TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Moderna Weekly Options

Trade Shoots Higher!

“Weekly Options” Members

Profit Up 150% In 1 day!

More Could Be Expected!

Tuesday, July 20, 2021

by Ian Harvey

A Moderna Weekly Options trade has provided members with a potential profit of 150% within the trading day on Monday, despite a major market pull-back, based on several crucial catalysts.

Moderna is to be added to the S&P 500 which will cause mutual fund managers to re-buy stock, therefore producing short-term increase in demand for its stock. As well, a harder and wider vaccine push is obvious due to the effects of the delta variant and the Moderna vaccine is 96% effective in preventing COVID hospitalizations and deaths from Delta variant infections.

The stock price is likely to continue increasing for the near-term.

Moderna Inc (NASDAQ: MRNA)

Prelude…..

On Monday, July 19, 2021, a Moderna Weekly Options trade was recommended to our members based on several catalysts.

READ Details of Original Moderna Weekly Options Recommendation Further Below.....

Why The Jump In Our Moderna Weekly Options Trade On Monday.....

Moderna, the biotech company, is now a household name after its Covid-19 vaccine mRNA-127 has been approved for use in many regions across the globe.

After 2020’s massive shares gains, the stock is up 200% year-to-date. The latest catalyst takes effect as Wall Street gives its seal of approval to join the exclusive list of companies that make up the S&P 500 – the stock market’s bellwether index, on July 21.

Moderna was up by nearly 10% in mid-afternoon trading Monday with its vaccine expected to fight effectively against the new coronavirus delta variant.

Because of its powerful delta variant, the coronavirus is very much on the rise again, therefore there is a need for a more powerful vaccine which will clearly benefit Moderna.

The Recommended Moderna Weekly Options Trade.....

** MODERNA WEEKLY OPTION TRADE: Buy MRNA JUL 30 2021 300.000 CALLS at approximately $10.00.

(Actually bought for $11.00)

Moderna Weekly Options Trade Call Success Explained.....

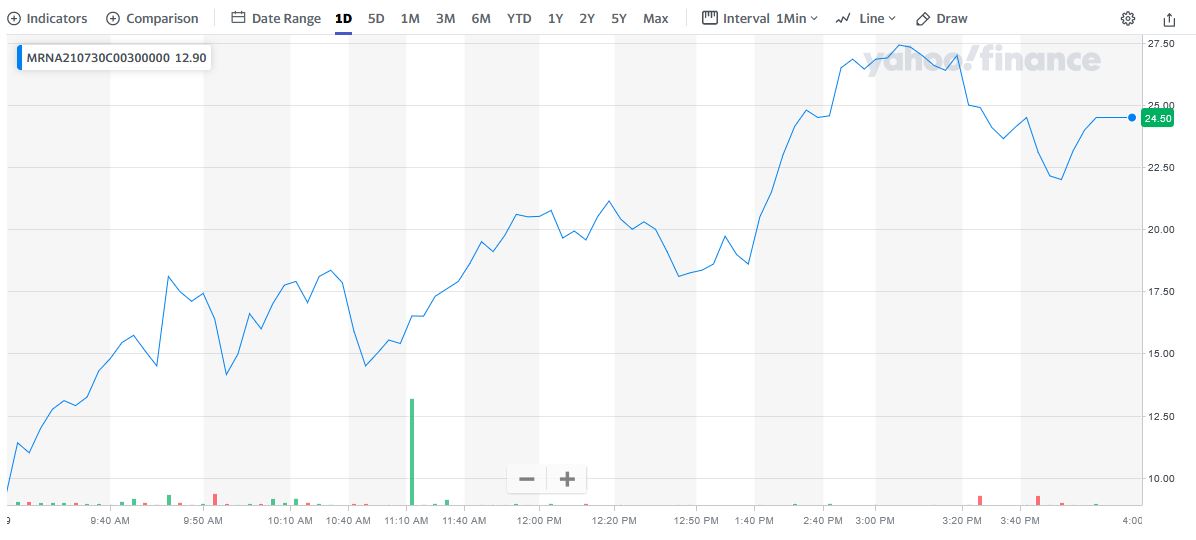

On Monday, July 19, 2021, “Weekly Options Members,” entered the Moderna Weekly Options trade mentioned above for $11.00, shortly after the market opened.

By 3:15pm the Moderna Weekly Options trade had reached a high of $27.55 – up 150% - an increase of $1,655 within the trading day.

It is very likely that a new Moderna Weekly Options trade, moving forward, could also be successful as early trading in the futures shows an increase in the stock price already.

Join us and see what we are proposing for a new Moderna Weekly Options Trade!

Why the Recommendation and

the Reasoning behind

the MODERNA Weekly Options Trade

Prelude to The Moderna Weekly Options Trade.....

Moderna Inc (NASDAQ: MRNA), which has seen its stock surge 250% over the past year as it helps vaccinate the world from the coronavirus, will officially enter the S&P 500 on July 21.

The news sent shares popping more than 8% to $282 in Friday's session as the stock will likely be purchased by fund managers who benchmark to the S&P 500. But Jefferies analyst Michael Yee says “he thinks the run in Moderna stock (MRNA) is far from done.”

"Moderna is the Tesla of biotech," says Yee, pointing to Moderna's impressive pipeline of product innovation. (read more in the Analysts Opinions down further)

Moderna shares have skyrocketed more than threefold over the past 12 months with its coronavirus inoculation getting emergency use authorization in the U.S. in December, just a week behind the first approval for Pfizer Inc. and BioNTech SE’s vaccine.

Earlier last week, its market valuation surpassed $100 billion, putting it in an elite group of biotech firms of that size.

The drug developer has rallied over 170% so far this year, making it the top-performing stock on the Nasdaq 100 Index. Its meteoric rally thus far could put it at the top spot of the S&P 500 when it joins next week.

Facts About Moderna.....

- Moderna is a pharmaceutical company developing treatments using messenger RNA (mRNA).

- The company believes that it can use mRNA to treat a wealth of conditions that affect humans.

- A recent example of that includes the company’s vaccine for the novel coronavirus.

- Moderna was founded in 2010 and is based out of Cambridge, Mass.

- It started trading shares of MRNA stock publicly on the Nasdaq Exchange in late 2018.

- The company currently employees about 1,500 people.

- Stéphane Bancel serves as the CEO of Moderna.

- Bancel has been acting as the company’s CEO since 2011, which is also when he joined its Board of Directors.

- Paul Burton is the CMO of Moderna.

- Burton joined Moderna after spending 16 years in the employ of Johnson & Johnson (NYSE:JNJ).

The Major Catalysts BEHIND THE MODERNA WEEKLY OPTIONS TRADE

1. Added to S&P 500…..

On Friday, Moderna was slated to be added to the popular S&P 500 index effective before the beginning of trading on Wednesday, July 21. It will replace Alexion Pharmaceuticals, which is being acquired by healthcare giant AstraZeneca.

Moderna is entering the S&P 500 after reporting only one quarter -- its most recent -- of profitability as a public company.

The addition makes sense intuitively, given that the vaccine maker's market capitalization has shot well above $100 billion after its recent success.

One of the requirements for inclusion in the index is that a company’s most recent quarterly earnings as well as the sum of its trailing four quarters’ earnings must be positive. Before Moderna’s Covid vaccination was authorized it was still a development stage biotech with no products to sell.

In the past, the S&P 500 selection committee has often waited for more than one quarter after a company had met its earnings criteria to include a large cap stock in the benchmark. For instance, Tesla Inc., the largest company ever added to the S&P 500, became eligible for inclusion after reporting second-quarter earnings in July 2020, but was not added until Dec. 18 after an additional quarter of profitability.

2. Consequences…..

Managers of mutual funds that track the S&P 500 will need to buy shares of Moderna following its inclusion in the index. Their purchases could lead to a short-term increase in demand for its stock, thereby boosting its price.

3. Johnson & Johnson Struggles…..

Moderna appeared to be benefiting from the struggles of one of its key vaccine maker rivals. The Food and Drug Administration added a warning to Johnson & Johnson's COVID-19 vaccine noting that it had been linked in extremely rare cases to an autoimmune condition known as Guillain-Barre syndrome. With no similar link found to that illness for Moderna's coronavirus vaccine, investors were likely betting that these potential safety concerns could lead to higher demand for Moderna's drug.

4. Vaccines…..

The Cambridge, Massachusetts-based company has said its vaccinations are producing antibodies against the more easily transmitted delta form of the pathogen, though at a lower level than for the main virus. Moderna is also targeting new vaccines and drugs for other viruses like Zika and the flu as well diseases like HIV and cancer.

5. Future Earnings…..

On Thursday, Aug. 5, Moderna will report its earnings for the fiscal second quarter of 2021. Analysts are forecasting that the vaccine maker will reverse a year-ago loss to record $6.04 EPS on sales of nearly $4.3 billion this quarter -- revenue growth of more than 6,000%!

6. Analysts’ Opinions.....

"Moderna is the Tesla of biotech," says Jefferies analyst Michael Yee, pointing to Moderna's impressive pipeline of product innovation.

Yee sees at least two medium-term catalysts for Moderna's stock price. First are the potential for COVID-19 booster shots out of Moderna, which could be discussed by management when the company reports earnings on Aug. 5.

"We see 2021 guidance increasing to $21 billion from $19 billion and expect positive commentary around boosters in development (potentially Delta next) and preparing for 2022 orders," Yee writes in a research note to clients. Yee believes the stockpiling of COVID-19 booster shots by the government would be a tailwind to players such as Moderna and Pfizer.

Meanwhile, Yee thinks investors shouldn't sleep on Moderna's efforts on flu vaccines.

"While the boosting [booster shot] debate will continue for the rest of the year, we do think the market will look to Phase I flu data by year-end. We think COVID infections probably start to rise again in winter as some protection wears down 6 [million]-8 million from March, but they will likely be mild. But Moderna is testing a multivalent influenza vaccine and has antibody titer data by year-end. We think this data will look very strong (very high titers) — and supports large Phase II/III in 2022/2023 for high PoS," Yee says.

The analyst has a $250 price target on Moderna's stock, but an upside target of $325.

"Our upside scenario of $325 considers high probabilities of success for each of the major areas and indications (vs. the base case)," explains Yee. "In this scenario, we assume MRNA's clinical candidates produce better-than-expected results in their ongoing programs, the prophylactic vaccine areas are significantly de-risked toward 90% PoS, and the cancer programs show positive early data, opening up a new area of R&D opportunity. We also note the potential for stock accretion on the race for Vaccine 2.0 against emerging COVID-19 variants."

Summary for the Moderna Weekly Options Trade.....

The company's fundamental business drivers will determine its long-term returns to shareholders. Fortunately, Moderna's future appears bright in this regard. Booster shots designed to combat emerging coronavirus variants are likely to produce bountiful streams of recurring revenue for Moderna, while its well-stocked pipeline of drug candidates could generate new revenue sources in the years ahead.

Therefore…..

The Moderna Weekly Options Trade Was A Big Winner!

What Further Moderna Weekly Optrions Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Moderna Weekly Options