TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Nvidia Soars Past $4 Trillion:

Weekly Call Option Already Up 56%, With More Upside Ahead

Thursday, July 10, 2025

by Ian Harvey

Nvidia has become the world’s first $4 trillion company, fueled by unmatched dominance in AI and soaring demand for its cutting-edge chips.

Analysts remain bullish, and a Weekly Options USA trade on NVDA is already up 56% — with more upside still on the table.

Join Us and Get the Trades - More

setups coming... Stay tuned!

AI Titan Breaks Records — And the Rally Isn’t Over Yet

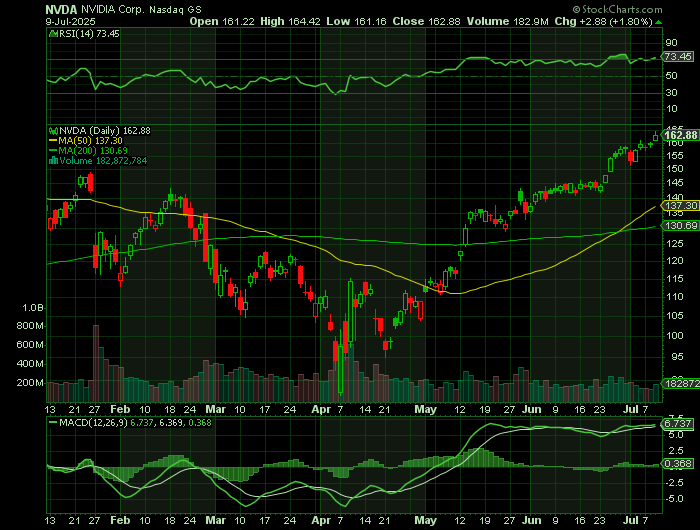

Nvidia (NASDAQ: NVDA) has once again shattered expectations, making history as the first publicly traded company to cross a $4 trillion market valuation. This unprecedented milestone underscores Nvidia’s dominant role in the AI revolution and fuels growing investor enthusiasm — including a strategic weekly call option play from Weekly Options USA that’s already up 56% in just two days. Despite the rapid gains, there’s still time for opportunistic investors to enter the trade.

The Backbone of the AI Boom

At the core of Nvidia’s meteoric rise is its unmatched leadership in artificial intelligence hardware and infrastructure. Its advanced GPUs and CUDA software have become indispensable to the world’s largest tech firms — including Microsoft, Amazon, Meta, and Alphabet — who are pouring hundreds of billions into AI data centers. Nvidia’s chips power the most advanced AI models, including OpenAI’s ChatGPT, cementing its central role in the current tech supercycle.

Nvidia’s data center business alone generated $39 billion in Q1 FY2026, representing 89% of its total revenue. Remarkably, 70% of that came from its next-gen Blackwell architecture, which is already being deployed at massive scale.

Sovereign AI and Global Expansion

Citi analysts recently upgraded Nvidia’s price target to $190, citing explosive demand from sovereign AI initiatives. Countries across Europe, Asia, and the Middle East are rushing to establish national AI infrastructure — and Nvidia is involved in virtually every major deal. Citi now expects Nvidia’s total addressable AI compute market to reach $563 billion by 2028, up from $500 billion, with networking TAM rising to $119 billion.

Nvidia is building AI gigafactories in partnership with major European telecoms and manufacturers like BMW and Volvo. These initiatives aim to solidify AI sovereignty and reduce reliance on U.S.-based hyperscalers — all powered by Nvidia’s cutting-edge GPUs.

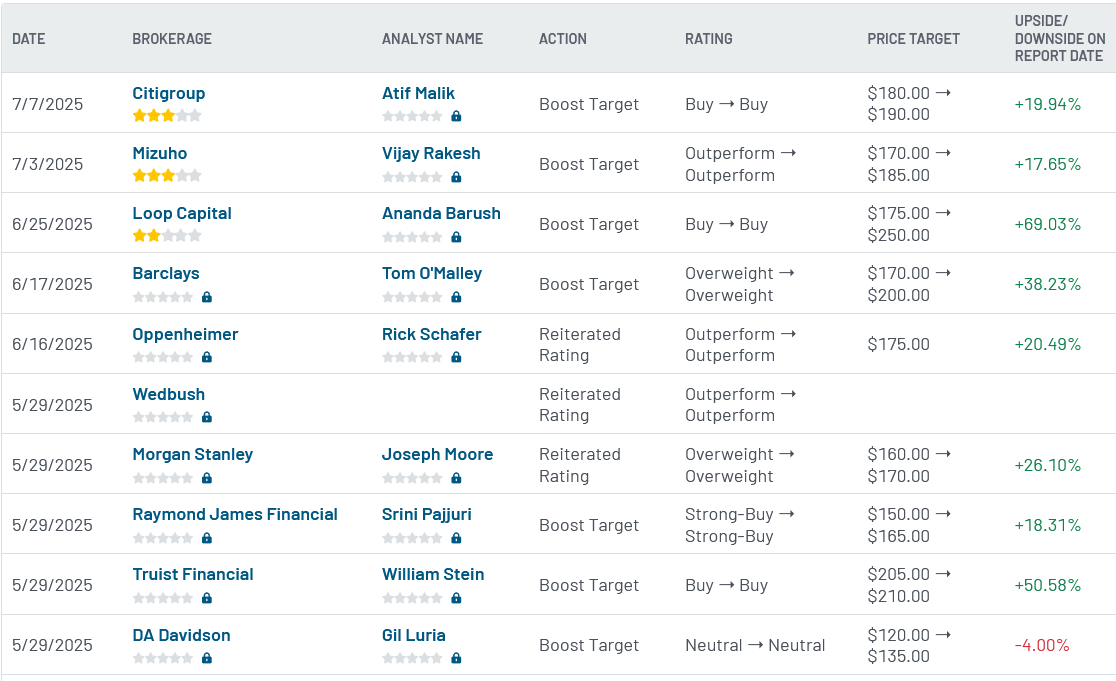

Analysts See More Room to Run

Despite its rapid rise, Wall Street remains bullish on NVDA. Out of 44 analysts covering the stock:

- 37 rate it a Strong Buy

- 3 recommend a Moderate Buy

- 3 suggest Hold

- Only 1 analyst rates it a Strong Sell

The average price target of $176.98 implies ~10% upside from current levels, while the high target of $250 suggests a potential 50% gain. CFRA analyst Angelo Zino sees Nvidia reaching $196 within a year, citing strong fundamentals and continued AI tailwinds.

Weekly Options USA: Trade Already +56%, But Opportunity Remains

Weekly Options USA alerted a NVDA call option trade that is already up 56% in just two trading days. The continued strength of the stock — backed by strong analyst sentiment and a bullish technical setup — means this trade may have more to run. Nvidia remains at the forefront of a once-in-a-generation technology shift, and momentum is on its side.

While past performance doesn’t guarantee future returns, the current setup is compelling. As Nvidia continues to expand its dominance in AI, robotics, and cloud infrastructure, traders and investors alike are eyeing significant upside in the short and long term.

The Road to $10 Trillion?

With a soaring product pipeline, multiple secular tailwinds, and unmatched market leadership, many are asking whether Nvidia could become the first $10 trillion company. CEO Jensen Huang — now worth an estimated $140 billion — recently stated, “This is the start of a powerful new wave of growth.”

For traders looking for immediate upside and investors seeking long-term potential, Nvidia is more than just a chipmaker — it’s the defining company of the AI era.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.