TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

A Take-Two Interactive Software Weekly Options Trade Makes 92%!

Members of “Weekly Options USA,” Using A Weekly Put Option, Are Up 92% Potential Profit

Due To A Poor Earnings Report!

More to come?

Join

Us and GET FUTURE TRADEs!

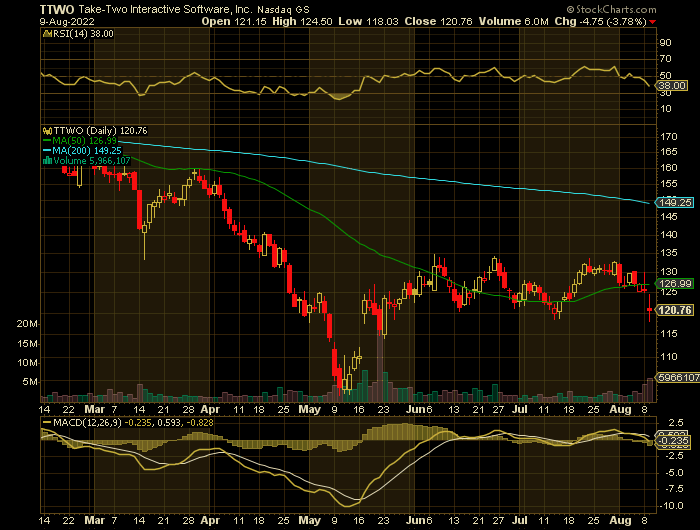

Take-Two Interactive Software reported a first-quarter fiscal 2023 loss of 76 cents per share against the year-ago quarter’s earnings of $1.30 per share. Shares closed the day down 3.78%. At one point the shares were down nearly 6.0% at $118.03.

Meantime, Weekly Options USA Members profit hits 92% using a Weekly Put Option!

Join Us And Get The Trades – become a member today!

Wednesday, August 10, 2022

Take-Two Interactive Software Inc. missed analysts’ estimates for annual profit after incorporating results from its purchase of mobile-game maker Zynga earlier this year.

Take-Two Interactive Software reported a first-quarter fiscal 2023 loss of 76 cents per share against the year-ago quarter’s earnings of $1.30 per share.

Net revenues jumped 35.5% year over year to $1.10 billion. Net Bookings surged 40.9% to $1 billion.

The Consensus Estimate for earnings and revenues was expected to be 53 cents per share and $1.04 billion, respectively.

Game revenues (92.5% of revenues) improved 28% year over year to $1.02 billion. Advertising revenues (7.5% of revenues) jumped 389.4% year over year to $83.2 million.

Adjusted earnings per share in fiscal 2023 will be $4.60 to $4.85, the company said, lower than analysts’ average projection for $5.37.

In May, Take-Two completed its $11 billion acquisition of Zynga, allowing the company to break into the fast-growing market for smartphone games.

“We are seeing some softness in the mobile market,” Chief Executive Officer Strauss Zelnick said Monday in a conference call after the results. Yet, he added, the company is “doing better than most, if not all” in the mobile games market.

The Profits Explained.....

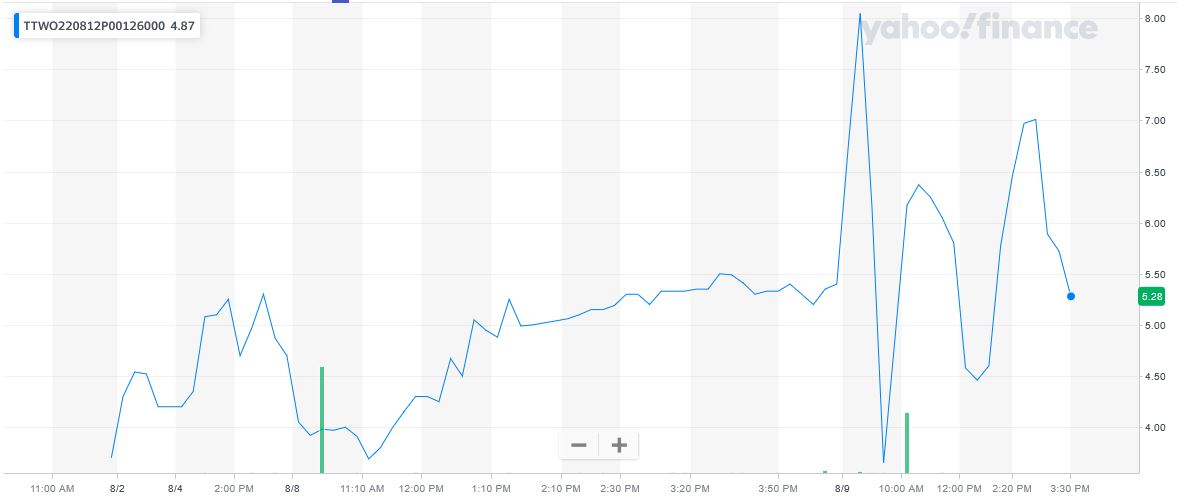

Entered the Take-Two Interactive Software trade on Tuesday, August 02, 2022 for $4.20.

Exited the trade Tuesday, August 09, for $8.05 for a potential profit of 92%.

Why the Weekly Options put Trade on

Take-Two Interactive Software

Take-Two Interactive Software, Inc. (NASDAQ:TTWO) reported earnings on Monday, August 08, after the market closed.

This publisher of "Grand Theft Auto" and other video games was expected to post quarterly earnings of $0.82 per share in its upcoming report, which represented a year-over-year change of -23.4%.

Revenues were expected to be $743.4 million, up 4.5% from the year-ago quarter.

For the last reported quarter, it was expected that Take-Two would post earnings of $1.01 per share when it actually produced earnings of $1.16, delivering a surprise of +14.85%.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

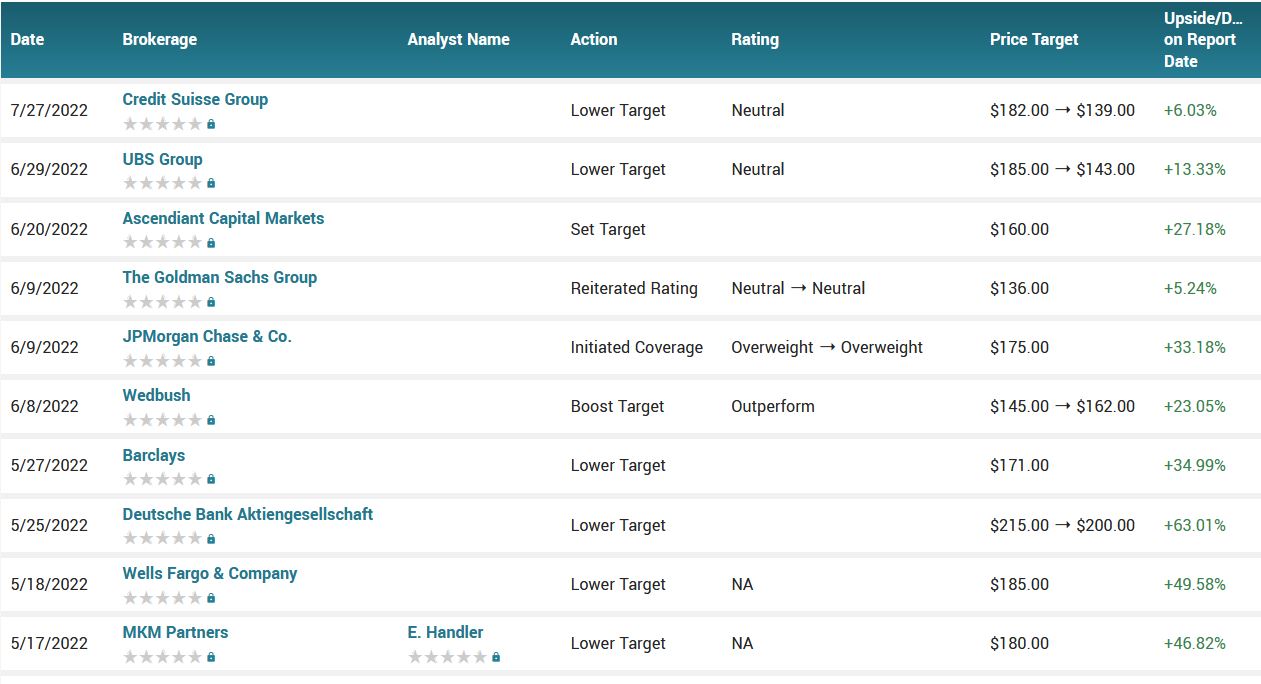

Last week Credit Suisse analyst Stephen Ju cut the price target of TTWO from $182 to $139 but maintained a Neutral rating.

About Take-Two Interactive Software.....

Take-Two Interactive Software, Inc. develops, publishes, and markets interactive entertainment solutions for consumers worldwide. The company offers its products under the Rockstar Games, 2K, Private Division, and T2 Mobile Games names.

It develops and publishes action/adventure products under the Grand Theft Auto, Max Payne, Midnight Club, and Red Dead Redemption names; and offers episodes and content, as well as develops brands in other genres, including the LA Noire, Bully, and Manhunt franchises.

The company also publishes various entertainment properties across various platforms and a range of genres, such as shooter, action, role-playing, strategy, sports, and family/casual entertainment under the BioShock, Mafia, Sid Meier's Civilization, XCOM series, and Borderlands.

In addition, it publishes sports simulation titles comprising NBA 2K series, a basketball video game; the WWE 2K professional wrestling series; and PGA TOUR 2K.

Further, the company offers Kerbal Space Program, OlliOlli World, and The Outer Worlds and Ancestors: the Humankind Odyssey under Private Division; and free-to-play mobile games, such as Dragon City, Monster Legends, Two Dots, and Top Eleven.

Its products are designed for console gaming systems, including PlayStation 4 and PlayStation 5; Xbox One; the Nintendo's Switch; personal computers; and mobile comprising smartphones and tablets.

The company provides its products through physical retail, digital download, online platforms, and cloud streaming services.

Take-Two Interactive Software, Inc. was incorporated in 1993 and is based in New York, New York.

Other Major Catalysts for the Take-Two Interactive Software Weekly Options Trade…..

Covid Hangover.....

The video game industry is suffering from a COVID hangover. After explosive growth throughout the pandemic, game sales are finally plummeting back to Earth.

It’s not just hardware and games sales that are taking a hit.

Gamers are also spending less time playing than last year as people around the world are venturing outside again as pandemic fears subside.

Spending Drop.....

According to NPD, June U.S. spending across game hardware, content, and accessories collapsed 11% year-over-year to $4.3 billion. Still, that’s far more than pre-pandemic levels, where NPD said June U.S. spending totaled $959 million in 2019.

The game industry certainly isn’t dying. But after such massive growth during the pandemic, it now has to reckon with a return to normalcy that could hurt.

Game Sales.....

In the latest quarters, gaming companies are reporting declines in game software sales versus 2021.

Gamers are also playing less than they were this time last year.

“Total gameplay time for PlayStation users declined 15% year-on-year in Q1,” Sony CFO Hiroki Totoki said when the company released its earnings report. “Gameplay time in the month of June improved 3% compared with May and was down only 10% versus June 2021, but this is a much lower level of engagement than we anticipated in our previous forecast.”

Supply chain disruptions and the global chip shortage made getting your hands on a next-generation console largely impossible unless you spent your time glued to Twitter checking for inventory updates at places like Best Buy.

NPD said that industry-wide, first-half U.S. hardware sales fell by 8% to $371 million. New console sales in the first half of the year also fell 9% to $2.1 billion.

Analysts.....

Credit Suisse analyst Stephen Ju cut the price target from $182 to $139 for Take-Two Interactive Software due to......

- The PT cut reflected the Zynga acquisition and EPS revision after factoring in the FX changes for the Grand Theft Auto Maker.

- His FY23/FY24 adjusted EPS estimate was now at $6.73/$10.90 vs. $4.61/$10.74.

- Ju opted for Rockstar and 2K over Zynga brands following the final terms of the Zynga transaction.

- As the ~$116 volume-weighted average TTWO share price fell below the collar range of $156.50-$181.88, the final terms of the transaction imply a ~$8.20/share price suggesting a ~14.6x CY22 EBITDA multiple on consensus estimates as of May 2022.

- He believed Take-Two would elect to use development talent toward bringing what should be updated mobile versions of Grand Theft Auto, Red Dead, NBA, and other potential Rockstar and 2K brands instead the legacy Zynga properties.

According to the issued ratings of 20 analysts in the last year, the consensus rating for Take-Two Interactive Software stock is Moderate Buy based on the current 4 hold ratings and 16 buy ratings for TTWO. The average twelve-month price prediction for Take-Two Interactive Software is $176.48 with a high price target of $215.00 and a low price target of $136.00.

Summary.....

Take-Two Interactive Software, Inc. has a one year low of $101.85 and a one year high of $195.82. The stock has a market capitalization of $15.10 billion, a PE ratio of 36.41, and a P/E/G ratio of 1.66 and a beta of 0.74. The business’s 50 day moving average price is $126.11 and its 200 day moving average price is $140.30.

As with most consumer tech companies, video game sales are cyclical.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Take-Two Interactive Software

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.