TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Costco Trading

Strategies Pre-Earnings!

Potential

Profits are 146.5% or 70%!

Thursday, December 16, 2021

by Ian HarveyCostco trading strategies were based on earnings that were due towards the end of the week. However, the idea was to profit on the stock movement prior to this event.

This was achieved with great success with members being able to accomplish this in several ways – the potential profits were 146.5% or 70%, depending on the strategy employed.

Costco

Wholesale Corporation (NASDAQ: COST)

Prelude…..

Costco trading strategies were based on earnings that were due towards the end of the week. However, the idea was to profit on the stock movement prior to this event and not rely on the actually earnings as has been shown that many times in past earnings of late, the stock can perform quite well but can then see its price drop afterwards.

On December 05, 2021 an article titled “Costco Earnings” was sent to newsletter members.....READ MORE.

On Monday, December 06 a recommendation was sent to Weekly Options USA members.....

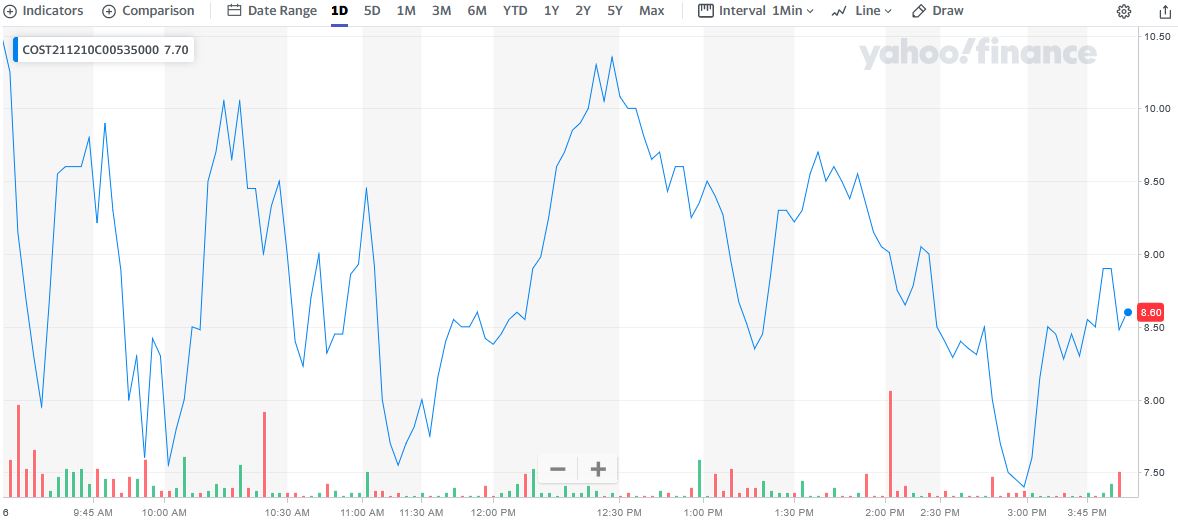

** OPTION TRADE: Buy COST DEC 10 2021 535.000 CALLS at approximately $8.50.

Costco Trading Strategies

There were several Costco trading strategies that could be applied to this trade at the time…..

Costco Trading Strategies No. 1…..a very hands-on approach…..

Monday December 06, 2021…..

- Bought 9:35 for $7.95

- Sold at 9:47 at $9.90

Profit 24.5%

- Re-Bought 10:17 for $7.60

- Sold at 10:17 at $10.05

Profit 32%

- Re-Bought 11:22 for $7.55

- Sold at 12:29 at $10.35

Profit 37%

- Re-Bought 2:57 for $7.40

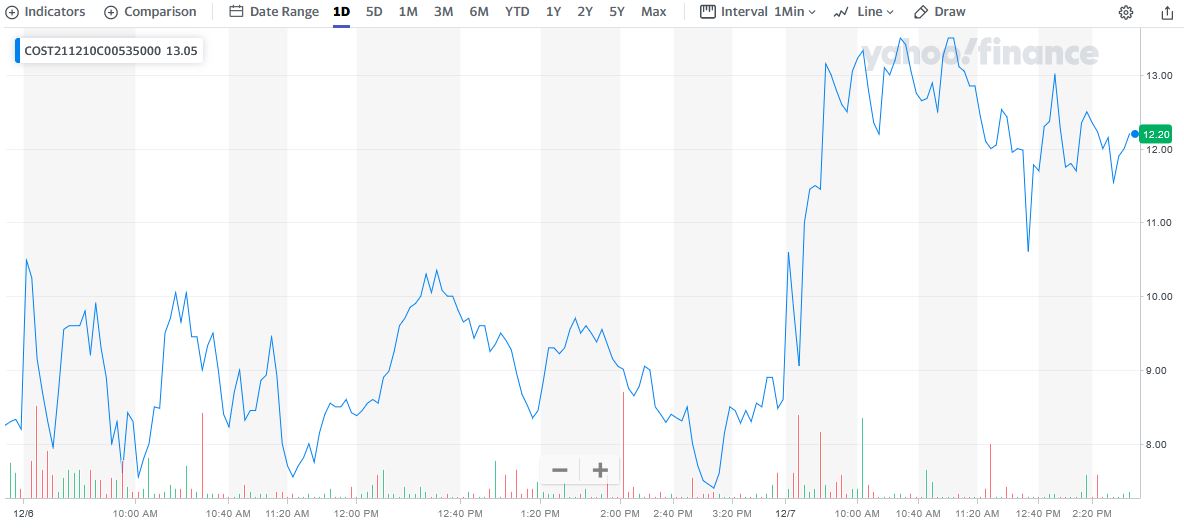

Tuesday December 07, 2021…..

- Sold at 10:19 at $13.50

Profit 82%

Total Profit is 146.5%

Costco Trading Strategies No. 2…..a less hands-on approach…..

Monday December 06, 2021…..

- Bought 9:35 for $7.95

Tuesday December 07, 2021…..

- Sold at 10:19 at $13.50

Total Profit is 70%

Costco Trading Strategies No. 3…..hold until after

earnings – which was not recommended –

but, in this case would have also been

profitable…..

Expectations THAT ApplIED to Costco Trading Strategies....

Costco was expected to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended November 2021.

The consensus earnings estimate is for $2.59 per share on revenue of $49.05 billion; but the Whisper number is higher at $2.77 per share.

Consensus estimates are for year-over-year earnings growth of 13.10% with revenue increasing by 13.52%.

The Actual Earnings Report.....

Costco came out with decent first-quarter fiscal 2022 results, wherein both the top and the bottom lines not only surpassed the Consensus Estimate but also improved year over year.

Costco came out with quarterly earnings of $2.97 per share, beating the Consensus Estimate of $2.59 per share. This compares to earnings of $2.29 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 14.67%.

Total revenues, which include net sales and membership fees, came in at $50,363 million, up 16.6% from the prior-year quarter.

Costco shares have added about 40.7% since the beginning of the year versus the S&P 500's gain of 25.2%.

Conclusion......

Looking at the Costco trading strategies that were employed it is obvious that the more hand-on approach, in this instance provided far greater profit then that of letting the trade play-out!

However, having said that, it is not in everyone’s ability to watch, and trade, the stock market full-time; therefore, setting exit limits is a method that can help.

FINALLY.....

To see what we are proposing for Future Trades CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Costco Trading Strategies

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.