TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Walgreens Shares Gets A Boost From Analysts!

Weekly Options

Members Are Up 88% Potential Profit

Using A Weekly call Option!

On Monday, Dow component Walgreens Boots Alliance Inc (NASDAQ:WBA) received favorable comments from analysts that bolstered its share price.

Analysts at JPMorgan upgraded their rating on Walgreens stock from neutral to overweight.

This set the scene for Weekly Options USA Members to profit by 88%, using a WBA Options trade!

Join Us And Get The Trades – become a member today!

Sunday, October 29, 2023

by Ian Harvey

Why the WBA Weekly Options Trade was Originally Executed!

On Monday, Dow component Walgreens Boots Alliance Inc (NASDAQ:WBA) received favorable comments from analysts that bolstered its share price.

Shares of Walgreens Boots Alliance were up 3% on Monday, and this trend is expected to continue.

Analysts at JPMorgan upgraded their rating on Walgreens stock from neutral to overweight.

Analyst Lisa Gill upgraded shares of Walgreens to Overweight from Neutral and increased her target for the stock price to $30 from $27. The call comes after the company reported disappointing financial results and announced the appointment of a new chief executive officer.

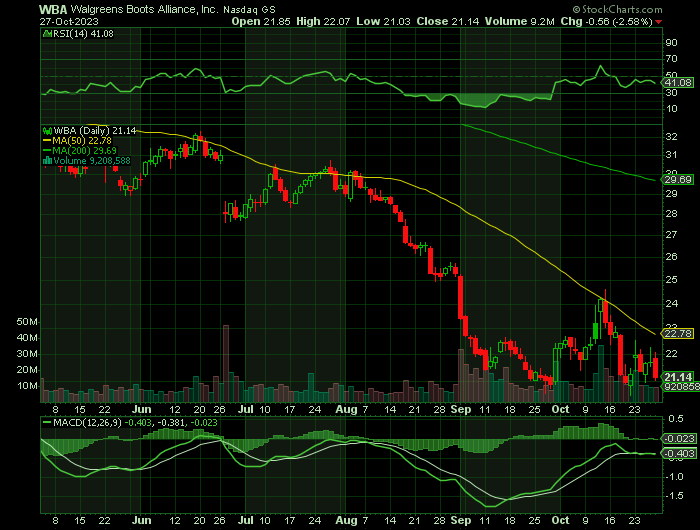

The stock has fallen 41% this year, and was on pace for its worst year on record.

The WBA Weekly Options Trade Explained.....

** OPTION TRADE: Buy WBA NOV 17 2023 22.500 CALLS - price at last close was $0.56 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the WBA Weekly Options (CALL) Trade on Tuesday, October 24, 2023, for $0.33.

Sold the WBA weekly options contracts on Thursday, October 26, 2023 for $0.62; a potential profit of88%.

Don’t miss out on further trades – become a member today!

About Walgreens Boots Alliance.....

Walgreens Boots Alliance Inc. is a world-renowned healthcare, pharmacy, and retailing company. Founded in 1901 by John Boot and Charles R. Walgreen, the company has grown to become a leader in the industry, operating in nine countries and providing access to healthcare services to millions of people around the world. Walgreens Boots Alliance operates through three main segments: U.S. Retail Pharmacy, International, and U.S. Healthcare.

The U.S. Retail Pharmacy segment includes the Walgreens business, which operates health and wellness services, retail drugstores, specialty and home delivery pharmacy services, and an equity method investment in AmerisourceBergen. Walgreens stores have locations in all 50 U.S. states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, offering access to consumer goods and services, pharmacy, photo department, and health and wellness services. Walgreens also operates online stores like Walgreens.com, Drugstore.com, VisionDirect.com, and Beauty.com.

The International segment consists of pharmacy-led health and beauty retail businesses outside the United States and a pharmaceutical wholesaling and distribution company in Germany. This segment includes the Boots brand, which has a history stretching back over 170 years in the United Kingdom, and stores in Ireland and Thailand with Boots franchise operations in the Middle East and Indonesia. The remainder of the division comprises Farmacias Ahumada (FASA) pharmacies in Chile and Benavides in Mexico. The Pharmaceutical Wholesale Division, including the Alliance Healthcare brand, supplied medicines and other healthcare products to more than 115,000 doctors, health centers, pharmacies, and hospitals annually in eleven countries through 306 distribution centers. AmerisourceBergen purchased most of the Alliance Healthcare wholesale division in June 2021 for $6.275bn in cash.

The U.S. Healthcare segment is a consumer-centric, technology-enabled healthcare business that engages consumers through a personalized, omnichannel experience across the care journey. This segment includes the operation of 334 VillageMD clinics, including 146 co-located clinics, 124 standalone clinics, and 64 affiliate clinics.

Walgreens Boots Alliance produces many brands, including Soltan and Botanics, Boots Pharmaceuticals, and Boots Laboratories, No. 7, that Alliance Boots and Walgreens sought to launch internationally following the first share purchase in 2012. These brands include the famous No. 7 beauty serums, developed in Nottingham, the UVA 5-star suncare protection by Soltan, and the Botanics range, developed in partnership with the Royal Botanic Gardens, Kew. Boots' brand range includes medicines, healthcare products, skincare, and many more. Walgreens also has a self-branded line of products called "Well at Walgreens."

For the fiscal year 2020, Walgreens Boots Alliance reported earnings of US$456 million. The reported revenue was US$139.5 billion, an increase of 2.5% over the previous fiscal cycle. As of 2022, Walgreens Boots Alliance is ranked #18 on the Fortune 500 rankings. The company pays a Quarterly dividend of $0.48, representing an annual dividend yield of 5.08%. Wall Street analysts consider Walgreens stock to be Undervalued.

Walgreens Boots Alliance has 862,503,540 shares outstanding, and its market cap is currently $31.99B. The company’s EPS estimate is $1.12, and its most recent earnings report saw it beat expectations with an EPS of $1.16. Following the earnings report, the stock price went down -6.135%. Among the most significant hedge funds holding Walgreens Boots Alliance’s shares is Antipodes Partners Ltd., which owns shares valued at $58M.

Walgreens Boots Alliance is a global healthcare leader committed to providing high-quality services and products to its customers. The company’s innovative strategies have earned it a reputation as a reliable and reputable partner for healthcare providers and consumers. With its wide array of products and services, Walgreens Boots Alliance is well-positioned to continue growing and meeting the needs of its customers for years to come.

Further Catalysts for the Weekly Options Trades…..

JPMorgan acknowledges that Walgreens still faces some serious challenges. The drugstore retail space remains quite competitive, and macroeconomic pressures could hurt overall profitability. However, the analysts believe that the recent leadership changes that put Tim Wentworth into the CEO position give Walgreens the ability to overcome some of its long-standing problems and improve its overall business performance.

Other Catalysts.....

On Oct. 12, Walgreens reported weaker earnings and revenue than Wall Street had expected and offered less upbeat financial guidance for fiscal 2023 than analysts had expected. But it was the announcement the day before that Tim Wentworth was stepping in as the new CEO that has raised hope on Wall Street.

“Today commences a new era for shares of WBA as Tim Wentworth assumes the CEO role,” Gill wrote in a research note Monday. “… While there is clearly work to be done, with a refreshed healthcare-focused management team and a lowered but credible bar that WBA has an opportunity to remove several overhangs in the coming quarters and improve performance.”

The analyst wrote that she is encouraged by the experience Wentworth is bringing to Walgreens from previous roles, including at Express Scripts and Cigna Group (CI). She also anticipates Walgreens will cut its quarterly dividend of 48 cents a share, and will prioritize reducing debt.

“Our rating is predicated on an upgraded management team executing vs an achievable bar from trough results and a valuation that appears to more than incorporate the uncertainty of the current situation,” Gill wrote. Walgreens currently trades at 6.2 times forward earnings, which is below the five-year average of 8.7 times.

Analysts.....

According to the issued ratings of 12 analysts in the last year, the consensus rating for Walgreens Boots Alliance stock is Hold based on the current 1 sell rating, 7 hold ratings and 4 buy ratings for WBA. The average twelve-month price prediction for Walgreens Boots Alliance is $33.15 with a high price target of $54.00 and a low price target of $21.00.

Summary.....

Shares of Walgreens were 4.8% higher to $22.28. The stock was the best performer Monday in the S&P 500, Dow Jones Industrial Average and Nasdaq 100.

Walgreens Boots Alliance Stock has a market cap of $18.97 billion, a PE ratio of -6.15, a P/E/G ratio of 1.27 and a beta of 0.72. The company has a current ratio of 0.63, a quick ratio of 0.30 and a debt-to-equity ratio of 0.29. Walgreens Boots Alliance has a twelve month low of $20.48 and a twelve month high of $42.29. The stock has a fifty day simple moving average of $23.21 and a 200-day simple moving average of $28.59.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from WALGREENS

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.