TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

KeyCorp Provides 51% Potential Profit, In 30 Minutes,

Using A

Weekly Option!

Members of “Weekly Options USA,” Using A Weekly put Option,

Make Potential Profit Of 51%,

After Keycorp Plummets Based On The

Fate Of Regional Banks!

where to now?

Join

Us and GET FUTURE TRADEs!

Shares of KeyCorp (NYSE: KEY) plummeted due to the anxiety of the fate of regional banks as the Federal Reserve decided on another 0.25% increase in its benchmark interest rate.

This set the scene for Weekly Options USA Members to profit by 51%, in half an hour, using a KEY Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, May 07, 2023

by Ian Harvey

Why the KEY Weekly Options Trade was Executed?

The fate of regional banks was a prime focus for markets Wednesday as the Federal Reserve decided on another 0.25% increase in its benchmark interest rate while opening the door to a pause.

And KeyCorp (NYSE: KEY) fell again Wednesday after plummeting on Tuesday. The S&P regional banking index (KRE) closed Wednesday down 1.8%.

The volatility follows an announcement Monday that JPMorgan Chase (JPM) purchased the bulk of First Republic (FRC), a deal which was designed to restore stability to the banking system after two months of turmoil.

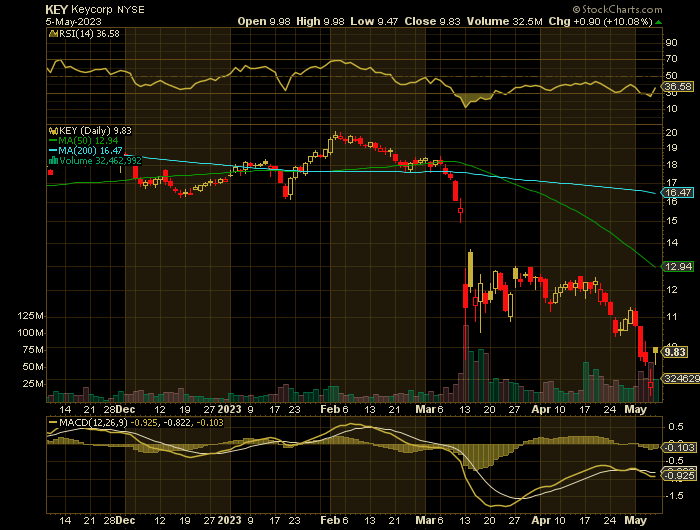

KeyCorp saw its stock price fall 10.1% in April, according to S&P Global Market Intelligence. The stock price is down about 45% year to date (YTD), trading at around $9.54 as of May 3.

The KEY Weekly Options Trade Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

** OPTION TRADE: Buy KEY MAY 26 2023 9.000 PUTS - price at last close was $0.65 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the KEY Weekly Options (PUT) Trade on Thursday, May 04, 2023, at 9:58, for $0.93.

Sold the KEY weekly options contracts on Thursday, May 04, 2023, half-an-hour later at 10:29 for $1.40; a potential profit of 51%.

Don’t miss out on further trades – become a member today!

About KeyCorp.....

KeyCorp is a Cleveland-based financial services company that provides a wide range of banking and financial solutions to individuals, small and medium-sized businesses, and large corporations across the United States. The company operates through its primary segments, Key Community Bank and Key Corporate Bank. Key Community Bank offers a wide range of products and services to individuals and small to medium-sized businesses. In contrast, Key Corporate Bank offers a range of commercial banking, treasury management, and capital markets products and services to large corporations.

KeyCorp has a long history of providing quality financial services to its clients. The company was founded in 1825 and has since become one of the largest banks in the United States, with over 1,100 branches and more than 1,500 ATMs nationwide. KeyCorp has also received numerous accolades for its financial performance, including recognition as one of the 2021 World's Most Admired Companies by Fortune Magazine and as one of America's Best Employers for Diversity in 2021 by Forbes.

The management team at KeyCorp is led by Chairman and Chief Executive Officer Chris Gorman, who has been with the company for over 25 years. Gorman is known for his focus on building strong relationships with clients and employees and his commitment to driving innovation and growth within the company. Other key leadership team members include Vice Chairman and Chief Risk Officer Mark Midkiff and Chief Financial Officer Don Kimble.

Regarding financial performance, KeyCorp has consistently delivered solid results over the past few years. The company reported that total revenue and net profit increased over several years. KeyCorp's profit margins have also remained strong, with an average net profit margin of around 20%. The company has maintained a strong balance sheet with enough assets to cover liabilities. Regarding valuation, KeyCorp trades at a price-to-earnings ratio slightly below the industry average. The company's price-to-book ratio is also lower than the industry average. These key metrics indicate that the stock may be undervalued relative to its peers.

The broader banking industry faces several challenges, including low-interest rates, increasing competition from fintech companies, and regulatory pressure. However, KeyCorp has been able to navigate these challenges by focusing on building strong relationships with clients and delivering innovative solutions that meet their needs. The company's primary competitors include other large banks such as JPMorgan Chase, Bank of America, and Wells Fargo.

Looking ahead, KeyCorp has many growth opportunities that it can pursue to continue to expand its business. The company has been investing in technology and digital capabilities to enhance its customer experience and improve operational efficiency. KeyCorp has also expanded its footprint in key markets, such as Texas and Florida, through strategic acquisitions and partnerships.

However, there are also potential risks and challenges that KeyCorp may face in the coming years. Changes in consumer preferences and technological disruption could impact the company's ability to attract and retain customers. Regulatory changes could also affect the company's operations and profitability.

The Actual Recommendation.....

(READ HERE)

Further Catalysts for the KEY Weekly Options Trade…..

One new point of pressure is being applied by short sellers who appear to be targeting lenders they perceive to be most vulnerable.

Short sellers have increased their bets against regional bank stocks by more than $440 million over the last 30 days, according to data from S3 Partners. Since Friday, short interest in PacWest rose to more than 18% of shares, making it the second most shorted regional bank stock for the same period.

"Ironically, a lot of people were willing to 'buy the dip' in March; I hear less of that talk now," said Alexander Yokum, an equities analyst for CFRA Research. "Now, I hear a lot of people say, I want to watch this play out first."

Short sellers who haven't faced losses are "emboldened," he added.

Another larger concern for the industry is a slow drain of deposits that is now a year in the making. Since mid-April 2022, banks have lost $960 billion in deposits, or roughly 5.3%, according to Fed data. That is the largest decline since the Fed began collecting the data in 1973.

"If we owned a bank right now, of course, we would be thinking about deposits," Yokum said. "But if it hasn't been a problem for the last 50 years, maybe you wouldn't have focused on it as much as you should have."

Fed Concerns.....

Concerns over the health of the banking system following the second largest bank failure a day earlier have been reignited. On Monday, First Republic Bank became the third bank to collapse in the last two months and was acquired by JPMorgan.

Excess of everything is bad. This holds true for U.S. regional banks in the current situation. For more than a year now, the Federal Reserve has been raising interest rates to control persistent inflation at the fastest pace not seen since the 1980s.

The Fed fund rates are now at a 15-year high of 4.75-5%. With the central bank expected to increase the rates by another 25 basis points at the end of the two-day FOMC meeting today, regional bank stocks will continue to feel the heat from higher rates.

We all know that banks benefit in a rising rate environment. But now, this has become a problem for banks, big or small. A host of issues, including potential recession, waning loan demand, rising funding costs, and high level of fixed-rate mortgage and commercial real estate loans, as well as uninsured deposits in the balance sheet, have turned the situation out of favor for banks.

In a normal situation, this rate increase would have been beneficial to banks’ net interest income and margin. But huge exposure to uninsured deposits and asset-liability mismatches are bigger concerns for banks like KeyCorp. Banks witnessed heavy deposit outflows following the collapse of Signature Bank and Silicon Valley Bank in March.

Earnings.....

The bank fell short of analysts' estimates for the quarter. Revenue of $1.7 billion was up 1.1% from the first quarter of 2022 but down 9.7% from the previous quarter. Net interest income was $1.1 billion, up 8.4% year over year, but down 9.9% from the previous quarter. Noninterest income was down 10% year over year.

Loans were up 15% year over year to $120 billion, but deposits were down 4.5% to $143 billion. However, deposits were only down 1.6% from the fourth quarter. But the costs of deposits were much higher -- $725 million, compared to $66 million a year ago. This was due to higher interest paid on deposits and an increase in short-term borrowings. As a result, the net interest margin dropped to 2.47% from 2.73% at the end of the fourth quarter.

In addition, higher provision for credit losses, due to an expected slowdown in the economy, also dragged on earnings. Net income fell to $276 million from $356 million in the previous quarter and $421 million in the first quarter of 2022.

Lower Guidance.....

One of the concerns was that KeyCorp lowered its guidance for net interest income, calling for it to be down 1% to 3% for fiscal year 2023 after giving previous guidance that it would be up 1% to 4%. CEO Chris Gorman said on the earnings call that this was due to higher deposit costs and a continued shift in the funding mix. Deposits are expected to be flat to down 2% for the year, while loans are anticipated to be up 6% to 9%.

Analysts.....

Dick Bove, financial strategist with Odeon Capital Group, said the short sellers who made a tidy profit betting against First Republic and Silicon Valley Bank are going to keep looking for new targets.

“The antelopes are being prowled by the lions here and the lions are going to find other ones to attack and bring down,” Dick Bove, financial strategist with Odeon Capital Group, told Yahoo Finance Monday, predicting other banks would still fail.

Wells Fargo (WFC) CEO Charlie Scharf said Tuesday at a Milken Institute conference in California that "unfortunately, there will be a lot of volatility and turmoil" among regional banks. But "the majority of the banks that we look at are still extremely strong."

Also, several analysts lowered their price targets for KeyCorp after the earnings were released, which further tanked the stock price. Among them was Citigroup, which maintained its buy rating but lowered the price target to $16 from $20. Similarly, Wells Fargo lowered it to $17 from $20 but kept its overweight rating.

According to the issued ratings of 16 analysts in the last year, the consensus rating for KeyCorp stock is Hold based on the current 2 sell ratings, 8 hold ratings and 6 buy ratings for KEY. The average twelve-month price prediction for KeyCorp is $16.55 with a high price target of $20.36 and a low price target of $12.00.

Summary.....

The current banking crisis is far

from over. The KBW Nasdaq Bank Index was down 4.5% Tuesday as the bank stocks

continued to bleed amid investor concerns over the impact of future rate hikes

on banks’ financials.

KeyCorp has a twelve month low of $9.60 and a twelve month high of $20.34. The company has a debt-to-equity ratio of 1.92, a quick ratio of 0.86 and a current ratio of 0.86. The firm’s 50 day moving average price is $13.69 and its 200-day moving average price is $16.55. The company has a market capitalization of $10.36 billion, a price-to-earnings ratio of 6.36, and a price-to-earnings-growth ratio of 1.46 and a beta of 1.25.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from KEYCORP

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.