TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

SNOWFLAKE UPDATE - 307%

Profit

Using A Weekly Options Trade!

Shares of data warehouse-as-a-service Snowflake Inc (NYSE: SNOW) jumped 5.3% on Friday after the Bureau of Labor Statistics provided a revised inflation reading for December 2023, which came in lower than expected.

Snowflake's cloud-based data warehouse and analytics platform offers consumption-based pricing, which let users dial down their spending when the economy tanked. As conditions improve, those same users will likely ramp up spending again, which bodes well for Snowflake.

Snowflake is expected to play a vital role in artificial intelligence (AI) and stands to benefit greatly from its growth going forward.

Snowflake's Data Cloud platform has become a go-to solution for solving AI issues and unlocking the potential of big data analytics.

This set the scene for Weekly Options USA Members to profit by 307% using a SNOWFLAKE Options trade!

Join Us And Get The Trades – become a member today!

Sunday, February 11, 2024

by Ian Harvey

UPDATE

Read the previous article about Snowflake HERE.

Shares of data warehouse-as-a-service Snowflake Inc (NYSE: SNOW) jumped 5.3% on Friday after the Bureau of Labor Statistics provided a revised inflation reading for December 2023, which came in lower than expected.

Snowflake's cloud-based data warehouse and analytics platform offers consumption-based pricing, which let users dial down their spending when the economy tanked. As conditions improve, those same users will likely ramp up spending again, which bodes well for Snowflake.

Why the Snowflake Weekly Options Trade was Originally Executed!

Snowflake Inc (NYSE: SNOW) is expected to play a vital role in artificial intelligence (AI) and stands to benefit greatly from its growth going forward.

Powerful hardware and well-crafted algorithms are essential for high-performance AI applications, but artificial intelligence systems are also only as good as the data they are trained on. As Snowflake's management explains, "There's no AI strategy without data strategy."

Snowflake's Data Cloud platform has become a go-to solution for solving this issue and unlocking the potential of big data analytics.

Organizations can upload their data to Snowflake, which is securely stored in the cloud. Users can search and analyze the data as needed. If the data is messy, Snowflake integrates with various third-party applications to modify or clean up the data as required. Additionally, users can share or purchase third-party data within Snowflake's marketplace.

Simply put, Snowflake can help companies build the data they need, secure and store it, and help them use it.

Data looks like a huge opportunity because data is growing exponentially. It's estimated that approximately 90% of the entire world's data was created in the past two years alone.

The world is becoming increasingly digital, creating more data faster. The population is growing and migrating online. Data also doesn't expire. Data from years past will remain important as long as it's used. So, old data isn't replaced; more data is created and stacked on top of it.

It's almost mind-bending to ponder how much data there will be five, 10, or 25 years from now.

That's why it's arguably genius that Snowflake charges its customers on a usage-based billing model. Customers can increase or throttle their storage and computing needs on Snowflake to control how much they spend.

That control could appeal to customers, but ultimately, the long-term growth of data points to them spending more on the platform. Snowflake's net revenue retention (NRR) is an impressive 135%. That's 35% revenue growth without factoring in any new customers.

And at just over 8,900 customers, there is a lot of room for customer growth. At the end of the third quarter, the company had 436 customers with annual contract values of more than $1 million -- an increase of 52% from the 287 clients it had in the category in the previous year's quarter.

There are over 300 million businesses worldwide, and Snowflake can potentially grow for decades if it captures even 500,000 of them over time.

Product revenue increased 34% year over year to reach $698.5 million, and non-GAAP (generally accepted accounting principles) adjusted free cash flow skyrocketed 70% to hit $111 million.

The Snowflake Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy SNOW FEB 23 2024 210.000 CALLS - price at last close was $4.63 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

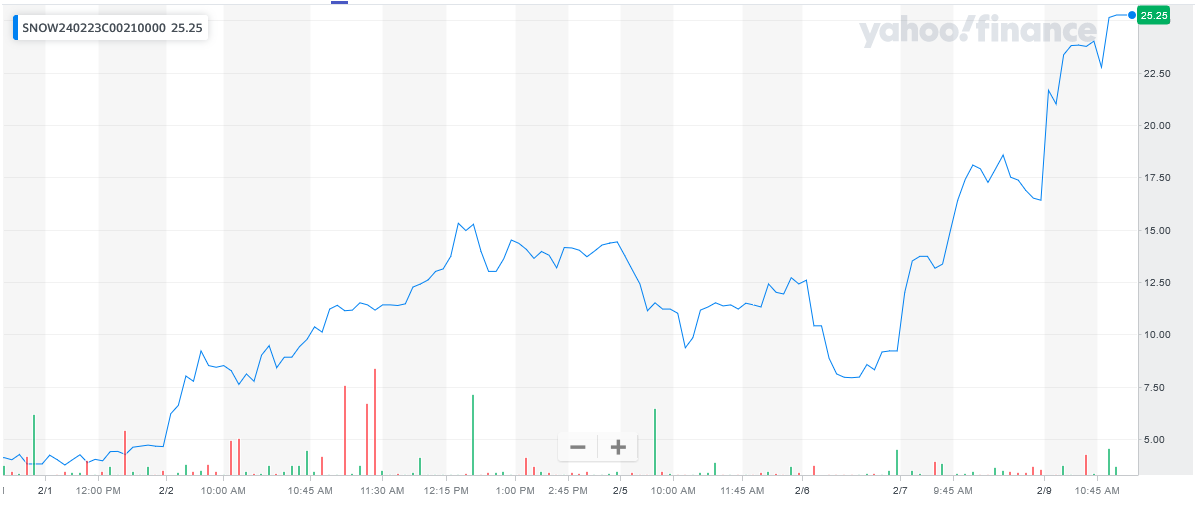

Entered the SNOW Weekly Options (CALL) Trade on Friday, February 02, 2024 at 9:33, for $6.20.

Sold half the SNOW weekly options contracts on Friday, February 02, 2024 at 12:30, for $15.30; a potential profit of 147%.

On Friday, February 09, 2024, the options contracts were now at $25.25, a potential profit of 307%.

Holding the remaining contracts for further profit!

Don’t miss out on further trades – become a member today!

About Snowflake .....

Snowflake Inc. is a cloud-based data storage, computing and analytics company with no official headquarters. The company embraced a non-centralized business model in 2021 but the history is much deeper than that.

The company was founded in 2012 as Snowflake Computing, Inc by a trio of data storage experts who kept it in stealth mode for its 1st 2 years. Snowflake Computing Inc. brought its offerings to the public in 2014 revealing that it already had 80 clients using its services. Services include cloud-based software and hardware applications that are highly scalable and include 3rd-party support to aid businesses with today’s rapidly changing technological landscape.

The company saw rapid growth over the next several years and reached unicorn status in 2017/2018. The company sold itself on the public market in 2020 and caused quite a stir when it did. The company priced its original offering at $75 to $85 per share and wound up listing them at $125 for the IPO. The IPO was oversubscribed and drove the price up to $240 before even the first trade was made. That gave the company a valuation of nearly $3.4 billion making it one of the largest cloud IPOs in history. Snowflake Computing, Inc shortened its name to Snowflake, Inc upon completion of the IPO.

Today, Snowflake Inc operates a cloud-based data platform in the United States and does business internationally. The company's primary product is Data Cloud, a cloud-based suite of tools that allows clients to consolidate data into a single location and facilitates deeper analytical insight and information sharing.

The company believes that data should not be siloed or only available for limited use. On Snowflakes platform, data is governed, which allows users to access 2nd and 3rd party data to gain the deepest insights possible. The platform also operates on the idea of a Data Lake that can be accessed anywhere from anywhere. Among the many benefits of using Snowflake’s one-cloud platform are access, global connectivity, cross-cloud operability and creating new revenue streams for businesses. The platform can be fully automated as well so clients are able “to harness data, not manage it”.

The company initially used Amazon’s AWS cloud services but switched to Microsoft’s Azure and then Google’s cloud which it is currently operating on. This progression has helped it gain its own deep insights and facilitates its ability to provide the best-in-class cross-cloud services on the market.

Security is central to the platform’s success. Not only is data stored in a centralized location and governed in a tiered manner (which keeps each business's IP and most trusted secrets safe) but the platform’s utility allows for state-of-the-art threat detection and some of the quickest response times in the industry.

Snowflake brought in $1.22 billion in revenue for 2022 and employs about 4,000 across its operating footprint. The company counts more than 1300 client partners and has more than 250 PBs of data under storage. The company offers solutions in 6 categories: Advertising, Media & Entertainment; Financial; Retail & CPG; Healthcare & Lifesciences and Marketing Analytics.

Further Catalysts for the SNOW Weekly Options Trade…..

Snowflake is making over $2.6 billion in annual revenue, turning 24% of that into free cash flow. That's cash to invest in growth, make acquisitions, or repurchase shares.

Analysts are optimistic about earnings growth, looking for an average of 61% annual growth over the long term. Clearly, the company's remarkable growth potential isn't lost on Wall Street.

Other Catalysts.....

Last November, the company launched Snowflake Cortex -- a toolset designed to help customers quickly build AI applications and analyze data. The software specialist is also in the early stages of rolling out Snowpark Container Services, which makes it easier for developers to access large language models and data libraries and flexibly utilize hardware within optimized parameters.

These two services are core pillars of the company's AI enablement strategy and are in the early stages of being made available to customers. Snowflake is also rolling out Document AI -- a service to turn unstructured data into partially structured data that can be used by AI systems.

With massive surges in the amount of data generated taking place, the vast majority of this data is unstructured. As a result, it can't be easily plugged into AI algorithms with much expectation that it will produce good results.

According to Snowflake's estimates, roughly 80% of the data currently being generated in the world is unstructured. Not every bit of that data will be useful, but Document AI is helping to put unstructured information into formats that are capable of being sorted and categorized. In turn, this makes them more applicable to analytics models and opens the door for superior performance in AI and large language-model algorithms.

Moving Forward.....

Snowflake estimates that it will have recorded product revenue of $2.65 billion in its 2024 fiscal year, which concludes at the end of January. Jump ahead five years, and the company anticipates posting annual product revenue of approximately $10 billion. Management also anticipates substantial improvements in margins over that stretch.

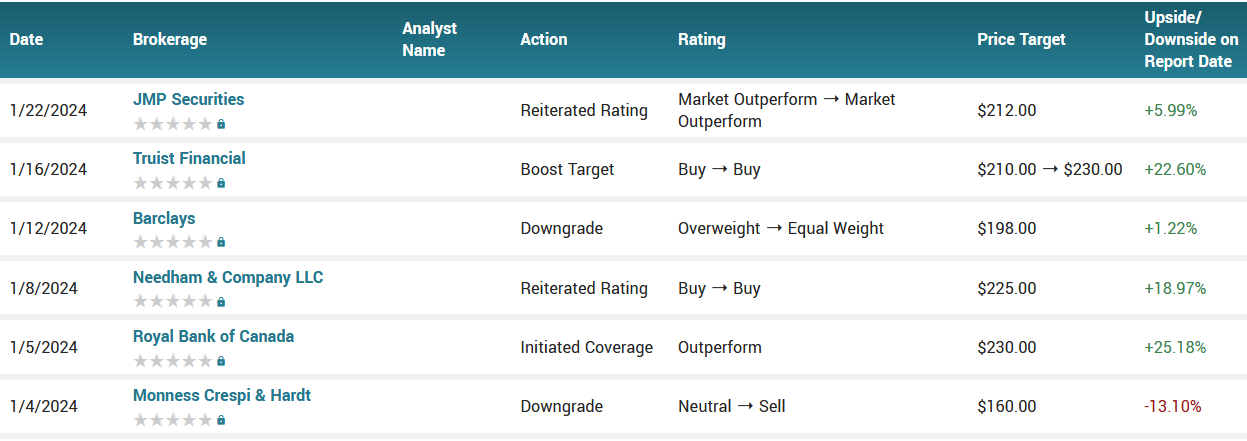

Analysts.....

According to the issued ratings of 27 analysts in the last year, the consensus rating for Snowflake stock is Moderate Buy based on the current 2 sell ratings, 6 hold ratings and 19 buy ratings for SNOW. The average twelve-month price prediction for Snowflake is $197.75 with a high price target of $250.00 and a low price target of $105.00.

Summary.....

With the data software specialist's share price still down by roughly half from the high that it hit in 2021, there is a chance to build a position in an already fast-growing company before AI tailwinds begin to accelerate.

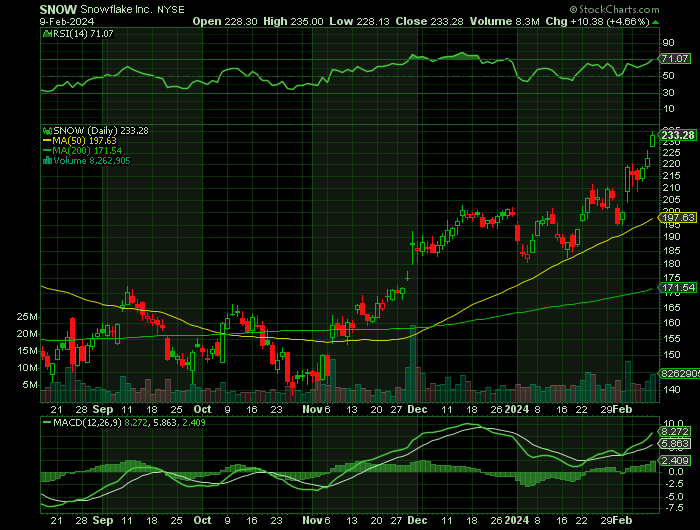

SNOW stock has a market cap of $65.49 billion, a P/E ratio of -74.58 and a beta of 0.97. Snowflake Inc. has a 1 year low of $128.56 and a 1 year high of $211.65. The company has a 50 day simple moving average of $192.00 and a 200 day simple moving average of $170.16.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from SNOWFLAKE

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.