TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

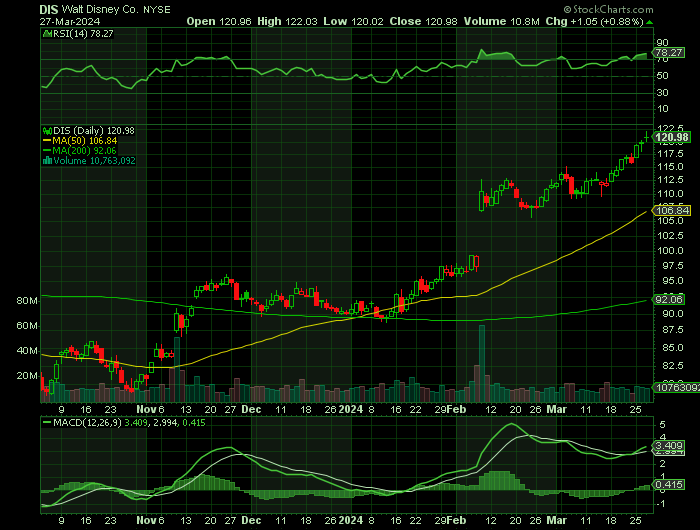

UPDATED - Disney Weekly Call Option Up 64%!

More Profit Expected

New Members Are Profiting!

New members following the advice from the previous article “Disney Weekly Call Option Up 30% In 1 Day!” have benefited!

Now up 64%!

Another analyst from UBS has boosted its price target on Walt Disney Co (NYSE:DIS) to $140.

This follows Barclays analyst Kannan Venkateshwar upgrading the stock to Overweight from Equal Weight and boosting his price target on shares to $135 from the prior $95. The move implies roughly 15% upside based on current trading levels of about $120 a share.

The shares have continued to move upwards since then.

This set the scene for Weekly Options USA Members to profit by 64% using a DIS Weekly Options trade!

Become a Member Today and get further trades like this!

Wednesday, March 27, 2024

by Ian Harvey

UPDATE.....

New members following the advice from the previous article “Disney Weekly Call Option Up 30% In 1 Day!” have benefited!

UBS issued updated guidance Wednesday morning, maintaining its optimism on Walt Disney Co (NYSE:DIS) stock and reiterating its buy rating. It boosted its price target to $140. That new price target represents an upside over the next 12 months or so of about 15%.

UBS said it is confident that Disney can drive free cash flow generation higher over the next few years. Driving the price target bump is the expectation that Disney will produce $9 billion in free cash flow this year and $14 billion in free cash flow in 2026. This will allow the company to raise its dividend, buy back shares, and make growth investments.

Why the Disney Weekly Options Trade was Originally Executed!

Walt Disney Co (NYSE:DIS) shares rose more than 2% on Monday following a fresh upgrade on Wall Street. The shares have continued to move upwards since then.

Barclays analyst Kannan Venkateshwar upgraded the stock to Overweight from Equal Weight and boosted his price target on shares to $135 from the prior $95. The move implies roughly 15% upside based on current trading levels of about $120 a share.

Venkateshwar argued better-than-expected free cash flow and earnings guidance, coupled with "tactical tailwinds" such as the Hollywood strikes, Hulu's consolidation, and cost cuts, have helped buoy investor confidence.

Meanwhile, "the propensity among media investors to be long Disney, has resulted in the stock outperforming broader markets meaningfully thus far this year, at a pace faster than we anticipated."

"The incessant Disney-related news flow ahead of the proxy vote has dominated investor considerations since last quarter's earnings, and we expect this to continue helping the stock near term," said Barclays.

The stock has been on a tear since the start of the year, up more than 30% compared to the S&P 500's (^GSPC) 10% rise over that same time period.

BECOME A MEMBER AND GET FUTURE TRADES!

About Walt Disney.....

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. It operates through two segments, Disney Media and Entertainment Distribution; and Disney Parks, Experiences and Products.

The company engages in the film and episodic television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX, Fox, National Geographic, and Star brands; and studios that produces motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, and Searchlight Pictures banners.

It also offers direct-to-consumer streaming services through Disney+, Disney+ Hotstar, ESPN+, Hulu, and Star+; sale/licensing of film and television content to third-party television and subscription video-on-demand services; theatrical, home entertainment, and music distribution services; staging and licensing of live entertainment events; and post-production services by Industrial Light & Magic and Skywalker Sound.

In addition, the company operates theme parks and resorts, such as Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort; and Shanghai Disney Resort; Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney as well as Aulani, a Disney resort and spa in Hawaii; licenses its intellectual property to a third party for the operations of the Tokyo Disney Resort; and provides consumer products, which include licensing of trade names, characters, visual, literary, and other IP for use on merchandise, published materials, and games.

Further, it sells branded merchandise through retail, online, and wholesale businesses; and develops and publishes books, comic books, and magazines.

The Walt Disney Company was founded in 1923 and is based in Burbank, California.

BECOME A MEMBER AND GET THE TRADE!

Further Catalysts for the DISNEY Weekly Options Trade…..

It's a significant turnaround for the company after its stock price hit multiyear lows last year.

The media giant has been grappling with challenges that include a declining linear TV business, slower growth in its parks business, and losses in its streaming business. A heated proxy battle with activist investor Nelson Peltz has also clouded the company's outlook.

But Venkateshwar argued Disney's next phase "may be more impactful as a number of turnaround elements still remain work in progress and may manifest more in numbers starting next year."

In his bull case, the analyst said sooner-than-expected streaming profitability could serve as a boon to the stock price.

"We expect Disney streaming to break even potentially a quarter or two earlier than company guidance of Q4 2024," he explained. "This is in part driven by the tailwinds from cost cuts over the last few quarters and recent price increases."

BECOME A MEMBER AND GET FUTURE TRADES!

The Disney Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy DIS APR 26 2024 120.000 CALLS - price at last close was $3.25 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the DIS Weekly Options (CALL) Trade on Tuesday, March 26, 2024 for $2.81.

Sold half the DIS weekly options contracts on Wednesday, March 27, 2024 for $4.60; a potential profit of 64%.

(This will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Walt Disney.....

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. It operates through two segments, Disney Media and Entertainment Distribution; and Disney Parks, Experiences and Products.

The company engages in the film and episodic television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX, Fox, National Geographic, and Star brands; and studios that produces motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, and Searchlight Pictures banners.

It also offers direct-to-consumer streaming services through Disney+, Disney+ Hotstar, ESPN+, Hulu, and Star+; sale/licensing of film and television content to third-party television and subscription video-on-demand services; theatrical, home entertainment, and music distribution services; staging and licensing of live entertainment events; and post-production services by Industrial Light & Magic and Skywalker Sound.

In addition, the company operates theme parks and resorts, such as Walt Disney World Resort in Florida; Disneyland Resort in California; Disneyland Paris; Hong Kong Disneyland Resort; and Shanghai Disney Resort; Disney Cruise Line, Disney Vacation Club, National Geographic Expeditions, and Adventures by Disney as well as Aulani, a Disney resort and spa in Hawaii; licenses its intellectual property to a third party for the operations of the Tokyo Disney Resort; and provides consumer products, which include licensing of trade names, characters, visual, literary, and other IP for use on merchandise, published materials, and games.

Further, it sells branded merchandise through retail, online, and wholesale businesses; and develops and publishes books, comic books, and magazines.

The Walt Disney Company was founded in 1923 and is based in Burbank, California.

BECOME A MEMBER AND GET FUTURE TRADES!

Further Catalysts for the DISNEY Weekly Options Trade…..

It's a significant turnaround for the company after its stock price hit multiyear lows last year.

The media giant has been grappling with challenges that include a declining linear TV business, slower growth in its parks business, and losses in its streaming business. A heated proxy battle with activist investor Nelson Peltz has also clouded the company's outlook.

But Venkateshwar argued Disney's next phase "may be more impactful as a number of turnaround elements still remain work in progress and may manifest more in numbers starting next year."

In his bull case, the analyst said sooner-than-expected streaming profitability could serve as a boon to the stock price.

"We expect Disney streaming to break even potentially a quarter or two earlier than company guidance of Q4 2024," he explained. "This is in part driven by the tailwinds from cost cuts over the last few quarters and recent price increases."

BECOME A MEMBER AND GET FUTURE TRADES!

Other Catalysts.....

Cost-cutting initiatives have paid off with Disney reinstating its dividend at the end of last year after postponing its payout during the pandemic.

Most recently surpassing its fiscal first quarter earnings expectations in early February, Disney’s Q1 EPS of $1.22 crushed the Consensus of $0.97 a share by 26% and soared from $0.99 a share in the comparative quarter.

Disney’s bottom line is now projected to expand 21% this year and is expected to jump another 19% in FY25 to $5.47 per share.

Attributed to its cost savings initiatives since the return of CEO Bob Iger in 2022, Disney’s long-term debt has drifted down to $42.1 billion compared to peaks of $52.91 billion in 2020.

Reinstated Dividend.....

Piggybacking to Disney's reinstated dividend, it will now pay a semi-annual dividend of $0.45 per share following its strong Q1 results which is 50% above its first post-pandemic payout of $0.30 a share in early January. The ex-dividend date is July 5 and is payable on July 25.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from DISNEY

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.