TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Cloudflare

(NET):

Strong Growth Continues Amid Strategic Pullback —

New Entry Point?

Friday, July 11, 2025

by Ian Harvey

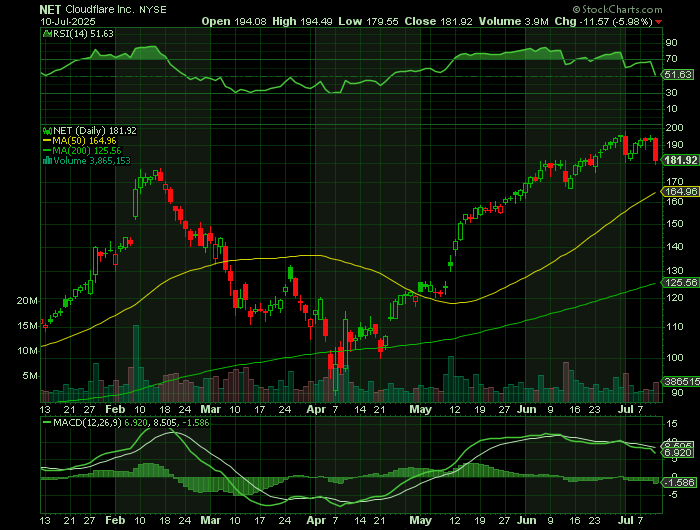

Cloudflare stock has exploded in 2025, fueled by strong revenue growth, expanding margins, and bullish analyst upgrades.

Following a temporary pullback, a new weekly call option trade may be setting up for another big gain.

Join Us and Get the Trades - More

setups coming... Stay tuned!

Cloudflare Cools… but Opportunity Heats Up

After a rapid surge that saw Weekly Options USA's recommended Cloudflare (NYSE: NET) call option soar 150%, a short-term pullback now opens the door for a fresh opportunity. While some investors reacted to insider selling and broader market volatility, the underlying story for Cloudflare remains one of impressive growth, expanding margins, and bullish analyst sentiment.

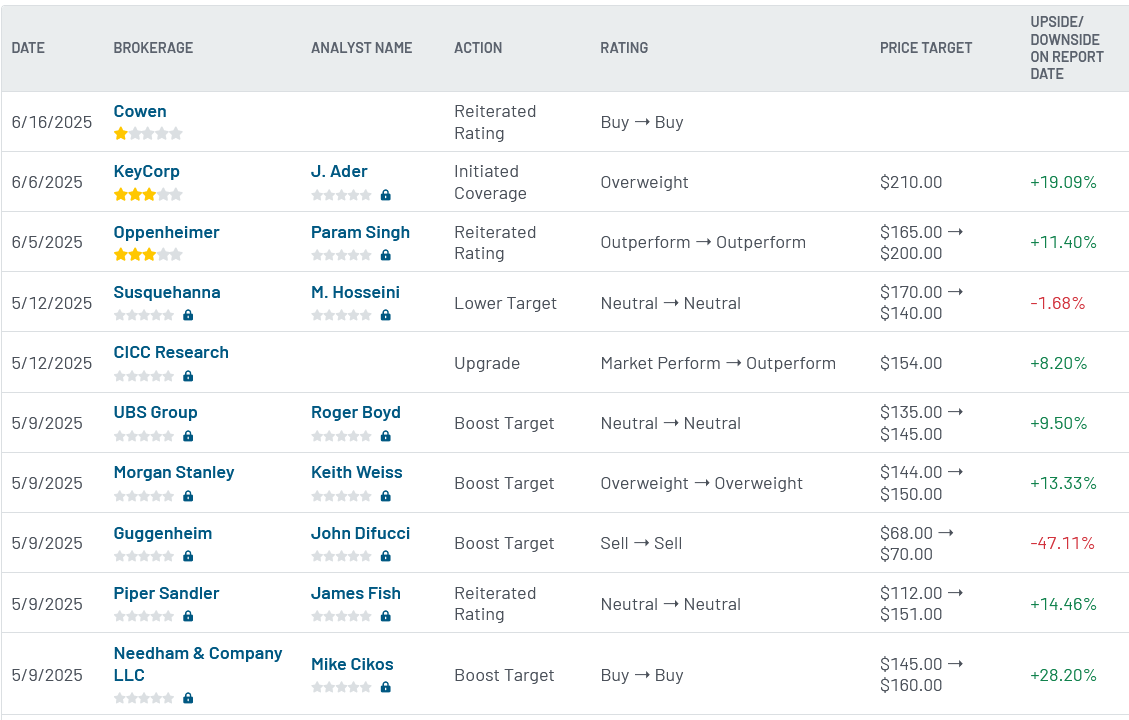

Analysts Still See Upside in Cloudflare

Despite a dip of nearly 6% on July 10, analysts remain broadly optimistic. Of the 29 analysts covering Cloudflare, 15 rate it a “Buy” and 1 a “Strong Buy,” compared to 10 “Hold” and just 3 “Sell” ratings. While the average 12-month price target of $145.92 is below the current trading price of ~$181, several analysts — including Oppenheimer and TD Cowen — have significantly increased their targets recently, with Cowen setting an ambitious $200 price target.

Cowen emphasized the company's resilient demand in the face of macroeconomic challenges and its long-term vision to reach $5 billion in recurring revenue. KeyCorp also set a $210 target, underscoring confidence in Cloudflare’s platform strength and market leadership.

Pullback = Potential Entry

The recent dip in share price is largely attributed to CEO Matthew Prince selling shares — a move that some interpreted as a cautionary signal. However, such activity is common among executives at this level and does not necessarily reflect declining confidence. Prince retains a substantial stake in the company, valued at over $70 million, signaling continued belief in the company’s direction.

More importantly, Cloudflare continues to outperform both the sector and broader market. Shares are up nearly 80% year-to-date, and despite the valuation concerns — with a forward P/E above 240 — the company is increasingly demonstrating operating leverage.

Why Investors Are Bullish

Cloudflare recently reported 26.5% year-over-year revenue growth and added 30 new large enterprise customers last quarter, pushing the total to 3,527. Its user base is now over 250,000 strong — a 27% increase from last year. This is all while reducing its sales and marketing spend as a percentage of revenue and increasing operating margins to 11.7%.

From a product perspective, Cloudflare’s innovations in edge computing, AI infrastructure, Zero Trust, and serverless technology are driving customer wins and long-term contracts. Its Workers.ai platform recently secured a $130 million contract, demonstrating the real-world demand for its cutting-edge capabilities.

And in a digital world increasingly shaped by AI, security, and speed, Cloudflare is positioned as critical infrastructure — now powering roughly 20% of global internet traffic through its 335+ global network locations.

The Bottom Line

Cloudflare is riding a powerful wave of secular growth in cybersecurity, CDN, and Zero Trust. Yes, it trades at a premium, but that’s often the price for category leaders in high-growth tech sectors. With analysts projecting continued revenue acceleration, improving margins, and a strong product pipeline, the company remains a top contender for long-term investors.

For short-term traders, the recent dip — paired with strong fundamentals — makes a second options trade attractive. Weekly Options USA is closely watching for the right moment to re-enter, and this pullback may be just the window needed.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from CLOUDFLARE

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.