TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Snap Inc. Earnings Expectations!

Monday, January 31, 2022

Snap Inc. reports results for the quarter ended December

2021, on Thursday, February 3, 2022, after the market closes, and Wall Street expects flat earnings compared to the year-ago quarter on

higher revenues.

The consensus earnings estimate is for $0.10 per share on revenue of $1.20 billion; but the Whisper number is lower at $0.09 per share.

What trade will be recommended to members?

Snap Inc Prelude.....

The end of 2021 and the initial trading days of 2022 have been rough for tech stocks. The prospect of multiple interest rate hikes has investors fleeing to risk-off assets, including stocks. And that means some of the biggest tech stocks may have further to fall.

But for growth investors, tech remains the sector to be in. Some appealing stocks have dropped 50% or more from their 2021 highs. That means it’s inevitable that some savvy buyers will be moving in to buy their favorite names at a discounted price.

However, price doesn’t always equal value. Some stocks have sold off and may never recover their previous level. Those are tough lessons for investors to learn.

Snap Inc (NYSE:SNAP) may not be quite in this category, but will continue to flounder in the near future.

This may be apparent when Snap reports earnings on Thursday, this week.

Influencing Factors for SNAP INC. Earnings

Earnings Date…..

Snap Inc will

report earnings at on Thursday, February 3, 2022, after the market closes.

Expectations.....

Wall Street expects flat earnings compared to the year-ago quarter on higher revenues when Snap Inc reports results for the quarter ended December 2021, on Thursday, February 3, 2022, after the market closes.

The consensus earnings estimate is for $0.10 per share on revenue of $1.20 billion; but the Whisper number is lower at $0.09 per share.

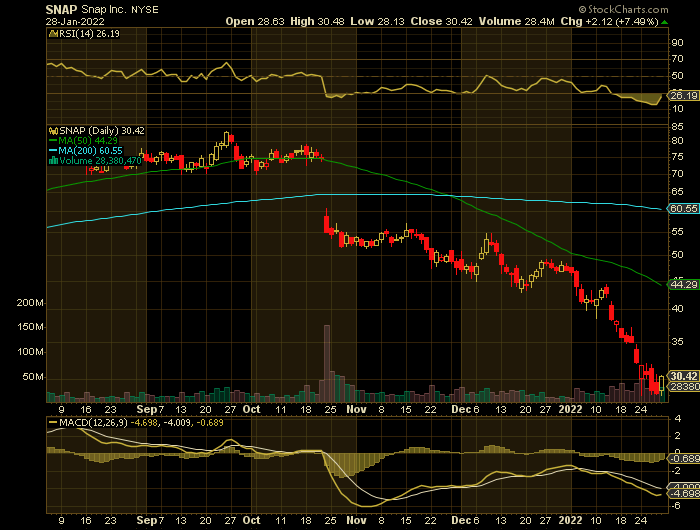

Consensus estimates are for year-over-year earnings growth of 42.86% with revenue increasing by 31.68%. The stock has drifted lower by 48.2% from its open following the earnings release to be 50.4% below its 200 day moving average of $61.36.

For the last reported quarter, it was expected that Snap would post earnings of $0.06 per share when it actually produced earnings of $0.17, delivering a surprise of +183.33%.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

Equities research analysts at Truist Financial issued their Q2 2022 earnings per share estimates for shares of Snap in a research note issued to investors on Wednesday, January 26th. Truist Financial analyst Y. Squali expects that the company will post earnings per share of ($0.05) for the quarter. Truist Financial also issued estimates for Snap’s Q3 2022 earnings at ($0.02) EPS, Q4 2022 earnings at $0.04 EPS, FY2024 earnings at $1.10 EPS, FY2025 earnings at $2.02 EPS and FY2026 earnings at $3.14 EPS.

Federal Reserve Action.....

Stocks are being stung by the larger shift toward safe havens as markets prepare for the Federal Reserve to start raising interest rates. Higher rates weigh particularly hard on the valuations of growth stocks, and that’s adding to already existing concerns about patent longevity, drug-pricing reform and tougher merger rules.

Privacy Issues.....

Apple rolled out changes a few quarters back giving users more control over how their activity could be tracked by advertisers. Multiple social-media companies called out the move as a headwind shortly after the rollout, and there is worry about Snap’s ability to navigate the new terrain.

There seems to be little evidence of progress on combating Apple’s privacy changes to the identifier for advertisers, or IDFA, since Snap reported third-quarter results.

Social-media companies need to build or promote alternate measurement capabilities that will allow advertisers to gauge the effectiveness of their ads, but Snap was initially too reliant on an Apple measurement tool that is proving to be ineffective.

The difficulties brought on by Apple’s ad changes could impact Snap’s ability to hit its multiyear revenue growth target of at least 50%.

Rise of TikTok.....

The continued rise of TikTok is a concern. Both TikTok and Snap Inc compete for more “experimental” ad budgets, and many agencies plan to “materially increase” their spending on TikTok in the next few years. Additionally, TikTok’s growing popularity ultimately could limit Snap’s user-growth opportunities.

Wedbush Comments.....

Multimedia instant messaging app Snap Inc does not evoke enough confidence to stay bullish on its stock, according to Wedbush analyst Ygal Arounian.

Ygal Arounian downgraded Snap shares from Outperform to Neutral and reduced the price target from $56 to $36.

Snap's revenue growth faces risk from a trio of factors, Arounian said in a note.....

- The social media platform has made little progress against Identifiers for Advertisers, or IDFA, since the company reported its third-quarter results, the analyst noted. IDFA is a random device identifier assigned by Apple, Inc. (NASDAQ:AAPL) to a user's device.

- This has the biggest near- and potentially mid-term impact on Snap's ability to get back to 50%-plus revenue growth, the analyst said.

- The company is facing difficult comparisons against the stellar growth seen in fiscal years 2020 and 2021, Arounian noted.

- The analyst also sees competitive factors increasing, particularly from TikTok. TikTok and Snap Inc share very similar audiences, putting the latter's engagement/time spent and ad dollars at risk, the analyst said. The Chinese app is gaining traction with advertisers, which could put pressure on Snap's budgets.

Wedbush, therefore, is more cautious on a risk/reward basis, particularly in an environment where high growth risk multiples are under duress.

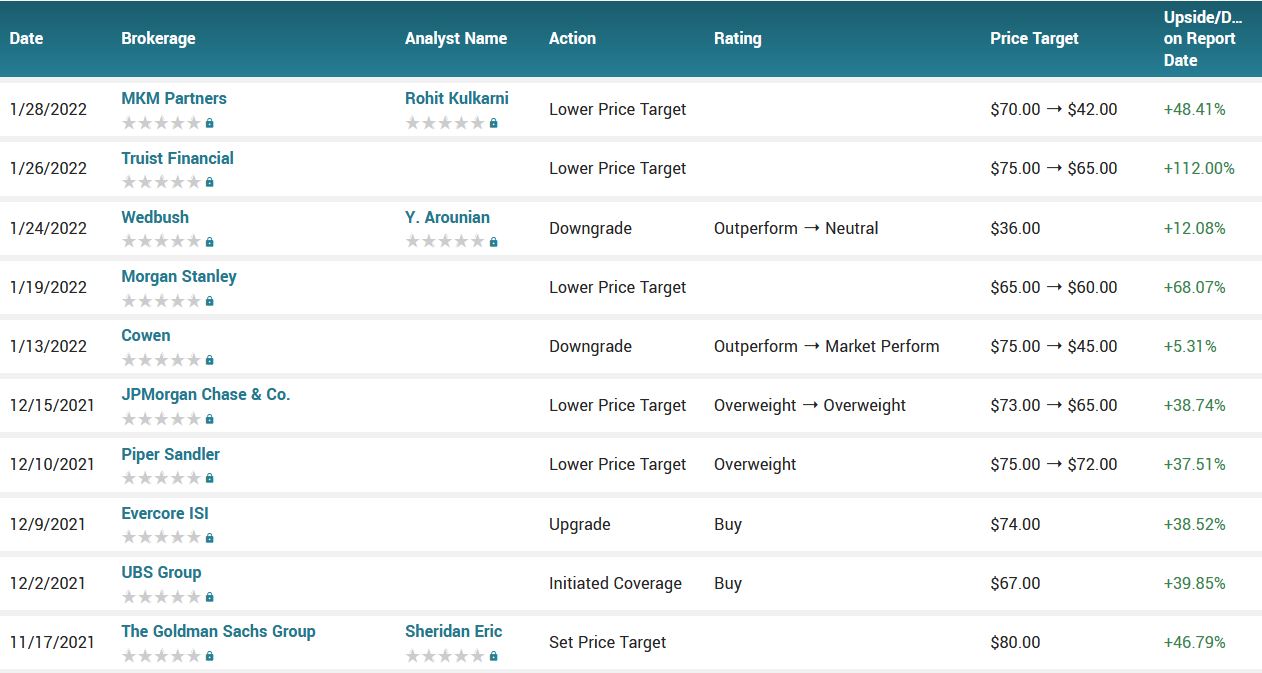

Other Analysts.....

Snap Inc had its price target decreased by equities research analysts at MKM Partners from $70.00 to $42.00 in a research report issued to clients and investors on Friday.

Snap Inc had its price target reduced by equities research analysts at Truist Financial from $75.00 to $65.00 in a research report issued to clients and investors on Wednesday.

According to the issued ratings of 32 analysts in the last year, the consensus rating for Snap Inc stock is Buy based on the current 7 hold ratings and 25 buy ratings for SNAP. The average twelve-month price target for Snap is $72.53 with a high price target of $104.00 and a low price target of $36.00.

Summary.....

Jefferies analysts said the current selloff is lasting longer than past ones -- and that may mean it will take more time for investors to regain their confidence.

Snap Inc has a 52 week low of $28.02 and a 52 week high of $83.34. The company has a quick ratio of 5.53, a current ratio of 5.53 and a debt-to-equity ratio of 0.65. The company has a fifty day simple moving average of $43.83 and a two-hundred day simple moving average of $60.28. The firm has a market capitalization of $48.97 billion, a P/E ratio of -72.43 and a beta of 1.07.

Back to Weekly Options USA Home Page from

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.