TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, mARCH 29, 2021

Weekly Options Trade – Intel Corporation (NASDAQ:INTC) Calls

Thursday, April 01, 2021

** OPTION TRADE: Buy INTC APR 09 2021 65.000 CALLS at approximately $0.75.

(Some members have asked for the following.....

Place a pre-determined sell at $2.00.

Include a protective stop loss of $n/a.

Prelude.....

Santa Clara, California based Intel Corporation (NASDAQ:INTC), a designer and manufacturer of digital technology platforms, a large-cap value stock and member of the Dow Jones Industrial Average, has a new plan to capture market share.

Intel Corporation, one of the largest chipmakers in the world, has lagged its peers over the last few years in the development of advanced transistor processors.

Intel’s rival, Advanced Micro Devices, Inc. (AMD), has already introduced 7nm chips to the market and plans to bring 3nm chips by 2022 through its business relationship with Taiwan Semiconductor Manufacturing Company Limited (TSM), which is already using 5nm chips.

Intel is yet to bring 7nm chips to the market, and this delay led Apple, Inc. (AAPL) to ditch Intel as a supplier of processors for MacBook products late last year.

The chip giant has lost its luster in recent years, as both Nvidia and AMD have delivered superior products and eaten away at its market share.

But Intel is certainly outperforming its hipper rivals in 2021. Year-to-date, the stock is up by 29%, delivering far better returns than both rivals, while the SOX - the major semiconductor index – is up by only 9%.

The Major Catalysts for This Trade.....

1. A Strategic Plan.....

Pat Gelsinger, the newly appointed Intel CEO joined the company on Feb. 15 and introduced a strategic plan on March 23 to expand the manufacturing capabilities of the company to bring advanced chips to the market. This is a step in the right direction.

Intel is planning to invest $20 billion in 2 new manufacturing facilities in Arizona to expand its foundry services segment. Fabless chipmakers, or semiconductor companies that design and sell hardware and semiconductor chips without manufacturing the silicon wafers used in their products, outsource the fabrication process to a foundry. Intel’s new plants are trying to capture this business opportunity and according to the recent announcement, Intel will treat the foundry business as a standalone unit to avoid cannibalization.

Separately, the company confirmed its plans to outsource some of its manufacturing needs to third-party chipmakers, which could turn out to be a catalyst for growth in the future. AMD has already seen success with this strategy.

"Our past attempts were somewhat half-hearted," Gelsinger said in a presentation to analysts, as reported by Bloomberg.

This time around, Intel appears fully committed to becoming a major player in the foundry business. The company will be able to offer manufacturing capacity in the U.S. and Europe, and customers will be able to make use of Intel's intellectual-property portfolio, including its x86 cores.

Given Intel's previous failure at getting a foundry business off the ground, along with its years-long struggles with manufacturing, the push into offering foundry services may seem unexpected. But given how profitable TSMC has become, it makes perfect sense.

2. Analysts Positivity.....

Many Wall Street analysts have been questioning Intel’s decision to manufacture all products internally, which has proved to be inefficient in the last few years. Using a blended production strategy might help Intel bring advanced chips to the market more efficiently, which in turn, will boost revenue growth.

Needham’s Quinn Bolton liked the latest developments that the new CEO Pat Gelsinger has implemented. The new man at the helm laid out Intel’s IDM (integrated device manufacturer) 2.0 strategy last week.

These include the production of modular tiles using state-of-the-art process technologies for the company’s client and data center CPUs as well as the Ponte Vecchio GPU.

“As a result,” said Bolton, “Intel is increasing its engagements with TSMC, Samsung, GlobalFoundries and UMC.”

As part of the new strategy, Intel will launch a new foundry business, called Intel Foundry Services (IFS).

Asia is now where the majority of the world's cutting edge foundry capacity is based, and Bolton says the company launched IFS to “address the industry's capacity constraints and need for more geographically balanced manufacturing capacity.”

IFS will have facilities in the U.S. and Europe. The focus will be on acquiring commercial customers, as well as finding “unique opportunities in government and security requirements in the U.S. and E.U.”

Furthermore, Intel is addressing the issues which have delayed the release of its next-gen 7-nanometer chips. Bolton says the company is “righting this wrong.” By more than doubling its use of EUV (extreme ultraviolet), it has now “re-architected and simplified its 7nm process flow.”

The company also gave an update on its earnings projections. Driven by “continued strength in notebook demand,” Intel anticipates beating its current 1Q21 revenue guidance of $17.5 billion and EPS forecast of $1.10.

To this end, the analyst reiterated a Buy rating on INTC shares along with a $74 price target.

3. Growth In The Adoption Of Cloud Computing Services.....

The growth in the adoption of cloud computing services accelerated as a result of the virus-induced recession that led to secular growth in the work from home movement. This presents Intel with a good opportunity to grow its earnings.

Data centers are under pressure to improve the efficiency of their servers to cater to the strong demand for cloud computing, and this can only be achieved by using advanced chips. Intel, as one of the leading chipmakers in the world, is well-positioned to benefit from this macroeconomic development.

4. Strong Presence.....

Intel’s strong presence in the personal computer chip market will also be a catalyst for growth. According to data from Gartner Research, worldwide PC shipments clocked in at 275 million units in 2020, growing 4.8% year-on-year. This was the highest annual growth rate seen since 2010, and the increased adoption of remote working played an important role in the growth of PC sales last year.

Many large-scale employers including Twitter, Inc., Snap Inc., and Alphabet Inc. have introduced plans to allow remote working in the long run, which is likely to keep PC sales at an elevated level in the next couple of years. This is good news for Intel.

Summary.....

Intel's core business of manufacturing PC and server chips is highly profitable, even with its manufacturing missteps. The company generated $20 billion of revenue, a gross margin of 56.8%, an operating margin of 29.5%, and net income of $5.9 billion in the fourth quarter of 2020. Intel is still a cash machine.

In the past, it made little sense to use manufacturing capacity to make chips for third parties when it was more lucrative to use that capacity for its own chips. But things have changed. Intel's profits are impressive, but so are foundry market leader TSMC's.

If Intel succeeds in becoming a major provider of foundry services, margin could potentially improve, given how profitable TSMC has become. Intel faces a lot of challenges: Its manufacturing difficulties remain, competitors may not want to turn to Intel for manufacturing, and it will take huge investments to overcome the manufacturing lead that TSMC has built. But the foundry business could be very profitable for Intel in the long run if everything goes right.

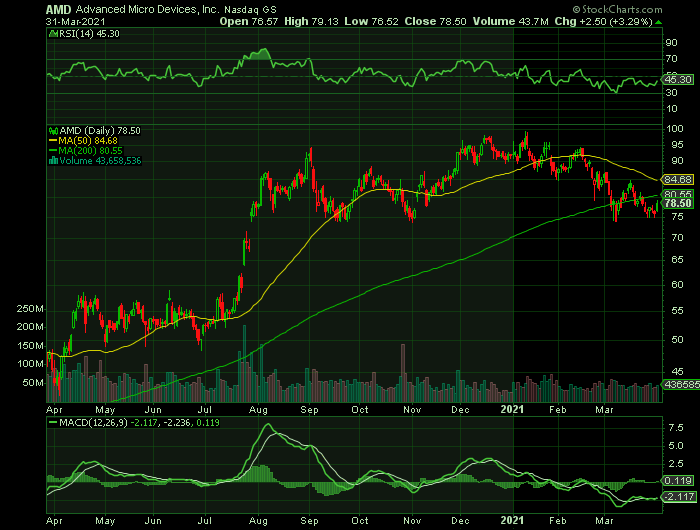

Weekly Options Trade – Advanced Micro Devices, Inc. (NASDAQ:AMD) Calls

Thursday, April 01, 2021

** OPTION TRADE: Buy AMD APR 09 2021 80.000 CALLS at approximately $1.00.

(Some members have asked for the following.....

Place a pre-determined sell at $2.50.

Include a protective stop loss of $0.40.

Prelude.....

The Santa Clara, Calif.-based company Advanced Micro Devices, Inc. (NASDAQ:AMD), a global semiconductor company, has been on a roll under the leadership of CEO Lisa Su, who took over in 2014.

Over the last few years, it has delivered competitive chip products for PC gaming and data centers. Furthermore, AMD has a strong product pipeline. In particular, its Zen-based 7-nanometer (nm) processors could take more market share away from Intel, which has suffered delays in releasing its 7 nm chips.

Revenue surged last year, thanks to consumers buying AMD-powered laptops for working from home and strong demand for server processors.

However, AMD stock hit a 52-week high in January this year, but the price for this high-flying chipmaker has pulled back over 20% since then thanks to a variety of factors such as the broader sell-off in tech stocks and rival Intel's (NASDAQ:INTC) resurgence under new leadership.

The Major Catalysts for This Trade.....

1. Earnings Report.....

Looking at Q4, AMD earned $570.00 million, a 26.95% increase from the preceding quarter. Advanced Micro Devices also posted a total of $3.24 billion in sales, a 15.82% increase since Q3. Advanced Micro Devices earned $449.00 million, and sales totaled $2.80 billion in Q3.

Advanced Micro Devices reported Q4 earnings per share at $0.52/share, which beat analyst predictions of $0.47/share.

2. Return on Capital Employed.....

In Q4, Advanced Micro Devices posted an ROCE of 0.1%.

Return on Capital Employed is an important measurement of efficiency and a useful tool when comparing companies that operate in the same industry.

For Advanced Micro Devices, the return on capital employed ratio shows the number of assets can actually help the company achieve higher returns, which should payoff from long-term financing strategies.

3. Eating Intels’ Market Dominance.....

For several years now, Advanced Micro Devices has eaten away at Intel’s market dominance in the CPU segment. Intel, however, with a new CEO at the helm, has been devising its comeback program.

However, Northland analyst Gus Richard calls Intel’s latest move a “strategic faux pas” that plays right into its CPU rival’s hands.

“We do not believe TSMC will relinquish its manufacturing lead to INTC any time soon and process technology leadership drives product leadership and GM higher,” said the analyst. “INTC expansion into the foundry market will increase AMD as a priority for TSMC and INTC will be persona non grata. For this reason, we expect AMD's market share momentum to continue.”

AMD’s and Xilinx’ – soon to be part of AMD - leading-edge volume is produced at TSMC, more wins for them means more business for TSMC.

“This will likely result in AMD getting earlier access to technology and better capacity allocation, cementing the Company's x86 process technology leadership for the foreseeable future,” Richard opined.

4. Analysts Positivity.....

As such, Richard reiterated an Outperform (i.e. Buy) rating on AMD shares along with a $96 price target. The analyst, therefore, anticipates gains of 24% over the coming months.

Also, AMD has been the subject of a number of recent analyst reports.....

- Rosenblatt Securities raised their price objective on shares of Advanced Micro Devices from $120.00 to $135.00 and gave the stock a “buy” rating in a research note on Wednesday, January 27th.

- Wedbush increased their target price on shares of Advanced Micro Devices from $100.00 to $110.00 and gave the stock an “outperform” rating in a research report on Tuesday, January 12th.

- Truist increased their target price on shares of Advanced Micro Devices from $96.00 to $101.00 in a research report on Wednesday, January 27th.

- Finally, Barclays raised their price target on shares of Advanced Micro Devices from $115.00 to $120.00 and gave the company an “overweight” rating in a report on Wednesday, January 27th.

Three equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and twenty-one have assigned a buy rating to the company’s stock. Advanced Micro Devices currently has an average rating of “Buy” and an average target price of $90.39.

5. The Pullback Is A Positive.....

One look at the pace of AMD's growth and its outlook for the year tells us that the recent sell-off in the stock may not be justified. The chipmaker ended 2020 on a high and expects to deliver massive growth once again this year.

The change in a company's future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company's shares.

AMD is expected to earn $1.93 per share for the fiscal year ending December 2021, which represents a year-over-year change of 49.6%.

Analysts have been steadily raising their estimates for Advanced Micro. Over the past three months, the Consensus Estimate for the company has increased 7.7%.

For Advanced Micro, rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company's underlying business. And investors' appreciation of this improving business trend should push the stock higher.

AMD can be expected to raise its game by the time Intel's 7nm chips hit the market by transitioning to the competing 5nm manufacturing node within the next couple of years. A smaller processing node will allow AMD to pack more transistors closer to each other, leading to improved computing performance and lower power consumption.

Therefore, AMD can remain ahead of Intel once it makes the transition to a smaller 5nm process node. Chipzilla is unlikely to regain its technology lead until the launch of its own 5nm process, the timeline for which is unknown right now. As it turns out, AMD's foundry partner Taiwan Semiconductor Manufacturing is reportedly working to increase the production capacity of 5nm chips. That should bode well for AMD, as it is expected to become TSMC's second-largest customer and enjoy stronger bargaining power.

Additionally, AMD can be expected to keep up the pressure on Intel in the data center space after the launch of its latest EPYC server processors. AMD claims that the latest EPYC 7003 processors based on the 7nm process are twice as fast as Intel's competing chips. Third-party tests conducted by AnandTech indicate the same.

More importantly, AMD has a solid lineup of clients using the latest EPYC server processors. They include Amazon, Cisco, Dell Technologies, Alphabet's Google, Microsoft, Lenovo, and Tencent. So it won't be surprising to see AMD log big gains in the data center market in both the short and the long run.

Summary.....

AMD has a quick ratio of 1.74, a current ratio of 2.28 and a debt-to-equity ratio of 0.10. The stock has a market cap of $91.77 billion, a price-to-earnings ratio of 102.16, a P/E/G ratio of 1.14 and a beta of 2.29. The firm has a fifty day simple moving average of $83.76 and a two-hundred day simple moving average of $85.63. Advanced Micro Devices, Inc. has a fifty-two week low of $41.70 and a fifty-two week high of $99.23.

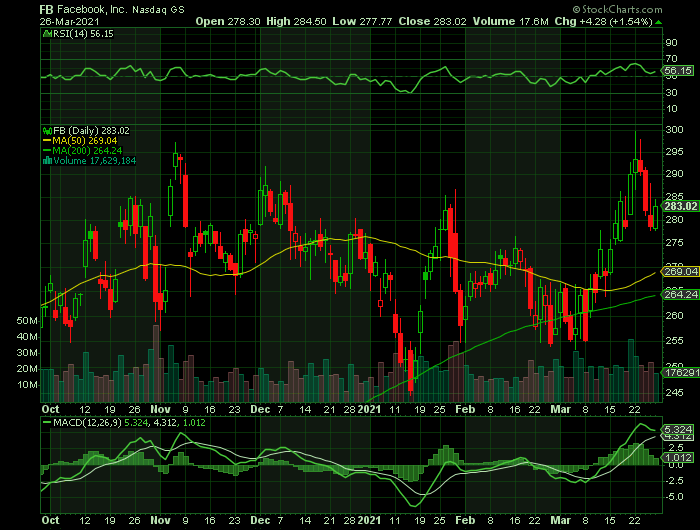

Weekly Options Trade – Facebook Inc. (NASDAQ:FB) Calls

Monday, March 29, 2021

** OPTION TRADE: Buy FB APR 09 2021 287.500 CALLS at approximately $4.90.

(Some members have asked for the following.....

Place a pre-determined sell at $9.80.

Include a protective stop loss of $2.00.

NOTE: Again, keep a close eye on the stock today – if there is sufficient profit it would be advisable to exit sooner than later!

Prelude.....

Facebook Inc. (NASDAQ:FB) stock, after six mostly moribund months, has reawakened. The spark came last Friday, when Facebook CEO Mark Zuckerberg gave a rousing update on the social media giant's big e-commerce push. He also suggested that a new privacy measure from Apple, which is among investors' biggest worries, could actually be a blessing in disguise for Facebook.

FB stock and other big tech growth stocks whose earnings surged amid the pandemic have taken a back seat as vaccines and massive fiscal stimulus begin to rev up the rest of the economy. But Facebook's slump was particularly notable.

Facebook blew away Q4 earnings estimates on Jan. 27, posting its fastest revenue growth in more than two years. But FB stock suffered a nasty reversal the next day, despite a flurry of price-target hikes to as high as 360.

The Major Catalysts for This Trade.....

Earnings Report.....

Facebook earnings easily surpassed fourth-quarter estimates. The FANG stock earned $3.88 per share, up 52% from a year ago and 69 cents ahead of the consensus. Revenue surged 33% to $28.1 billion.

The accelerating revenue growth came despite a further dip in daily active users in the U.S. and Canada to 195 million, down from 198 million in Q2. Facebook had previously warned that a spike in use of the social media app that occurred early in the pandemic would moderate as life normalized.

The bigger picture is that Facebook advertisers, a group that has grown to more than 10 million businesses, are using the social media site to connect with prospective customers like never before.

Worldwide daily active users rose to 1.845 million on the Facebook platform vs. 1.82 million the prior quarter, led by growth in the Asia-Pacific region. Across all platforms, daily active users hit 2.6 billion.

Q4's growth came as ad impressions served across Facebook properties grew at a slower 25% pace vs. a year ago. However, the average price per ad rose 5%, after falling 9% in Q3.

Facebook Ad Rates.....

The rates Facebook draws for its advertising took a hit in 2020,

buffeted by headwinds ranging from an industry slump alongside the COVID-19

pandemic to the "Stop Hate For Profit" campaign, which led hundreds

of advertisers to boycott the platform last summer.

But those rates (measured in cost per thousand impressions, or CPM) have

returned to pre-pandemic levels and are showing continued growth - back to

business, as it were.

The cost of Facebook advertising is up 30% compared to mid-March 2020, data

from Aisle Rocket show.

Rates are back at around $8/CPM, and back on the growth track: “Projections are showing that CPMs will continue to increase – and we are not even in the holiday season yet, where we typically see the highest CPMs on Facebook,” says Aisle Rocket's Jen Strojin, suggesting the rate could hit $11/CPM by late summer.

CPMs are a proxy for competition, analysts note, and so Facebook is now the beneficiary of more competitive advertisers who pulled back campaigns early in the pandemic, but are now making moves such as pivoting to e-commerce.

“Everybody wants back in the pool, because they want to get in on the pent-up demand and the recovery,” says Kenshoo's Chris Costello.

Analysts Positivity.....

Veteran wall street tech analyst Brent Thill has cautioned against buying stocks in the underperforming tech sector, with the exception of social media giant Facebook.

The Jefferies analyst said that tech is “off limits right now” as investors put more money into travel and airline stocks amid hopes of a strong economic recovery from the pandemic.

According to the analyst, valuation combined with the tech names could currently be frustrating a lot of investors.

Thill said that compared to other companies in the tech sector, Facebook is a “cheap name.”

“$15 of earnings power and a mid-20 [P/E] multiple on it, and you are at $350 to $375 on the stock. So you got a lot of upside still on Facebook. We like that,”the analyst added.

Antitrust Suits.....

On Dec. 9, the Federal Trade Commission and a group of state attorneys general filed separate antitrust cases alleging that Facebook's acquisitions of Instagram and WhatsApp were anticompetitive in nature and intended to bolster its monopoly position.

So far analysts are largely dismissing the possibility of a breakup.

"We continue to believe the likelihood of a breakup of FB is low (judges are typically loathe to undo transactions) and the sum of parts of the various segments is likely similar or greater than FB current valuation," Raymond James analyst Aaron Kessler wrote in a December note.

Facebook Shops.....

On the PressClub podcast on March 19, Zuckerberg announced that Facebook Shops, first announced last May, has more than 1 million active shops in its digital mall and 250 million shoppers, or at least browsers, per month.

Shops is Facebook's big effort to bring e-commerce purchases in-house, instead of just facilitating user-advertiser connections that result in off-site purchases. Businesses can set up a single shop for customers to access on both Facebook and Instagram.

Morgan Stanley analyst Brian Nowak said in a research note that the scale Shops has achieved in just 10 months "should give investors more confidence in the durability of FB's multiyear growth."

Nowak said Morgan Stanley's AlphaWise survey had previously suggested that about 30% of Americans are shopping on Facebook's Instagram site per month. Morgan Stanley has estimated $1.9 billion in annual revenue tied to Instagram Shops. Zuckerberg's disclosure "implies that the global contribution from Shops this/next year is likely to be larger than our ~$1.9bn annual estimate,"Nowak wrote.

Summary.....

It's dangerous to bet against FB stock, even as it faces a long antitrust battle and regulatory threats. Growth stocks could continue to face headwinds from rising interest rates. Yet Facebook has showed impressive agility with its well-timed e-commerce push.

Back to Weekly Options USA Home Page