TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Roblox

Screams Higher After Earnings!

Weekly Option Members Up 64% Potential

Profit!

Members of “Weekly Options USA,” Using A Weekly call Option,

Make Potential Profit Of 64%,

After Roblox Released Its Earnings Report For The First Quarter Of 2023

With Revenue

Clocking In At Just Over $655 Million,

Representing 22% Growth Over The Same

Period Of 2022.

That Was On The Back Of Total Bookings That Climbed 23% Higher

To Nearly $774 Million.

where to now?

Join

Us and GET FUTURE TRADEs!

Roblox Released Its

Earnings Report For The First Quarter Of 2023 With Revenue Clocking In At Just

Over $655 Million, Representing 22% Growth Over The Same Period Of 2022. That Was

On The Back Of Total Bookings That Climbed 23% Higher To Nearly $774 Million.

This set the scene for Weekly Options USA Members to profit by 64% in 3 days, using a RBLX Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, May 11, 2023

by Ian Harvey

Why the Roblox Weekly Options Trade was Executed?

Roblox Corp (NYSE: RBLX) is expected to beat earnings estimates when it reports earnings on Wednesday, May 10, 2023 at approximately 8:00 AM ET.

The consensus estimate is for a loss of $0.42 per share on revenue of $766.15 million, representing 42.6% year-over-year revenue growth, but the Whisper number is a little better with a loss of $0.39 per share.

Short interest has decreased by 8.6% and overall earnings estimates have been revised higher since the company's last earnings release.

After some uneven performance over the previous 18 months due to pandemic-related engagement shifts, Roblox's fourth-quarter results were quite encouraging. While daily active users (DAUs) were flat on a sequential basis at 58.8 million in Q4, the platform's DAU count was up 19% compared to the prior-year period. Average bookings per user declined slightly, but the increase in active users was enough to push total bookings for the period up 17% year over year to hit $899.4 million.

The RBLX Weekly Options Trade Explained.....

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

** OPTION TRADE: Buy RBLX MAY 26 2023 37.000 CALLS - price at last close was $1.77 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the RBLX Weekly Options (CALL) Trade on Monday, May 08, 2023

for $2.08.

Sold the RBLX weekly options contracts on Wednesday, May 10, 2023 for $3.40; a potential profit of 64%.

Some members may still be holding SPOT weekly options contracts; therefore, we are looking for the Roblox stock to continue moving upwards this week.

The Actual Report…..

For the first quarter, revenue clocked in at just over $655 million, representing 22% growth over the same period of 2022. That was on the back of total bookings that climbed 23% higher to nearly $774 million.

On the other hand, the company's net loss under generally accepted accounting principles (GAAP) deepened. It was $268 million ($0.44 per share), against the $160 million shortfall in the year-ago quarter.

This meant a mixed quarter for the online gaming platform. On average, analysts tracking Roblox stock were modeling barely over $768 million for revenue, but $0.35 per share for a net loss.

The initial post-earnings sell-off was likely due to that earnings miss. It's also likely that investors then took a harder look at that booking figure, which Roblox touts as "a timelier indication of trends in our operating results that are not necessarily reflected in our revenue."

By that yardstick, the specialty tech company is doing very well. It didn't hesitate to point out that growth has improved considerably over the past five quarters. Prior to the first quarter's 23% year-over-year rise, these increases were 17% and 10%. The two quarters before that, bookings actually declined by 4% and 3%, respectively.

Over the last four quarters, the company has surpassed consensus EPS estimates just once.

Roblox shares have added about 27.2% since the beginning of the year versus the S&P 500's gain of 7.3%.

About Roblox.....

Roblox Corporation develops and operates an online entertainment platform.

It offers Roblox Client, an application that allows users to explore 3D digital worlds; and Roblox Studio, a toolset that allows developers and creators to build, publish, and operate 3D experiences and other content. The company also provides Roblox Cloud, a solution that provides services and infrastructure to power the human co-experience platform. It serves customers in the United States, Canada, Europe, the Asia-Pacific, and internationally.

Roblox Corporation was incorporated in 2004 and is based in San Mateo, California.

The Roblox stock initial public offering (IPO) via direct listing occurred on March 10 with a suggested price of $45 per share. With a direct listing, no new shares in the company are created and sold. Nor did the Roblox IPO raise any capital. Instead, current investors begin selling already existing shares based on demand when trading opens.

On March 10, Roblox stock closed at 69.50, more than 54% above the 45 IPO price. A huge price percentage increase on the IPO day indicates strong institutional backing.

The Actual Recommendation.....

(READ HERE)

Further Catalysts for the ROBLOX Weekly Options Trade…..

Roblox Story.....

The company's eponymous "Roblox" game was one of the top five biggest mobile games of 2022 in the world in terms of revenue. The Roblox mobile game showed player spending of $861.86 million in 2022.

What makes Roblox different from other online game platforms is that it lets users create their own games. Developers receive 30% of the proceeds generated from a game, such as the sale of virtual outfits and avatars.

Metaverse.....

In many respects, Roblox is already succeeding with the type of metaverse vision that Meta Platforms is sinking billions of dollars into pursuing each quarter. Having a successful metaverse platform potentially allows the platform owner to collect huge amounts of valuable data, play host to a wide variety of additional applications and services, take a cut of every transaction conducted through its channels, generate revenue from advertisements, and take advantage of other avenues for monetization.

Think of what Apple and Alphabet have accomplished with their respective mobile operating systems and App Store and Google Play platforms. A thriving metaverse can provide similar competitive advantages and sources of revenue, and it looks like Roblox is in the early stages of capitalizing on a massive opportunity

The metaverse leader is back to posting solid bookings increases and engagement growth, and its long-term growth potential is tantalizing. With business performance coming in strong and the stock still trading down roughly 74% from its high, Roblox offers big upside potential.

"The metaverse is bigger than gaming," said Christina Wootton, Roblox vice president of brand partnerships. "We're ushering in this new category of human co-experience. It's an immersive place where people can come and connect with one another and have shared virtual experiences. They can do things together, such as work, learn, play, shop and experience entertainment."

Analysts.....

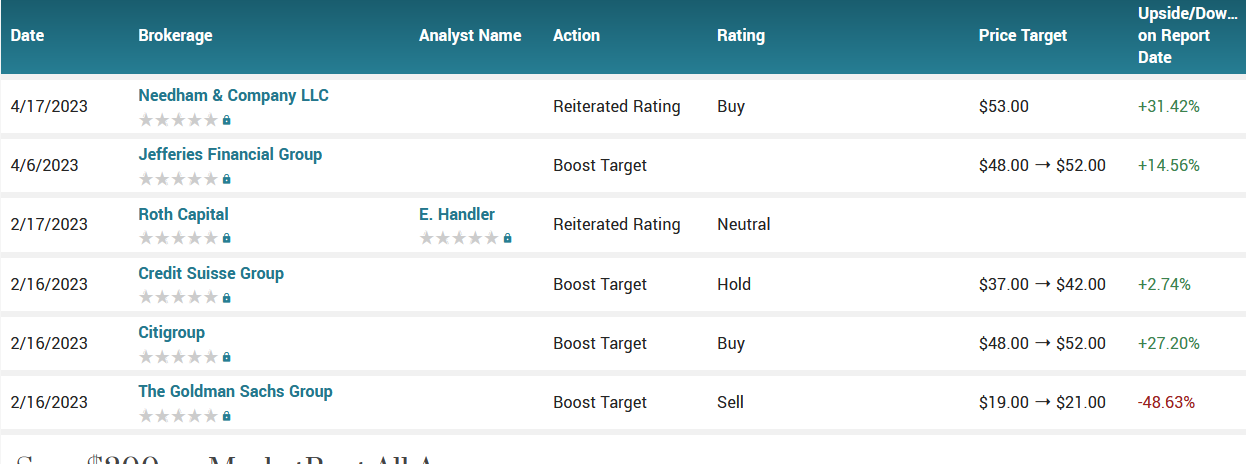

According to the issued ratings of 25 analysts in the last year, the consensus rating for Roblox stock is Hold based on the current 7 sell ratings, 9 hold ratings and 9 buy ratings for RBLX. The average twelve-month price prediction for Roblox is $37.92 with a high price target of $55.00 and a low price target of $19.00.

Summary.....

Roblox has a quick ratio of 1.55, a current ratio of 1.55 and a debt-to-equity ratio of 3.24. The business has a 50-day moving average price of $41.32 and a two-hundred day moving average price of $37.23. Roblox has a 12-month low of $21.65 and a 12-month high of $53.88. The firm has a market cap of $19.32 billion, a P/E ratio of -22.25 and a beta of 1.80.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from ROBLOX

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.