TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Trump

Media & Technology MONTHLY Call Option Up 138%!

Become a Member and Get future Trades.

Investors, presumably rich ones, are buying large volumes of DJT shares, pushing up the stock once again.

As well, massive buying by Trump supporters see it as a way to support their candidate.

This set the scene for Monthly Options USA Members to profit by 138% using a DJT Monthly Options trade!

Become a Member Today and get future trades!

Thursday, May 02, 2024

by Ian Harvey

Why the Trump Media & Technology Monthly Options Trade was Originally Executed!

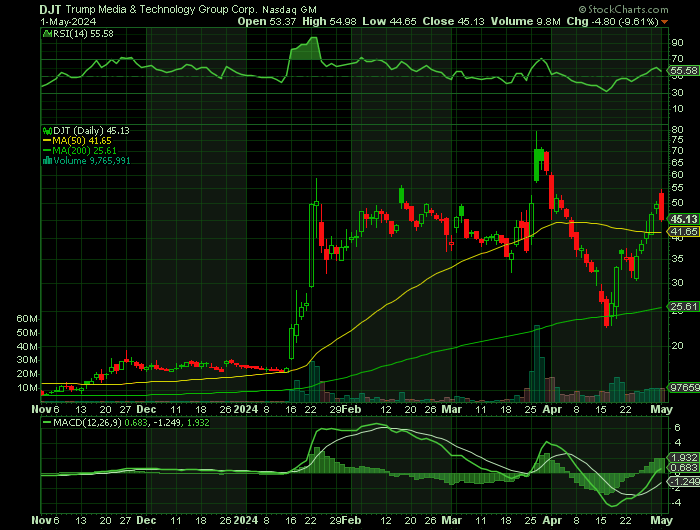

As of Friday morning, a month since Trump Media & Technology Group Corp (NASDAQ: DJT)'s initial public offering sent its stock to $66.22; it has plunged to $38.49. Research firms FactSet and S3 Partners shows that investors using puts and “short selling” have paper profits so far of at least $200 million, not including the costs of puts, which vary from trade to trade.

Still, amateur traders, mostly risking no more than a few thousand dollars each, say the stock is too volatile to declare victory yet. So they are cashing in a bit now, letting other bets ride and stealing a glance at the latest stock movements.

There have been plenty of scary moments, including last week when DJT, the ex-president’s initials and stock ticker, jumped nearly 40% in two days.

Despite all this volatility Trump’s stake is still worth $4 billion.

And now, investors, presumably rich ones, are buying large volumes of DJT shares, pushing up the stock once again.

As well, massive buying by Trump supporters see it as a way to support their candidate.

The DJT MONTHLY Options Potential Profit Explained.....

** OPTION TRADE: Buy DJT SEP 16 2024 40.000 CALLS - price at last close was $6.50 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

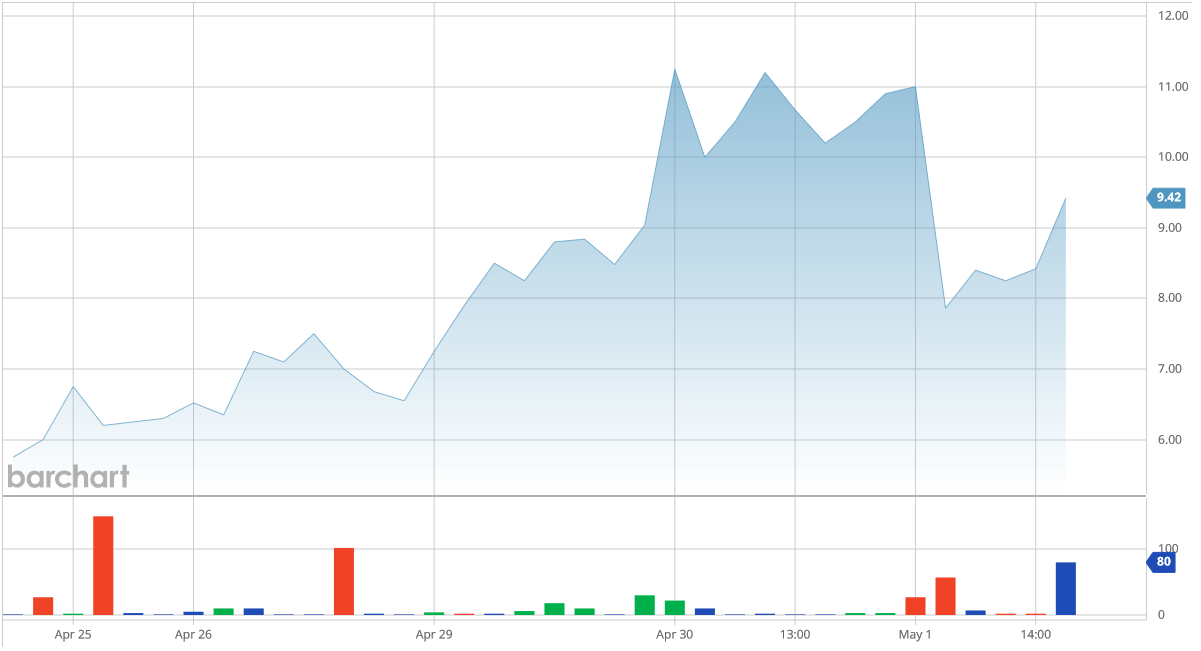

Entered the DJT Monthly Options (CALL) Trade on Friday, April 26, 2024 for $6.30.

Sold the DJT Monthly options contracts on Tuesday, April 30, 2024 for $15.00; a potential profit of 138%.

(This will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

Further Catalysts for the DJT Monthly Options Trade…..

Trump Media spokeswoman Shannon Devine said the company is in a “strong financial position” with $200 million in cash and no debt, and said the AP was “selecting admitted Trump antagonists.”

Another danger to the stock is a “short squeeze.” If the price rises sharply, it could set off a rush by short sellers who fear they’ve bet wrongly to return their borrowed shares right away and limit their losses. And so they start buying shares to replace the ones they borrowed and sold, and that very buying tends to work against them, sending the price higher, which in turn scares other short sellers, who then also buy, setting off a vicious cycle of price hikes.

“If DJT starts rallying, you’re going to see the mother of all squeezes,” says S3 Partners short-selling expert Ihor Dusaniwsky, who spent three decades at Morgan Stanley helping investors borrow shares. “This is not for the faint of heart.”

And if that wasn’t enough, there is a final oddball feature of DJT stock that could trigger an explosion in prices, up or down.

“Lock up” agreements prohibit Trump and other DJT executives from selling their shares until September. That leaves the float, or the number of shares that can be traded each day by others, at a dangerously tiny 29% of total shares that will someday flood the market. That means a big purchase or sale on any day that would barely move a typical stock can send DJT flying.

The stock's volatility, experts say, is tied to Trump Media's prime asset: Trump himself. Trump Media runs the social media platform Truth Social, which Trump created after he was banned from Twitter and Facebook following the Jan. 6, 2021, Capitol riot. The former Republican president, who is his party's presumptive nominee for the White House this year, is a prolific poster to Truth Social and has a legion of diehard supporters.

“I LOVE TRUTH SOCIAL, I LOVE THE TRUTH!” Trump posted the day his company went public.

Most large investors have balked at buying the company's stock. Based in Sarasota, Florida, Trump Media has been losing loads of money and struggling to raise revenue, according to regulatory filings. That doesn't appear to have dissuaded Trump's supporters from embracing a chance to invest in a piece of him.

“It’s everything out of the ordinary,” said Julian Klymochko, CEO of Calgary-based Accelerate Financial Technologies Inc.

“I call it the mother of all meme stocks,” he said, using a phrase oft-repeated about Trump Media. It’s the nickname given to stocks that get caught up in buzz online and shoot way beyond what traditional analysis says they’re worth.

Therefore…..

For future trades, join us here at Monthly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Trump Media & Technology Group

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.