TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Robinhood

Markets Stock Falls After Earnings Report!

but, “Weekly Options” Members are Up 130% Using A Weekly put Option!

Can More Profit Be Expected?

Don’t

Miss Out On Further Profit!

Sunday, January 30, 2022

by Ian HarveyRobinhood Markets stock fell after reporting earnings on Thursday. Shares opened 14% lower Friday after reporting fourth-quarter revenue on Thursday which missed Wall Street analysts' estimates.

But, “Weekly Options USA” Members, Are Up 130% after executing a Weekly Put Option!

Can

More Profit Be Expected?

Don’t Miss Out On Further Profit!

Robinhood Markets Inc (NASDAQ: HOOD)

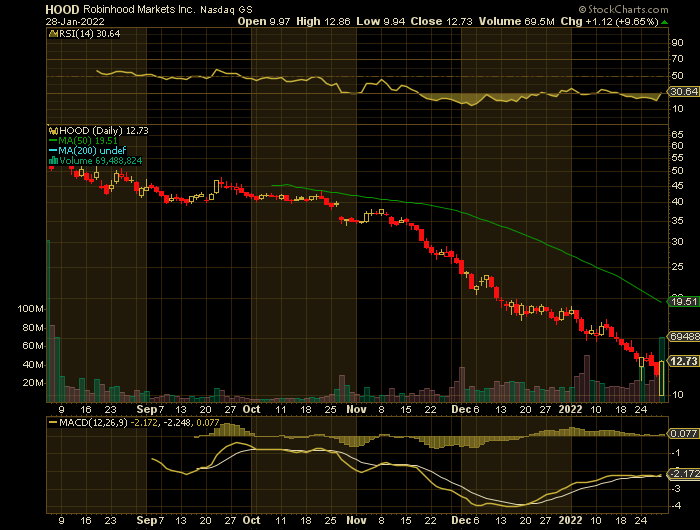

Robinhood Markets Inc (NASDAQ: HOOD) stock has continued to slide due to the bloodbath occurring in the cryptocurrency market. As well, shares of the company, which went public last year, slid further Thursday to new all-time lows before bouncing after missing Wall Street analysts' estimates.

Robinhood stock is still down more than 25% already this year and is about 85% below its record high.

Bitcoin prices, which have started to rebound slightly Moday, had dropped nearly 25% this year and are about 50% below their all-time high from November. That hurts companies like Robinhood Markets which allow traders to buy and sell bitcoin, ethereum and other digital currencies.

Other stocks with ties to cryptocurrencies, such as Square owner Block, Elon Musk's Tesla and software firm MicroStrategy, run by uber-crypto bull Michael Saylor, have all fallen and are off to an abysmal start to 2022 as well.

But the broader market volatility is doubly bad for Robinhood Markets, given that it is primarily known as an app for trading stocks.

But Members Profit More Than 130% in the past week on the Robinhood Markets Trade.....

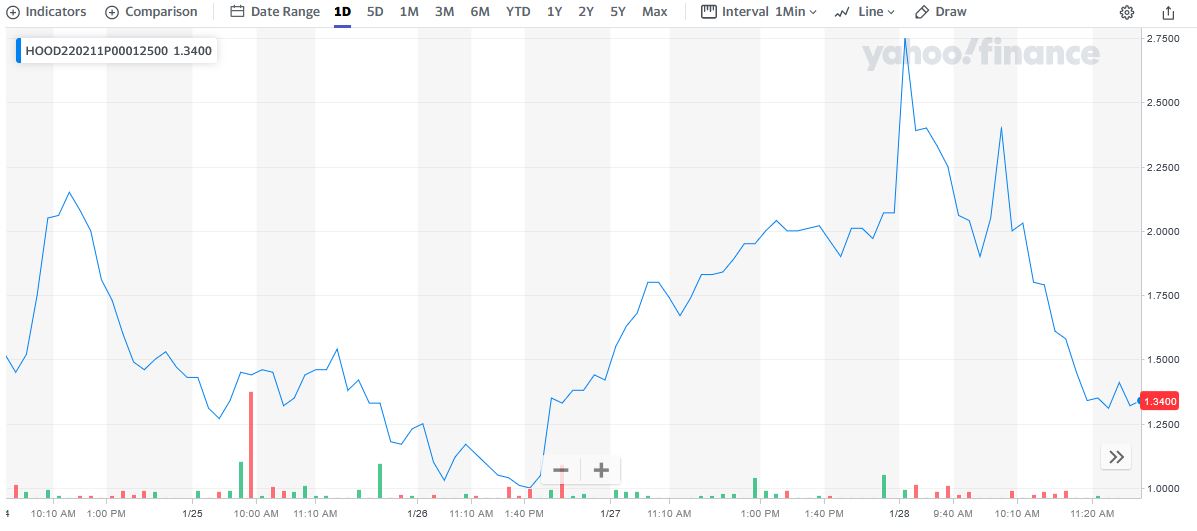

Weekly Options USA Members entered this trade on Tuesday, January 25, 2022.

** OPTION TRADE: Buy HOOD FEB 11 2022 12.500 PUTS - price at last close was $1.43. (adjust accordingly – up to $1.80 OR even market price)

Actually bought for $1.27

Sold Friday, January 28 for $2.83

Potential Profit of 130%.

Why The Profit Was Achieved on Robinhood Markets?

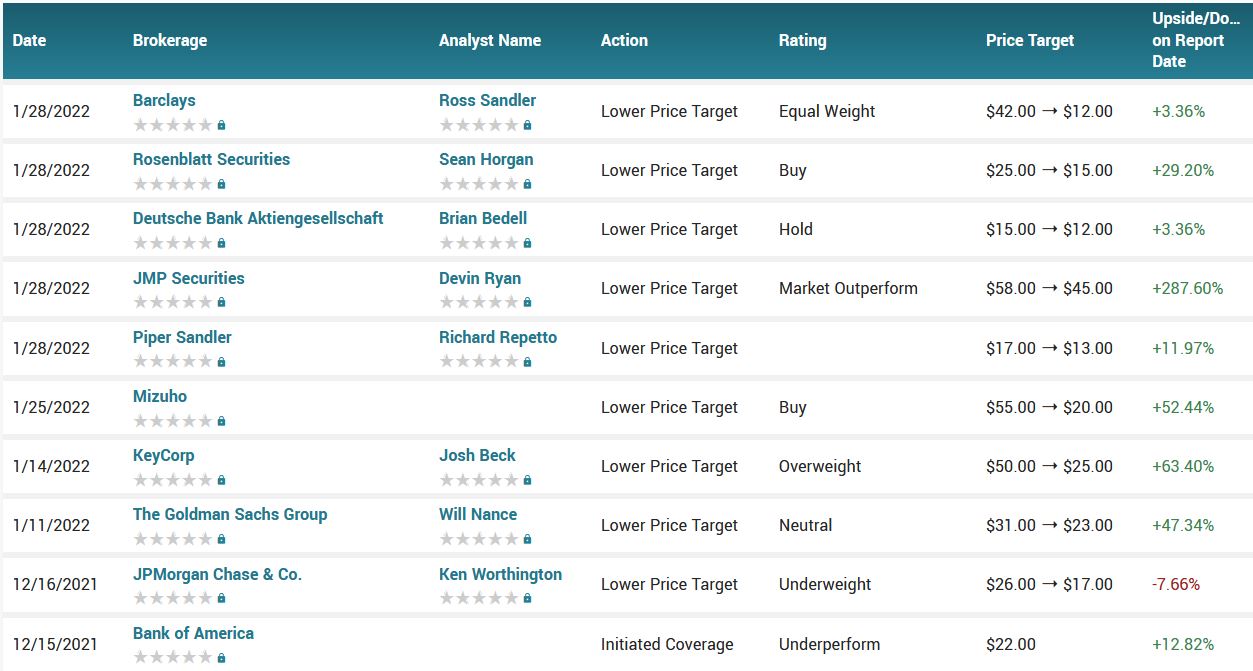

Shares of Robinhood Markets, the disruptive financial brokerage targeting millennials and Gen Z, opened 14% lower Friday after reporting fourth-quarter revenue on Thursday which missed Wall Street analysts' estimates. The company's revenue outlook for the current quarter also came in below expectations. Shares of the commission-fee trading platform declined around 10% in after-hours on Thursday.

The company's revenue outlook for the first quarter of this year also came in below expectations. Robinhood forecasts revenue of $340 million, while Wall Street was projecting $447 million.

About Robinhood ……

On July 28, Robinhood Markets priced 55 million shares at $38 a share, raising $2.1 billion. But the pricing came in at the low end of its expected range. The stock closed the day at 34.82, more than 8% below the IPO price.

The company is known for pioneering commission-free stock trading with no account minimums. The platform allows users to make unlimited commission-free trades in stocks, exchange-traded funds, options and cryptocurrencies. Robinhood ranked among the best online stock brokers in 2021 for Mobile Trading Platforms/Apps and Margin Investing/Interest Rate.

The app is popular among young and first-time investors and traders. Millions of young investors flocked to Robinhood during the meme-stocks trading mania for stocks like GameStop (GME) and AMC Entertainment (AMC). Excitement around cryptocurrencies like Bitcoin also fueled interest in the app.

"While we are only six years into our journey, we have already seen profound transformations in how people think about their money," Chief Executive Vlad Tenev and Chief Creative Officer Baiju Bhatt said in written remarks with the Robinhood IPO filing.

"The next generation of investors is younger and more diverse than ever before and finance is now as culturally relevant as music and the arts," the executives said.

The Major Catalysts for the ROBINHOOD MARKETS Weekly Options Trade….

Robinhood Markets was just one of many companies that saw their shares hit hard in early trading on Monday. Traders and investors are concerned about higher interest rates, which now seem likely amid the highest inflation in years. The U.S. Federal Reserve will begin a two-day meeting on Tuesday that could end with a signal that rates will begin rising as soon as March.

Monthly Users.....

Robinhood Markets will release its fourth-quarter 2021 earnings on January 27.

Given that it's an online trading platform, the majority of Robinhood's revenues come from trade-related transactions. As a result, more monthly users equal more trading activity on the platform, which implies more transaction revenues for Robinhood. For Robinhood, transaction-based revenues are fees gained by routing customer orders for stocks, options, or cryptocurrency to other brokers.

In fact, effective user growth remains the key to Robinhood's success.

Robinhood's website traffic increased in the most recent Q4 quarter, earnings from which have yet to be published. To put things into perspective, total unique visits to Robinhood increased by 18.7% year-over-year to 35.9 million. The increase in visits reflects that Robinhood Markets may be able to deliver good year-over-year top-line results in the Q4 quarter.

However, the data for monthly visitors to Robinhood.com are not particularly encouraging for the month of December. While the company's projected monthly visitation climbed by 0.7% in November, it fell by 17.7% quarter-over-quarter to 10.5 million users in December.

The drop in unique visitors in December is expected to have reduced Robinhood's revenues in the fourth quarter to some extent. Furthermore, Robinhood's key metrics, ARPU (average revenue per user) and MAU (monthly active users), may have declined in the fourth quarter due to the dip in its monthly user base.

Sentiment.....

It’s not all about the figures in the sales. But the reaction can come from what management says about the future. What Wall Street wants to hear is that they are coming into their own. Management also needs to lay out the path forward into a better prosperity. Nobody wants to invest in a stock that has dwindling growth trends, especially a young company like this.

Lock-Up Period.....

Robinhood Markets lock-up period is set to end on Tuesday, January 25th. Robinhood Markets had issued 55,000,000 shares in its public offering on July 29th. The total size of the offering was $2,090,000,000 based on an initial share price of $38.00. After the expiration of Robinhood Markets’ lock-up period, restrictions preventing company insiders and major shareholders from selling shares in the company will be lifted.

Market Setbacks.....

The Dow

Jones Industrial Average at one point fell more than 860 points in Monday's

session, as traders fretted about the outcome of the Fed meeting on Wednesday.

Worries on earnings out of Tesla and Apple this week — and the precarious

situation between Russia and Ukraine — is also hurting sentiment for stocks.

The S&P

500 slipped into correction early on in the session, defined as a 10% decline

from a recent high.

"It certainly is a plethora of pain for investors

this morning. I would be very hesitant of getting in or adding positions in

just about anything before we hear from an increasingly hawkish Federal Reserve

on Wednesday," said The

Strategic Funds managing director Marc LoPresti on Yahoo Finance Live.

As it

stands, the Nasdaq is down 15% so far in 2022, followed by an 11% drop for the

S&P 500 and a 8.1% decline for the Dow.

Inflation.....

Recent sell-offs in tech stocks are mostly tied to inflation, which is at a 40-year high. To prevent a dizzying rise in prices from doing damage to the economy, the Federal Reserve has hinted that it would start raising interest rates this year, and analysts expect the institution to do it at least three times this year, starting in March.

This scenario makes less risky assets, such as Treasury bonds, savings accounts - just as attractive as tech stocks, whose economic model is future growth.

The prospect of better and higher returns on investment from assets judged to be low-risk makes investors less inclined to buy technology stocks that sell promises.

Crowd Following.....

Out of the pandemic, we saw a new breed of traders using the Robinhood Markets platform. Those profits have vanished in the last few months as the Russell 2000 crashed from its highs. With it Robinhood’s stock came down hard. Now it cannot find its footing.

Robinhood Markets won’t share data on actual performance of its customers, but Noah Weidner, writer of the Business As Usual newsletter and now a member of the editorial team at Stocktwit, shows calculations that crowd-following behavior helped them and then hurt them.

The latter outcome was baked into their behavior as influenced by the investing app, according to an academic paper by Brad Barber, Terrance Odean, Xing Huang and Chris Schwarz. They note that inexperienced investors are more likely to be influenced by what they see others doing and that Robinhood’s “Top Movers” are traded disproportionately. And, because trading is so frictionless on the app, they tend not to rely on critical thinking as much as more seasoned investors. They also trade frequently—about 40 times as much per dollar in their accounts compared with a customer of Charles Schwab based on data from early 2020.

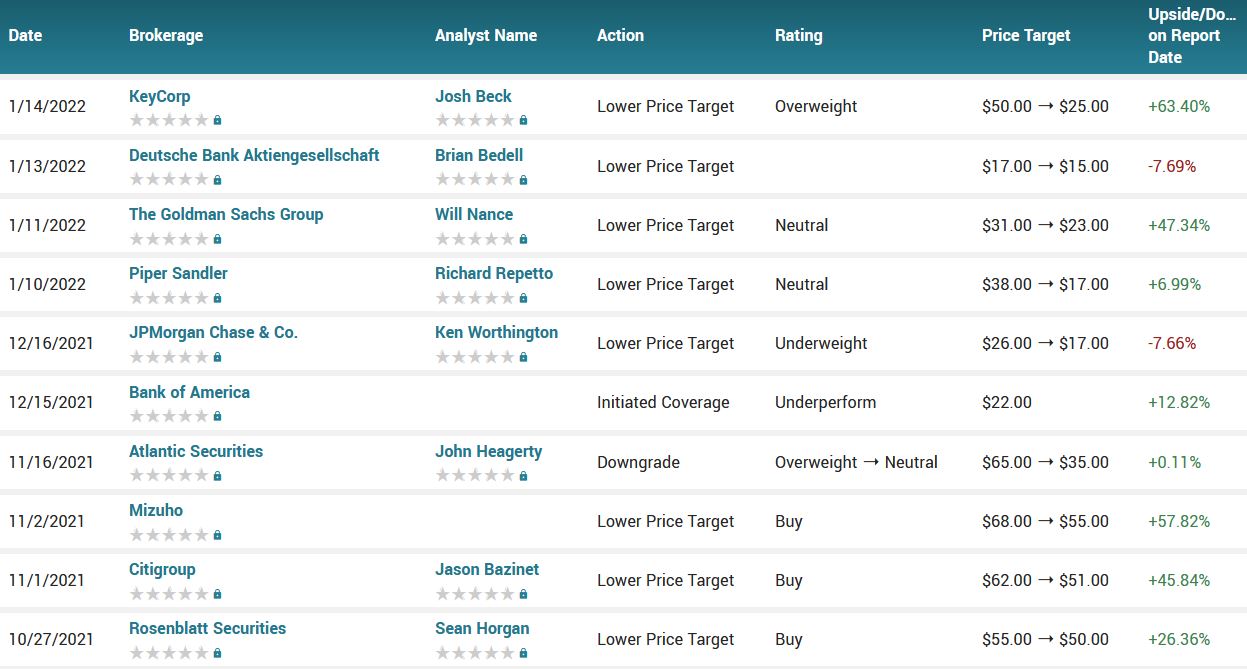

Analysts.....

According to the issued ratings of 14 analysts in the last year, the consensus rating for Robinhood Markets stock is Hold based on the current 2 sell ratings, 6 hold ratings and 6 buy ratings for HOOD. The average twelve-month price target for Robinhood Markets is $37.17 with a high price target of $65.35 and a low price target of $15.00.

Summary.....

The website traffic numbers for Robinhood do not appear to be very impressive for Q4. In addition, the business cautioned during its Q3 earnings conference that seasonal headwinds and lower trading activity might harm the company's fourth-quarter results. The prediction appears to be coming true.

Robinhood still has a substantially large membership; their profit and loss statement is too young to lend any stock support. Total revenues fell dramatically in the third quarter of 2021. This is a concern, because if that happens again, the selling will continue.

Conclusion.....

Despite an overall disappointing report from Robinhood, the stock was well into positive territory by late morning Friday based on unclear factors, but maybe due to.....

- analysts seemed to lean positive on the stock after the report despite the ugly quarter, and

- Robinhood Markets investors who have long rallied around buying the dip in other investments may be doing the same here, especially as the stock does look cheap, down more than two-thirds from its $38 initial public offering price.

However, there's still a lot of uncertainty for the stock!

Updated Chart of Analysts.....

Therefore…..

Another Successful Trade With Robinhood Markets Stock!

Will We Hold For Further Profit?

What Further Robinhood Markets Weekly Trades Will We Recommend?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Robinhood Markets