TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

A Rivian Weekly Put Option Provides 93% Profit In

One Day!

Weekly Options Members

Are Up 93% Potential Profit

Using A Weekly PUT Option!

Rivian Automotive Inc (NASDAQ: RIVN) sank after the electric-vehicle maker announced plans to issue $1.5 billion in convertible debt and reported preliminary third-quarter revenue.

Rivian has been burning through cash to boost production and keep up with market leader Tesla.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 93%, using a RIVN Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, October 06, 2023

by Ian Harvey

Why the RIVN Weekly Options Trade was Originally Executed!

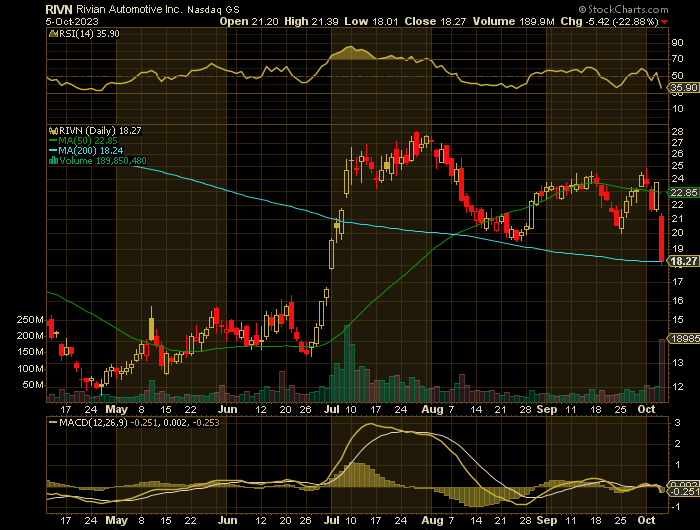

Rivian Automotive Inc (NASDAQ: RIVN) sank in post market trading Wednesday after the electric-vehicle maker announced plans to issue $1.5 billion in convertible debt and reported preliminary third-quarter revenue.

The Irvine, California-based company said in a securities filing that it planned to offer green convertible senior notes due in 2030 as a private offering to qualified institutional buyers. It granted the purchasers an option to buy an additional $225 million.

Rivian also said it expects revenue for the three months ended Sept. 30 in a range of $1.29 billion to $1.33 billion, compared with a $1.3 billion consensus estimate from analysts.

The stock had risen about 29% this year as of the close on Wednesday.

About Rivian Automotive.....

Rivian Automotive, Inc. is an OEM EV manufacturer focused on pickup trucks and SUVs. The company was founded in 2009 and is based in San Jose, California. Rivian is among the greenest of the EV makers choosing to achieve carbon neutrality well ahead of the Paris Climate Accord timeline. Rivian Automotive went public in 2021.

The company designs, develops, manufactures, and sells electric adventure vehicles and accessories through direct sales to consumers and commercial markets. The company vehicles are designed for sustainability and long lifespans across all components with repairability and reusability key to the end result. That includes engineering specifications such as easily removable batteries and batteries that can be easily recycled or repurposed into stationary power packs when their EV lifespan is spent.

The company offers five-passenger pickup trucks and sports utility vehicles under the R1T and R1S labels. The R1T is a highly configurable pickup while the R1S is an off-road capable SUV. The R1T is hailed as the world’s first EV adventure vehicle, it began production in early 2021 and the first deliveries were made later that same year. By mid-2022 the company had delivered more than 8,000 vehicles with production ramping quickly.

The R1T comes with 8 different drive modes geared for offroading, city adventures, and everything in between. Among the choices is the “Drift” mode which proactively distributes power to offset traction control and increase the “fun” factor. The vehicle comes with a 240 to 400-mile range depending on the battery and motor combination and individual driving styles. In regard to its capabilities, the truck can go from 0 to 60 in 3 seconds, tow up to 11,000 pounds, and wade through 3 feet of water with no problems.

The RIVN Weekly Options Trade Explained.....

** OPTION TRADE: Buy RIVN NOV 03 2023 23.000 PUTS - price at last close was $1.45 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the RIVN Weekly Options (CALL) Trade on Thursday, October 05, 2023, at 9:31, for $2.61.

Sold the RIVN weekly options contracts on Thursday, October 05, 2023, at 3:23, for $5.05; a potential profit of 93%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the RIVN Weekly Options Trade…..

The bond issuance, which could dilute the current shareholders’ interests, comes after the company disappointed investors earlier this week by maintaining its full-year guidance for producing 52,000 battery-electric vehicles this year.

Rivian manufactures two consumer models and a plug-in delivery van for Amazon.com Inc., its biggest shareholder. It’s a front-runner in a large pack of startups chasing market incumbent Tesla Inc., but has struggled with supply-chain challenges and a slow ramp since its November 2021 initial public offering.

Rivian plans to release its official financial results for the third quarter on Nov. 7.

The company expects revenue for the three months ended Sept. 30 to be between $1.29 billion and $1.33 billion, compared with nearly $540 million a year earlier. Analysts on average were expecting $1.30 billion, as per LSEG estimates.

Other Catalysts.....

Rivian, like its EV rivals, has been burning through cash to boost production and keep up with market leader Tesla, which has slashed prices amid concerns of softening demand for electric vehicles in the United States.

Rivian's cash balance as of Sept. 30 was estimated to be at $9.1 billion, down from $10.2 billion in June, it said.

The Amazon-backed startup firm beat third-quarter deliveries expectations earlier this week as it ramped up production to meet sustained demand for its pickup trucks and SUVs despite high borrowing costs for consumers.

Analysts.....

According to the issued ratings of 20 analysts in the last year, the consensus rating for Rivian Automotive stock is Moderate Buy based on the current 7 hold ratings and 13 buy ratings for RIVN. The average twelve-month price prediction for Rivian Automotive is $29.65 with a high price target of $44.00 and a low price target of $15.00.

Summary.....

Rivian Automotive has a debt-to-equity ratio of 0.23, a current ratio of 5.66 and a quick ratio of 4.71. The business has a 50 day moving average price of $23.09 and a 200-day moving average price of $18.30. The stock has a market capitalization of $21.15 billion, a P/E ratio of -3.45 and a beta of 1.97. Rivian Automotive, Inc. has a fifty-two week low of $11.68 and a fifty-two week high of $37.39.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from RIVIAN

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.