TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

Trade” Recommendations

Week Beginning Monday, APRIL 24, 2023

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trades – Amazon.com, Inc. (NASDAQ: AMZN) CALLS

Thursday, April 27, 2023

** OPTION TRADE: Buy AMZN MAY 05 2023 110.000 CALLS - price at last close was $2.29 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Amazon.com, Inc. (NASDAQ: AMZN) is scheduled to report financial results today after the market closes, and is expected that cost-cutting measures have helped profitability and cloud services sales growth is bottoming out.

I would suggest that if there is enough movement before the earnings then exit with some profit.

An alternative move is to sell half your options contracts before the earnings report, and then sell the other half after the report and hope for a positive outcome.

Amazon.com is best known for its range of e-commerce companies, its research and development into customer experience and new markets, that can drive it as a growth stock. As of April 2023, Amazon.com had a total market capitalization of more than $1 trillion, making it an appealing choice for growth investors.

Amazon has relentlessly focused on delivering exceptional customer experiences through fast and reliable delivery, a wide selection of products and easy-to-use technology. For example, Amazon Web Services, the company's cloud computing division, has become a dominant player in the market in just a few years, bolstered by a loyal customer base. Amazon has recently begun investigating the healthcare market, another potential outlet for future growth.

About Amazon.com.....

Amazon, or Amazon.com, is the world's largest and leading portal for eCommerce. It was founded by Jeff Bezos, incorporated in 1994, and later went public in 1997. The company is headquartered in Seattle, Washington, and is a member of the influential FAANG group of stocks. When it comes to stocks, Amazon is proof that small companies can do big things; the AMZN stock price was pennies when it was first listed and now it trades well over $100 (split adjusted) per share.

The company is not a true retailer nor a pure-play manufacturer but in the business of connecting consumers and merchants together. The website was first created as a means of selling books at a discount but it has since grown to include most verticals in the retail sector. A few of the products the company does manufacture are the Kindle and Fire Tablets, Fire TVs, and smart home devices like Echo. Echo is powered by an AI personality named Alexa which can take vocal commands from its users.

Today, Amazon operates in three segments including North America, International, and Amazon Web Services. The first two segments are the core retail business while Amazon Web Services includes a host of Internet-related services for consumers and businesses alike. A little-known fact is that Amazon Web Services is as important to the function of the Internet as Google because of the infrastructure it provides and it hosts so many business websites.

Services provided by Amazon for merchants include listing, fulfillment, and advertising as well as subscriptions. Services provided by Amazon Web Services include cloud computing, storage, database maintenance, analytics, machine learning, and even artificial intelligence. In regard to the company's operations, Amazon Web Services is the smaller of the three segments but is a fast-growing and well-established part of the business that has had a positive influence on the AMZN stock price.

Among the many ancillary services provided by Amazon is Kindle Direct Publishing. This is a cloud-based service that enables writers and publishers to publish their works directly in the Kindle Store. Kindle, if you are unaware, is an Internet-connected tablet designed for reading books but also streams other forms of entertainment. Amazon also develops and publishes its own media content that is available via Kindle or the Amazon App that can be found on most smart TVs.

Amazon is also a disruptor, moving into new digital markets whenever it thinks it can make a profit. The move into streaming is only one example, another is a push into healthcare. Amazon Prime is another disruptive move and is a subscription service that entitles members exclusive access to Amazon services.

Amazon's stock price can be affected by factors including the pace of revenue growth, profitability, growth in the AWS segment, and any stock splits that may occur. The Amazon share price was impacted by splits 4 times between the IPO in 1997 and June 2022 and additional splits should be anticipated. The forecast for Amazon stock, splits aside, is for steadily increasing price action punctuated by pullbacks, corrections, and consolidations. While there is competition for Amazon, this company is entrenched and will stand the test of time because eCommerce is the way businesses thrive in today's markets.

Further Catalysts for the AMZN Weekly Options Trade…..

E-commerce and cloud computing giant Amazon reports earnings Thursday, April 27 after the market close. The precarious nature of the current market regime makes this report quite significant.

Of particular interest to investors will be revenue numbers in AWS Cloud, as it has been a major driver of growth for Amazon. Its primary competitors in the cloud space, Microsoft MSFT, and Alphabet GOOGL reported earnings Tuesday evening, and provided interesting insights into what to expect from AMZN.

Amazon has been on a tear, rallying 25% YTD, considerably better performance than the S&P 500. However, investors shouldn’t forget how painful 2022 were for AMZN. The stock price more than halved in 2022, leaving Amazon shares still down almost -40% over the last two years, well below the performance of the index.

Earnings.....

Considering the forecasted weakness in business and consumer spending broadly, analysts still have fairly strong expectations for Amazon. Sales are projected to grow 7.2% YoY to $125 billion for the current quarter.

Amazon is expected to beat estimates by 11.5% for earnings. Last quarter Amazon really blew away analyst expectations and reported earnings that were 40% above estimates.

Cloud Computing.....

In the Q4 report, Amazon’s cloud computing segment reported 20% growth YoY, below Q3’s 28% growth, and Q2 33% growth. While 20% growth in sales is nothing to scoff at, the deceleration is an extremely important development, as AWS is a major engine for growth. Because of the shifting macroeconomic environment, firms have clearly tried to cut some of their cloud spending.

Halo.....

Amazon is winding down its health-focused Halo devices and membership as the tech giant continues to cut costs.

The company told customers on Wednesday that it will issue refunds to anyone who purchased Amazon Halo devices in the past year. Refunds will also be issued to customers who have unused prepaid Halo subscriptions fees.

Amazon introduced its Halo line in 2020 with the launch of a fitness-tracking wristband that worked alongside a subscription service and smartphone app. Since then, it has expanded the line to offer more wearables and a bedside device that tracks sleeping patterns.

“While we are proud of what we built, we recently made the difficult decision to stop supporting Amazon Halo effective July 31, 2023,” the company said in a blog post.

Halo is the latest unit to get axed as by Amazon as it works to reduce costs amid worries about the wider economic environment and sluggish online sales. Among other cuts, the company has shuttered its hybrid virtual, in-home care service Amazon Care, the video calling device Amazon Glow and scaled back its Scout delivery program in recent months.

Valuation.....

Amazon is currently trading at a one-year forward price to sales ratio of 1.9x, which is well below its 10-year median of 2.7x and below the broad market average of 3.6x. This is a compelling valuation for the tech giant.

AI.....

Although Amazon is best known for its e-commerce sites, cloud computing is the company's primary profit driver. Amazon Web Services (AWS) generated a whopping $22.8 billion in operating income in 2022, up from $18.5 billion in 2021. That was despite significant macroeconomic challenges, including inflation and recessions fears, which drove many businesses to slow their technology investments.

Inflation is moderating and the economy will eventually strengthen, both of which should increase Amazon's cloud profits. But AWS is set to enjoy an even more powerful growth catalyst in the coming years: artificial intelligence.

Amazon's new service, Bedrock, is designed to help customers easily build and scale generative AI applications. Generative AI is cutting-edge technology made popular by apps like ChatGPT, which can produce text, images, and other novel content from user prompts. Bedrock provides access to AI models, including Amazon's new Titan models, as well as those offered by Stability AI, Anthropic, and other providers. Additionally, Amazon's custom-designed Trainium and Inferentia2 chips can reduce the cost of training AI models and running generative AI workloads on AWS, thereby making the technology accessible to more people.

Amazon already has over 100,000 customers for its AI services. Amazon management said it believes generative AI will have a "profound impact across industries" and power "a technological revolution that will continue for decades to come." Amazon intends to lead this revolution, and it's investing aggressively to advance this game-changing technology.

Automation…..

Automation should further enhance Amazon's profitability. The robotics market could grow to a staggering $9 trillion by the end of the decade, up from $70 billion in 2022, according to Ark Investment Management. Amazon is also a powerhouse in this booming industry.

Ark notes that the adoption of industrial robots tends to accelerate during economic calamities, such as the 2002 dot-com crash and the 2008-2009 financial crisis. This somewhat counterintuitive trend is likely to persist. The reason is simple: automation can reduce labor costs.

Moreover, technological advancements are driving a rapid improvement in robot performance, so much so that Ark believes Amazon could begin to add more robots to its warehouses than people in the coming years.

So Amazon has an intriguing choice: sell its leading robot technology to other businesses or keep it in-house and enjoy the corresponding productivity gains. Either option should help to drive Amazon's profits higher in the decade ahead.

Analysts.....

Amazon also stands to benefit from the long-term growth of the online retail industry. Yet investors appear to be underestimating just how valuable this market could be, according to analysts at the investment firm run by JPMorgan Chase. The firm recently named Amazon its best internet stock idea.

Analyst Doug Anmuth acknowledged that macroeconomic issues are weighing on Amazon's results. But he expects e-commerce companies to return to their historical norm of wrestling away market share from brick-and-mortar retailers. He also sees Amazon's profit margins improving, due in part to its cost-cutting initiatives. All told, Anmuth sees Amazon's stock rising more than 30% to $135 per share.

As Anmuth noted, CEO Andy Jassy is working to cut expenses throughout Amazon's retail operations. Jassy's plan includes job cuts and a slower pace of expansion for the company's massive fulfillment network. While painful in the short term, these measures should make Amazon more efficient and, by extension, profitable.

In a letter to shareholders, Jassy noted that roughly 80% of global retail sales still occur in physical stores. That leaves plenty of room for growth for the e-commerce giant. And the additional sales Amazon earns should come with higher margins, thanks to its efficiency-boosting efforts.

According to the issued ratings of 43 analysts in the last year, the consensus rating for Amazon.com stock is Moderate Buy based on the current 2 hold ratings and 41 buy ratings for AMZN. The average twelve-month price prediction for Amazon.com is $143.75 with a high price target of $270.00 and a low price target of $106.00.

Summary.....

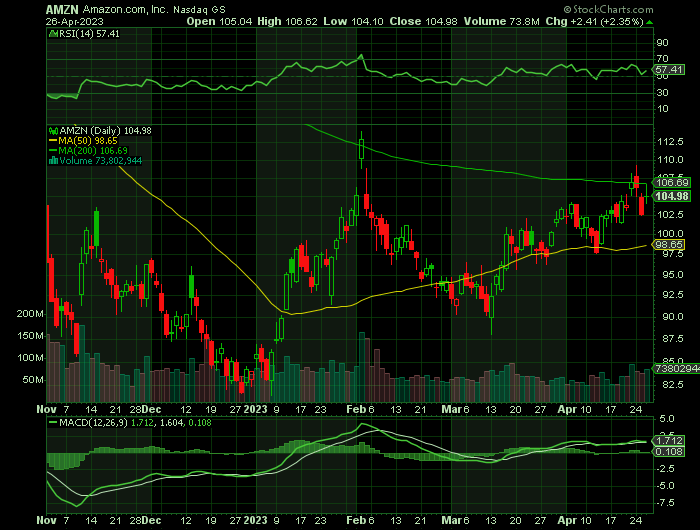

If Amazon can retake the pre-Covid highs ~$110 level, it should be an extremely bullish signal for the stock. Additionally, the $100 level seems to be a psychological level of interest, and so long as price holds above there, investors can remain bullish.

Amazon has a market cap of $1.08 trillion, a PE ratio of -393.53, a P/E/G ratio of 3.95 and a beta of 1.26. The stock’s 50-day simple moving average is $98.35 and its two-hundred day simple moving average is $97.54. Amazon.com has a 1 year low of $81.43 and a 1 year high of $146.57. The company has a current ratio of 0.94, a quick ratio of 0.72 and a debt-to-equity ratio of 0.46.

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trade – Spotify Technology SA (NYSE: SPOT) CALLS

Wednesday, April 26, 2023

** OPTION TRADE: Buy SPOT MAY 12 2023 140.000 CALLS - price at last close was $4.02 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Spotify Technology SA (NYSE: SPOT) has released its earnings report for the first quarter of 2023 and the headline figure is the number of users the company has. As of March 31st, 515 million people were using the audio streaming service. That's the first time Spotify has had more than half a billion users. Q1 was also Spotify's second-biggest quarter for user growth to date — its audience increased by five percent from the previous quarter and 22 percent year over year. The user base grew by 26 million, which is 15 million more than Spotify had expected. The company said it saw growth in both developed and developing markets, as well as almost every age group.

About Spotify Technology.....

Spotify Technology SA is a digital music service offering music fans instant access to a world of music. It operates through the Premium and Ad-Supported segments.

The Premium segment provides subscribers with unlimited online and offline high-quality streaming access of music and podcasts on computers, tablets, and mobile devices. Users can connect through speakers, receivers, televisions, cars, game consoles, and smart watches. It also offers a music listening experience without commercial breaks.

The Ad-Supported segment provides users with limited on-demand online access of music and unlimited online access of podcasts on their computers, tablets, and compatible mobile devices. It also serves both a premium subscriber acquisition channel and a robust option for users who are unable or unwilling to pay a monthly subscription fee but still want to enjoy access to a wide variety of high-quality audio content.

The company was founded by Daniel Ek and Martin Lorentzon in April 2006 and is headquartered in Luxembourg.

Further Catalysts for the SPOT Weekly Options Trade…..

Overall, Spotify posted a net operating loss of €156 million ($172 million) for the quarter. That's far more than the €6 million ($6.6 million) loss it saw in the first quarter of 2022, though it's an improvement over the €270 million ($297 million) Spotify lost the previous quarter.

While overall revenue was up by 14 percent year over year from €2.66 billion ($2.93 billion) to €3.04 billion ($3.34 billion), it dipped by four percent from the previous quarter. Revenue from paid subscribers didn't change significantly from Q4 2022, but it dropped by 27 percent on the ad-supported side from €449 million ($494 million) to €329 million ($362 million) — though revenue from free users rose by 17 percent year over year. The quarter-to-quarter drop is perhaps a result of advertisers tightening their belts somewhat, leading to lower ad spend.

Advertisers aren't the only businesses trying to rein in costs. Spotify, like many other major tech companies in recent months, has laid off a sizable proportion of its staff. In January, the company laid off six percent of workers, which equates to around 600 people based on the 9,800 that Spotify employed as of the end of 2022.

Additionally, Spotify seems to be placing a bigger focus on the core parts of its business. It recently announced plans to shut down both its live audio app, Spotify Live, and Heardle, the Wordle-style song-guessing game it bought last summer.

Subscription Plan.....

Spotify once again decided not to raise prices on its U.S. subscription plan, despite recent hikes at Apple Music (AAPL) and YouTube Premium (GOOGL) — but CEO Daniel Ek hinted an increase could come at some point this year.

"We'd like to raise prices in 2023," the executive said on the company's Q1 earnings call, but cautioned that decision will largely revolve around ongoing negotiations with label partners.

The executive said the music streaming giant raised prices last year in 46 different markets, which continued to outperform despite the increase.

"When the timing is right, we will raise it and that price increase will go down well because we're delivering a lot of value for our customers," he added.

Institutional Activity.....

Baillie Gifford & Co. grew its holdings in Spotify Technology by 6.7% during the 3rd quarter. Baillie Gifford & Co. now owns 27,964,517 shares of the company’s stock worth $2,413,338,000 after acquiring an additional 1,764,880 shares during the last quarter.

BlackRock Inc. lifted its position in shares of Spotify Technology by 20.2% during the 3rd quarter. BlackRock Inc. now owns 4,214,562 shares of the company’s stock valued at $363,717,000 after acquiring an additional 707,653 shares during the period.

Samlyn Capital LLC lifted its position in shares of Spotify Technology by 394.4% during the 3rd quarter. Samlyn Capital LLC now owns 453,792 shares of the company’s stock valued at $39,162,000 after acquiring an additional 362,003 shares during the period.

Renaissance Technologies LLC acquired a new position in shares of Spotify Technology during the 1st quarter valued at $37,966,000.

Finally, Alecta Tjanstepension Omsesidigt increased its stake in Spotify Technology by 9.0% during the 3rd quarter. Alecta Tjanstepension Omsesidigt now owns 3,035,600 shares of the company’s stock valued at $261,790,000 after purchasing an additional 250,000 shares in the last quarter.

52.80% of the stock is owned by institutional investors.

Analysts.....

Analysts largely expect Spotify to announce higher subscription fees in the coming months given its recent profitability push.

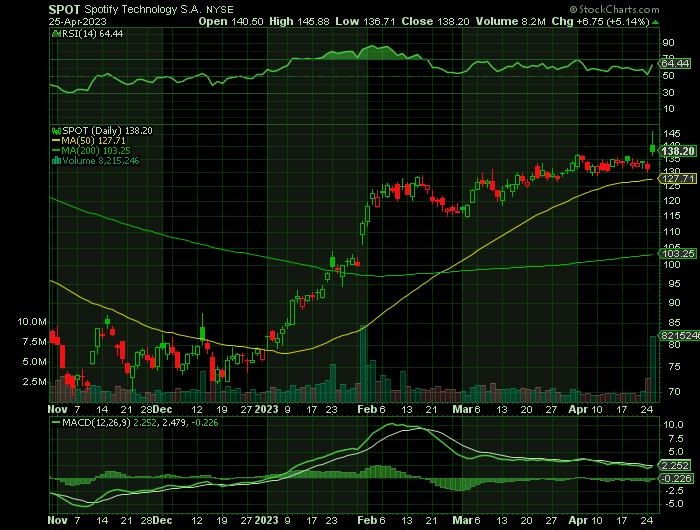

According to the issued ratings of 22 analysts in the last year, the consensus rating for Spotify Technology stock is Moderate Buy based on the current 7 hold ratings and 15 buy ratings for SPOT. The average twelve-month price prediction for Spotify Technology is $139.67 with a high price target of $180.00 and a low price target of $95.00.

Summary.....

The company reiterated its guidance of gross margins between 30% to 35% over the long term amid plans to further scale its podcasting and ads business.

Overall, Ek said the company is "really trying to focus on how can we optimize for growth," adding there are many ways to achieve growth in the near-term, besides just increasing prices.

"We have many tools at our disposal as we're thinking about how to increase growth," he said, referencing more runway for premium subscribers and average revenue per user. "The industry realizes that, and our label partners realizes that as well. That's the constant dialogue we are in."

Spotify Technology has a market capitalization of $25.21 billion, a PE ratio of -43.29 and a beta of 1.76. Spotify Technology S.A. has a 12-month low of $69.29 and a 12-month high of $136.73. The business’s 50 day simple moving average is $127.47 and its 200-day simple moving average is $101.11.

Back to Weekly Options USA Home Page