TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

United

Parcel Service Shares Fall But Members Profit!

Weekly Options Members Are Up 346% Using A Weekly PUT

Option!

United Parcel Service, Inc. (NYSE: UPS) is currently mired in multiple headwinds, which have made it an unimpressive investment option, but great for a PUT option.

UPS, the world's biggest package delivery company, posted mixed second-quarter results on Tuesday, August 08, beating on earnings but falling short on revenue amid a pullback in deliveries and labor negotiations.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 346%, using a UPS Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, August 24, 2023

by Ian Harvey

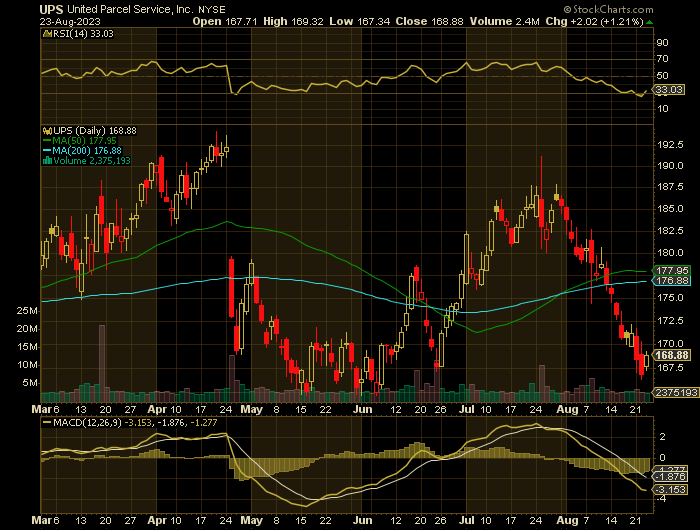

United Parcel Service, Inc. (NYSE: UPS) is currently mired in multiple headwinds, which have made it an unimpressive investment option.

The Consensus Estimate for current-quarter earnings has been revised 15.4% downward over the past 60 days. For the current year, the consensus mark for earnings has moved 9.5% south in the same time frame. The unfavorable estimate revisions indicate brokers’ lack of confidence in the stock.

The UPS stock has lost 1.8% year to date against its industry’s 12.5% growth.

Why the UPS Weekly Options Trade was Originally Executed!

United Parcel Service, Inc. (NYSE: UPS), the world's biggest package delivery company, posted mixed second-quarter results on Tuesday, August 08, beating on earnings but falling short on revenue amid a pullback in deliveries and labor negotiations.

The company posted an operating profit of $2.8 billion, or $2.54 per adjusted share. Earnings per share came in above Wall Street estimates, but well below the $3.29 figure in the same quarter last year. Revenue of $22.1 billion fell short of expectations of $23 billion, and was down 10.9% from $24.8 billion in the year-ago quarter.

Lower deliveries and package volumes were partly to blame, as consumers shopped less online and ordered fewer products amid a pullback in discretionary spending. Domestic revenue fell 6.9% to $14.4 billion, from $15.46 billion in the year-ago quarter. It's a divergence from seasonal trends, as revenue has historically tended to rise in the fiscal second quarter.

UPS shares were down as much as 3% in early trading Tuesday before recovering losses. They're up just under 4% so far this year.

The UPS Weekly Options Trade Explained.....

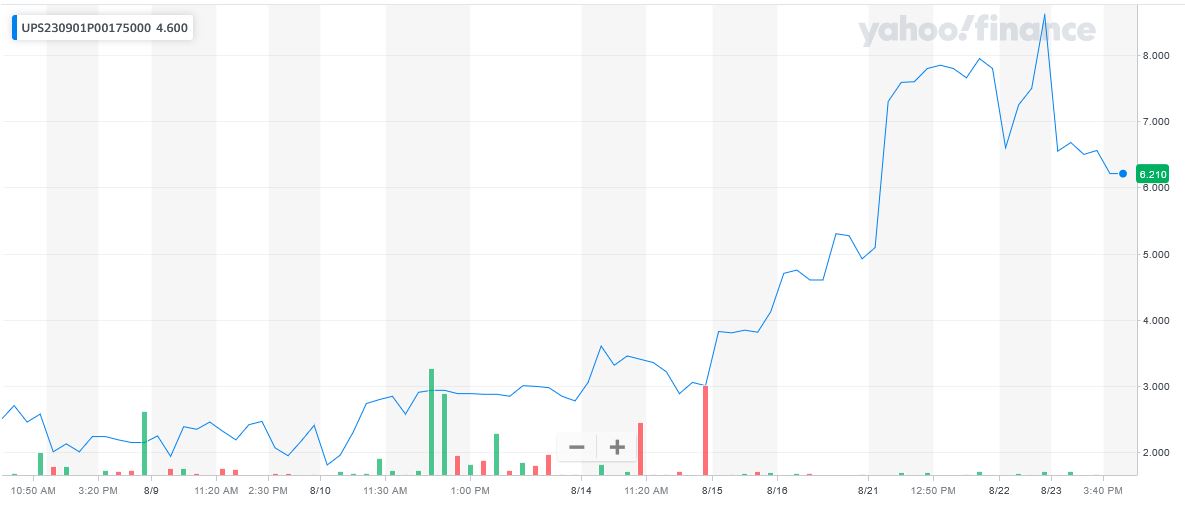

** OPTION TRADE: Buy UPS SEP 01 2023 175.000 PUTS - price at last close was $2.14 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the UPS Weekly Options (PUT) Trade on Wednesday, August 09, 2023, for $1.93.

Sold the UPS weekly options contracts on Tuesday, August 22, 2023 for $8.61; a potential profit of 346%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the UPS Weekly Options Trade…..

UPS has been involved in a series of negotiations with the International Brotherhood of Teamsters, a labor union representing its workers. The two parties reached an agreement last month, which secured higher wages, better working conditions, and other workplace improvements for up to 340,000 UPS workers.23

The company lowered its revenue and profit margin forecasts as a result. Consolidated revenue for 2023 is now forecast at $93 billion, with a projected operating margin of 11.8%, below the current 13.2%.

"UPS is updating its full-year 2023 consolidated revenue and adjusted operating margin targets primarily to reflect the volume impact from labor negotiations and the costs associated with the tentative agreement reached with the International Brotherhood of Teamsters on July 25, 2023," the company said.

Other Catalysts.....

Average daily volume in UPS’ domestic segment, its largest, dropped 9.9% in the second quarter, compared to the 2022 period. There was more parcel diversion in July than the company expected, though the losses weren’t as severe as in June. UPS said it expects that by the end of 2023 it will return average daily volumes to even with December 2022 levels. For the second half of 2023, it expects average daily volumes to be down by single-digit percentages year over year.

According to the company, the diverted business was split evenly, with one-third each going to FedEx Corp., the U.S. Postal Service and regional delivery carriers.

UPS’ U.S. average daily volume in the quarter totaled 17.4 million parcels, according to ShipMatrix, a consultancy. Domestic and international volume combined totaled 20.9 million daily parcels, the firm said.

The company expects wages and benefits to rise by 3.3%, compounded annually, over the life of the contract. The bulk of the increases will occur in the first year, because the Teamsters wanted a front-loaded bump to offset current inflation levels, UPS said. The first-year increases, which will average $2.75 an hour for full- and part-timers, were higher than planned, UPS said. The fifth year will be the second-highest-cost year, with smaller increases in years two through four.

Analysts.....

Jonathan Chappell of Evercore ISI, who said UPS’ formidable cost-management efforts and expected price increases will not offset the headwinds over the next few quarters from the higher labor costs. He has a $185-a-share price target, down from $187. After a rocky start to the day, UPS shares recovered much of their early losses. It closed at it traded at $180.59 a share, down $1.56 per share.

According to the issued ratings of 21 analysts in the last year, the consensus rating for United Parcel Service stock is Hold based on the current 3 sell ratings, 10 hold ratings, 7 buy ratings and 1 strong buy rating for UPS. The average twelve-month price prediction for United Parcel Service is $189.04 with a high price target of $225.00 and a low price target of $100.00.

Summary.....

United Parcel Service shares traded down $1.90 during trading hours on Tuesday, hitting $180.25. 4,220,666 shares of the company were exchanged, compared to its average volume of 3,333,290. The company has a market cap of $154.81 billion, a price-to-earnings ratio of 14.24, and a P/E/G ratio of 1.70 and a beta of 1.07. United Parcel Service, Inc. has a fifty-two week low of $154.87 and a fifty-two week high of $209.39. The company has a quick ratio of 1.34, a current ratio of 1.34 and a debt-to-equity ratio of 0.99. The firm’s fifty day moving average is $178.57 and its 200 day moving average is $181.29.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from United

Parcel Service

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.