued financial strength and disciplined management.

AWS once again led the charge, posting 20% year-over-year revenue growth and expanding its operating margin to 34.6%. The division’s rebound was driven by the landmark $38 billion multi-year partnership with OpenAI, under which AWS provides computing infrastructure for next-generation AI models. This agreement confirmed AWS’s role as a critical player in global AI development — a high-margin, long-term growth catalyst that Wall Street hailed as transformative.

E-Commerce and Advertising Continue to Thrive

While AWS delivered the biggest boost to profitability, Amazon’s retail and advertising arms maintained double-digit growth. North American sales climbed 11%, international sales 10%, and advertising revenue soared 22% year-over-year. With Prime Video ads and retail media networks driving new income streams, Amazon’s business model demonstrated a balanced mix of recurring and high-margin revenue sources.

Despite record investments — over $120 billion in capital expenditures during the past year — Amazon’s balance sheet remained solid, with a debt-to-equity ratio of just 0.15. These investments, directed primarily toward AI-enabled data centers and infrastructure, are widely expected to fuel the next decade of growth.

Analysts’ Confidence Remains Strong

Following Amazon’s stellar results, analysts became even more bullish. Of 56 analysts surveyed, 51 rated the stock a Buy and three a Strong Buy, with only one Hold and one Sell rating. The consensus 12-month price target rose to $291.94, while top estimates from Wedbush and Morgan Stanley reached as high as $340.00.

Wedbush analysts Dan Ives and Scott Devitt described the OpenAI partnership as a “transformative moment” for AWS and raised their target to the Street high of $340, citing Amazon’s “reaccelerating cloud growth and emerging AI dominance.” Bernstein, Telsey Advisory Group, and Mizuho also reiterated Outperform ratings, emphasizing strong momentum in AWS and digital advertising.

Institutional Confidence and Future Outlook

Institutional investors have continued to increase their holdings, with major firms such as Sequoia Financial Advisors, Montrusco Bolton Investments, and Vest Financial boosting their positions. Over 72% of Amazon shares are now institutionally owned — a testament to confidence in the company’s strategic direction.

With artificial intelligence transforming every corner of the digital economy, Amazon stands at the forefront. Its diversified structure — spanning e-commerce, advertising, and cloud computing — ensures multiple growth engines that are already generating impressive returns.

Conclusion: A Proven Winner with More Upside Ahead

The Amazon weekly call trade executed by Weekly Options USA not only delivered a remarkable 318% gain but also validated the group’s disciplined approach to identifying high-potential opportunities. Following this success, another trade on Amazon has already been recommended, reflecting continued confidence in the company’s upward trajectory.

Amazon’s leadership in cloud computing, expanding AI ecosystem, robust retail base, and strong analyst support make it one of the most compelling growth stories in global technology today. For investors and traders alike, the company continues to demonstrate why it remains a cornerstone of innovation — and why its story is far from over.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from Amazon.com

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.