TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Spotify

Technology Weekly Option Up 132% Potential

Profit!

Members of “Weekly Options USA,” Using A Weekly put Option,

Make Potential Profit Of 132%,

After Spotify Released Its Earnings Report For The First Quarter Of 2023

And Showed

That The Number Of Users The Company Has Is More Than Half A Billion!

where to now?

Join

Us and GET FUTURE TRADEs!

Spotify released its earnings

report for the first quarter of 2023 and showed that the number of users the

company has is more than half a billion.

This set the scene for Weekly Options USA Members to profit by 132% using a SPOT Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, May 09, 2023

by Ian Harvey

Why the Spotify Weekly Options Trade was Executed?

Spotify Technology SA (NYSE: SPOT) has released its earnings report for the first quarter of 2023 and the headline figure is the number of users the company has. As of March 31st, 515 million people were using the audio streaming service. That's the first time Spotify has had more than half a billion users.

Q1 was also Spotify's second-biggest quarter for user growth to date — its audience increased by five percent from the previous quarter and 22 percent year over year. The user base grew by 26 million, which is 15 million more than Spotify had expected. The company said it saw growth in both developed and developing markets, as well as almost every age group.

The SPOT Weekly Options Trade Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

*** OPTION TRADE: Buy SPOT MAY 12 2023 140.000 CALLS - price at last close was $4.02 - adjust accordingly.

Entered the SPOT Weekly Options (CALL) Trade on Wednesday, April 26, 2023

for $2.50.

Sold the SPOT weekly options contracts on Monday, May 08, 2023 for $5.81; a potential profit of 132%.

Some members may still be holding SPOT weekly options contracts; therefore, we are looking for the Spotify stock to continue moving upwards this week.

Don’t miss out on further trades – become a member today!

About Spotify Technology.....

Spotify Technology SA is a digital music service offering music fans instant access to a world of music. It operates through the Premium and Ad-Supported segments.

The Premium segment provides subscribers with unlimited online and offline high-quality streaming access of music and podcasts on computers, tablets, and mobile devices. Users can connect through speakers, receivers, televisions, cars, game consoles, and smart watches. It also offers a music listening experience without commercial breaks.

The Ad-Supported segment provides users with limited on-demand online access of music and unlimited online access of podcasts on their computers, tablets, and compatible mobile devices. It also serves both a premium subscriber acquisition channel and a robust option for users who are unable or unwilling to pay a monthly subscription fee but still want to enjoy access to a wide variety of high-quality audio content.

The company was founded by Daniel Ek and Martin Lorentzon in April 2006 and is headquartered in Luxembourg.

The Actual Recommendation.....

(READ HERE)

Further Catalysts for the SPOTIFY Weekly Options Trade…..

Overall, Spotify posted a net operating loss of €156 million ($172 million) for the quarter. That's far more than the €6 million ($6.6 million) loss it saw in the first quarter of 2022, though it's an improvement over the €270 million ($297 million) Spotify lost the previous quarter.

While overall revenue was up by 14 percent year over year from €2.66 billion ($2.93 billion) to €3.04 billion ($3.34 billion), it dipped by four percent from the previous quarter. Revenue from paid subscribers didn't change significantly from Q4 2022, but it dropped by 27 percent on the ad-supported side from €449 million ($494 million) to €329 million ($362 million) — though revenue from free users rose by 17 percent year over year. The quarter-to-quarter drop is perhaps a result of advertisers tightening their belts somewhat, leading to lower ad spend.

Advertisers aren't the only businesses trying to rein in costs. Spotify, like many other major tech companies in recent months, has laid off a sizable proportion of its staff. In January, the company laid off six percent of workers, which equates to around 600 people based on the 9,800 that Spotify employed as of the end of 2022.

Additionally, Spotify seems to be placing a bigger focus on the core parts of its business. It recently announced plans to shut down both its live audio app, Spotify Live, and Heardle, the Wordle-style song-guessing game it bought last summer.

Subscription Plan.....

Spotify once again decided not to raise prices on its U.S. subscription plan, despite recent hikes at Apple Music (AAPL) and YouTube Premium (GOOGL) — but CEO Daniel Ek hinted an increase could come at some point this year.

"We'd like to raise prices in 2023," the executive said on the company's Q1 earnings call, but cautioned that decision will largely revolve around ongoing negotiations with label partners.

The executive said the music streaming giant raised prices last year in 46 different markets, which continued to outperform despite the increase.

"When the timing is right, we will raise it and that price increase will go down well because we're delivering a lot of value for our customers," he added.

Institutional Activity.....

Baillie Gifford & Co. grew its holdings in Spotify Technology by 6.7% during the 3rd quarter. Baillie Gifford & Co. now owns 27,964,517 shares of the company’s stock worth $2,413,338,000 after acquiring an additional 1,764,880 shares during the last quarter.

BlackRock Inc. lifted its position in shares of Spotify Technology by 20.2% during the 3rd quarter. BlackRock Inc. now owns 4,214,562 shares of the company’s stock valued at $363,717,000 after acquiring an additional 707,653 shares during the period.

Samlyn Capital LLC lifted its position in shares of Spotify Technology by 394.4% during the 3rd quarter. Samlyn Capital LLC now owns 453,792 shares of the company’s stock valued at $39,162,000 after acquiring an additional 362,003 shares during the period.

Renaissance Technologies LLC acquired a new position in shares of Spotify Technology during the 1st quarter valued at $37,966,000.

Finally, Alecta Tjanstepension Omsesidigt increased its stake in Spotify Technology by 9.0% during the 3rd quarter. Alecta Tjanstepension Omsesidigt now owns 3,035,600 shares of the company’s stock valued at $261,790,000 after purchasing an additional 250,000 shares in the last quarter.

52.80% of the stock is owned by institutional investors.

Analysts.....

Analysts largely expect Spotify to announce higher subscription fees in the coming months given its recent profitability push.

According to the issued ratings of 22 analysts in the last year, the consensus rating for Spotify Technology stock is Moderate Buy based on the current 7 hold ratings and 15 buy ratings for SPOT. The average twelve-month price prediction for Spotify Technology is $139.67 with a high price target of $180.00 and a low price target of $95.00.

Summary.....

The company reiterated its guidance of gross margins between 30% to 35% over the long term amid plans to further scale its podcasting and ads business.

Overall, Ek said the company is "really trying to focus on how can we optimize for growth," adding there are many ways to achieve growth in the near-term, besides just increasing prices.

"We have many tools at our disposal as we're thinking about how to increase growth," he said, referencing more runway for premium subscribers and average revenue per user. "The industry realizes that, and our label partners realizes that as well. That's the constant dialogue we are in."

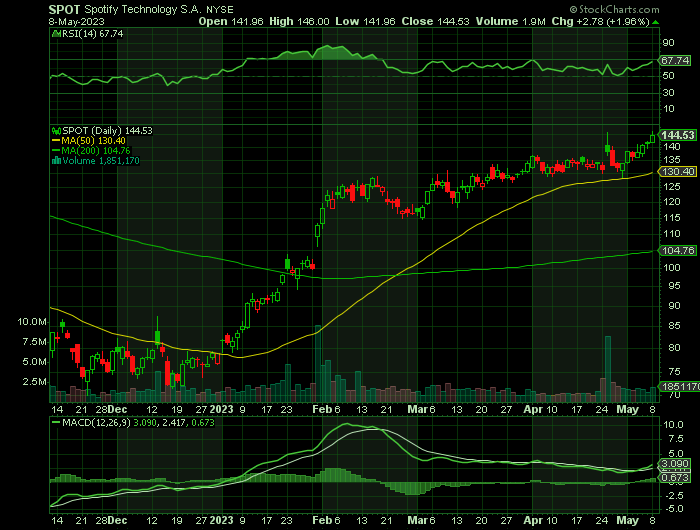

Spotify Technology has a market capitalization of $25.21 billion, a PE ratio of -43.29 and a beta of 1.76. Spotify Technology S.A. has a 12-month low of $69.29 and a 12-month high of $136.73. The business’s 50 day simple moving average is $127.47 and its 200-day simple moving average is $101.11.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SPOTIFY

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.