TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Twilio Stock Price

Jumps!

and, "Weekly Options Members” Make 410% Potential Profit

In two (2) Trading days!

More to Come?

April 7, 2021

Twilio stock has risen 4.04% while the S&P 500 has fallen -0.05% on Tuesday, Apr 6. TWLO has gained $14.07 from the previous closing price of $348.43 on volume of 1,587,722 shares. Over the past year the S&P 500 is up 53.02% while TWLO has gained 315.44%.

And,

“Weekly Options Members” managed to gain a potential profit of 410% within 2 trading days.

More upwards movement is expected, and for those that have exited the trade, a new trade may be considered.

Twilio Inc (NYSE:TWLO)

The Actual Recommended Trade…..

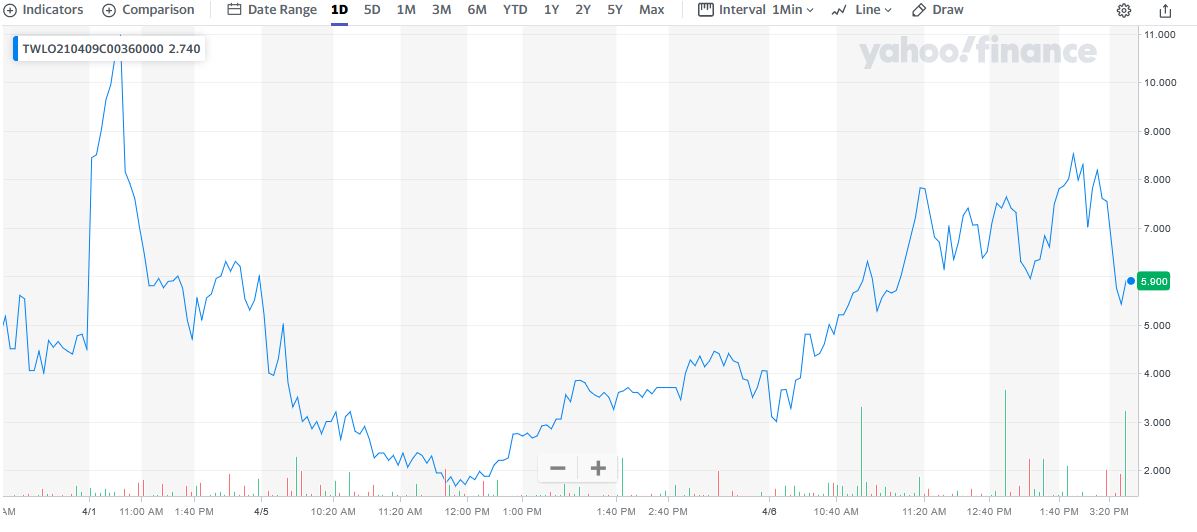

** OPTION TRADE: Buy TWLO APR 09 2021 360.000 CALLS at approximately $6.00.

(actually bought for $1.67 – TWLO stock price dropped after the market opened and finally bottomed at $1.67)

The Profit Explained…..

Weekly Options Members” entered a Twilio trade on Monday, April 05, 2021 for $1.67 at 11:57am.

The stock price started its upward movement and continued to do so after the market opened the next day.

At 1:47pm Tuesday, April 06 the price of the option had hit $8.52 – a nice profit of 410%.

TOTAL PROFIT FOR THE DAYS TRADING IS 410%

Prelude.....

Communication platform-as-a-service (CPaaS) company Twilio Inc (NYSE:TWLO) had a dream run in 2020, driven by the pandemic-triggered migration of companies to cloud-based architecture. Despite giving up some of its gains amid the ongoing tech sell-off, the stock is still up over 300% in the last twelve months.

Twilio provides developers usage-based programmable application program interfaces (APIs) to build cloud-based communication protocols like email, voice, messaging, and other app services within customers' applications. The company also offers platform services that include access to networking and storage, as well as application services such as the flexible cloud-based contact center platform Twilio Flex and authorization service Authy. Twilio aims to become a leading consumer engagement platform and is targeting a total addressable market of $87 billion by 2023.

Why The Trade Recommendation On Twilio?

The Major Catalysts for This Trade.....

1. Past Earnings Report.....

Twilio's fiscal 2020 financial performance was quite encouraging. Revenue jumped 55% year over year to $1.76 billion. However, the company's GAAP loss from operations increased from $369.8 million in the prior year to $492.9 million in 2020, mainly due to increased operating expenses and fees to network providers. But the operating expenses grew by 44% year over year -- which is slower than the revenue growth rate. In fact, the company's fiscal 2020 non-GAAP income from operations was $35.7 million, a stark improvement from a loss of $1.8 million in 2019.

Twilio is inching closer to becoming a profitable organization. Hence, it can continue to soar much higher in the coming quarters.

2. Guidance.....

Twilio's guidance for the current quarter indicates that it is on track to sustain a terrific pace of growth. The company expects top-line growth of 45.5% in the current quarter after finishing fiscal 2020 with a revenue increase of 55%. Also, it is worth noting that it had originally expected 30% to 31% revenue growth for 2020, and it ended up blasting past those expectations due to the tailwinds created by the pandemic.

It won't be surprising to see Twilio exceed its own expectations once again in 2021 as more companies make the switch to cloud-based contact centers. According to Twilio's 2021 state of consumer engagement report, 95% of the 2,500 enterprise decision-makers surveyed expect to either maintain or increase their investment in customer engagement, and 87% believe that digital engagement will play an important role in their business.

3. Digital Transformation Acceleration.....

92% of the businesses Twilio surveyed said that the COVID-19 pandemic had led them to accelerate their shift to the cloud. Twilio anticipates this digital transformation will continue. It points out that the forecast that annual investments in digital transformation will double by 2023 to $2.3 trillion and account for over half of information technology spending. As such, it won't be surprising to see more call center seats move to the cloud.

Twilio has estimated that only 17% of the 15 million contact center seats were in the cloud before the pandemic. That proportion is expected to jump to 50% by 2025, setting the stage for the company to sustain its high rate of growth for years to come.

4. Diversification.....

Twilio has been diversifying into higher-margin businesses with the help of acquisitions that should help support long-term margin expansion. The recent purchase of Segment, for instance, will support cross-selling opportunities at Twilio and expand the company's presence into the fast-growing customer data platform market.

5. Analysts Positivity.....

Analysts estimate that Twilio's revenues will grow by more than 30% annually over the next couple of years. That trend could continue over a longer period as contact centers move to the cloud.

Jefferies analyst Samad Samana initiated coverage of Twilio with a Buy rating and $451 price target.

Samana said Twilio has been successfully disrupting the communication space for several years now. He said Twilio should be able to maintain impressive growth numbers even as the business scales up.

Since 2016, Twilio has generated about 60% compound annual revenue growth, and Samana said the company should continue to grow at above a 30% annual rate through at least 2023.

Twilio’s focus on developers differentiates the company from its high-tech peers, Samana said. In addition, the company has been focusing more on landing large customers and working more closely with Deloitte and other partners.

Twilio was modestly profitable in 2020, but Samana said that profitability will increase significantly over time as the company dials back its investments and adds more high-margin revenue streams. Twilio’s long-term gross margin target is above 60%.

“Messaging carries a ~45% GM, but Voice, Email and App Services are all well above 70%,” Samana wrote in the note.

From a valuation perspective, Twilio shares are trading roughly in-line with its high-growth tech stock peers. However, Samana said Twilio deserves to trade at a premium valuation to other growth stocks because of its dominant positioning in a nascent growth market.

Several other analysts have also commented on the company.....

- William Blair restated an "outperform" rating on shares of Twilio in a research note on Thursday, February 18th.

- Northland Securities boosted their target price on Twilio from $390.00 to $500.00 in a research note on Thursday, February 18th.

- Stifel Nicolaus assumed coverage on Twilio in a research note on Wednesday, January 13th. They issued a "buy" rating and a $425.00 target price on the stock.

- KeyCorp boosted their target price on Twilio from $420.00 to $550.00 and gave the company an "overweight" rating in a research note on Thursday, February 25th.

- Finally, Canaccord Genuity boosted their target price on Twilio from $385.00 to $510.00 and gave the company a "buy" rating in a research note on Thursday, February 25th.

Two analysts have rated the stock with a hold rating and twenty-two have issued a buy rating to the company. The company presently has a consensus rating of "Buy" and an average price target of $442.36.

Summary.....

Twilio's stock price declines in recent weeks offer a better opportunity to buy options of a company that appears primed for growth.

Conclusion.....

Twilio remains the leader in the communication platform as a service (CPaaS) market, helping leading companies communicate with their customers. As companies and consumers become more digitally native, the need to have an intuitive and sophisticated software communication platform will become essential.

With their recent acquisition of Segment, Twilio is evolving from a pure software communications company into a customer experience company. The acquisition will help Twilio's customers be able to leverage AI and data analytics in order to better serve their end customers.

The company's significant investments have paid dividends to revenue growth and dollar-based net expansion.

Also, the number of customers who use Twilio's platform has continued to expand. During the most recent quarter, the company reported 221k customers, up significantly from the 64k customers at the end of 2018.

Twilio has already laid out their path to profitability. With the company investing into their future growth opportunities, they are gaining scale and widespread customer adoption which will lead to higher levels of profitability in the future.

Given the company's significant revenue growth opportunities via recent acquisitions and investments, as well as continued product and geographic expansion, the company is a winner.

Therefore…..

Will Twilio Continue To Provide Profit?

Will We Recommend Another Trade On Twilio?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

While there are many more areas that can help to explain option trading, this is a basic overview of what stock options are, and where and how they started.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Twilio Stock Price Jumps!