TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

roku Weekly Call Option up 190% Profit!

Is There More To Come?

Join Us and Get the Trades!

Media-streaming technology expert Roku Inc (NASDAQ: ROKU) absolutely crushed Wall Street's consensus estimates in the first quarter of 2024.

One of the biggest challenges to emerge from the ongoing shift from traditional television viewing to streaming is the changing paradigm for advertisers. Now, Roku and programmatic advertising leader The Trade Desk are joining forces to help bridge the gap.

This set the scene for Weekly Options USA Members to profit by 190% using a ROKU Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, May 15, 2024

by Ian Harvey

UPDATE

Media-streaming technology expert Roku Inc (NASDAQ: ROKU) absolutely crushed Wall Street's consensus estimates in the first quarter of 2024. Revenues came in 4% above the average analyst estimates and the net loss was about half as deep as Wall Street expected.

ROKU announced that it has secured exclusive multi-year rights to broadcast Major League Baseball’s (MLB) Sunday Leadoff live games. The company will broadcast these games for free on The Roku Channel. It is set to introduce a new section called MLB Zone on Roku, where fans can explore live and upcoming games, nightly recaps, highlights and more.

The

company recently entered into some notable partnerships and added some

important features to its platform. Some notable partnerships include a

collaboration with the Summer Olympic Games, The Trade Desk

TTD and ISpot. New features like Advertiser Showrooms and Immersive Home

Screens are also noteworthy.

These efforts are expected to boost streaming hours as well as platform revenues

in the upcoming quarters.

Roku's free cash flow is hitting an all-time high.The margins are down but revenue has continued to rise due to the company attracting new users and those users spending tons of time streaming video on the platform, increasing the number of ad impressions.

More importantly, Roku recently exercised some operational discipline. In Q1, the company's operating expenses were down 16% year over year -- this sharp reduction in spending helps boost cash flows.

Why the Roku Weekly Options Trade was Originally Executed!

One of the biggest challenges to emerge from the ongoing shift from traditional television viewing to streaming is the changing paradigm for advertisers. Once upon a time, it was easy for marketers to reach their desired audiences, but the shift to streaming and the proliferation of viewing options has made it more difficult than ever for advertisers to reach their target markets.

Now, streaming platform Roku Inc (NASDAQ: ROKU) and programmatic advertising leader The Trade Desk (NASDAQ: TTD) are joining forces to help bridge the gap.

As well, despite a disappointing first-quarter earnings report last Thursday, one analyst is still bullish on Roku in spite of its recent underperformance. Benchmark lowered its price target on Roku from $115 to $105 following the report, but reiterated a buy rating.

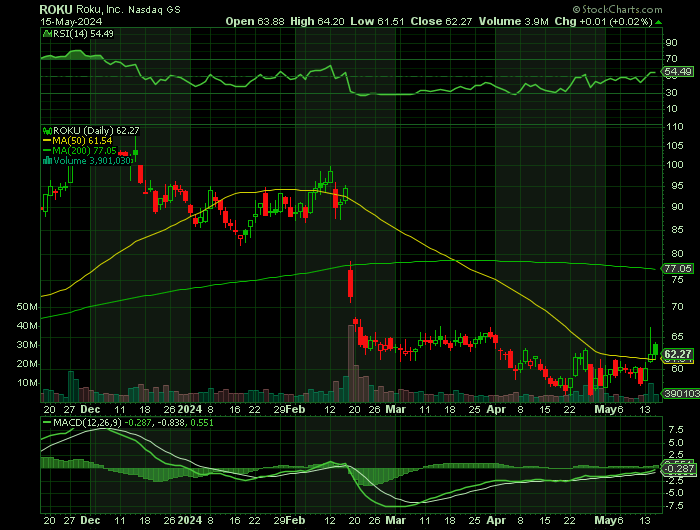

Roku shares have tumbled 35% this year amid intense competition in the streaming industry.

However, the stock has firmed by 5% over the past 12 months, which could signal underlying strength.

The Alcoa Weekly Options Potential Profit Explained.....

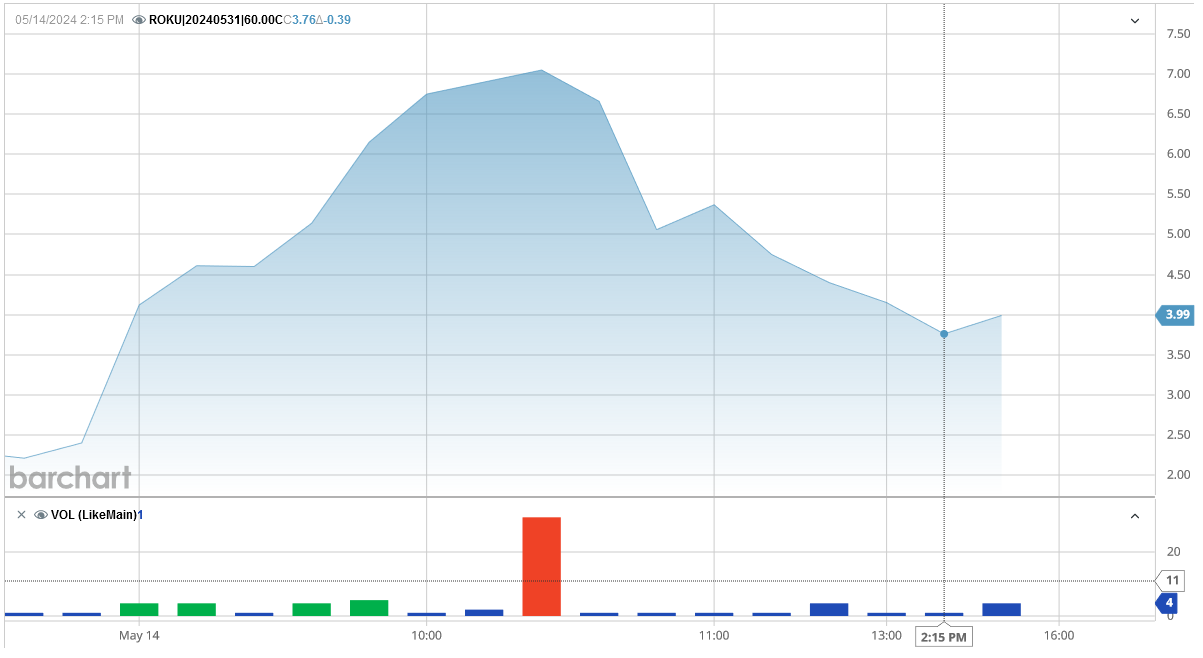

** OPTION TRADE: Buy ROKU MAY 31 2024 60.000 CALLS - price at last close was $3.10 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the ROKU Weekly Options (CALL) Trade on Friday, May 03, 2024 for $2.50.

Sold the ROKU weekly options contracts on Tuesday, May 14, 2024 for $7.25; a potential profit of133%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Roku.....

Roku, Inc., together with its subsidiaries, operates a TV streaming platform. The company operates in two segments, Platform and Player.

Its platform allows users to discover and access various movies and TV episodes, as well as live TV, news sports, shows, and others. As of December 31, 2021, the company had 60.1 million active accounts. It also provides digital and video advertising, content distribution, subscription, and billing services, as well as other commerce transactions, and brand sponsorship and promotions; and manufactures, sells, and licenses smart TVs under the Roku TV name.

In addition, the company offers streaming players, and audio products and accessories under the Roku brand name; and sells branded channel buttons on remote controls of streaming devices.

It provides its products and services through retailers and distributors, as well as directly to customers through its website in the United States, Canada, the United Kingdom, France, Mexico, Brazil, Chile, Peru, North and South Americas, and Europe. Roku, Inc. was incorporated in 2002 and is headquartered in San Jose, California.

Further Catalysts for the ROKU Weekly Options Trade…..

In a press release that dropped on Tuesday, The Trade Desk and Roku announced "a new data-driven TV streaming partnership" to help advertisers plan more effective ad campaigns for streaming viewers. The goal of the partnership is "to leverage Roku Media and audience and behavioral data so that The Trade Desk customers can better understand and optimize their campaigns for TV streaming viewers."

Roku is the top streaming platform in the U.S., with more than 81.6 million households in its fold. Furthermore, the Roku smart TV operating system (OS) is the No. 1 selling TV OS in the U.S. and Mexico and was in roughly 40% of all TVs sold in the first quarter. The company has also been selling its own Roku-branded connected TVs (CTV), further expanding its reach.

"CTV has emerged as one of the most powerful digital advertising channels on the open internet," said Jed Dederick, The Trade Desk's chief revenue officer. "This new partnership with Roku will enable The Trade Desk's clients to put valuable new data insights to work and fully optimize their [advertising] campaigns," he said.

"Matching Roku's reach with the power of The Trade Desk's innovative solutions will unlock new ways for marketers to reach the right TV streaming audiences strategically," said Jay Askinasi, Roku's global media chief.

Other Catalysts.....

Roku reported first-quarter earnings on April 25. Net revenue totaled $882 million, up 19% from a year ago. It posted a net loss, which narrowed to $50.9 million, or 35 cents a share, in the first quarter from $193.6 million, or $1.38 a share a year earlier.

The ongoing losses and cutthroat competition have caused Roku shares to tumble since November, leading analysts to rethink their Roku stock price targets, and Cathie Wood to take action.

“Roku had a very good first quarter, with impressive user engagement driving strong revenue growth and EBITDA (earnings before interest, taxes, depreciation and amortization) that is tracking better than our full-year forecast,” Morningstar analyst Matthew Dolgin said.

“Management tempered expectations a bit for the second half of 2024 but believes it is setting itself up for acceleration in 2025.”

Growth Prospects.....

One of Roku's biggest strengths is its ecosystem. The more viewers it can attract to its platform, the more attractive it becomes to advertisers and the more revenue it can generate. Thankfully, things are still moving in the right direction on that front for the streaming leader. In the first quarter, Roku's streaming accounts grew by 14% year over year to 81.6 million. Streaming hours jumped 23% year over year to 30.8 billion.

Roku streamed a staggering amount of media last year, more than 100 billion hours. If things keep up, it will easily surpass what it accomplished in 2023. With engagement rising in the first quarter, Roku's top and bottom lines also saw healthy growth. The company's revenue of $881.5 million was 19% higher than the year-ago period, while it reported a net loss per share of $0.35, much better than the loss per share of $1.38 recorded in the prior-year quarter.

Roku's strong results point to a continued rebound in the advertising market, which has struggled for some time, and a growing streaming industry. The soaring viewer engagement should boost Roku's ad-spot rates over time.

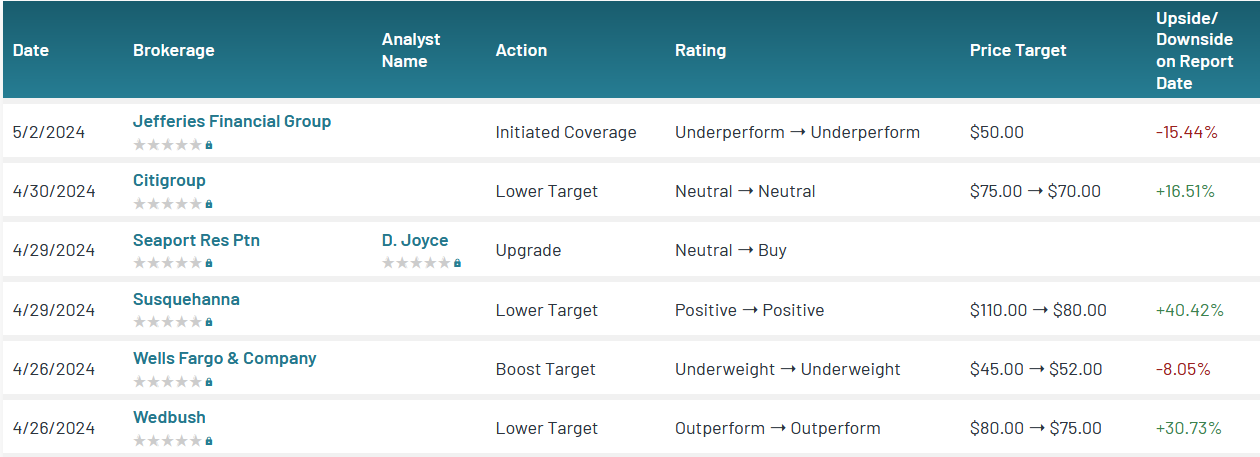

Analysts.....

Benchmark's lowered price target still calls for Roku to jump nearly 90% over the next year as it noted soft second-quarter guidance. However, the analyst also believes Roku is on its way to becoming a must-advertise platform, which makes sense as ad-based streaming subscriptions are climbing rapidly.

Wells Fargo kept its underweight rating on Roku but raised its target price to $52 from $45.

According to the issued ratings of 22 analysts in the last year, the consensus rating for Roku stock is Hold based on the current 4 sell ratings, 9 hold ratings and 9 buy ratings for ROKU. The average twelve-month price prediction for Roku is $82.50 with a high price target of $116.00 and a low price target of $50.00.

Summary.....

Roku still has a lot of upside potential as the underlying consumption metrics continue to grow rapidly, but management needs to do a better job of driving profitability and giving a long-term vision of where the business is headed.

Roku stock's 50-day moving average price is $62.17 and its 200-day moving average price is $78.18. The company has a market capitalization of $8.60 billion, a P/E ratio of -15.02 and a beta of 1.69.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from ROKU

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.