TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Teladoc Weekly Options Call Trade Recommendation!

Profit On Options trade

Climbs 62% In 4 Hours!

Further Profit Expected?

Friday, May 28, 2021

by Ian Harvey

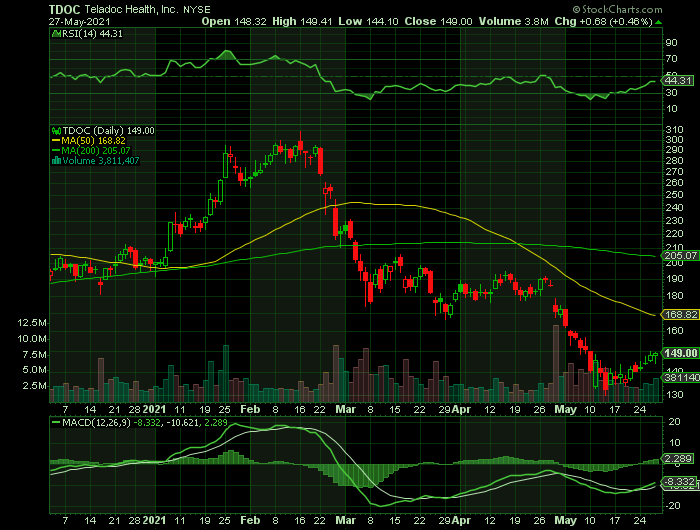

Teladoc was the recommended weekly call option on Thursday “or our "Weekly Options USA” members. We feel that there is still further growth expected as the stock price only progressed 0.68 (+0.46%) to sit at $149.

Meantime, “Weekly Options Members,” are already showing potential profits of 62%.

Teladoc Health Inc (NYSE: TDOC)

Prelude…..

According to data analytics company Definitive Healthcare, the use of telehealth solutions surged by more than 6,000% during the pandemic. And the worldwide telehealth industry is projected to hit an eye-popping valuation of $521 billion by 2030, from just $83 billion in 2020.

However, a few healthcare stocks are well off their highs from earlier this year. These big pullbacks can present big buying opportunities for investors.

Teladoc Health Inc (NYSE: TDOC), a telemedicine and virtual healthcare company, is one of those stocks that has pulled back; but is looking attractive at current levels of around $150. TDOC stock is trading at the same levels it was at in March 2020, compared to the S&P which has moved up 87%.

TDOC stock has significantly underperformed the broader markets, primarily due to valuation concerns at higher levels. Note that TDOC stock actually rallied 3.6x from levels of $83 in the beginning of 2020 to $294 in mid-February 2021. However, it has seen a large drop of over 50% since then.

Now that the stock has corrected (down 20% in the last one year) despite revenue growing 98% y-o-y over the last four quarters, it is believed that TDOC stock is likely to see higher levels.

Looking at a longer time period, TDOC stock is up 300% from levels of $35 seen toward the end of 2017. The rise in stock price over the last three years or so can be attributed to favorable changes in the company’s revenue per share. The company’s revenues have trended higher, rising 369% from $0.2 billion in 2017 to $1.1 billion in 2020, led by higher demand for its virtual health services. While the company posted strong revenue growth over the recent years, it also issued more shares, resulting in a 64% jump in total shares outstanding.

The Recommended Trade.....

** OPTION TRADE: Buy TDOC JUN 11 2021 150.000 CALLS at approximately $4.70.

(Some members have asked for the following suggested exit prices.....

Place a pre-determined sell at $9.40.

Include a protective stop loss of $1.90.

The Major Catalysts for This Trade.....

Teladoc Health is top dog and first mover in the online telehealth industry. Now some major players like Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT) might be moving in.

They have a huge doctor network. They have a stronger brand than Amwell (NYSE:AMWL). Teladoc obviously has a giant network of physicians. They are also expanded into mental health, with therapists available.

Virtual healthcare is an expanding market. You get more players going into it, but the market itself is getting bigger and they're competing with the existing model. Historically, it's like Amazon, for instance. Amazon was early in e-commerce. They were early in internet retail. Other people came online, everybody came online. That did not hurt Amazon, it helped them because it just validates the model, makes more and more people, the late bloomers get online, too, and they all go to Amazon which is the one they've heard about. This is where Teladoc will win.

2. Livongo Deal.....

Livongo represents a big opportunity for revenue growth. The company brought to Teladoc expertise in the virtual management of chronic diseases such as hypertension and diabetes. Teladoc enrolled 62,000 chronic care members in the first quarter. That was a 66% increase from Livongo's enrollment during the same period a year ago. And the number of patients enrolled in more than one chronic care program tripled year over year.

Teladoc not only has telehealth but they also have remote patient monitoring suite of services from Livongo. This is an attractive proposition more so than what Amazon has, because Teladoc is trying to occupy this whole spectrum of digital health.

In 2020, Teladoc's total visits grew to 10.6 million -- a 156% increase year over year. But Teladoc is positioned for much more than video visits for socially distanced consumers. In late 2020, Teladoc closed an $18.5 billion acquisition of Livongo, a leader in diabetic care with innovations in "applied health signals" and digital coaching. Since then, Teladoc has been moving into other chronic condition areas and more broadly into what Teladoc calls "whole person care." This evolution beyond its virtual urgent care roots represents a massive market opportunity for Teladoc.

They are really building out an end-to-end product suite. That is more than Amazon can offer today.

3. Immense Growth Potential.....

Considering the massive surge last year in telehealth adoption, which was of course fueled by the COVID-19 pandemic, you would expect Teladoc's growth rate to slow after such an incredible year in 2020. But Teladoc still has immense growth potential.

The company has a lot of potential, even just in its existing client base. There are a lot of employees and family members at existing Teladoc clients who don't yet use the company's services and products. So there is a really big opportunity even if Teladoc didn't even sign a new client, just by going after more of the market potential at existing clients.

The pandemic isn't over. But many people have returned to their old routines, going back to their workplaces and scheduling routine in-person medical appointments. However, this hasn't hurt Teladoc's business. It continues to see major growth. The company posted a 151% increase in first-quarter revenue. And total visits climbed 56% to 3.2 million. Based on this, it would be fair to say that the growing popularity of online medical visits isn't a trend that was solely powered by this health crisis.

In the company's Q1 earnings call, CFO Mala Murthy said, "I expect 2021 to be an investment year." Plans include product launches, expanding into new markets, and fully integrating the acquisition of Livongo, which Teladoc completed about seven months ago.

4. Company Connections.....

Teladoc has over 40% of the Fortune 500 as its clients. It has some big companies, as well as a lot of smaller companies as well.

Teladoc is working to expand its primary care offering. It recently signed agreements with several Fortune 1,000 companies. Those programs will launch nationwide by the first quarter of next year. They won't significantly contribute to revenue in 2021 -- but we should expect to see gains next year and farther down the road.

And that pretty much describes Teladoc's situation: The company is laying the foundations now for growth across its business in the years to come. Meanwhile, growth hasn't exactly screeched to a halt. The company says revenue may increase by as much as 85% this year to more than $2 billion, and total visits should be in the range of 12.5 million and 13.5 million. That would be up from 10.6 million visits in 2020.

5. Cross-selling.....

Teladoc has a great opportunity to cross-sell other parts of the platform Livongo Health, which they acquired last year. This gave the company a really promising, fast-growing digital platform for chronic condition management, particularly diabetes and hypertension.

Teladoc has a great opportunity to cross-sell that Livongo platform, as well as some of these other products and services, to its existing client base.

Teladoc Health is a virtual care company like no other. Traditional primary physician consultations aside, the company also specializes in managing chronic illnesses and behavioral health. During the first quarter of 2021, more than 658,000 patients enrolled in one of Teladoc's chronic care services, tripling over Q1 2020.

The company began offering mental health services in October 2020. The results have been spectacular. In areas where patients sometimes wait three to nine months to see a psychiatric professional, Teladoc has replaced that with instantaneous, 24/7 support. Due to its superb services, Teladoc's revenue increased by 151% year over year to $453.7 million. Its total visits more than doubled to 4.28 million in the same period.

6. ‘myStrength Complete’.....

TDOC has come up with a new mental health service named ‘myStrength Complete’. The service will bring together a complete range of mental health solutions right from apps to clinicians. This will make it convenient for patients to get timely help, tailored to their needs and terms.

Bundling different kinds of services into one relieves patients of navigating through multiple websites, mobile apps or virtual care platforms. This comprehensive care will attract more patients and also retain them for long.

With this offering, Teladoc is targeting the mental health care market, which is set to expand. Rising psychological issues are widely seen across all age groups but more so among the millennials. Per a recent Market Insight Reports study, the global behavioural/mental health market size is expected to reach $245 billion, seeing a CAGR of 2.5% during the 2020-2027 forecast period.

Teladoc is leveraging its last year’s acquisition of Livongo to launch this mental healthcare service. Notably, Livingo provides behavioral health care program.

7. Teladoc Health Is a Top ARK Holding.....

While following its goal to "invest solely in disruptive innovations", Teladoc Health became one of the largest holdings across several of Wood's ETFs including the ARK Innovation ETF (NYSEMKT:ARKK), ARK Next Generation Internet ETF (NYSEMKT:ARKW), and ARK Genomics Revolution ETF (NYSEMKT:ARKG).

2021 has

been a difficult year for ARK, but Teladoc now represents the No. 1 holding in

ARK Genomics, No. 2 holding in ARK Innovation, and No. 6 holding in ARK Next

Generation Internet.

Analysts’ Opinions.....

JPMorgan managing director and healthcare analyst Lisa Gill says Teladoc is still one of her favorite stocks. Teladoc has been under some pressure since reporting the quarter, but they’re the biggest virtual health care company out in the marketplace and they’re the only one with an end-to-end solution. I think a lot of investors are concerned about telehealth becoming commoditized. I think when you look at that one-fifth of care into the home, Teladoc is going to be incredibly well-positioned with the chronic conditions that they serve.

Wall Street analysts -- there’s around 30 of us that now cover Teladoc -- seemed to take different approaches to modeling the quarter. If you look at the visit fees, the Street was at $75 million, and Teladoc reported $54 million, which you would think was a massive miss. At $55.5 million, our estimate was in the ballpark with TDOC’s number.

Secondly, Teladoc has all along talked about the fact they have 1.5 million to 2 million members that were on their platform on an interim basis because of the pandemic.

And thirdly, they had deferred revenue of just over $6 million for the Livongo business. So it looked like they missed our Livongo number by about $4.5 million, but when you take into account the deferred revenues, they didn’t miss our number.

But a year ago, Livongo had a really big contract that they added in the first quarter of 2020, which makes the comp tougher.

It feels like it’s this expectations game with Teladoc. We have followed the company since they went public in 2015, and they generally don’t raise numbers in the first quarter; they did last year because it was a really unusual time.

TDOC has been the subject of a number of other research reports.....

- Credit Suisse Group lowered their price objective on shares of Teladoc Health from $300.00 to $264.00 and set an “outperform” rating for the company in a research report on Thursday, May 6th.

- DA Davidson upped their price objective on shares of Teladoc Health from $260.00 to $275.00 and gave the company a “buy” rating in a research report on Wednesday, March 3rd.

- Finally, SVB Leerink upped their target price on shares of Teladoc Health from $256.00 to $266.00 and gave the stock an “outperform” rating in a research note on Wednesday, March 3rd.

Eleven equities research analysts have rated the stock with a hold rating and nineteen have given a buy rating to the stock. The stock has an average rating of “Buy” and an average price target of $241.70.

Summary.....

A 2020 McKinsey & Company report on telehealth suggested virtual care could expand from virtual urgent care to encompass approximately 20% of Medicare, Medicaid, and commercial spending in physician offices, outpatient centers, and home health. This shift represents around a $250 billion U.S. market opportunity for companies like Teladoc. That estimate doesn't even include the potential for international expansion.

Teladoc expects to generate $2 billion in sales this year, a stunning increase over the $1.09 billion in revenue it had in 2020. What's more, it is guiding for its EBITDA to surpass $265 million, compared to an EBITDA of $126.8 million in 2020.

Teladoc's future growth story will continue to benefit from these momentous tailwinds in the digital healthcare industry even as the pandemic slowly subsides. Teladoc was also growing very quickly before the pandemic. In 2019, revenue was up 32% and visits on its platform jumped 57% from the previous year.

Teladoc capitalized on high demand for its platform and services in 2020, marking nearly 100% revenue growth and a 156% surge in visits from the prior year. The company also made multiple acquisitions last year that expanded its market share and broadened the scope of its services, with one of the most notable being its $18.5 billion merger with fellow digital healthcare giant Livongo.

Teladoc with a comprehensive suite of virtual healthcare clinical services, global footprint covering clients, medical operations and members, unmatched breadth of solutions for clients served across all channels and a highly scalable and secure API-driven technology platform provides it with an edge over other players.

Therefore…..

Note That This Teladoc Weekly Options Call Trade Is Only A Suggestion!

Will Teladoc Stock Price Continue Its Upward Momentum?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Zynga Earnings