TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Weekly Options Exiting Strategy

On

Moderna Pays-Off!

A Good Example Of “Greed Undoing A Profitable Trade”

Wednesday, July 21, 2021

by Ian Harvey

A weekly options exiting strategy is continually

encouraged by Weekly Options USA, so that members exit and profit when sufficient

profit has been achieved; and avoid the so easy “GREED” factor, and then have a losing trade!

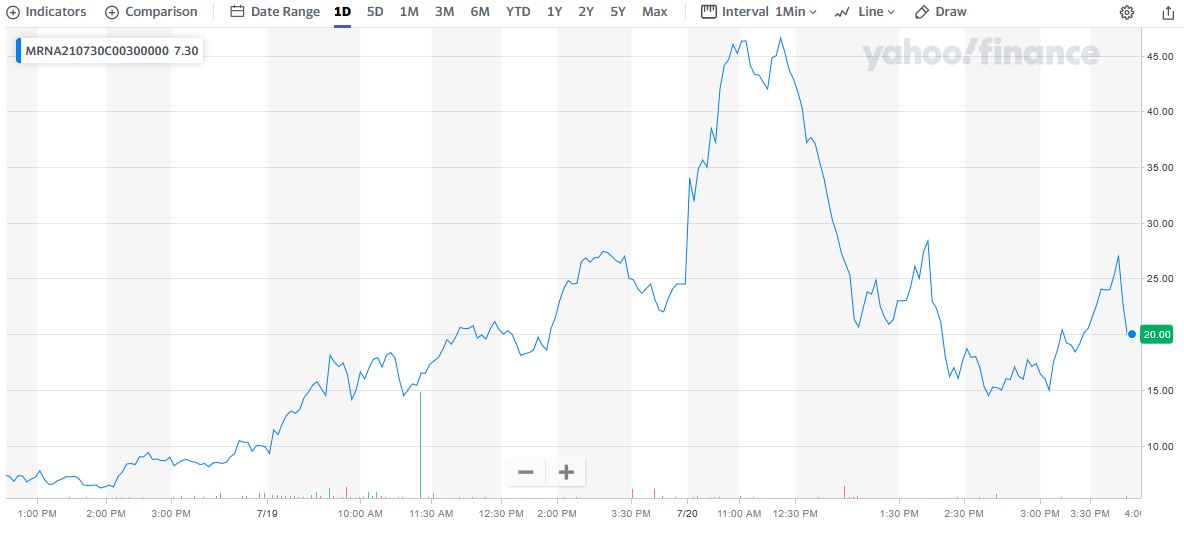

As an example of this we look at Moderna (MRNA) – a call option trade recommended on Monday, July 19 – which provided profits of 150% on the day.

But alas, this upward movement was not to continue however!

Moderna Inc (NASDAQ: MRNA)

Prelude to Tuesday Moderna Trading…..

On Monday, July 19, 2021, a Moderna Weekly Options trade was recommended to our members based on several catalysts.

READ Details of the successful Weekly Options Exiting Strategy on Moderna that occurred on Monday in the article.....

“Moderna Weekly Options Trade Shoots Higher!”

On Tuesday the Weekly Options Exiting Strategy on Moderna Re-Visited.....

This re-visit to our weekly options exiting strategy on Moderna was brought to my attention when one of our members from “Weekly Options USA” contacted me and asked,

“Ian, MRNA I am up $3,680 on your alert. I want to close the option and take my money. What’s your opinion to stay in longer or take your earnings? Thanks.”

“That’s incredible, on 1 options contract in 24 hours!”

I was actually floored for a while that a member was still holding the trade. However, I quickly agreed to his weekly options exiting strategy on Moderna as soon as possible – pointing out that it was.....

“Better to have a bird-in-the-hand instead of waiting for two-in-the-bush!”

OR

“Letting GREED undo a great profitable trade!”

Why the Weekly Options Exiting Strategy Worked Out.....

Admittedly, the stock price continued upwards until nearly midday, reaching potential profits of 323% ($3,557 on top of cost), but this did not last. Just before midday the stock price plunged dramatically, and continued to do so in the after-hours trading session.

Why the Stock Price Plunge on Moderna Stock?

Moderna (MRNA), the COVID-19 vaccine maker, was the most heavily traded company on Wall Street ahead of its debut in the S&P 500 on Wednesday.

During Tuesday's session, Moderna surged as much as 9% and fell as much as 7%. The stock has gained about 18% since July 15, when S&P Dow Jones Indices announced its addition to the S&P 500.

The stock closed the trading day session down 2.00% (-$6.26 to close at $307.33).

After the bell, Moderna dropped an additional 1%, also in heavy volume.

The latest volatility in Moderna's stock comes as concerns increase over the highly contagious Delta variant of COVID-19, now responsible for the majority of new infections. Fears about a resurgence in the virus slammed Wall Street on Monday.

Moving Forward.....

Moderna stock could move higher in the coming weeks as MRNA has received price-target hikes from J.P. Morgan Securities and Goldman Sachs to $131 and $299, respectively.

Separately, Takeda Pharmaceutical said it would supply an extra 50 million doses of Moderna's vaccine to Japan.

It is possible that more analysts will jump on the positive bandwagon, which will mean that Moderna stock could move higher in the coming weeks.

Of the 13 analysts covering the stock, eight still call it a tepid "hold." Plus, today's price-target hikes put MRNA's 12-month consensus price target at $195.93, which is a 35.2% discount to current levels.

MRNA has now snapped a four-day win streak, though in the last nine months alone, the equity is up an incredible 323.5%.

Therefore…..

Employing a Weekly Options Exiting Strategy Is Essential For Sound Profit As Well As Peace-of-Mind!

What Further Moderna Weekly Optrions Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Weekly Options Exiting Strategy