TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Target Corporation Shares

Continue To Take A Hit!

But Members Now

Up 530% Potential Profit

Using A Weekly Put Option!

Members of “Weekly Options USA,” Using A Weekly Put

Option, Make Potential Profit Of 530%,

As Target Corporation Not Only Receives

Backlash From "Rainbow

Capitalism,"

But Is Seeing Inflation-Wary Consumers Cutting Spending

Causing

Weak Sales Leading To Analysts’ Downgrades.

Where To Now?

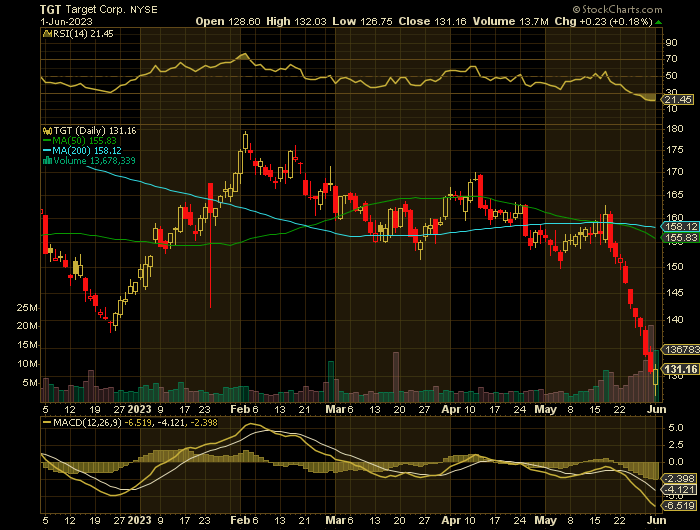

Target Corporation shares continue to fall with downgrades appearing due to weak sales and backlash

from the sale of LGBQT+ Pride merchandise.

This set the scene for Weekly Options USA Members to profit by 530% using a Target Weekly Put Options trade!

Join Us And Get The Trades – become a member today!

Friday, June 02, 2023

by Ian Harvey

Prelude…..

Since Target Corporation (NYSE:TGT) shared that it was pulling some LGBQT+ Pride merchandise off its shelves, the company’s stock price has tumbled.

Consumers are cutting back discretionary spending this year because of a weakening economy, marked by high inflation and the inevitable resumption of student loan payments. The latter factor will lower the amount of money consumers have to buy things.

Why the Target Shares Weekly Options Trade was Executed?

Target Corporation is the most recent company to be dragged into the supposed "woke war," currently rampaging across social media. Against the backdrop of a trans-friendly Bud Light promotion and Disney's ongoing battle with right-wing Florida Gov. Ron DeSantis, the recent rally against Target's selection of LGBTQ+ merchandise could have the company worried.

Recent posts on social media have criticized Target's exceptionally-inclusive line of LGBTQ+ clothing. The uproar mainly focuses on kids' clothes or swimsuits and undergarments designed for transgender customers.

The Target Weekly Options Trade Explained.....

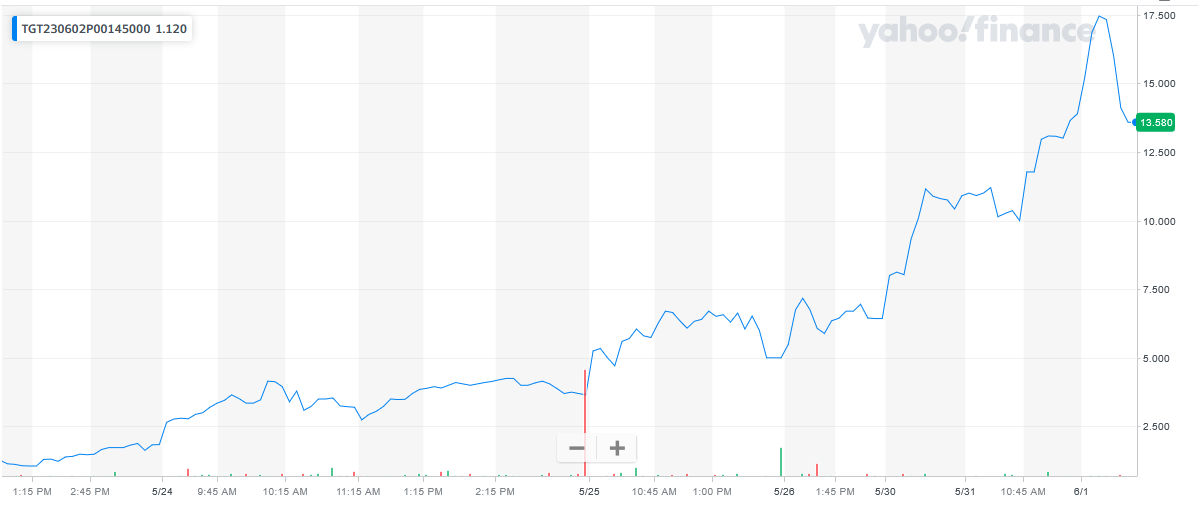

** OPTION TRADE: Buy TGT JUN 02 2023 145.000 PUTS - price at last close was $1.84 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the TGT Weekly Options (PUT) Trade on Wednesday, May 24, 2023, at 9:33, for $2.77.

Sold half the TGT weekly options contracts on Thursday, May 25, 2023, at 11:46, for $6.70; a potential profit of 142%.

Total Dollar Profit is $770 - $277 (cost of contract) = $493

Sold the remaining TGT weekly options contracts on Thursday, June 01, 2023, for $17.45; a potential profit of 530%.

Total Dollar Profit is $1,745 - $277 (cost of contract) = $1,468

Add Both Totals - $1,468 + $493 = $1,961

Don’t miss out on further trades – become a member today!

Student Loan Restart Effect.....

Target's sales may face a hit as student loan repayments restart in early September as part of the debt ceiling deal, JPMorgan warned Thursday afternoon.

"Target over-indexes to the millennial customer and, should student loan payments come back on, the company is more exposed than others in our coverage," analyst Chris Horvers wrote in a note. "Buy-side client expectations are in the $6-8 million per month consumer outflow range should this happen, per our conversations, which represents a potential 1-2 point [comparable] headwind to retail spending."

Horvers slashed his rating to Neutral from Overweight. His new price target is $133, down from $182.

The new debt ceiling agreement between the White House and Republicans prohibits President Joe Biden from extending the student loan forbearance. Payments will restart on Sept. 1.

Removing LGBTQ-themed Merchandise…..

Since Target Corporation shared that it was pulling some LGBQT+ Pride merchandise off its shelves, the company’s stock price has tumbled.

The company's decision last week to remove some LGBTQ-themed merchandise after customer backlash has triggered even more global backlash.

Target's collection for Pride Month, which is celebrated every year in June, includes more than 2,000 products, including Carnell's Abprallen brand. His brand's products are the only ones so far that have been removed both in-store and online, he said.

Cautious Spending…..

Cautious consumer spending warrants a more cautious take on Target's stock, aside from the student loan repayment issue.

Consumers are cutting back discretionary spending this year because of a weakening economy, marked by high inflation and the inevitable resumption of student loan payments. The latter factor will lower the amount of money consumers have to buy things.

Entering this year, the retailer warned investors that the broader economy, in which inflation-wary consumers would cut spending, would negatively impact sales, including the merchandise key to Target’s success: apparel, accessories, and home goods. The company predicted comparable sales for the year would be anywhere from a low single-digit percentage decline to a low single-digit percentage gain.

Target said things weren’t looking too good at the end of the quarter and that April was weak. That does not bode well for the second quarter although Target hopes that a strong back-to-school and back-to-college season will help the retailer still hit its end-of-the-year sales targets.

Analysts’ Downgrades…..

Christopher Horvers, an analyst with J.P. Morgan, thinks Target’s situation is in a dire situation.

"We continue to believe that the consumer is broadly weakening while the share of wallet shift away from goods (51% of [Target's] sales) is ongoing," Horvers wrote in a note, in which he downgraded Target stock from “Overweight” to “Neutral.” His new price target is $133, down from $182.

The company “has been giving back share on a [one-year] view and we believe this share loss could accelerate into back to school and linger into holiday given consumer pressures and recent company controversies," he said.

Summary…..

Shares are down by about 14% in the past week and a half as investors worry about potential second quarter sales and profit hits from the high-profile unrest.

Meanwhile, Target is coming off another quarter of challenged sales as inflation-battered shoppers curtailed discretionary purchases such as apparel and home goods. Historically, these are bread-and-butter sellers for Target — and key profit margin enhancers.

Alleged organized crime at Target stores is also weighing on results, execs have said.

Surprisingly, Target stock actually rose Thursday, gaining 23 cents to close at $131.16.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from TARGET

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.