TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

Trade” Recommendations

Week Beginning Monday, may 01, 2023

TAKE PROFIT WHEN AVAILABLE!

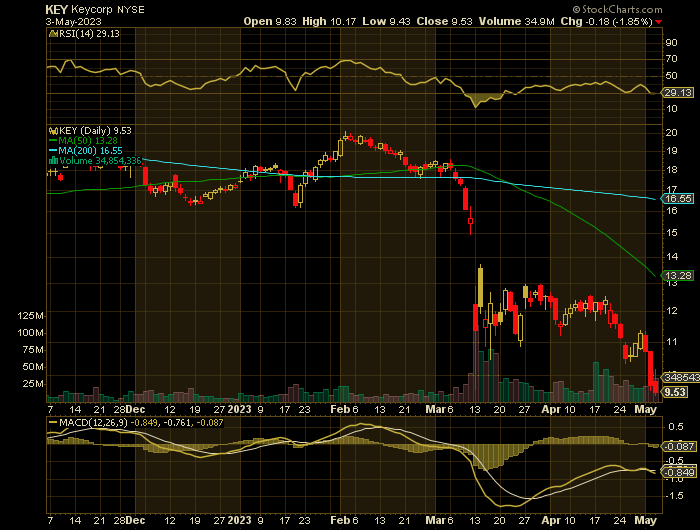

Weekly Options Trades – KeyCorp (NYSE: KEY) Puts

Thursday, May 04, 2023

** OPTION TRADE: Buy KEY MAY 26 2023 9.000 PUTS - price at last close was $0.65 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

I would suggest that if there is enough movement before the earnings then exit with some profit.

An alternative move is to sell half your options contracts and risk a positive outcome from the earnings report.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

The fate of regional banks was a prime focus for markets Wednesday as the Federal Reserve decided on another 0.25% increase in its benchmark interest rate while opening the door to a pause.

And KeyCorp (NYSE: KEY) fell again Wednesday after plummeting on Tuesday. The S&P regional banking index (KRE) closed Wednesday down 1.8%.

The volatility follows an announcement Monday that JPMorgan Chase (JPM) purchased the bulk of First Republic (FRC), a deal which was designed to restore stability to the banking system after two months of turmoil.

KeyCorp saw its stock price fall 10.1% in April, according to S&P Global Market Intelligence. The stock price is down about 45% year to date (YTD), trading at around $9.54 as of May 3.

About KeyCorp.....

KeyCorp is a Cleveland-based financial services company that provides a wide range of banking and financial solutions to individuals, small and medium-sized businesses, and large corporations across the United States. The company operates through its primary segments, Key Community Bank and Key Corporate Bank. Key Community Bank offers a wide range of products and services to individuals and small to medium-sized businesses. In contrast, Key Corporate Bank offers a range of commercial banking, treasury management, and capital markets products and services to large corporations.

KeyCorp has a long history of providing quality financial services to its clients. The company was founded in 1825 and has since become one of the largest banks in the United States, with over 1,100 branches and more than 1,500 ATMs nationwide. KeyCorp has also received numerous accolades for its financial performance, including recognition as one of the 2021 World's Most Admired Companies by Fortune Magazine and as one of America's Best Employers for Diversity in 2021 by Forbes.

The management team at KeyCorp is led by Chairman and Chief Executive Officer Chris Gorman, who has been with the company for over 25 years. Gorman is known for his focus on building strong relationships with clients and employees and his commitment to driving innovation and growth within the company. Other key leadership team members include Vice Chairman and Chief Risk Officer Mark Midkiff and Chief Financial Officer Don Kimble.

Regarding financial performance, KeyCorp has consistently delivered solid results over the past few years. The company reported that total revenue and net profit increased over several years. KeyCorp's profit margins have also remained strong, with an average net profit margin of around 20%. The company has maintained a strong balance sheet with enough assets to cover liabilities. Regarding valuation, KeyCorp trades at a price-to-earnings ratio slightly below the industry average. The company's price-to-book ratio is also lower than the industry average. These key metrics indicate that the stock may be undervalued relative to its peers.

The broader banking industry faces several challenges, including low-interest rates, increasing competition from fintech companies, and regulatory pressure. However, KeyCorp has been able to navigate these challenges by focusing on building strong relationships with clients and delivering innovative solutions that meet their needs. The company's primary competitors include other large banks such as JPMorgan Chase, Bank of America, and Wells Fargo.

Looking ahead, KeyCorp has many growth opportunities that it can pursue to continue to expand its business. The company has been investing in technology and digital capabilities to enhance its customer experience and improve operational efficiency. KeyCorp has also expanded its footprint in key markets, such as Texas and Florida, through strategic acquisitions and partnerships.

However, there are also potential risks and challenges that KeyCorp may face in the coming years. Changes in consumer preferences and technological disruption could impact the company's ability to attract and retain customers. Regulatory changes could also affect the company's operations and profitability.

Further Catalysts for the KEY Weekly Options Trade…..

One new point of pressure is being applied by short sellers who appear to be targeting lenders they perceive to be most vulnerable.

Short sellers have increased their bets against regional bank stocks by more than $440 million over the last 30 days, according to data from S3 Partners. Since Friday, short interest in PacWest rose to more than 18% of shares, making it the second most shorted regional bank stock for the same period.

"Ironically, a lot of people were willing to 'buy the dip' in March; I hear less of that talk now," said Alexander Yokum, an equities analyst for CFRA Research. "Now, I hear a lot of people say, I want to watch this play out first."

Short sellers who haven't faced losses are "emboldened," he added.

Another larger concern for the industry is a slow drain of deposits that is now a year in the making. Since mid-April 2022, banks have lost $960 billion in deposits, or roughly 5.3%, according to Fed data. That is the largest decline since the Fed began collecting the data in 1973.

"If we owned a bank right now, of course, we would be thinking about deposits," Yokum said. "But if it hasn't been a problem for the last 50 years, maybe you wouldn't have focused on it as much as you should have."

Fed Concerns.....

Concerns over the health of the banking system following the second largest bank failure a day earlier have been reignited. On Monday, First Republic Bank became the third bank to collapse in the last two months and was acquired by JPMorgan.

Excess of everything is bad. This holds true for U.S. regional banks in the current situation. For more than a year now, the Federal Reserve has been raising interest rates to control persistent inflation at the fastest pace not seen since the 1980s.

The Fed fund rates are now at a 15-year high of 4.75-5%. With the central bank expected to increase the rates by another 25 basis points at the end of the two-day FOMC meeting today, regional bank stocks will continue to feel the heat from higher rates.

We all know that banks benefit in a rising rate environment. But now, this

has become a problem for banks, big or small. A host of issues, including

potential recession, waning loan demand, rising funding costs, and high

level of fixed-rate mortgage and commercial real estate loans, as well as

uninsured deposits in the balance sheet, have turned the situation out of favor

for banks.

In a normal situation, this rate increase would have been beneficial to banks’

net interest income and margin. But huge exposure to uninsured deposits and

asset-liability mismatches are bigger concerns for banks like KeyCorp. Banks

witnessed heavy deposit outflows following the collapse of Signature Bank and

Silicon Valley Bank in March.

Earnings.....

The bank fell short of analysts' estimates for the quarter. Revenue of $1.7 billion was up 1.1% from the first quarter of 2022 but down 9.7% from the previous quarter. Net interest income was $1.1 billion, up 8.4% year over year, but down 9.9% from the previous quarter. Noninterest income was down 10% year over year.

Loans were up 15% year over year to $120 billion, but deposits were down 4.5% to $143 billion. However, deposits were only down 1.6% from the fourth quarter. But the costs of deposits were much higher -- $725 million, compared to $66 million a year ago. This was due to higher interest paid on deposits and an increase in short-term borrowings. As a result, the net interest margin dropped to 2.47% from 2.73% at the end of the fourth quarter.

In addition, higher provision for credit losses, due to an expected slowdown in the economy, also dragged on earnings. Net income fell to $276 million from $356 million in the previous quarter and $421 million in the first quarter of 2022.

Lower Guidance.....

One of the concerns was that KeyCorp lowered its guidance for net interest income, calling for it to be down 1% to 3% for fiscal year 2023 after giving previous guidance that it would be up 1% to 4%. CEO Chris Gorman said on the earnings call that this was due to higher deposit costs and a continued shift in the funding mix. Deposits are expected to be flat to down 2% for the year, while loans are anticipated to be up 6% to 9%.

Analysts.....

Dick Bove, financial strategist with Odeon Capital Group, said the short sellers who made a tidy profit betting against First Republic and Silicon Valley Bank are going to keep looking for new targets.

“The antelopes are being prowled by the lions here and the lions are going to find other ones to attack and bring down,” Dick Bove, financial strategist with Odeon Capital Group, told Yahoo Finance Monday, predicting other banks would still fail.

Wells Fargo (WFC) CEO Charlie Scharf said Tuesday at a Milken Institute conference in California that "unfortunately, there will be a lot of volatility and turmoil" among regional banks. But "the majority of the banks that we look at are still extremely strong."

Also, several analysts lowered their price targets for KeyCorp after the earnings were released, which further tanked the stock price. Among them was Citigroup, which maintained its buy rating but lowered the price target to $16 from $20. Similarly, Wells Fargo lowered it to $17 from $20 but kept its overweight rating.

According to the issued ratings of 16 analysts in the last year, the consensus rating for KeyCorp stock is Hold based on the current 2 sell ratings, 8 hold ratings and 6 buy ratings for KEY. The average twelve-month price prediction for KeyCorp is $16.55 with a high price target of $20.36 and a low price target of $12.00.

Summary.....

The current banking crisis is far

from over. The KBW Nasdaq Bank Index was down 4.5% Tuesday as the bank stocks

continued to bleed amid investor concerns over the impact of future rate hikes

on banks’ financials.

KeyCorp has a twelve month low of $9.60 and a twelve month high of $20.34. The company has a debt-to-equity ratio of 1.92, a quick ratio of 0.86 and a current ratio of 0.86. The firm’s 50 day moving average price is $13.69 and its 200-day moving average price is $16.55. The company has a market capitalization of $10.36 billion, a price-to-earnings ratio of 6.36, and a price-to-earnings-growth ratio of 1.46 and a beta of 1.25.

TAKE PROFIT WHEN AVAILABLE!

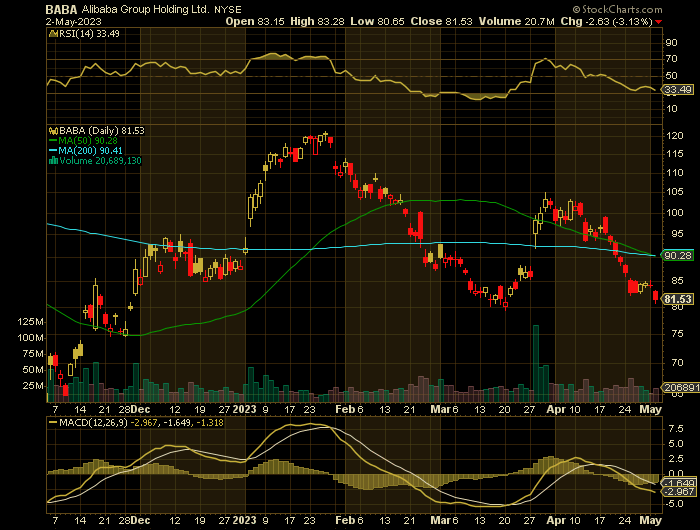

Weekly Options Trades – Alibaba Group Holding Ltd (NYSE:BABA) Puts

Wednesday, May 03, 2023

** OPTION TRADE: Buy BABA MAY 26 2023 80.000 PUTS - price at last close was $3.00 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

I would suggest that if there is enough movement before the earnings then exit with some profit.

An alternative move is to sell half your options contracts and risk a positive outcome from the earnings report.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Alibaba Group Holding Ltd (NYSE:BABA) is in an uphill battle after Alibaba’s American Depositary Receipts dropped 2.3% below where they were before the e-commerce firm announced its overhaul plan in late March, wiping out as much as 20% in gains.

It was originally hoped that a split into six units would boost the empire’s value and increase chances of listing those units publicly, reversing woes faced after the sudden halt of Ant Group’s initial public offering in 2020 amid Beijing’s concerns about influence.

But as US-China geopolitical tensions flare, there is a backtrack on this earlier enthusiasm. Concerns about broader weakness in sentiment for Chinese equities, coupled with questions about the potential initial public offering pipeline and a lack of growth catalysts, are also weighing on the stock’s outlook.

“Whatever valuation gains from Alibaba spinning off and separately listing its business units may be tempered by the weak sentiment towards China because those IPOs will be harder to execute and valuations may be lower,” said Vey Sern Ling, managing director at Union Bancaire Privee.

Over the past month, shares of this online retailer have returned -18.3%.

About Alibaba.....

Alibaba Group Holding Limited is an eCommerce and Internet technology giant headquartered in the People's Republic of China. Its core platform, Alibaba.com, is the world’s 3rd largest eCommerce platform by sales. The company, through its vast network of subsidiary companies, provides the infrastructure and marketing to help merchants of all sizes develop their brands and to connect with customers in the People's Republic of China and internationally. The company also aids other businesses with a vast array of digital and logistical solutions with a reach that spans the globe.

Alibaba was co-founded by Jack Ma in 1999 when it became clear the Internet and digitization were the future of commerce. Mr. Ma is a billionaire investor, businessman, and philanthropist who believes in an open and free-market economy. The company went public in September 2014 with an IPO on the NYSE. The IPO set a record with its valuation of $25 billion and the company is now worth more than $225 billion and ranked among the 10 most valuable companies by market cap. Alibaba is also ranked 5th largest globally in regards to its work in AI, and it owns the world's largest B2B, B2C, and C2C eCommerce portals. In 2022, Alibaba’s Singles Day event brought in $139 billion to set a new one-day record.

The principal purpose of Alibaba Group Holding Limited is to open the Chinese market and connect it to the world. The company operates through seven segments including China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

The company’s eCommerce platforms include Taobao Marketplace, Tmall, Alimama, 1688.com, Alibaba.com, Aliexpress, Lazada, Trendyol, and Daraz. Taobao Marketplace is a social-media eCommerce platform while Alimama is a monetization platform for entrepreneurs. 1688.com and Alibaba.com are wholesale marketplaces where individuals and businesses can connect with bulk items and the remainder are eCommerce retail platforms and search engines targeting specific markets. In addition, the company also operated a retail chain called Freshippo and Tmall Global which is an import platform for eCommerce.

Other digital services provided by Alibaba include Taoxianda, which is a digital integration service for FMCG goods and grocery retailers, and Cainiao Network which is a logistical services platform complemented by Ele.me, a delivery and services platform.

Alibaba also supports the infrastructure of the Internet with a range of products and services that include computing, storage, network, security, database, big data, and IoT connectivity. This segment includes a suite of cloud-based services such as Alibaba Pictures and content platforms that provide streaming media.

Further Catalysts for the BABA Weekly Options Trade…..

Alibaba’s post-spinoff fizzle in part also reflects a broader concern about the recovery trajectory in China’s economy. As a bellwether for the nation’s consumption patterns, analysts have revised its earnings forecast down by around 5% since March, according to Bloomberg-compiled data. Among concerns are a sky-high unemployment rate and decelerating private investment.

The macro headwinds have made plans for IPO fundraising particularly difficult. Last week, the firm cut prices for its cloud services — a unit it aims to make public. The move suggests the firm is willing to cede more profits this year to keep business away from rivals like Tencent Holdings Ltd. Continued share sales by SoftBank Group Corp., an early and key investor, is also hurting prospects.

Positioning.....

The stock remains in the red in both Hong Kong and US year-to-date, lagging behind rival Tencent, but still outperforming its e-commerce competitor JD.com Inc. and PDD Holdings Inc. Alibaba’s Hong Kong shares are trading at about 10 times forward one-year earnings, versus 12.3 times for JD.com and 19.3 for Tencent.

Revamping Plans Upset.....

Alibaba's organizational revamping plans instilled investor optimism over a valuation boost and drove chances of listing those units publicly, Bloomberg reports.

Investors expected the restructuring and the subsequent IPOs to ward off the downside from the sudden halt of Ant Group's IPO in 2020.

Unfortunately, the geopolitical frictions, concerns about broader weakness in sentiment for Chinese equities, questions about the potential initial public offering pipeline, and a lack of growth catalysts are weighing on the stock's outlook.

As a forerunner for the nation's consumption patterns, analysts have slashed its earnings forecast by around 5% since March, according to Bloomberg, citing concerns about the sky-high unemployment rate and decelerating private investment.

Analysts.....

Looking forward, analysts say that stronger fundamentals including steady revenue growth will be key to a revival.

“Alibaba will likely struggle to revive its overall revenue growth with cloud alone and there is a limit to how much incremental profit you can get out of cutting costs/headcount,” said Bloomberg Intelligence analyst Catherine Lim. “The firm needs to have a new growth catalyst for each of the other four businesses, excluding cost cutting moves, to support any premium valuation at the point of spinoff or IPO.”

According to the issued ratings of 15 analysts in the last year, the consensus rating for Alibaba Group stock is Buy based on the current 14 buy ratings and 1 strong buy rating for BABA. The average twelve-month price prediction for Alibaba Group is $149.40 with a high price target of $180.00 and a low price target of $120.00.

Summary.....

Shares of BABA traded down $2.86 during midday trading on Tuesday, hitting $81.30. 6,188,910 shares of the company’s stock were exchanged, compared to its average volume of 23,692,574. The company has a debt-to-equity ratio of 0.13, a current ratio of 1.74 and a quick ratio of 1.74. The stock has a 50 day moving average price of $90.70 and a 200-day moving average price of $90.76. The company has a market cap of $215.29 billion, a PE ratio of 46.24, and a price-to-earnings-growth ratio of 1.00 and a beta of 0.66. Alibaba Group Holding Limited has a 12 month low of $58.01 and a 12 month high of $125.84.

TAKE PROFIT WHEN AVAILABLE!

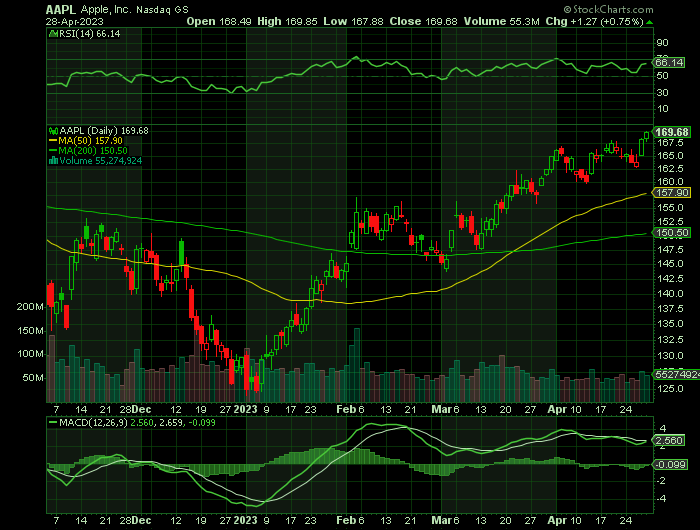

Weekly Options Trade – Apple Inc. (NASDAQ:AAPL) Calls

Monday, May 01, 2023

** OPTION TRADE: Buy APPL MAY 12 2023 170.000 CALLS - price at last close was $3.81 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

I would suggest that if there is enough movement before the earnings then exit with some profit.

An alternative move is to sell half your options contracts and risk a positive outcome from the earnings report.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Apple Inc. (NASDAQ:AAPL) is confirmed to report earnings on Thursday, May 4, 2023 at approximately 4:30 PM ET. The consensus earnings estimate is $1.44 per share on revenue of $92.94 billion, a decline of 4.5% year-over-year, but the Whisper number is a bit higher at $1.47 per share.

Investors are bullish going into the company's earnings release expecting a beat.

Short interest has decreased by 5.6% and overall earnings estimates have been revised higher since the company's last earnings release.

Year to date, Apple stock is up 30.6%. That compares with an 8.6% rise for the S&P 500.

About Apple.....

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

It also sells various related services. In addition, the company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; AirPods Max, an over-ear wireless headphone; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, HomePod, and iPod touch.

Further, it provides AppleCare support services; cloud services store services; and operates various platforms, including the App Store that allow customers to discover and download applications and digital content, such as books, music, video, games, and podcasts.

Additionally, the company offers various services, such as Apple Arcade, a game subscription service; Apple Music, which offers users a curated listening experience with on-demand radio stations; Apple News+, a subscription news and magazine service; Apple TV+, which offers exclusive original content; Apple Card, a co-branded credit card; and Apple Pay, a cashless payment service, as well as licenses its intellectual property.

The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers.

Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.

Further Catalysts for the AAPL Weekly Options Trade…..

Apple has a market capitalization of $2.6 trillion, and has long been known for its dominance of the smartphone market, a space in which it accounts for more than 24% of all sales globally. In the first quarter of the company's fiscal 2022, $66 billion of Apple's $117 billion total net sales were derived from iPhone sales.

While sales of these hardware products remain Apple's bread and butter, another segment is quickly catching up. The company's services segment, which is comprised largely of subscription-based offerings like Apple Music, is growing rapidly. This recurring revenue business contributed $21 billion of Apple's total net sales in the first-quarter period, more than sales from its Mac, iPad, or Wearables/Home/Accessories segments.

Past Earnings.....

Apple reported revenues of $117.15 billion in the last reported quarter, representing a year-over-year change of -5.5%. EPS of $1.88 for the same period compares with $2.10 a year ago.

Compared to the Consensus Estimate of $121.21 billion, the reported revenues represent a surprise of -3.34%. The EPS surprise was -2.59%.

Over the last four quarters, Apple surpassed consensus EPS estimates three times. The company topped consensus revenue estimates three times over this period.

iPhone.....

The iPhone represented 56% of total company revenue in the latest fiscal quarter (Q1 2023 ended Dec. 31). And it's the gateway product that brings consumers in.

"We're proud to now have over 2 billion active devices in our installed base," CFO Luca Maestri said on the Q1 2023 earnings call. This massive installed base has doubled over the past seven years, a remarkable feat that exemplifies Apple's ubiquity. While the majority of these devices are iPhones, it's worth noting the success of Apple's other products.

Services Segment.....

Besides beautiful hardware products, Apple's services segment is becoming a more important part of the business that drives customer loyalty and stickiness. In the latest fiscal quarter, services accounted for 18% of total sales, a percentage that has increased steadily over time. This segment carries a gross margin of over 70%, much higher than the products group, so investors can expect Apple's profitability to rise in the years ahead.

Also, Apple's ongoing foray into financial services has been impressive, with Apple Pay, Apple Card, and now a high-yield savings account added to the mix. The business attracts a more affluent customer base, so these offerings are poised to do well in the long run, providing Apple with another key revenue driver.

Moving Ahead.....

Apple is also looking to the future as it seeks to build out its competitive advantage in other lucrative markets, including the financial services space. The company launched its own buy now, pay later product last year.

And it just launched an interest-bearing savings account in partnership with Goldman Sachs. The account currently boasts an annual percentage yield of 4.15%, while the national average is only around 0.4%.

The company is also looking to other high-octane industries on which to build out its growth story. While it still has a modest footprint in the advertising space, it's estimated that Apple could be generating more than $10 billion in ad revenue alone by the end of next year.

Then, there's the much anticipated virtual reality headset, which by some reports could be out as early as June of this year.

There's possibly an even bigger product on the horizon that can be an absolute game changer. It is still believed that Apple is working on an electric vehicle. Unsurprisingly, information about this is scarce, but it's hard to imagine a scenario where an automobile designed and made by Apple, with integration into the software ecosystem, doesn't immediately become a hit. And because the car market is gigantic, this has the potential to move the needle for the business.

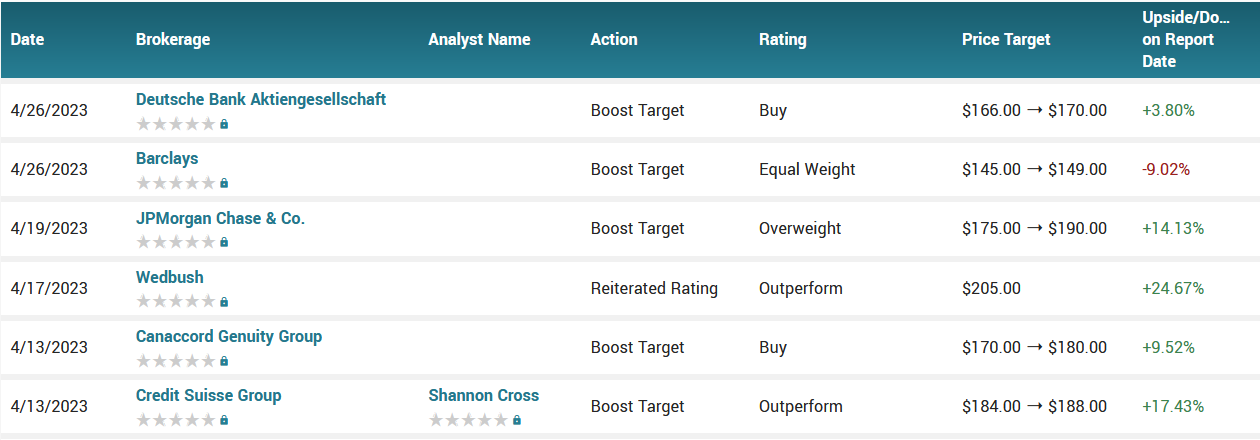

Analysts.....

In a recent note to clients, Morgan Stanley analyst Erik Woodring called Apple "the best house in a challenged neighborhood." He rates Apple stock a "top pick" with a price target of 180.

Woodring predicts Apple will post in-line results but guide analysts lower for the June quarter.

However, he sees several catalysts for Apple stock in the months ahead. They include the rumored introduction of a mixed-reality headset at the company's Worldwide Developers Conference in June.

Other catalysts could include re-accelerating services growth in the June quarter and easing foreign-exchange headwinds. Plus, Apple should see a pickup in handset sales with the launch of the iPhone 15 series this fall, Woodring said.

Deutsche Bank analyst Sidney Ho expects Apple to deliver in-line results and give mixed guidance. He rates Apple stock as buy with a price target of 170.

"Investors are attracted by the company's quality of earnings and its strong balance sheet in an uncertain macro environment," Ho said in a note to clients. "We expect this investor preference to continue."

According to the issued ratings of 32 analysts in the last year, the consensus rating for Apple stock is Moderate Buy based on the current 2 sell ratings, 4 hold ratings and 26 buy ratings for AAPL. The average twelve-month price prediction for Apple is $170.09 with a high price target of $205.00 and a low price target of $54.00.

Summary.....

Although Apple isn't usually the first to bring a new product to market, it has proven that what it offers can be the best. Finding ways to have a higher number of active devices across the world, whether it's phones, tablets, headsets, or cars, feeds into Apple's powerful ecosystem, making its economic moat that much stronger.

Apple has a market capitalization of $2.66 trillion, a price-to-earnings ratio of 28.59, a price-to-earnings-growth ratio of 2.18 and a beta of 1.30. Apple has a fifty-two week low of $124.17 and a fifty-two week high of $176.15. The firm has a 50-day simple moving average of $157.78 and a 200-day simple moving average of $147.65. The company has a debt-to-equity ratio of 1.76, a quick ratio of 0.89 and a current ratio of 0.94.

Back to Weekly Options USA Home Page