TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Credit Suisse – Taking Advantage Of The Debacle!

Members of “Weekly Options USA,” Using A Weekly put Option,

Make Potential Profit Of 622%,

After The

Collapse Of The Share Price Due To Rapid,

Technology-Enabled Withdrawals Of Deposits.

where to now?

Join

Us and GET FUTURE TRADEs!

Credit Suisse said the collapse of the share price related to the failure to design and maintain effective risk assessments in its financial statements. The Swiss Bank defaulted as its debts hit a record high amid the fallout from the collapse of Silicon Valley Bank.

This set the scene for Weekly Options USA Members to profit by 622%, using a Credit Suisse Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, March 28, 2023

by Ian Harvey

Why the Profit on Credit Suisse Weekly Options?

Credit Suisse said the collapse of the share price related to the failure to design and maintain effective risk assessments in its financial statements. The Swiss Bank defaulted as its debts hit a record high amid the fallout from the collapse of Silicon Valley Bank.

The Profits Explained.....

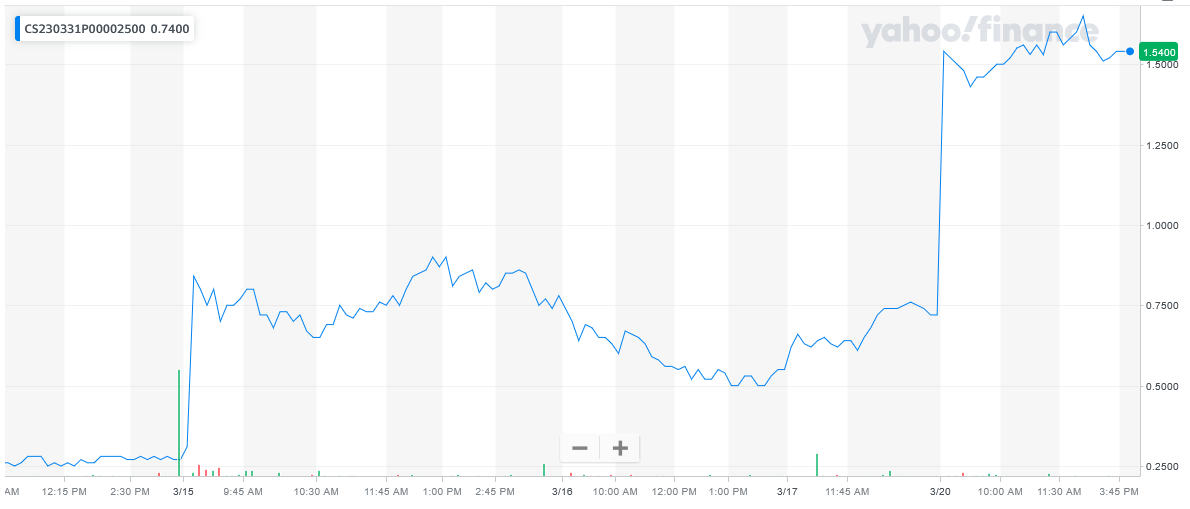

The Trade: Buy CS MAR 31 2023 2.500 PUTS - price at last close was $0.26 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the Credit Suisse Weekly Options (PUT) Trade on Tuesday, March 14, 2023 at 10:46 for $0.23.

Sold half the contracts on Wednesday, March 15, 2023 for $1.22; a potential profit of 430%.

On Friday, March 24, 2023, sold the remaining contracts for $1.66; a further potential profit of 622%.

Don’t miss out on further trades – become a member today!

The Actual Recommended

Trade for CREDIT SUISSE.....

(READ HERE)

Prelude.....

The cost of insuring the bonds of Credit Suisse Group AG (NYSE: CS) against default climbed to the highest on record as the collapse of Silicon Valley Bank sparked concern about broader contagion in the banking industry.

Five-year credit default swaps for the Zurich-based lender jumped as much as 36 basis points on Monday to 453 basis points, according to pricing source CMAQ.

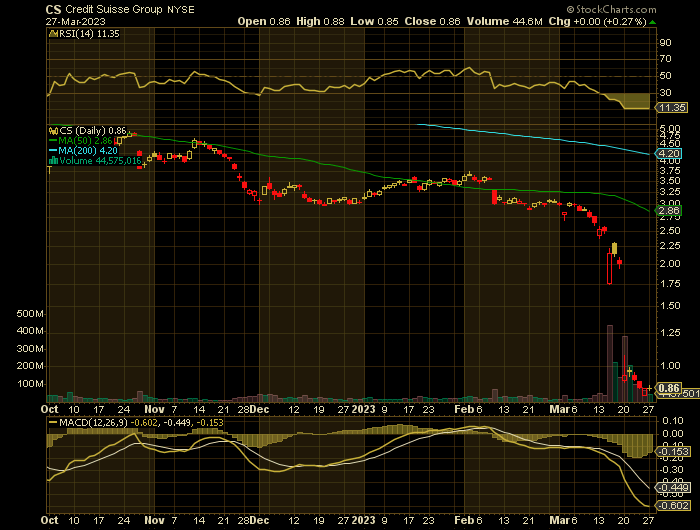

Shares of European banks and insurers slumped on Monday and Credit Suisse’s stock tumbled as much as 15% to a fresh record low.

Earlier this month, Credit Suisse said it was delaying publication of its annual report following a last-minute query by US regulators over previous financial statements.

The bank is also grappling with departures across departments.

Further Catalysts for the CS Weekly Options Trade…..

Silicon Valley Bank.....

Bank shares in Europe and Asia plunged on Monday as the collapse of startup-focused Silicon Valley Bank continued to batter markets, while U.S. large banks failed to hold onto a brief premarket rally after authorities moved to stem the contagion.

The bank's shares tumbled over 12% and were trading at 2.20 Swiss francs ($2.41) per share, down from a previous low of 2.41 francs hit on Friday. They are down almost 20% year to date.

Material Weaknesses.....

Credit Suisse has identified “material weaknesses” in its reporting and controls procedures for the last two years in the latest blow to the scandal-hit lender.

The Swiss bank said the issues relate to the failure to design and maintain effective risk assessments in its financial statements.

In its annual report, it said: “Management did not design and maintain an effective risk assessment process to identify and analyse the risk of material misstatements in its financial statements.”

As a result, for 2021 and 2022, “the group’s internal control over financial reporting was not effective”.

Credit Suisse was forced to delay the publication of its annual report last week following a late-night phone call from US regulators who raised questions about its accounts.

Debt.....

The latest blunder comes after the Swiss regulator said on Monday that the bank was being “closely monitored” after bets that it could default on its debts hit a record high amid the fallout from the collapse of Silicon Valley Bank.

Credit Suisse's debt was also falling on Monday, with the lender's U.S. dollar perpetual bonds being hit most and declining between five and ten cents on the dollar, Refinitiv Eikon data showed.

Past Debacles.....

In 2021, Credit Suisse suffered a multi-billion dollar hit linked to Archegos Capital Management, the family office linked to investor Bill Hwang. It subsequently issued a report that identified procedural deficiencies leading to the debacle. The bank has also completely reshuffled top management since then and is on its second re-boot plan in as many years.

Outflows.....

Credit Suisse has been dogged by outflows of client cash since the last quarter of 2022, when more than 110 billion francs was pulled. The bank said Tuesday that withdrawals had continued into this month, even after it started a huge campaign to win back client confidence.

Robert Kiyosaki.....

"The problem is the bond market, and my prediction, I called Lehman Brothers years ago, and I think the next bank to go is Credit Suisse," the Rich Dad Company co-founder Robert Kiyosaki said on Monday, "because the bond market is crashing."

Kiyosaki further explained how the bond market – the economy’s "biggest problem" – will put the U.S. in "serious trouble" as he expects the American dollar to weaken.

Analysts.....

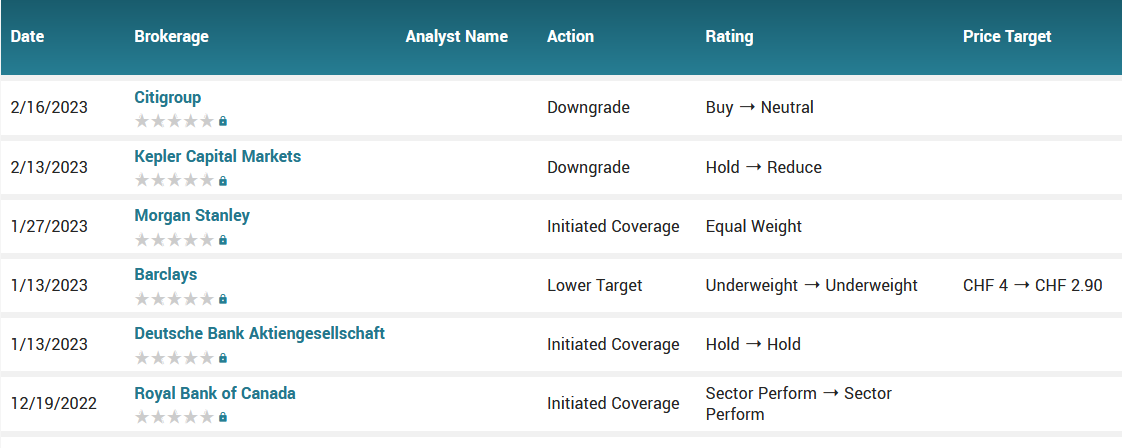

According to the issued ratings of 13 analysts in the last year, the consensus rating for Credit Suisse Group stock is Hold based on the current 5 sell ratings, 6 hold ratings and 2 buy ratings for CS.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Credit Suisse

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.