TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Up-and-Coming

Traders” Recommendations

- Week Beginning -

Monday, MAY 10, 2021

Option Trade – Nio Inc – ADR (NYSE: NIO) Calls

Friday, May 14, 2021

** OPTION TRADE: Buy NIO AUG 20 2021 35.000 CALLS at approximately $3.15. (Max. $2.50)

Place a pre-determined sell at $6.30.

Also include a protective stop loss of $1.25.

Shanghai-based EV manufacturer Nio Inc – ADR (NYSE: NIO) is the most prominent and successful Chinese company in the Chinese EV space and is quickly catching up to Tesla. It’s led by a charismatic founder, William Li Bin, and it has the biggest ambitions and deepest pockets.

NIO has successfully penetrated the market, created a product that consumers want, and is increasing production.

The total Chinese EV market is going to rapidly grow in the coming years due to secular trends and government support. By 2025, the Chinese government is targeting that 25% of car sales will be EVs as part of its plan to reduce pollution. It’s pursuing this target through a combination of subsidies, tax credits, investment, and quotas.

The country has also added to their battery charging infrastructure. For consumers, EVs are heavily subsidized, additionally, there’s an expedited process for getting permits and licenses which can take many months for gas-powered vehicles.

As a result, these policies have created a boom in the Chinese EV space.

About Nio…..

Founded in 2014, the company originally operated under the name NextCar, changing it to NIO in July 2017. In its Chinese form, the name translates to "Blue Sky Coming," which stems from management's vision of a future with azure skies absent the pollution from

Raising $1 billion during its initial public offering, NIO debuted as a publicly traded company on the American market in September 2018. On its first day of trading, the stock opened at $6, closed at $6.60, and traded as high as $6.93 for a reasonable pop.

On Sept. 24, 2018, the company achieved a new Guinness World Record when Chen Haiyi from China ascended the Purog Kangri glacier in Tibet and reached an altitude of 18,751 feet in the NIO ES8, setting a record for the highest altitude achieved in an electric car. According to the company, the feat was meant to demonstrate the EV's prowess in high altitude and extreme cold.

While NIO's vehicles may only be seen on the roads of China, the company is drawing on talent from a worldwide pool of employees. In San Jose, California, for example, the company's North America headquarters is home to more than 500 employees who primarily focus on software development. According to the company, the London office works on "commercial Formula E [race car] management, strategic management, and our supercar development." Nearly 200 employees in the Munich office concentrate on product and brand design.

Earnings.....

Nio’s recent earnings report on April 29 was probably about as good as investors could have asked for. This Chinese EV maker reported a relatively positive beat.

The company beat on the top line, bringing in 8 billion Yuan compared to average analyst estimates of 7.5 billion Yuan. However, the real strength in Nio’s earnings report was its gross margin improvement.

The company reported a substantial gross margin improvement this past quarter. Its gross margin of 19.5% is much higher than the market expected and 3% higher than the same quarter last year.

Influencing Factors.....The electrification of transportation seems to be on a path of no return. EV sales are expected to jump from 1.7 million in 2020 to 26 million 10 years from now, and then more than double from there to 54 million by 2040 according to industry research provider BloombergNEF. The firm believes that China alone, the world's largest automotive market, will account for about 13 million EV sales in 2030, and 18 million by 2040.

That puts NIO in the right place at the right time. To that end, NIO and its partner JAC Motor just began construction of a new industrial park in collaboration with the city of Hefei, China, on April 29. The park will include a new factory to support future production growth.

NIO sold 44,000 EVs, 113% growth over 2019. For the first quarter of 2021, that rapid sales growth accelerated. NIO delivered 20,060 vehicles in the first quarter, representing 423% year-over-year growth. So far, NIO has grown sales by offering three electric SUV models. But starting next year, it will begin production of its highly anticipated ET7 luxury sedan.

The sedan has some intricate features. The sleek exterior includes autonomous driving sensors, what the company describes as a "crystal-like heartbeat" taillight, all-glass roof, and a digital entry system that extends the flush handle and automatically releases the door's "e-latch" as the driver approaches. The ET7 also comes with a larger 150-kWh battery pack that will provide a range of about 621 miles, according to the company. That's farther than Tesla's (NASDAQ:TSLA) Model S maximum range of 402 miles, as well as the Lucid Motors Air sedan range of 517 miles.

The sedan has some intricate features. The sleek exterior includes autonomous driving sensors, what the company describes as a "crystal-like heartbeat" taillight, all-glass roof, and a digital entry system that extends the flush handle and automatically releases the door's "e-latch" as the driver approaches. The ET7 also comes with a larger 150-kWh battery pack that will provide a range of about 621 miles, according to the company. That's farther than Tesla's (NASDAQ:TSLA) Model S maximum range of 402 miles, as well as the Lucid Motors Air sedan range of 517 miles.

Analysts Thoughts.....

A number of equities research analysts have recently issued reports on the stock.....

- Nomura Instinet initiated coverage on shares of NIO in a research report on Friday, January 22nd. They set a “buy” rating and an $80.30 price target for the company.

- Mizuho raised their price objective on shares of NIO from $60.00 to $65.00 and gave the stock a “buy” rating in a research note on Monday, May 3rd. They noted that the move was a valuation call.

- Deutsche Bank Aktiengesellschaft reissued a “buy” rating and set a $60.00 price objective on shares of NIO in a research note on Tuesday, April 27th.

- Smith Barney Citigroup reiterated a “neutral” rating on shares of NIO in a research note on Tuesday, January 12th.

- Finally, Citigroup Inc. 3% Minimum Coupon Principal Protected Based Upon Russell cut shares of NIO from a “buy” rating to a “neutral” rating and raised their price objective for the stock from $46.40 to $68.30 in a research note on Tuesday, January 12th.

Consensus among analysts for NIO is a Moderate Buy with 7 Buy and 3 Hold ratings. The stock has an average analyst price target of $60.40, which implies 78.27% upside potential over the next 12 months.

Summary.....

Nio’s shares are up about 800% in the last 12 months, and the company is valued at about $55 billion.

Nio is one of those hyper-growth stocks that is a compelling investment. This is a stock with all the catalysts in its favor right now. It isn’t just growing – it’s growing fast, and profitably.

Nio’s position as a tech and EV play is working to its disadvantage right now. The market is selling off speculative names, and throwing excellent growth stocks out with the bathwater. Accordingly, Nio’s near-50% discount to its all-time high is a great opportunity for this options trade.

Nio has a current ratio of 2.42, a quick ratio of 2.33 and a debt-to-equity ratio of 0.84. The firm has a market capitalization of $54.71 billion, a price-to-earnings ratio of -37.49 and a beta of 2.81. The firm’s fifty day simple moving average is $38.41 and its 200 day simple moving average is $46.07. Nio Inc – has a twelve month low of $3.18 and a twelve month high of $66.99.

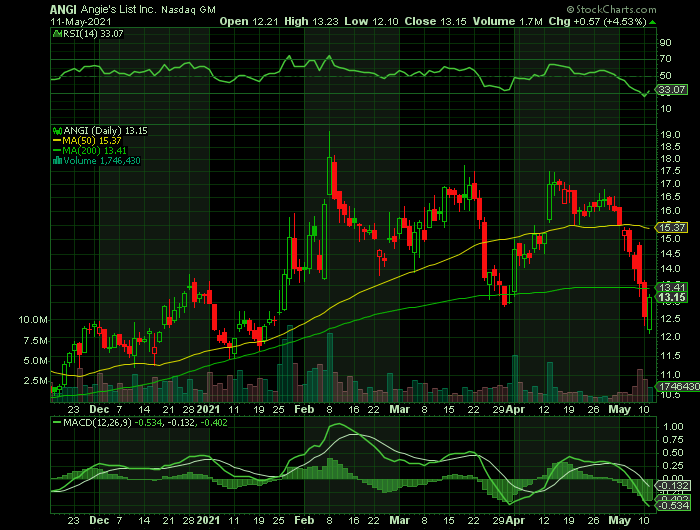

Option Trade – Angi Inc (NASDAQ: ANGI) Calls

Wednesday, May 12, 2021

** OPTION TRADE: Buy ANGI AUG 20 2021 12.500 CALLS at approximately $2.00. (Max. $2.40)

Place a pre-determined sell at $4.00.

Also include a protective stop loss of $0.80.

Nearly two months ago, Angi Inc (NASDAQ: ANGI), the company formerly known as ANGI Homeservices, announced a rebrand. The company refreshed its logo and brought together its two principal brands, Angie's List and HomeAdvisors, under the name Angi.

The rebrand was the first major step under new CEO Oisin Hanrahan, who wants to streamline the organization, focus its mission on delivering value for customers and service providers, and grow new pre-priced Angi Services, where the company books jobs itself and then hands them off to service providers.

The company is majority-owned by IAC, the holding company

that has shepherded companies like Match Group and Expedia to

industry-leading positions. It was formed by a 2017 merger of Angie's List and

HomeAdvisor, which was orchestrated by IAC. It's the leading company in its

industry by a wide margin, but it's also struggled to harness the opportunity

in home services, which includes everything from plumbing to landscaping to

house cleaning, a total market Hanrahan says is worth $500 billion. For

comparison, Angi's 2020 revenue was just above $1 billion.

About Angi.....

Angi Inc offers home service professionals in the United States and internationally.

Its HomeAdvisor digital marketplace service connects consumers with service professionals for home repair, maintenance, and improvement projects; provides consumers with tools and resources to find local, pre-screened, and customer-rated service professionals, as well as offers online appointment booking; and connects consumers with service professionals by telephone, as well as offers several home services-related resources.

Earnings.....

Angi reported earnings last Thursday for the first time since the rebranding announcement, reporting revenue growth of 13% to $387 million with adjusted EBITDA down 33% $23.2 million, in part due to ongoing investments in Angi Services.

Angi reported break-even quarterly earnings per share versus the Consensus Estimate of a loss of $0.04. This compares to loss of $0.02 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 100%. A quarter ago, it was expected that this provider of a digital marketplace for home services would post a loss of $0.03 per share when it actually produced a loss of $0.03, delivering no surprise.

Over the last four quarters, the company has surpassed consensus EPS estimates two times.

Angi posted revenues of $387.03 million for the quarter ended March 2021, surpassing the Consensus Estimate by 1.76%. This compares to year-ago revenues of $343.65 million. The company has topped consensus revenue estimates three times over the last four quarters.

Moving Forward.....

Management expects mid-teens revenue growth rate for the second and third quarters before returning to around 20% revenue growth in the fourth quarter, in line with its long-term guidance of 20% top-line growth. It also expects adjusted EBITDA margin to be at single-digit levels as the company invests in the pre-priced services business.

Rebranding the business and building a new business model will be a big project and take years to reach fruition, but the company is targeting a $500 billion, highly fragmented, offline market that is ripe for an online platform like Angi. Additionally, the company is adding ancillary services like payments and a subscription membership that should boost frequency from both customers and service providers, further building out its ecosystem and creating competitive advantages.

The company plans to invest $60 million in Angi Services this year to

make onboarding service providers easier and to build out pricing models in

each one of its hundreds of categories. There's work to be done, but the path

to success is clear -- and new features like the subscription program, which

offers discounts of up to 20% on jobs for a $30 annual fee, as well as

financing through Affirm, will only help it reach that goal.

Influencing Factors.....

The company is the leading online home services marketplace, helping homeowners find everything from plumbers to painters to house cleaners, but has struggled to grow through the pandemic as demand on its platform exhausted its supply of home service providers.

That challenge has weighed on the stock, but that could soon change. Not

only is the economy on its way to normalizing as more people get vaccinated,

but Angi has also recently rebranded under a new management team, which is

focused on turning around the business.

The core of its growth strategy is building out its fixed-price platform, which offer customers an easy way to book jobs -- and more importantly, gives the company an opportunity to go directly to service professionals with jobs in hand, rather than just a platform where professionals can find customers. In addition to improving and growing the fixed-price product, the company is also focused on features like payment collection and financing, helping to eliminate the friction between buyers and sellers on the platform.

Hanrahan underscored the potential of Angi Services, saying, "The unbelievable part of that business is that it is abnormal to have a business doing $250 million in revenue, growing 66% year on year, and not spending an incremental dime on consumer marketing." He explained that the company is able to do that because "We have this engine of excess demand from our regular leads and ads business." In other words, the customer demand for a such a product is already there.

Analysts Thoughts.....

A number of equities research analysts have recently issued reports on the stock.....

- JPMorgan Chase & Co. raised their target price on shares of Angi from $15.00 to $20.00 and gave the company an "overweight" rating in a research report on Monday, February 8th.

- Citigroup upped their price target on shares of Angi from $14.00 to $19.00 in a research note on Monday, February 8th.

- BTIG Research downgraded Angi from a "buy" rating to a "neutral" rating in a research report on Friday, February 5th.

- Finally, TheStreet raised Angi from a "d+" rating to a "c-" rating in a report on Monday, May 3rd.

One research analyst has rated the stock with a sell rating, three have assigned a hold rating and ten have issued a buy rating to the company's stock. The company has an average rating of "Buy" and a consensus target price of $16.56.

Summary.....

Angi Services, which launched in 2019, is off to a strong start. Revenue from the pre-priced offering grew 66% in the first quarter to $55 million, making up about 15% of total revenue. What was especially valuable about that growth, according to Hanrahan, is that it came with no incremental marketing spend, making the category a huge potential profit driver at scale.

If Angi gets it right, the opportunity is enormous, as the home service market could be worth as much as $500 billion.

Angi has a 1-year low of $7.79 and a 1-year high of $19.17. The company has a debt-to-equity ratio of 0.56, a current ratio of 3.82 and a quick ratio of 3.82. The company has a market capitalization of $6.29 billion, a price-to-earnings ratio of 1,259.26 and a beta of 1.88. The business has a 50-day moving average of $15.26 and a 200-day moving average of $13.69.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.