TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Nio Options Trade Charges Higher!

Profit On Option

Climbs 192%!

Another Trade Anticipated?

Wednesday, June 02, 2021

by Ian Harvey

Nio Options Trade provided a profit of 192% on Tuesday for “Up-and-Coming” members as the stock rallied on a positive delivery update and a Citi upgrade. As well, on Friday Nio reclaimed its 50-day line.

NIO stands out for its strong market position and innovation. In particular, the company's highly differentiated battery strategy sets it apart from competitors.

Is it time to look at further options trades on Nio?

Nio Inc – ADR (NYSE: NIO)

Prelude…..

On Friday May 14, 2021, “Up-and-Coming” Members were recommended a Nio Options Trade that would cost $3.15 to execute.

Shanghai-based EV manufacturer Nio Inc – ADR (NYSE: NIO) is the most prominent and successful Chinese company in the Chinese EV space and is quickly catching up to Tesla. It’s led by a charismatic founder, William Li Bin, and it has the biggest ambitions and deepest pockets.

NIO has successfully penetrated the market, created a product that consumers want, and is increasing production.

The total Chinese EV market is going to rapidly grow in the coming years due to secular trends and government support. By 2025, the Chinese government is targeting that 25% of car sales will be EVs as part of its plan to reduce pollution. It’s pursuing this target through a combination of subsidies, tax credits, investment, and quotas.

The country has also added to their battery charging infrastructure. For consumers, EVs are heavily subsidized, additionally, there’s an expedited process for getting permits and licenses which can take many months for gas-powered vehicles.

As a result, these policies have created a boom in the Chinese EV space.

The Recommended Nio Options Trade.....

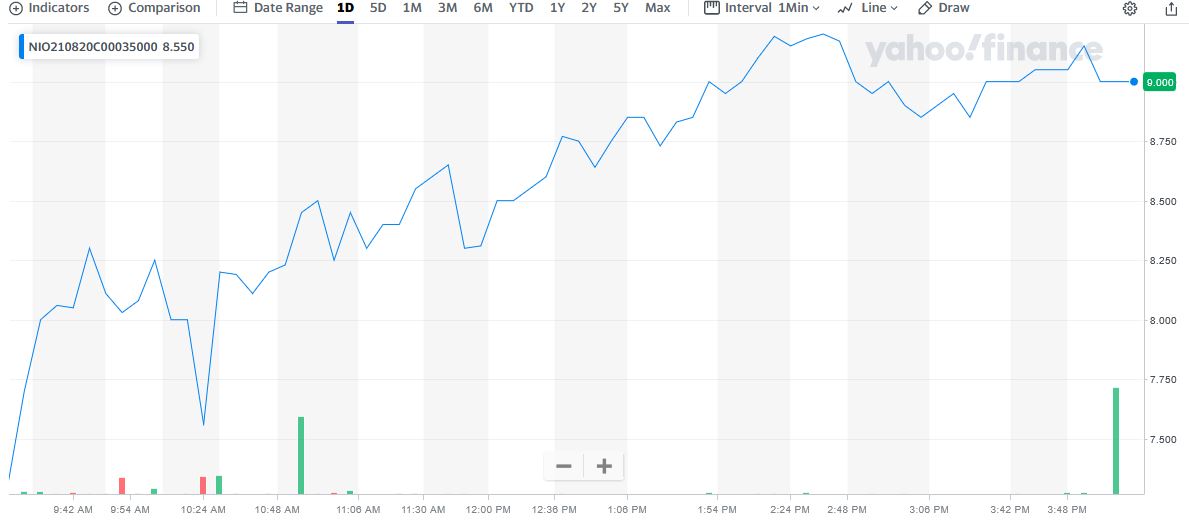

** NIO OPTIONS TRADE: Buy NIO AUG 20 2021 35.000 CALLS at approximately $3.15.

Nio Options Trade Call Success Explained.....

Last Friday, May 28, 2021, members Nio Options Trade climbed as high as $7.00 – a potential profit of 122%.

However, on Tuesday, June 01, 2021, the Nio Options Trade shot higher hitting $9.20 – a potential profit of 192%.

Why the Jump for the Nio Options Trade

1. NIO's innovative battery strategy was on display Friday, giving it a decent chance of capturing a leading position in the emerging EV industry. The company's highly differentiated battery strategy sets it apart from competitors. The company is in hyper growth mode and is expected to be free cash flow positive by 2022.

NIO has proven to be a fast-paced, aggressive and innovative company. In just seven years, NIO established itself as the premium electric SUV OEM in China, and now it is moving into sedans and expanding into Europe.

In August 2020, NIO announced a potential game changer: its battery-as-a-service (BaaS) subscription offering.

This offering differentiates NIO from competitors and solves two strategic issues: driving the mass adoption of EV and improving its competitive position.

2. Monthly Deliveries Report – NIO said in a statement on Tuesday morning that it delivered 6,711 vehicles in May, a decline of about 5.5% from April that was explained by a need to reduce production amid a global shortage of semiconductors. However, this is an increase of 95.3% year-over-year.

That decline was no surprise, as NIO had warned auto investors in April that it expected chip-related production disruptions in the second quarter. The good news -- there was some -- is that NIO reiterated its upbeat guidance for second-quarter deliveries, as it expects to be able to make up some of the difference in June. The company still expects to deliver between 21,000 and 22,000 vehicles in the quarter, roughly double its year-ago total.

Given that NIO delivered 13,183 vehicles in April and May, that guidance implies deliveries of between 7,817 and 8,817 in June, which would be an increase of between 109% and 136% from June 2020 and a record month for the company.

To read the “News Release” from Nio CLICK HERE.

3. Citi Analyst Upgrade -In a new note on Tuesday, Citi analyst Jeff Chung raised his bank's rating on NIO's shares to buy, from neutral, while increasing Citi's price target for NIO to $58.30 from $57.60.

Chung wrote that he now sees China sales of "new energy vehicles," a category that includes electric vehicles and hybrids, rising more quickly than he had previously expected. He now expects Chinese consumers to buy 2.52 million new energy vehicles in 2021 and 7.84 million in 2025, versus the 1.79 million in 2021 and 6.86 million in 2025 he had previously forecast.

For NIO specifically, Chung expects the company's order backlogs to increase in the second quarter, which will in turn "substantially increase" its revenue and market share in the second half of the year, with new products driving additional growth in 2022.

Chung's upgrade is a big part of why the stock is up Tuesday.

For the Original Reasoning Behind the Nio Options Trade.....

To best understand why we recommended a Nio Options Trade it would be best to read.... “

“Up-and-Coming Traders” Recommendations Week Beginning Monday, May 10, 2021”

Therefore…..

This Nio Options Trade Is A Big Winner !

Will Nio Stock Price Continue Its Upward Momentum?

Will We Recommend Another Nio Options Trade?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Nio Options