TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

tesla Weekly Options Trade

Provides 158%

Potential Profit!

Members of “Weekly Options USA,” Using A Weekly call Option,

Are Up 158%, With The Leading EV Maker Reporting

Record Earnings Last Year -- Despite Various Headwinds.

More profit to come?

Join

Us and GET FUTURE TRADEs!

Tesla stock remains a behemoth in the automotive industry. With a market cap of around $540 billion, Tesla is several times bigger than Ford and General Motors combined.

And business is heading in the right direction.

This set the scene for Weekly Options USA Members to profit by 158%, using Tesla Weekly Options trade!

Join Us And Get The Trades – become a member today!

Sunday, March 26, 2023

by Ian Harvey

Why the Profit on Tesla Weekly Options?

Musk has created quite a few successful businesses with the biggest asset at the moment being Tesla Inc (NASDAQ: TSLA) equity.

While Tesla stock is known for being volatile, it remains a behemoth in the automotive industry. With a market cap of around $540 billion, Tesla is several times bigger than Ford and General Motors combined.

And business is heading in the right direction.

The Profits Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the Tesla Weekly Options (CALL) on Tuesday, March 14, 2023

at 10:10 for $7.20.

Exited the trade on Wednesday, March 22, 2023 for $18.60, a potential profit of 158%.

Don’t miss out on further trades – become a member today!

The Actual Recommended

Trade for Tesla.....

(READ HERE)

Prelude.....

Recently, Musk and his executive team hosted their highly anticipated investor conference. Typically, during these events, Musk is known to reveal new products and services and paint a roadmap for Tesla Inc (NASDAQ: TSLA)'s future. Needless to say, Tesla stock usually tends to swing in the days leading up to these investor days.

In this instance, however, investors and Wall Street seemed less enthused. Tesla stock declined nearly 13% over the last five trading days since the event. With Tesla stocks downward momentum, this appears to be an attractive buy at this valuation.

Musk has created quite a few successful businesses with the biggest asset at the moment being Tesla equity.

While Tesla stock is known for being volatile, it remains a behemoth in the automotive industry. With a market cap of around $540 billion, Tesla is several times bigger than Ford and General Motors combined.

And business is heading in the right direction.

In 2022, Tesla’s vehicle deliveries grew 40% year over year to $1.31 million. Meanwhile its production increased 47% year over year to 1.37 million.

Wall Street analysts also see upside in Tesla shares. For instance, Morgan Stanley analyst Adam Jonas has an ‘overweight’ rating on Tesla and a price target of $220 — roughly 27% above where the stock sits today.

Further Catalysts for the TSLA Weekly Options Trade…..

The Conference.....

Perhaps the most noteworthy takeaway from the presentation was Tesla's estimated $10 trillion investment it plans to make in manufacturing among the following: renewable energy grid ($0.8 trillion), transition to EVs ($7.0 trillion), heat pumps ($0.3 trillion), high-temperature thermal ($0.8 trillion), and planes and ships ($1.0 trillion).

Basically, Musk is telling investors that he sees Tesla as more than just an automotive company. His vision to push green energy further into the DNA of society means Tesla allocating capital to other forms of transportation and innovative features in manufacturing.

Also, management confirmed that Tesla would be building a new factory in Mexico.

Volatility.....

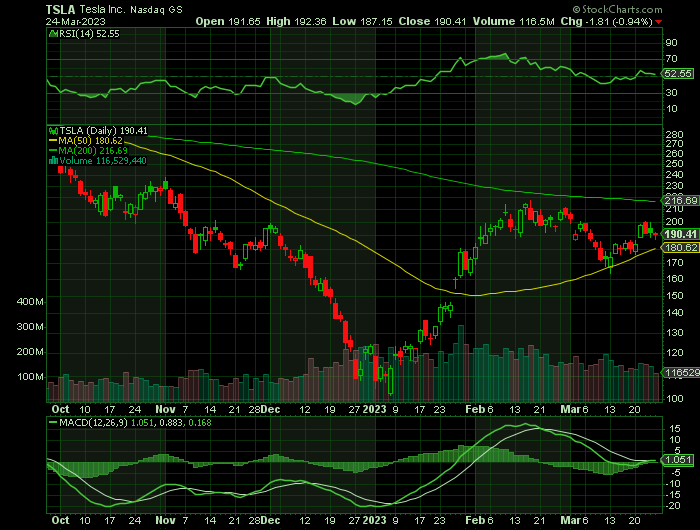

Toward the end of 2022, Tesla stock began to crater. Much of this was attributed to cyclical trends in technology and software companies, particularly those on the Nasdaq.

Some investors saw a buying opportunity in early 2023 before Tesla reported Q4 earnings. Several buyers joined the momentum, leading to a surge in Tesla's stock price. Clearly, this upswing reached a fever pitch in mid-February, as Tesla's stock price had nearly doubled in terms of absolute dollars from its January lows.

Even so, it's interesting to see that since reporting earnings at the end of January, Tesla stock dropped but not in an overdramatic fashion.

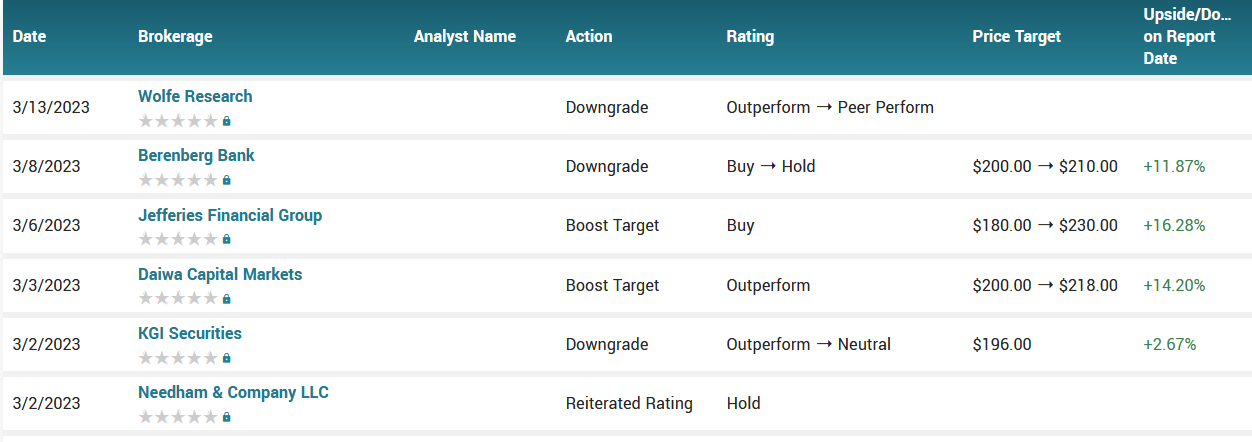

Analysts Opinions.....

According to the issued ratings of 37 analysts in the last year, the consensus rating for Tesla stock is Hold based on the current 4 sell ratings, 14 hold ratings and 19 buy ratings for TSLA. The average twelve-month price prediction for Tesla is $221.39 with a high price target of $430.33 and a low price target of $33.33.

Summary.....

Despite a sell-off over the last month or so, the stock price is only down roughly 11%. When accounting for a fairly mundane investor conference, vehicle price cuts, and recession fears, all things considered, Tesla stock appears to have some fundamental support.

Tesla stock traded down $3.56 during mid-day trading on Monday, hitting $169.88. The company’s stock had a trading volume of 46,758,407 shares, compared to its average volume of 184,049,797. The firm has a market capitalization of $537.52 billion, a PE ratio of 47.87, and a price-to-earnings-growth ratio of 2.10 and a beta of 2.06. Tesla, Inc. has a 1 year low of $101.81 and a 1 year high of $384.29. The company has a current ratio of 1.53, a quick ratio of 1.05 and a debt-to-equity ratio of 0.04. The stock’s fifty day moving average is $168.70 and its two-hundred day moving average is $200.18.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Advanced

Micro Devices Weekly Options Trade

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.