TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, March 13, 2023

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trade – Charles Schwab Corporation Common Stock (NYSE: SCHW) Calls

Thursday, March 16, 2023

** OPTION TRADE: Buy SCHW MAR 31 2023 65.000 CALLS - price at last close was $1.97 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Taking advantage of the dip!

And, CEO Walter Bettinger of Charles Schwab Corporation Common Stock (NYSE: SCHW) has definitely taken advantage of the sell-off.

‘Buy the dip’ has not become the ubiquitous phrase it is for no reason. With bank stocks recently falling in unison whether they are in danger of meeting the same fate as SVB and Signature bank or not, there are plenty of ‘buy the dip’ opportunities to take advantage of right now.

Having watched shares of his firm Charles Schwab drop by more than 30% since the crisis began, CEO Walter Bettinger said on Tuesday that he purchased 50,000 shares for his own personal account. Bettinger also said he was not alone in doing so, claiming the bank’s clients were also loading up on SCHW shares.

If the insiders are loading up, that sends a strong signal to investors they must believe their company shares are undervalued.

The Charles Schwab Company Profile.....

The Charles Schwab Corporation, through its subsidiaries, provides wealth management, securities brokerage, banking, asset management, custody, and financial advisory services. The company operates in two segments, Investor Services and Advisor Services. The Investor Services segment provides retail brokerage and banking services, retirement plan services, and other corporate brokerage services; equity compensation plan sponsors full-service recordkeeping for stock plans, stock options, restricted stock, performance shares, and stock appreciation rights; and retail investor, retirement plan, and mutual fund clearing services.

Further Catalysts for the SCHW Weekly Options Trade…..

Eighty per cent of Schwab’s deposits are insured. Cash sorting settles down as rate hikes ease. Schwab ended 2022 with a 7.2 per cent leverage ratio. That equates to a $17bn buffer. The business generates about $28bn of cash each quarter through principal maturity, interest and net new asset growth. Schwab has access to over $300bn of liquidity through the Federal Home Loan Bank (FHLB) and other facilities. Tat is ample capacity to handle even dire short-term illiquidity.

Charles Schwab has ample liquidity, the chief executive of the bank and brokerage said on Tuesday, moving to allay concerns about a "doomsday scenario" that has weighed broadly on bank stocks after the failure of two U.S. lenders since Friday.

"We have not raised capital and we are not in the market at this point for M&A transactions," Walt Bettinger, CEO of Charles Schwab, told Reuters in an interview.

The firm saw an influx of $4 billion in assets to the parent company on Friday as clients moved assets to Schwab from other firms, Bettinger said.

Schwab on Monday reported that total client assets slid to $7.38 trillion in February, down 4% compared with a year ago.

Bettinger said Schwab was comfortable with the assets on its bank portfolio -- which is separate from its brokerage business -- contrasting it with other companies that had run into trouble.

"Our available for-sale portfolio is short in duration and high in quality, and our held-to-maturity is slightly longer in duration but still short compared to many people, and very high-quality," said Bettinger, who has led Schwab since the 2008 financial crisis.

Banks can classify bonds as “held-to-maturity” (HTM) and are not required to count changes in value if the securities are kept until they are repaid, or they can keep the bonds as “available-for-sale” (AFS), which means they must count unrealized losses against capital, but are free to sell the securities at any time.

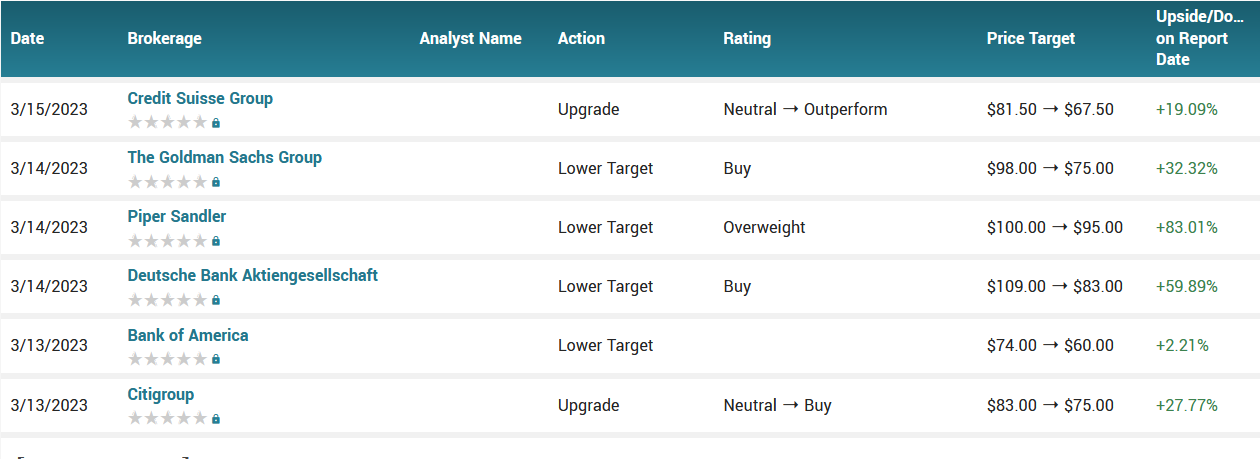

Analysts.....

Compared to many regional banks that have come under pressure in the last week, Schwab has higher unrealized securities portfolio losses in comparison to its capital levels, said Richard Repetto, a managing director at Piper Sandler.

“That said, due to robust supplemental liquidity sources, we think it is very unlikely that SCHW will ever need to sell HTM securities to meet deposit withdrawal requests,” with $150 billion to $200 billion of available liquidity, he said in a note to clients on Monday.

According to the issued ratings of 16 analysts in the last year, the consensus rating for Charles Schwab stock is Moderate Buy based on the current 1 sell rating, 2 hold ratings and 13 buy ratings for SCHW. The average twelve-month price prediction for Charles Schwab is $85.04 with a high price target of $99.00 and a low price target of $60.00.

Summary.....

The pressure on Schwab's stock eased after Bettinger told CNBC earlier on Tuesday that he had bought 50,000 Schwab shares while billionaire investor Ron Baron said he "modestly increased" his position in Schwab.

About 82% of deposits held by Schwab were insured, falling under the Federal Deposit Insurance Corporation's limit of $250,000.

The bank has "access to significant liquidity" including an estimated $100 billion of cash flow from cash on hand, portfolio-related cash flows, plus new assets.

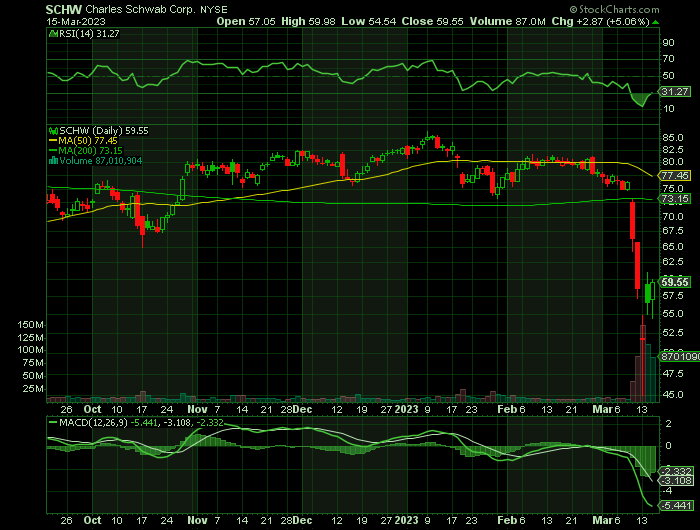

The company has a fifty day moving average price of $79.15 and a two-hundred day moving average price of $77.20. The company has a market cap of $96.29 billion, a PE ratio of 14.93, and a P/E/G ratio of 0.91 and a beta of 0.93. The company has a current ratio of 0.38, a quick ratio of 0.38 and a debt-to-equity ratio of 0.77. Charles Schwab has a 12-month low of $45.00 and a 12-month high of $93.16.

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trade – Tesla Inc (NASDAQ: TSLA) CALLS

Tuesday, March 14, 2023

** OPTION TRADE: Buy TSLA MAR 24 2023 180.000 CALLS - price at last close was $5.85 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

Recently, Musk and his executive team hosted their highly anticipated investor conference. Typically, during these events, Musk is known to reveal new products and services and paint a roadmap for Tesla Inc (NASDAQ: TSLA)'s future. Needless to say, Tesla stock usually tends to swing in the days leading up to these investor days.

In this instance, however, investors and Wall Street seemed less enthused. Tesla stock declined nearly 13% over the last five trading days since the event. With Tesla stocks downward momentum, this appears to be an attractive buy at this valuation.

Musk has created quite a few successful businesses with the biggest asset at the moment being Tesla equity.

While Tesla stock is known for being volatile, it remains a behemoth in the automotive industry. With a market cap of around $540 billion, Tesla is several times bigger than Ford and General Motors combined.

And business is heading in the right direction.

In 2022, Tesla’s vehicle deliveries grew 40% year over year to $1.31 million. Meanwhile its production increased 47% year over year to 1.37 million.

Wall Street analysts also see upside in Tesla shares. For instance, Morgan Stanley analyst Adam Jonas has an ‘overweight’ rating on Tesla and a price target of $220 — roughly 27% above where the stock sits today.

Further Catalysts for the TSLA Weekly Options Trade…..

The Conference.....

Perhaps the most noteworthy takeaway from the presentation was Tesla's estimated $10 trillion investment it plans to make in manufacturing among the following: renewable energy grid ($0.8 trillion), transition to EVs ($7.0 trillion), heat pumps ($0.3 trillion), high-temperature thermal ($0.8 trillion), and planes and ships ($1.0 trillion).

Basically, Musk is telling investors that he sees Tesla as more than just an automotive company. His vision to push green energy further into the DNA of society means Tesla allocating capital to other forms of transportation and innovative features in manufacturing.

Also, management confirmed that Tesla would be building a new factory in Mexico.

Volatility.....

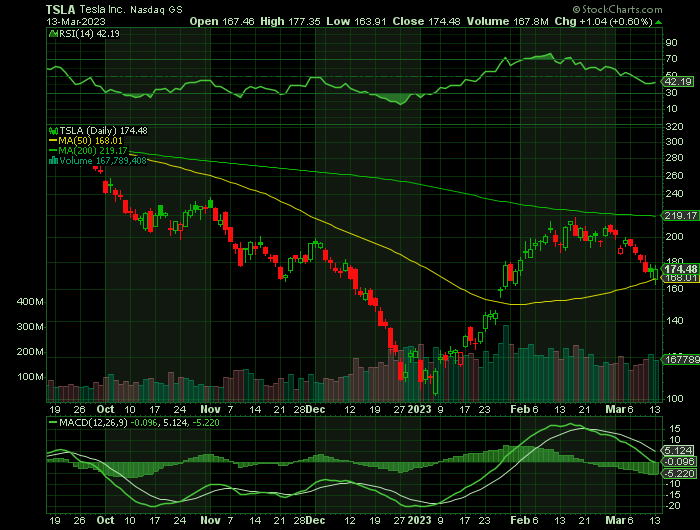

Toward the end of 2022, Tesla stock began to crater. Much of this was attributed to cyclical trends in technology and software companies, particularly those on the Nasdaq.

Some investors saw a buying opportunity in early 2023 before Tesla reported Q4 earnings. Several buyers joined the momentum, leading to a surge in Tesla's stock price. Clearly, this upswing reached a fever pitch in mid-February, as Tesla's stock price had nearly doubled in terms of absolute dollars from its January lows.

Even so, it's interesting to see that since reporting earnings at the end of January, Tesla stock dropped but not in an overdramatic fashion.

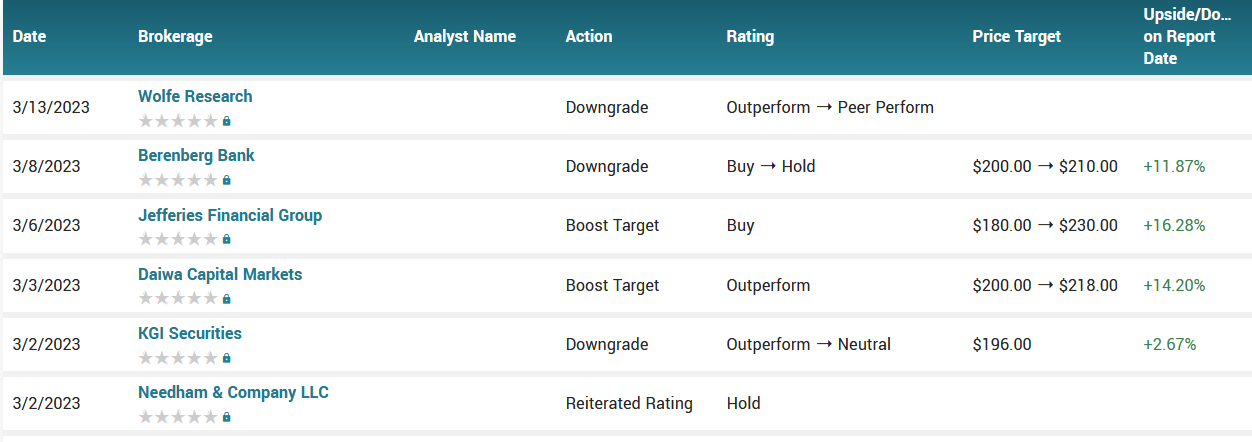

Analysts.....

According to the issued ratings of 37 analysts in the last year, the consensus rating for Tesla stock is Hold based on the current 4 sell ratings, 14 hold ratings and 19 buy ratings for TSLA. The average twelve-month price prediction for Tesla is $221.39 with a high price target of $430.33 and a low price target of $33.33.

Summary.....

Despite a sell-off over the last month or so, the stock price is only down roughly 11%. When accounting for a fairly mundane investor conference, vehicle price cuts, and recession fears, all things considered, Tesla stock appears to have some fundamental support.

Tesla stock traded down $3.56 during mid-day trading on Monday, hitting $169.88. The company’s stock had a trading volume of 46,758,407 shares, compared to its average volume of 184,049,797. The firm has a market capitalization of $537.52 billion, a PE ratio of 47.87, and a price-to-earnings-growth ratio of 2.10 and a beta of 2.06. Tesla, Inc. has a 1 year low of $101.81 and a 1 year high of $384.29. The company has a current ratio of 1.53, a quick ratio of 1.05 and a debt-to-equity ratio of 0.04. The stock’s fifty day moving average is $168.70 and its two-hundred day moving average is $200.18.

TAKE PROFIT WHEN AVAILABLE!

Weekly Options Trade – Credit Suisse Group AG (NYSE: CS) Puts

Tuesday, March 14, 2023

** OPTION TRADE: Buy CS MAR 31 2023 2.500 PUTS - price at last close was $0.26 - adjust accordingly.

(Some members have asked for the following.....BASE THIS ON YOUR RISK TOLERANCE!

Place a pre-determined sell at Approx. 50% of BUY price. (or vary according to your strategy)

Include a protective stop loss of -60% of price entered.

(CAUTION: Check the direction of the stock movement before executing – enter at the best available price – as you will be aware this stock market of late is extremely volatile and very unpredictable!)

NOTE: Personally, due to the volatility the market is experiencing as well as the fact that I am hands-on, I do not use a protective stop loss, but do have a flexible pre-determined sell point)

AGAIN – ADJUST TO YOUR OWN RISK TOLERANCE!

Prelude.....

The cost of insuring the bonds of Credit Suisse Group AG (NYSE: CS) against default climbed to the highest on record as the collapse of Silicon Valley Bank sparked concern about broader contagion in the banking industry.

Five-year credit default swaps for the Zurich-based lender jumped as much as 36 basis points on Monday to 453 basis points, according to pricing source CMAQ.

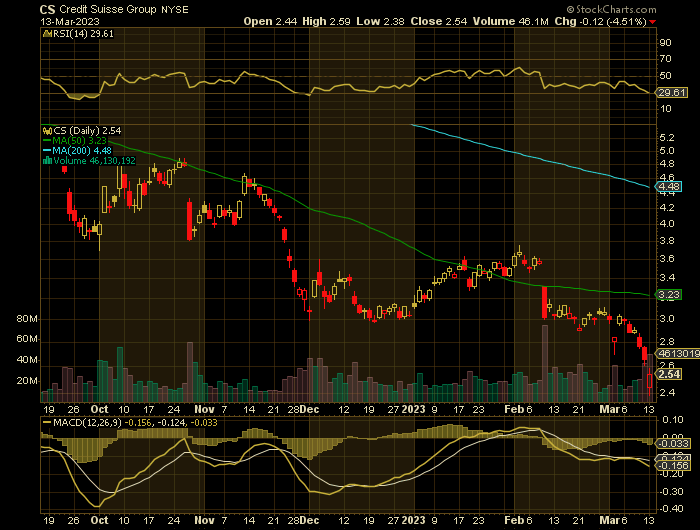

Shares of European banks and insurers slumped on Monday and Credit Suisse’s stock tumbled as much as 15% to a fresh record low.

Earlier this month, Credit Suisse said it was delaying publication of its annual report following a last-minute query by US regulators over previous financial statements.

The bank is also grappling with departures across departments.

Further Catalysts for the CS Weekly Options Trade…..

Silicon Valley Bank.....

Bank shares in Europe and Asia plunged on Monday as the collapse of startup-focused Silicon Valley Bank continued to batter markets, while U.S. large banks failed to hold onto a brief premarket rally after authorities moved to stem the contagion.

The bank's shares tumbled over 12% and were trading at 2.20 Swiss francs ($2.41) per share, down from a previous low of 2.41 francs hit on Friday. They are down almost 20% year to date.

Material Weaknesses.....

Credit Suisse has identified “material weaknesses” in its reporting and controls procedures for the last two years in the latest blow to the scandal-hit lender.

The Swiss bank said the issues relate to the failure to design and maintain effective risk assessments in its financial statements.

In its annual report, it said: “Management did not design and maintain an effective risk assessment process to identify and analyse the risk of material misstatements in its financial statements.”

As a result, for 2021 and 2022, “the group’s internal control over financial reporting was not effective”.

Credit Suisse was forced to delay the publication of its annual report last week following a late-night phone call from US regulators who raised questions about its accounts.

Debt.....

The latest blunder comes after the Swiss regulator said on Monday that the bank was being “closely monitored” after bets that it could default on its debts hit a record high amid the fallout from the collapse of Silicon Valley Bank.

Credit Suisse's debt was also falling on Monday, with the lender's U.S. dollar perpetual bonds being hit most and declining between five and ten cents on the dollar, Refinitiv Eikon data showed.

Past Debacles.....

In 2021, Credit Suisse suffered a multi-billion dollar hit linked to Archegos Capital Management, the family office linked to investor Bill Hwang. It subsequently issued a report that identified procedural deficiencies leading to the debacle. The bank has also completely reshuffled top management since then and is on its second re-boot plan in as many years.

Outflows.....

Credit Suisse has been dogged by outflows of client cash since the last quarter of 2022, when more than 110 billion francs was pulled. The bank said Tuesday that withdrawals had continued into this month, even after it started a huge campaign to win back client confidence.

Robert Kiyosaki.....

"The problem is the bond market, and my prediction, I called Lehman Brothers years ago, and I think the next bank to go is Credit Suisse," the Rich Dad Company co-founder Robert Kiyosaki said on Monday, "because the bond market is crashing."

Kiyosaki further explained how the bond market – the economy’s "biggest problem" – will put the U.S. in "serious trouble" as he expects the American dollar to weaken.

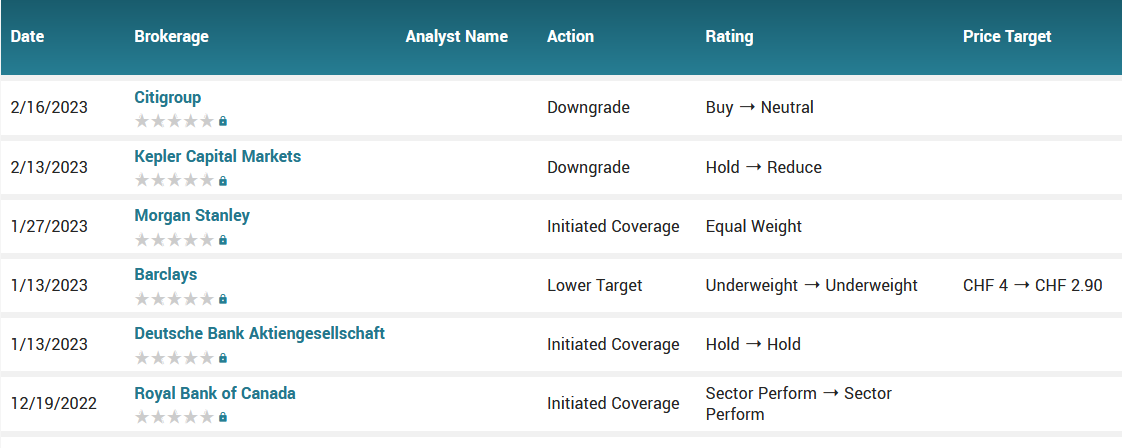

Analysts.....

According to the issued ratings of 13 analysts in the last year, the consensus rating for Credit Suisse Group stock is Hold based on the current 5 sell ratings, 6 hold ratings and 2 buy ratings for CS.

Back to Weekly Options USA Home Page