TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

“Weekly Options

TradeS” Recommendations

Week Beginning Monday, November

09, 2020

Weekly Options Results for the Week Beginning November 09, 2020

Quick Profits by Picking the Right Time!

The Weekly Recommendations were sent to Members before trading started on Tuesday, November 10, 2020. As the market was in a decline at the start of the day it was advisable to wait and try to pick the bottom before executing the trade.

Taking the bottom reached and then selling at an appropriate top was the main objective to gain the maximum potential profit. Obviously this is quite difficult but even 50% attained was quite excellent for a few hours of trading.

The Recommendations and Profits…..

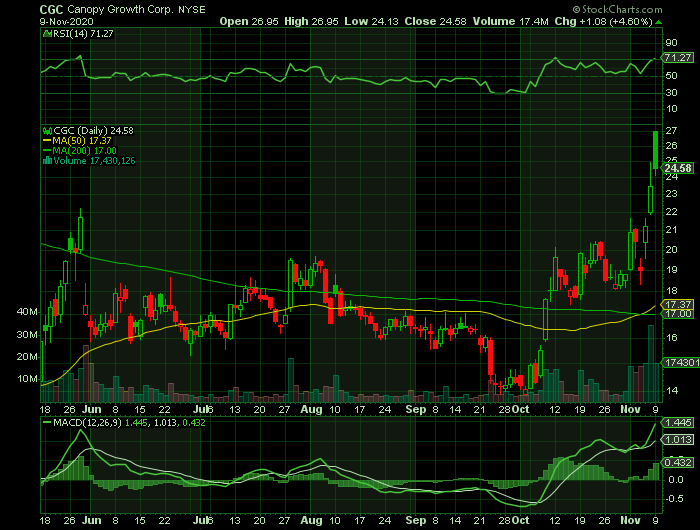

1. Buy CGC NOV 13 2020 25.000 CALLS

Time bought 9.34am for a cost of $0.22 – Sold at 11.04am for $0.82 - profit of 273%

2. RKT NOV 13 2020 22.000 CALLS

Time bought 1.04pm for a cost of $1.01 – Sold at 3.35pm for $1.85 - profit of 83%

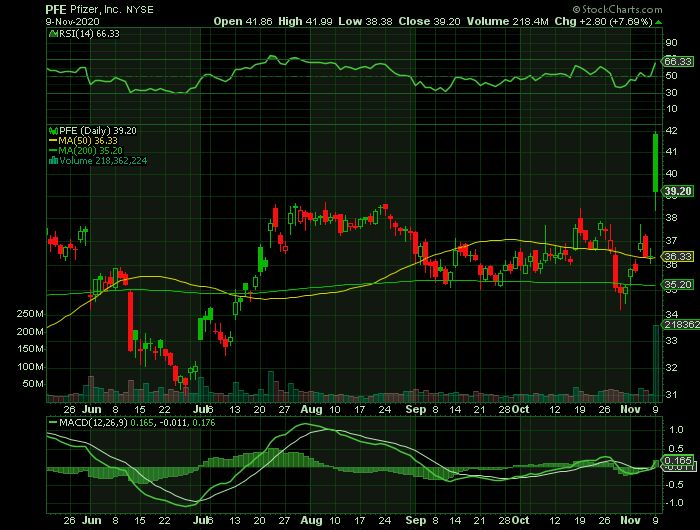

3. PFE NOV 13 2020 40.000 CALLS

Time bought 10.44am for a cost of $0.17 – Sold at 10.55pm for $0.31 - profit of 82%

Due to the volatility experienced in the stock market at the moment, taking profits early, and not waiting until expiry, is advisable!

Entering the Trades on Wednesday had a different Outcome.....

1. Buy CGC NOV 13 2020 25.000 CALLS

Bought for a cost of $0.18 – Sold for $0.55 - profit of 205%

2. RKT NOV 13 2020 22.000 CALLS

Bought for a cost of $0.12 – Sold for $0.41 - profit of 242%

3. PFE NOV 13 2020 40.000 CALLS

Bought for a cost of $0.27 – Sold for $0.05 - loss of 82%

Summary......

So combining the total potential profits for these three trades, it comes to 438% for a few hours’ work. Even half of this comes to 219%.

Weekly Options Trade – Pfizer Inc. (NYSE:PFE) Calls

Tuesday, November 10, 2020

** OPTION TRADE: Buy PFE NOV 13 2020 40.000 CALLS at approximately $0.58.

The Major Catalyst for This Trade.....

Pfizer Inc. (NYSE:PFE) vaccine trial success signals a breakthrough in the pandemic battle. Pfizer's experimental COVID-19 vaccine is more than 90% effective based on initial trial results, the drug-maker said on Monday, a major victory in the war against a virus that has killed over a million people and battered the world's economy.

An interim analysis of a phase 3 study of tens of thousands of volunteers showed their COVID-19 vaccine candidate was more than 90% effective in participants who were not previously infected with the virus. As a result, PFE shares were up 13.4% Monday morning. The stock closed the day up 7.69%. Expect this to continue to climb during the week.

The Story.....

Shares of Pfizer Inc. jumped 11.5% in premarket trading Monday, after the company said their COVID-19 vaccine candidate achieved "success" in the first interim analysis from a Phase 3 study.

The company said BNT162b2 vaccine candidate was found to be more than 90% effective in preventing COVID-19 in trial participants without previous evidence of SARS-CoV-2 infection. The companiesy said they are planning to submit for Emergency Use Authorization (EUA) to the Food and Drug Administration soon after the safety milestones are met, which is currently expected in the third week of November.

"Today is a great day for science and humanity," said Pfizer Chief Executive Dr. Albert Bourla. "The first set of results from our Phase 3 COVID-19 vaccine trial provides the initial evidence of our vaccine's ability to prevent COVID-19."

Dr. Anthony Fauci, the nation’s top infectious disease expert, said Pfizer’s findings of a coronavirus vaccine candidate that is more than 90% effective were “extraordinary,” per a report.

“The results are really quite good, I mean extraordinary,” said Fauci, director of the National Institute of Allergy and Infectious Diseases, according to the Washington Post.

The company is still awaiting data on safety, which it expects to be made available by the third week of November, according to a press release.

William Schaffner, infectious diseases expert at Vanderbilt University School of Medicine in Nashville, Tennessee, called the Pfizer results better than most anticipated. “The study isn’t completed yet, but nonetheless the data look very solid.”

Pfizer's stock has lost 7.1%, while the S&P 500 SPX, has gained 8.6% this year.

The Result for Pfizer.....

The European Union said on Monday it would soon sign a contract for up to 300 million doses of the Pfizer COVID-19 vaccine.

The company has a $1.95 billion contract with the U.S. government to deliver 100 million vaccine doses beginning this year. They did not receive research funding from the Trump administration’s Operation Warp Speed vaccine program.

The drugmakers have also reached supply agreements with the United Kingdom, Canada and Japan.

The interim analysis, conducted after 94 participants in the trial developed COVID-19, examined how many had received the vaccine versus a placebo.

The Trump administration has said it will have enough vaccine doses for all of the 330 million U.S. residents who want it by the middle of 2021.

Analysts Thoughts.....

Mizuho Securities analyst Vamil Divan forecast the vaccine may generate sales in excess of $8.5 billion for Pfizer in 2020-2021 alone.

"Focus is likely to begin shifting back towards the vaccine and broader growth outlook," Goldman Sachs strategists Dominic Wilson and Vickie Chang told clients over the weekend. The "likely delivery" of major vaccine news in the next few weeks, they said, is the "next key event."

Goldman Sachs said before the Pfizer announcement that a "safe, effective vaccine"

could send stocks up by another 5% to 10%. Despite the pandemic, that would

likely push top indexes to new records.

Strategists at UBS told clients Monday that given the worsening virus

outlook — the United States is quickly approaching 10 million Covid-19 cases —"quick approval of an effective

vaccine" is a key ingredient for markets to keep rising.

"Unless a vaccine

comes within a few weeks, slower [economic] data momentum is a real risk to the

markets," the bank said.

Summary…..

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Weekly Options Trade – Canopy Growth Corp (NYSE: CGC) Calls

Tuesday, November 10, 2020

** OPTION TRADE: Buy CGC NOV 13 2020 25.000 CALLS at approximately $0.82.

The Major Catalyst for This Trade.....

The Major Catalysts for This Trade.....

Canadian pot producer Canopy Growth Corp (NYSE: CGC) reported earnings Monday, before the market opened, posting a narrower-than-expected fiscal second-quarter loss and revenue that topped forecasts.

On top of this report Cannabis stocks are enjoyed a third consecutive day of big gains amid expectations that Joe Biden will lead a reform effort that will spark investment in the sector. "While Tuesday night's election did not clearly show who America thinks should lead the nation, it did make clear that we are united on replacing our country's archaic cannabis laws," said the Cannabis Consumer Policy Council. Marijuana would be decriminalized at a federal level in the United States under a Biden administration, but efforts toward full legalization may also not be off the table.

These catalysts should continue to push the stock price upwards.

The Story.....

The Report.....

The company, the world's largest pot produer, posted a loss in the period of 9 cents a Canadian share vs. analysts’ forecasts that called for a loss of 37 cents.

Net revenue in the second quarter was C$135.3 million, higher than analysts’ estimates of C$118.1 million and up 77% from a year earlier.

"We saw another quarter of improvement in our operating expense ratio while our marketing and R&D investments are being re-directed to drive sales," said Chief Financial Officer Mike Lee in a statement. "Importantly, our end-to-end review has identified cost savings opportunities in the range of $150-$200 million across cost of goods sold, general and administrative expenses, and inventory, and efforts are underway to quickly capture value.”

"Leveraging ongoing improvements across our business, we are accelerating our path to profitability, notably in our largest market, Canada,” Lee added.

Changing Cannabis Law.....

Smith Falls, Ontario-based Canopy Growth and other pot stocks traded wildly last week after Joe Biden’s win in the U.S. presidential election was seen as favorable to the sector.

Biden and his camp have made decriminalizing marijuana on a federal level a focal point of the Democrat's presidential campaign, in contrast to President Donald Trump.

Voters in New Jersey and Arizona passed measures last week that legalized recreational marijuana for adults age 21 and older. New Jersey is the biggest state on the East Coast to legalize marijuana.

Now four more states have legalized recreational sales of the drug, leading to one-third of Americans living in states that have approved legal adult use of marijuana.

About Canopy.....

Canopy is the biggest cannabis company measured by market capitalization, thanks to a $4 billion investment from Corona beer brewer Constellation Brands Inc. It is also the only Canadian company that has agreed to acquire a U.S. multi-state operator, the largest of the pot businesses in the U.S. because they operate in multiple legal-pot states, via its agreement with Acreage Holdings.

“We’re excited by the prospects of participating in the U.S. THC market, and we’ve already developed a U.S. ecosystem that positions us well as [a] hemp and cannabis powerhouse when, not if, U.S. permissibility happens,” Chief Executive David Klein said in a conference call Monday.

Canopy has also launched CBD brands with Martha Stewart in the U.S. and is aiming to become a major cannabis-focused CPG company, Klein said.

Summary…..

Three Canadian pot companies released quarterly earnings Monday amid stock gains of 30% to 150% since the open on Thursday. Only one, Canopy Growth Corp was able to show sales growing appreciably from last year, despite opening of the Canadian market to new products such as edibles and vapes.

Canopy Growth appears to be making the most from its last couple of weeks of trading on the New York Stock Exchange. The Canadian cannabis producer moves its shares to the Nasdaq on Nov. 16, 2020.

It looks like Canopy is on course to continue delivering solid revenue growth along with making progress toward achieving profitability.

Weekly Options Trade – Rocket

Companies Inc (NYSE: RKT) Calls

Tuesday, November 10,

2020

** OPTION

TRADE: Buy RKT NOV 13 2020 22.000 CALLS at approximately $1.30.

The Major Catalysts for This Trade.....

The Detroit-based mortgage lender Rocket Companies Inc (NYSE: RKT) will report earnings after the market closes today, Tuesday, November 10, 2020. The consensus earnings estimate is $1.03 per share on revenue of $4.34 billion; but the Whisper number is higher at $1.13 per share.

Rocket Companies is a “very well-run company.

Rocket Companies is a much better lender than traditional lenders in terms of defaults.

Other catalysts for the stock are low interest rates, an exodus of people moving from the city to the suburbs and a Joe Biden win in the presidential race.

There’s going to be a wave of immigration.

About Rocket.....

Rocket Companies, Inc engages in the mortgage business in the United States. It is involved in originating, processing, underwriting, and servicing predominantly government sponsored enterprises-conforming mortgage loans, as well as Fair Housing Act, U.S. Department of Agriculture, and U.S. Department of Veteran's Affairs mortgage loans.

Analysts Thoughts.....

Wedbush started coverage on shares of Rocket Companies in a report on Thursday, September 10th. They issued a “neutral” rating and a $24.00 target price on the stock.

Other analysts comments about this stock......

- Royal Bank of Canada started coverage on shares of Rocket Companies in a research note on Monday, August 31st. They issued an “outperform” rating and a $32.00 price objective on the stock.

- Credit Suisse Group began coverage on shares of Rocket Companies in a report on Monday, August 31st. They set a “neutral” rating and a $29.00 price objective for the company.

- UBS Group began coverage on shares of Rocket Companies in a report on Monday, August 31st. They set a “neutral” rating and a $28.00 price objective for the company.

- Barclays began coverage on shares of Rocket Companies in a report on Monday, August 31st. They set an “equal weight” rating and a $25.00 price objective for the company.

- Finally, JPMorgan Chase & Co. upgraded shares of Rocket Companies from a “neutral” rating to an “overweight” rating and set a $28.50 price objective for the company in a report on Friday, October 9th.

One analyst has rated the stock with a sell rating, nine have issued a hold rating and five have given a buy rating to the company. Rocket Companies has an average rating of “Hold” and a consensus target price of $27.04.

Summary…..

Rocket Companies, Inc. has a 52 week low of $17.78 and a 52 week high of $34.42. The business has a fifty day moving average price of $21.14.

Rocket is an amazing company with a fabulously successful history and culture. It dominates online mortgage originations. It is believed that its technology platform and culture provide a unique competitive advantage that will allow it to grow market share, earnings and cash flow over time. The mortgage market is volatile and refi’s are likely to peak this year, which will cause volatility in earnings and potentially the stock.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page