TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

UPDATED

– 143% Using A Devon Energy Weekly Option!

More Profit To Come!

The energy sector is up big so far in 2024, largely thanks to an 11% surge in the price per barrel of Brent crude oil.

And, Devon Energy Corp (NYSE: DVN) is one of the companies that will directly benefit from higher oil prices the most as it is solely in the business of producing oil and gas, known as an exploration and production (E&P) company.

Also, the analyst community is continuing to favour Devon Energy.

Devon's mix of quality assets, compelling shareholder return policy, and investment strategy make it an ideal stock to buy for oil price bulls.

This set the scene for Weekly Options USA Members to profit by 143% using a DVN Options Trade!

Join Us And Get The Trades – become a member today!

Wednesday, April 10, 2024

by Ian Harvey

LATEST UPDATE

The energy sector is up big so far in 2024, largely thanks to an 11% surge in the price per barrel of Brent crude oil.

And, Devon Energy Corp (NYSE: DVN) is one of the companies that will directly benefit from higher oil prices the most as it is solely in the business of producing oil and gas, known as an exploration and production (E&P) company.

Also, the analyst community is continuing to favour Devon Energy.

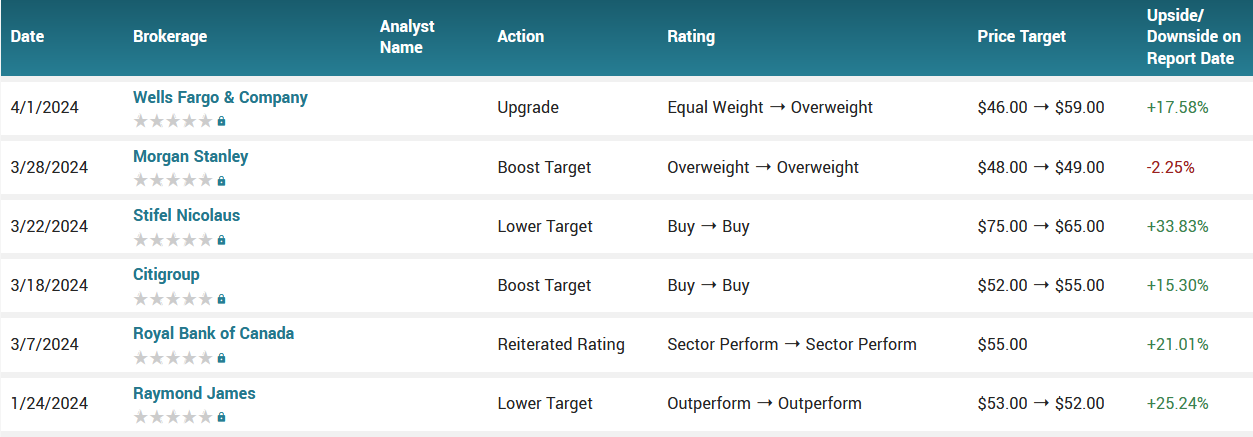

Recently Citi upgraded its price target to $55 based on an improvement in Devon's natural gas assets, and Wells Fargo raised its rating to overweight and its price target to $59 in anticipation of improvements in well efficiency due to Devon drilling in its core Delaware basin assets.

Now, although analysts at Truist lowered their target price on the stock to $66 from $69, the target still implies a near 24% upside potential over the next 12 months or so.

Truist's view is that the financial industry is still too negative on the oil exploration and production sector, suggesting that they (asset managers) are underweight in the sector. In simple terms, this means Truist feels asset managers, who often sector weight their holdings in line with S&P 500 sector weightings, are holding less than the S&P 500 weightings in exploration and production oil stocks.

This is sometimes seen as a bullish indicator because it implies there's potential for asset managers to allocate more money to the sector and balance their holdings to the S&P 500 sector weightings. Truist believes investors should be "overweight" the sector, so there's even more potential upside.

The price of oil is $86 a barrel; OPEC and OPEC+ countries (including energy giants Saudi Arabia and Russia) continue to curtail production, and whoever wins the election, the new U.S. administration will have to replenish the massive drawdown in the strategic petroleum reserve undertaken by the current regime.

Meanwhile, Devon's mix of quality assets, compelling shareholder return policy, and investment strategy make it an ideal stock to buy for oil price bulls.

Previous UPDATE – April 04, 2024 – Read “Devon Energy Weekly Option Provides 67% Profit!”

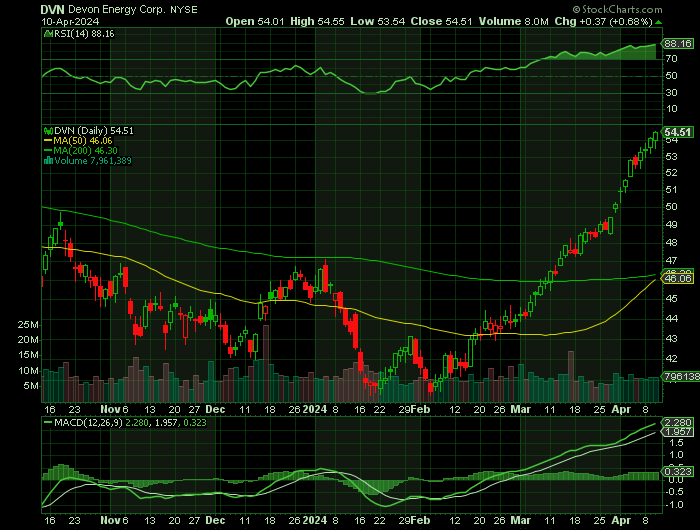

Shares of Devon Energy Corp (NYSE: DVN) rose by 13.9% in March due to a combination of an increase in the price of oil, from around $77 a barrel at the start to about $83 at the end of the month, and the Wall Street analyst community’s warming to the company's capital allocation policy in 2024.

Management plans to return 70% of free cash flow to investors in 2024 through share buybacks and dividends, with the remaining 30% used to retire debt and increase cash balances.

A Wells Fargo analyst is bullish on the stock, raising the price target to $59 because of Devon's focus on drilling its higher-quality Delaware Basin assets.

Also, a Citi analyst was excited by its improving natural gas assets in March, and the analyst upgraded the price target on the stock to $55.

Devon is an efficient producer, capable of generating enough cash to fund its capital program even if the price of oil drops to $40 a barrel.

Why the Devon Energy Weekly Options Trade was Originally Executed!

High-yield energy stock Devon Energy Corp (NYSE: DVN) has a 15.5% upside according to analysts at Wells Fargo, who just raised the price target on Devon Energy stock to $59 from $46 previously and upgraded the stock to "overweight" from "equal weight."

One reason for the upgrade is enthusiasm for the company's capital allocation plan and focus on its core assets in the Delaware Basin (straddling west Texas and New Mexico). Devon Energy is allocating 60% of its $3.3 billion to $3.6 billion capital allocation in 2024 to the Delaware basin.

The analyst believes that Devon's drilling activity in these assets in early 2024 will improve well efficiency. It's a view shared by management, as its 2024 plan calls for its investment in drilling in the Delaware Basin to improve well productivity by up to 10%.

The company has a good track record of expanding production and making extensions and discoveries to its resources.

Over the past month, shares of this oil and gas exploration company have returned +13.9%.

The Devon Energy Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy DVN MAY 03 2024 52.000 CALLS - price at last close was $1.30 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

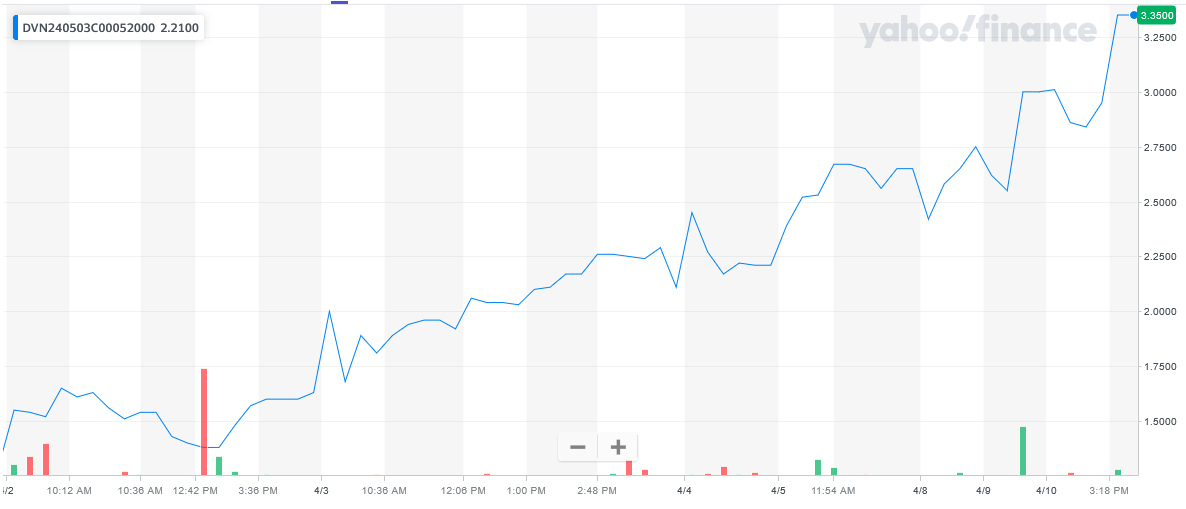

Entered the DVN Weekly Options (CALL) Trade on Tuesday, April 02, 2024 for $1.38.

Sold HALF the DVN weekly options contracts on Wednesday, April 03, 2024 for $2.30; a potential profit of 67%.

Sold more of the DVN weekly options contracts on Wednesday, April 10, 2024 for $3.35; a potential profit of 143%.

(This result will vary for members depending on their entry and exit strategies).

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Devon Energy.....

Devon Energy Corporation is an independent oil and gas company headquartered in Oklahoma City, Oklahoma. The company was incorporated in 1971 by John Nichols and his son J. Larry Nichols and later went public in August 2000. The company has since grown to be included in the S&P 500 and is one of the first energy companies to introduce resolutions requiring the company to monitor its impact on global warming. One time a major player in the global oil market, Devon has since sold off its offshore holdings in an effort to focus on US production and its transition to a lower-carbon future.

Devon Energy merged with WPX in early 2021 in an all-stock merger of equals. The new company is primarily engaged in the exploration, development, and production of oil, natural gas, and natural gas liquids in the US midwest. The company operates more than 5,100 wells in Oklahoma’s Delaware Basis, Eagle Ford Group, and the two locations in the Rocky Mountains. As of late 2022, the company laid claim to 1.625 million barrels of reserves including 44% petroleum, 27% natural gas liquids, and 29% natural gas. Daily production was running in the range of 300,000 BPD in petroleum liquids, 125,000 BPD in natural gas liquids, and 920 million cubic feet of natural gas.

Rick Muncrief, formally CEO of WPX, is now the head of Devon Energy. Mr. Muncrief comes to the table with more than 40 years of experience including 27 years with one of the US Big Three Oil Companies. WPX Energy (Williams Production and Exploration) brought properties in the Williston and Permian Basins to the combined company. Its proven reserves were roughly 527 million barrels of oil and equivalents. The company also owns and operates a midstream network of pipelines and storage facilities it uses to market and deliver its products.

Devon Energy Corporation has pledged to reduce its GHG impact to net zero by 2050. This will be done by a variety of methods that include improving efficiency and leakage, a reduction in flaring, and the electrification of its operations. Near-term goals include a 50% reduction in GHG by 2030 including a 65% reduction in methane release and a 100% reduction in flaring. The company is also focused on reducing its environmental impact by relying on recycled water wherever possible and plans to reduce freshwater usage by 90% in the most active areas. Total greenhouse gas emissions have been in decline since 2018 and fell 17% between 2018 and 2020 alone.

The Catalysts for the DVN Weekly Options Trade…..

Devon has a good track record of growing resources, not least through extensions and discoveries.

Based on a price of oil of $80 per barrel in management's 2024 projections and the current share price of $48.37, Devon's free-cash-flow (FCF) yield could be almost 10% in 2024. Given that management is targeting to return 70% of FCF to investors in 2024, there should be ample room to pay a hefty dividend as well as buying back shares to enhance the dividend per share in the future.

Other Catalysts.....

For Devon Energy, the consensus sales estimate for the current quarter of $3.58 billion indicates a year-over-year change of -6.3%. For the current and next fiscal years, $14.87 billion and $15.25 billion estimates indicate -2.6% and +2.6% changes, respectively.

Devon Energy reported revenues of $4.15 billion in the last reported quarter, representing a year-over-year change of -3.6%. EPS of $1.41 for the same period compares with $1.66 a year ago.

Compared to the Consensus Estimate of $3.87 billion, the reported revenues represent a surprise of +7.11%. The EPS surprise was +1.44%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company topped consensus revenue estimates just once over this period.

Analysts.....

According to the issued ratings of 15 analysts in the last year, the consensus rating for Devon Energy stock is Moderate Buy based on the current 3 hold ratings and 12 buy ratings for DVN. The average twelve-month price prediction for Devon Energy is $55.88 with a high price target of $65.00 and a low price target of $48.00.

Summary.....

Devon Energy opened at $50.94 on Monday. Devon Energy has a fifty-two week low of $40.47 and a fifty-two week high of $56.19. The stock has a market cap of $32.35 billion, a price-to-earnings ratio of 8.74 and a beta of 2.19. The business has a fifty day moving average of $44.83 and a 200-day moving average of $45.38. The company has a quick ratio of 0.99, a current ratio of 1.07 and a debt-to-equity ratio of 0.46.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from

Devon Energy

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.