TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Facebook Inc Continues To Move

Higher!

“Weekly Options Members” Are Now Up 352% Potential

Profit!

More to Come?

April 8, 2021

Facebook Inc shares continue on their upward trajectory. The company posted a 52% rise in earnings for Q4. Sales growth increased 33%, up from 22% in the prior quarter. That marks two quarters of rising growth.

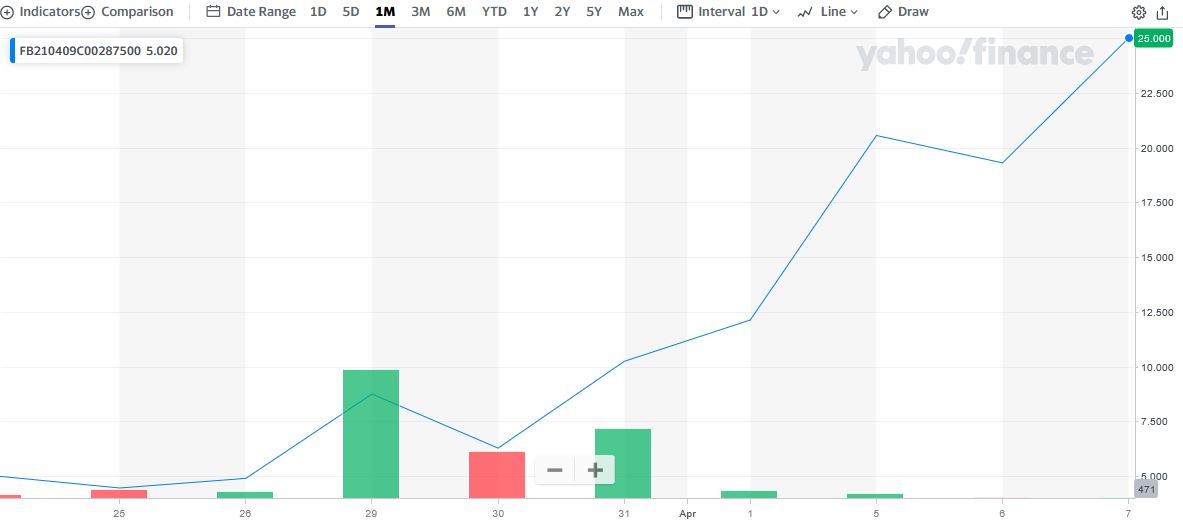

And, “Weekly Options Members” have gained potential profits of 352% since Monday, March 29, 2021.

More upwards movement is expected, and for those that have exited the trade, a new trade may be considered.

And still, $400 looks promising!

Facebook Inc (NASDAQ:FB)

The Actual Recommended Trade…..on Monday, March 29, 2021…..

** OPTION TRADE: Buy FB APR 09 2021 287.500 CALLS at approximately $4.90.

The Profit Explained…..

Actual entry price was $5.68 at the open of the market.

Price yesterday, April 07, for the option was $25.70.

TOTAL PROFIT SO FAR IS 352%

In other words 1 contract is now worth $2,570 for an investment of $568!

Why The Trade Recommendation On Facebook?

This was explained in the original recommendation......Read about it HERE.

We also wrote an article the day after the trade where an 80% profit was made in the first couple of hours – “Facebook Poised To Go Higher!”

Where to Now for Facebook Inc?

It appears that Facebook Inc is just getting started!

That's according to a new analysis of the stock from analyst Lloyd Walmsley at Deutsche Bank, who has raised the target price of the shares to a new "street high."

Walmsley's new level is $385, from the previous $355. The former is more than 32% above Facebook's most recent closing price. He's maintaining his buy recommendation on the stock.

Walmsley believes that ad spending, a crucial source of revenue for the company, will see a rise.

"We think investor focus is starting to shift away from fears around iOS changes toward a continued ad recovery and benefits from more eCommerce activity shifting into Facebook's platform," Walmsley wrote in his research note explaining the price target hike.

Facebook Inc already has a massive user base, so it can't rely on significant improvement in those numbers to drive its business forward. Rather, it will be reliant on expanding advertising take and other revenue sources for meaningful growth. Walmsley thinks that it has several levers it can pull for this, including the Tik Tok-like Reels video feature in Instagram. He's estimating that Reels can potentially pull in $21 billion in revenue.

Facebook Inc has shaken off all sorts of political headwinds, sidestepping ferocious opposition from the conservative side of the aisle, and appears poised to break out in a major uptrend that could target 400.

Also, Jefferies analyst Brent Thill said on March 8 that the stock looked attractive following a recent pullback. He added that it trades at a 40% discount to the Nasdaq despite expectations that revenue growth will accelerate in 2021.

Wall Street consensus has a ‘Buy’ rating based upon 39 ‘Buy’, 4 ‘Overweight’, 5 ‘Hold’, and 2 ‘Sell ‘recommendations. Price targets range from a low of $220 to a Street-high $418.

Facebook Inc Continues To Grow.....

Shares of Facebook Inc continue to climb as the social media giant benefited from optimism about the vaccine rollout and the economic recovery later this year; as well as some bullish analyst chatter. The tech stock did seem to benefit from a rotation out of high-priced growth stocks and into value stocks, which includes Facebook since the company now trades at a discount to the S&P 500.

Facebook Inc ended the world's most challenging year in generations with 2.8 billion people visiting its namesake site each month. It had another 500 million unique visitors going to Instagram or WhatsApp on a monthly basis. Combined, that's 3.3 billion people (over 42% of the people on the planet) visiting a Facebook-owned asset at least once a month.

This is definitely the go to for advertising – one of the reasons Facebook grew ad revenue last year by 21%. And, Facebook Inc has plenty of room to increase from the $84 billion made from ad revenue last year which came from Facebook and Instagram.

"This was a strong quarter for our business, as the acceleration of online commerce we've seen during the pandemic continued into the holiday season," explained Facebook chief operating officer Sheryl Sandberg during the company's fourth-quarter earnings call.

Even more, despite continued significant uncertainty in some advertising

verticals, Facebook CFO Dave Wehner said he expects Facebook's year-over-year

revenue growth rates to "remain

stable or modestly accelerate sequentially in the first and second quarters of

2021."

Moving Ahead.....

Over the course of the past month, Facebook has had several blog posts laying out its strategy in human-computer interaction, or augmented reality (AR) and virtual reality (VR), and the company said it was working on a wristband that would control AR glasses. Facebook sees VR and AR as the next frontier in technology, and its Oculus platform is one of the leaders in the space.

On Monday, the social media giant announced Dynamic Ads for Streaming, a product that laser-targets the growing legion of streaming video service providers.

"With Dynamic Ads for Streaming, when people see an ad for your service in their feed, they can swipe through the ad to see personalized, relevant titles they might be interested in, based on interests they've shown on Facebook and Instagram," the company wrote, referring to both its eponymous social networking site and its high-profile photo-sharing site.

"Audiences can also follow your call to action to start a trial or subscribe," Facebook added.

Facebook cited research from Kantar indicating that 64% of people considering a subscription to a streaming service are doing so based on its library, not an individual title.

As well, Facebook Inc started public testing of a new application dubbed Hotline on Wednesday, where creators can speak and take live questions from an audience.

This Q&A product combines audio with text and video elements and comes as social media platforms experiment with a rush of new live audio features.

The success of the invite-only, year-old app Clubhouse, which has reported 10 million weekly active users, has demonstrated the potential of audio chat services, particularly during the COVID-19 pandemic.

Facebook is also very aggressive with its VR development, which is a market that many believe will boom soon.

Toward the end of last month, Facebook's WhatsApp also got approval to handle peer-to-peer payments in Brazil.

Conclusion.....

Even at the all-time highs Facebook Inc shares still trade at an attractive valuation, even after the stock's strong performance recently.

Despite Facebook demonstrating strong

business momentum and management guiding for a potential acceleration in the

near term, shares trade at a very conservative valuation. The stock has a

price-to-earnings ratio of just 30 -- a low level considering analysts, on

average, expect Facebook's earnings per share to grow at an average rate of

nearly 22% annually for the next five years.

Therefore…..

Will Facebook Inc Continue To Provide Profit?

Will We Recommend Another Trade On Facebook Inc?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

While there are many more areas that can help to explain option trading, this is a basic overview of what stock options are, and where and how they started.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Facebook Inc Continues To Move Higher Higher!