TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Netflix

NFLX Stock Continues To Rocket Higher!

And, “Weekly Options” Members are Up 220% or 409%,

Depending On The Strike Price,Using A Weekly call Option!

Can More Profit Be Expected?

Don’t

Miss Out On Further Profit!

Tuesday, February 01, 2022

by Ian HarveyNetflix NFLX

continued to move upwards on Monday, after analysts at Citi Research and Edward

Jones both upgraded the stock; and is still on a positive streak this

morning!

And, “Weekly Options USA” Members, Are Up 220% or 409%, Depending On The Strike Price, Using A Weekly Call Option!

Can

More Profit Be Expected?

Don’t Miss Out On Further Profit!

Netflix Inc (NASDAQ: NFLX)

Shares of Netflix Inc. NFLX rocketed higher on Monday for their best day in more than a year after a pair of analysts at Citi Research and Edward Jones said the stock’s selloff had gone too far.

This rise is on top of the rise last Thursday after Billionaire investor William Ackman, of Pershing Square Capital Management, had built a new stake in streaming service NFLX worth more than $1 billion.

Read the article “Netflix Stock Climbs After Ackman’s Hedge Fund Buys In!”

NFLX soared on Monday to close at $427.14, adding $42.78 (11.13%) by the close of the market.

The Trades Explained.....

Weekly Options USA Members entered this trade on Thursday, January 27, 2022 – with a choice of two strike prices.

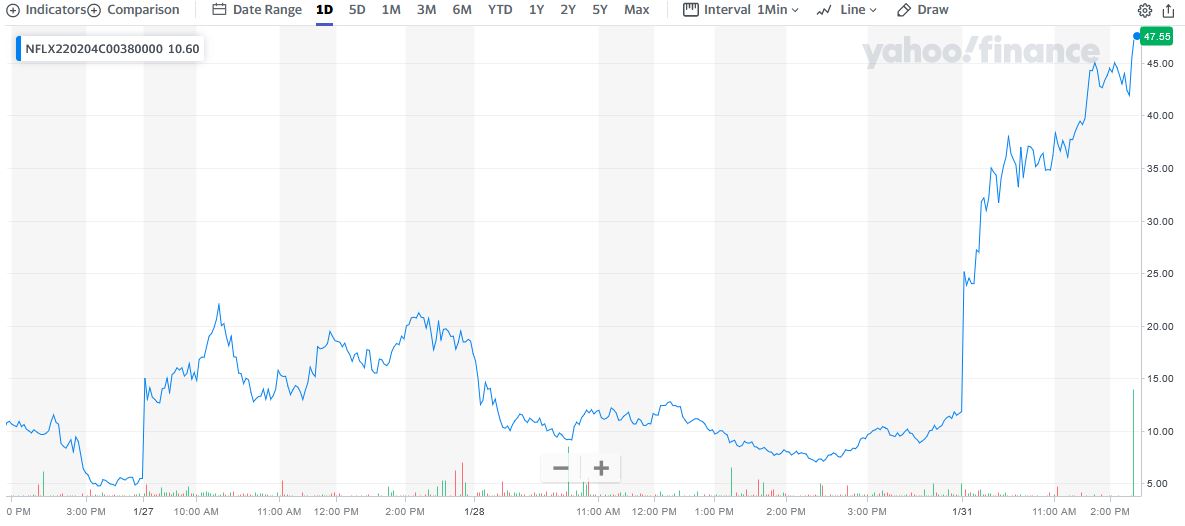

Trade 1. Expiry of 380.

Bought at $14.85 and reached $47.55 on Monday – providing 220% potential profit.

This is a profit of $3,270 on 1 contract!

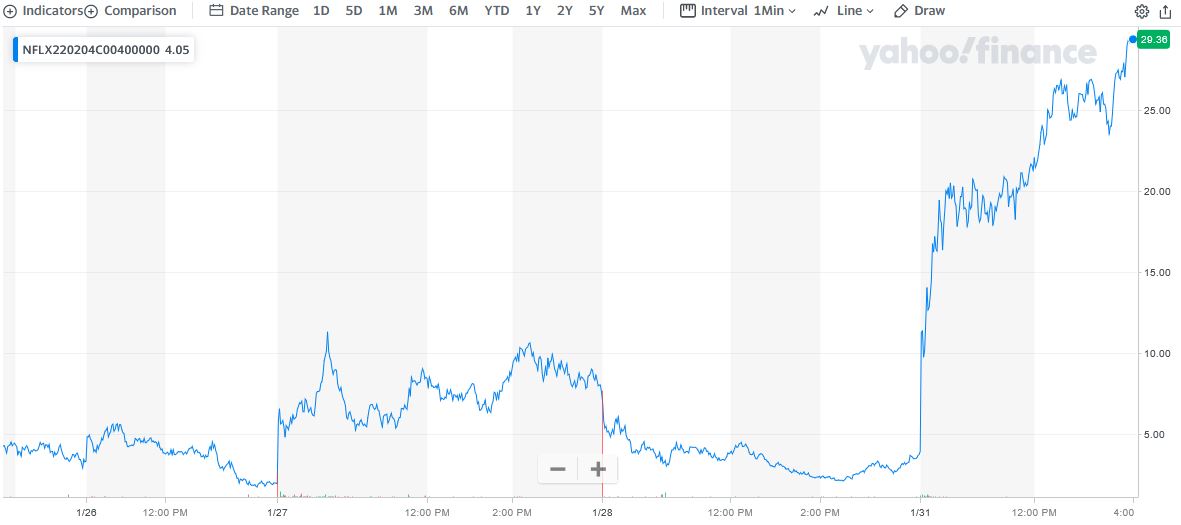

Trade 2. Expiry of 400.

Bought at $5.80 and reached $29.50 on Monday – providing 409% potential profit.

This is a profit of $2,370 on 1 contract!

Influencing Factors for NFLX Gains

The Analysts Upgrades on NFLX.....

Edward Jones analyst David Heger expects that investors could come to appreciate the wider scope of the company’s story.

“We have anticipated that as Netflix’s business matures, investors will increasingly value the stock on financial results rather than subscriber growth,” he wrote. “We still expect that Netflix can grow its long term earnings at a double-digit rate as it further expands into international markets.”

That international expansion offers ample opportunities for subscriber growth as well, Heger added. And he likes the company’s overall positioning because he believes Netflix’s investments in content have helped differentiate the service.

He raised his rating on Netflix’s stock to buy from hold.

Citi analyst Jason Bazinet upgraded Netflix stock to buy from

neutral (hold), while simultaneously adjusting the firm's price target down

from $595 to $450.

The analyst cited the decline in the stock, noting it had come under

substantial pressure in the wake of its fourth-quarter earnings report.

However, he noted that an analysis of the enterprise value per subscriber

indicate that, at the current price, investors are assuming that Netflix's

growth will flatline, with no material subscriber growth or improvement is its

user economics after 2023.

Bazinet wrote in a note to clients: "While

Netflix ... may see more modest sub growth, we see other top-line vectors. For

Netflix, we believe the firm has ample pricing power."

Insider Buying…..

Netflix’s stock rise Monday also comes after co-CEO Reed Hastings bought $20 million worth of the shares, disclosed after the market closed Friday. It was Hastings’ first open-market purchase of Netflix shares since the company’s 2002 IPO, in an evident show of confidence in the stock.

Hastings added $20 million to his holdings, bringing his total share count to nearly 5.16 million shares.

Summary.....

The shares are down nearly 40% over the past three months – so there is plenty of room for further positive stock movement.

Therefore…..

We Have Had A Successful Netflix Trade!

Will We Hold For Further Profit?

What Further Netflix Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from NFLX