TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Apple Provides 46% Potential

Profit Using A Weekly Option!

Members of “Weekly Options USA,” Using A Weekly CALL Option,

Make Potential Profit Of 46%,

After Apple Earnings Beat Expectations!

where to now?

Join

Us and GET FUTURE TRADEs!

Shares of Apple Inc. (NASDAQ:AAPL) moved higher on Friday after reporting earnings of $1.52 per share on revenue of $94.84 billion for the fiscal second quarter ended March 2023.

This set the scene for Weekly Options USA Members to profit by 46%, using an AAPL Weekly Options trade!

Join Us And Get The Trades – become a member today!

Saturday, May 06, 2023

by Ian Harvey

Why the AAPL Weekly Options Trade was Executed?

Apple Inc. (NASDAQ:AAPL) is confirmed to report earnings on Thursday, May 4, 2023 at approximately 4:30 PM ET. The consensus earnings estimate is $1.44 per share on revenue of $92.94 billion, a decline of 4.5% year-over-year, but the Whisper number is a bit higher at $1.47 per share.

Investors are bullish going into the company's earnings release expecting a beat.

Short interest has decreased by 5.6% and overall earnings estimates have been revised higher since the company's last earnings release.

Year to date, Apple stock is up 30.6%. That compares with an 8.6% rise for the S&P 500.

The AAPL Weekly Options Trade Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

** OPTION TRADE: Buy AAPL MAY 12 2023 170.000 CALLS - price at last close was $3.81 - adjust accordingly.

Entered the AAPL Weekly Options (CALL) Trade on Monday, May 01, 2023, at 9:35, for $3.55.

Sold half the AAPL weekly options contracts on Wednesday, May 03, 2023 for $4.45; a potential profit of 25%.

Sold the remaining AAPL weekly options contracts on Friday, May 05, 2023 for $5.20; a potential profit of 46%.

Some members may still be holding AAPL weekly options contracts; therefore, we are looking for the APPL stock to continue moving upwards next week.

Don’t miss out on further trades – become a member today!

The Actual Earnings Report…..

Apple reported earnings of $1.52 per share on revenue of $94.84 billion for the fiscal second quarter ended March 2023. The consensus earnings estimate was $1.44 per share on revenue of $92.94 billion. The Whisper number was $1.47 per share. The company beat expectations by 3.40% while revenue fell 2.51% compared to the same quarter a year ago.

The company said during its conference call it expects third quarter revenue to decline similarly to its second quarter decline, or revenue of approximately $80.88 billion. With gross margins of 44.0% to 44.5%, this calculates to earnings of $1.14 to $1.17 per share. The current consensus earnings estimate is $1.21 per share on revenue of $84.71 billion for the quarter ending June 30, 2023.

“We are pleased to report an all-time record in Services and a March quarter record for iPhone despite the challenging macroeconomic environment, and to have our installed base of active devices reach an all-time high,” said Tim Cook, Apple’s CEO. “We continue to invest for the long term and lead with our values, including making major progress toward building carbon neutral products and supply chains by 2030.”

About Apple.....

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

It also sells various related services. In addition, the company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; AirPods Max, an over-ear wireless headphone; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, HomePod, and iPod touch.

Further, it provides AppleCare support services; cloud services store services; and operates various platforms, including the App Store that allow customers to discover and download applications and digital content, such as books, music, video, games, and podcasts.

Additionally, the company offers various services, such as Apple Arcade, a game subscription service; Apple Music, which offers users a curated listening experience with on-demand radio stations; Apple News+, a subscription news and magazine service; Apple TV+, which offers exclusive original content; Apple Card, a co-branded credit card; and Apple Pay, a cashless payment service, as well as licenses its intellectual property.

The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers.

Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California.

The Actual Recommendation.....

(READ HERE)

Apple has a market capitalization of $2.6 trillion, and has long been known for its dominance of the smartphone market, a space in which it accounts for more than 24% of all sales globally. In the first quarter of the company's fiscal 2022, $66 billion of Apple's $117 billion total net sales were derived from iPhone sales.

While sales of these hardware products remain Apple's bread and butter, another segment is quickly catching up. The company's services segment, which is comprised largely of subscription-based offerings like Apple Music, is growing rapidly. This recurring revenue business contributed $21 billion of Apple's total net sales in the first-quarter period, more than sales from its Mac, iPad, or Wearables/Home/Accessories segments.

Past Earnings.....

Apple reported revenues of $117.15 billion in the last reported quarter, representing a year-over-year change of -5.5%. EPS of $1.88 for the same period compares with $2.10 a year ago.

Compared to the Consensus Estimate of $121.21 billion, the reported revenues represent a surprise of -3.34%. The EPS surprise was -2.59%.

Over the last four quarters, Apple surpassed consensus EPS estimates three times. The company topped consensus revenue estimates three times over this period.

iPhone.....

The iPhone represented 56% of total company revenue in the latest fiscal quarter (Q1 2023 ended Dec. 31). And it's the gateway product that brings consumers in.

"We're proud to now have over 2 billion active devices in our installed base," CFO Luca Maestri said on the Q1 2023 earnings call. This massive installed base has doubled over the past seven years, a remarkable feat that exemplifies Apple's ubiquity. While the majority of these devices are iPhones, it's worth noting the success of Apple's other products.

Services Segment.....

Besides beautiful hardware products, Apple's services segment is becoming a more important part of the business that drives customer loyalty and stickiness. In the latest fiscal quarter, services accounted for 18% of total sales, a percentage that has increased steadily over time. This segment carries a gross margin of over 70%, much higher than the products group, so investors can expect Apple's profitability to rise in the years ahead.

Also, Apple's ongoing foray into financial services has been impressive, with Apple Pay, Apple Card, and now a high-yield savings account added to the mix. The business attracts a more affluent customer base, so these offerings are poised to do well in the long run, providing Apple with another key revenue driver.

Moving Ahead.....

Apple is also looking to the future as it seeks to build out its competitive advantage in other lucrative markets, including the financial services space. The company launched its own buy now, pay later product last year.

And it just launched an interest-bearing savings account in partnership with Goldman Sachs. The account currently boasts an annual percentage yield of 4.15%, while the national average is only around 0.4%.

The company is also looking to other high-octane industries on which to build out its growth story. While it still has a modest footprint in the advertising space, it's estimated that Apple could be generating more than $10 billion in ad revenue alone by the end of next year.

Then, there's the much anticipated virtual reality headset, which by some reports could be out as early as June of this year.

There's possibly an even bigger product on the horizon that can be an absolute game changer. It is still believed that Apple is working on an electric vehicle. Unsurprisingly, information about this is scarce, but it's hard to imagine a scenario where an automobile designed and made by Apple, with integration into the software ecosystem, doesn't immediately become a hit. And because the car market is gigantic, this has the potential to move the needle for the business.

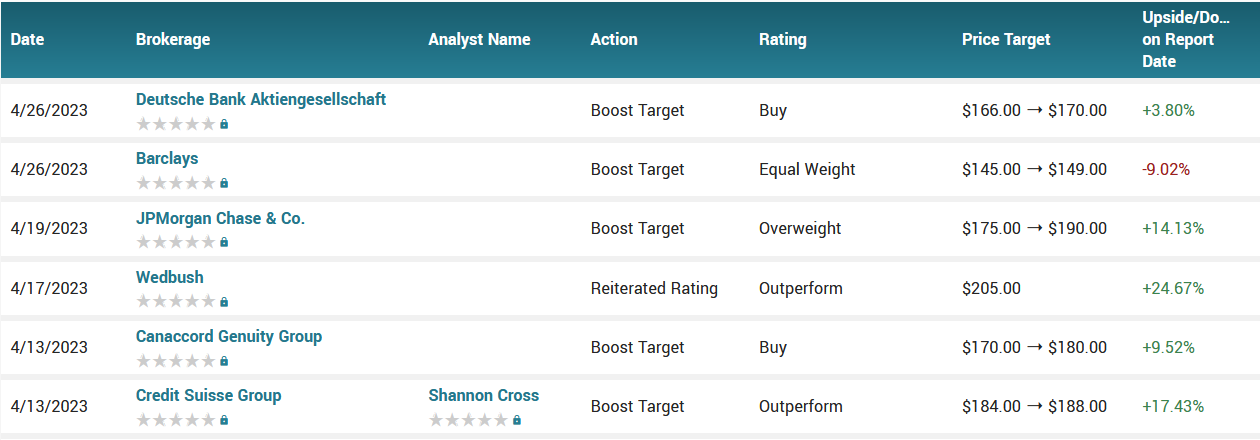

Analysts.....

In a recent note to clients, Morgan Stanley analyst Erik Woodring called Apple "the best house in a challenged neighborhood." He rates Apple stock a "top pick" with a price target of 180.

Woodring predicts Apple will post in-line results but guide analysts lower for the June quarter.

However, he sees several catalysts for Apple stock in the months ahead. They include the rumored introduction of a mixed-reality headset at the company's Worldwide Developers Conference in June.

Other catalysts could include re-accelerating services growth in the June quarter and easing foreign-exchange headwinds. Plus, Apple should see a pickup in handset sales with the launch of the iPhone 15 series this fall, Woodring said.

Deutsche Bank analyst Sidney Ho expects Apple to deliver in-line results and give mixed guidance. He rates Apple stock as buy with a price target of 170.

"Investors are attracted by the company's quality of earnings and its strong balance sheet in an uncertain macro environment," Ho said in a note to clients. "We expect this investor preference to continue."

According to the issued ratings of 32 analysts in the last year, the consensus rating for Apple stock is Moderate Buy based on the current 2 sell ratings, 4 hold ratings and 26 buy ratings for AAPL. The average twelve-month price prediction for Apple is $170.09 with a high price target of $205.00 and a low price target of $54.00.

Summary.....

Although Apple isn't usually the first to bring a new product to market, it has proven that what it offers can be the best. Finding ways to have a higher number of active devices across the world, whether it's phones, tablets, headsets, or cars, feeds into Apple's powerful ecosystem, making its economic moat that much stronger.

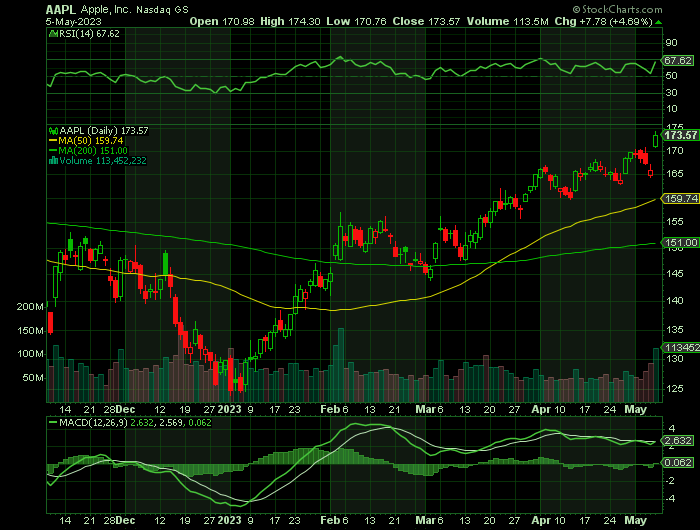

Apple has a market capitalization of $2.66 trillion, a price-to-earnings ratio of 28.59, a price-to-earnings-growth ratio of 2.18 and a beta of 1.30. Apple has a fifty-two week low of $124.17 and a fifty-two week high of $176.15. The firm has a 50-day simple moving average of $157.78 and a 200-day simple moving average of $147.65. The company has a debt-to-equity ratio of 1.76, a quick ratio of 0.89 and a current ratio of 0.94.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from APPLE

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.