TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

PulteGroup

Shares Climb Due To Business Boost!

Members Make Potential

Profit of 52%, In 2 Days, Using A

Weekly Call Option!

Executives at PulteGroup, Inc. (NYSE: PHM) say an ongoing lack of housing inventory is boosting their business.

The robust earnings and revenue figures reflect PulteGroup’s strong financial performance during this quarter and highlight its ability to meet and exceed market projections.

And, analysts have a favorable attitude towards PHM.

This set the scene for Weekly Options USA Members Make Potential Profit Of 52%, in 2 days, using a PHM Weekly Options trade!

Join Us and Get Future Trades!

Friday, July 28, 2023

by Ian Harvey

There has been a surge in call options which indicates a bullish sentiment among investors, who are betting on the stock’s upward trajectory.

The robust earnings and revenue figures reflect PulteGroup’s strong financial performance during this quarter and highlight its ability to meet and exceed market projections.

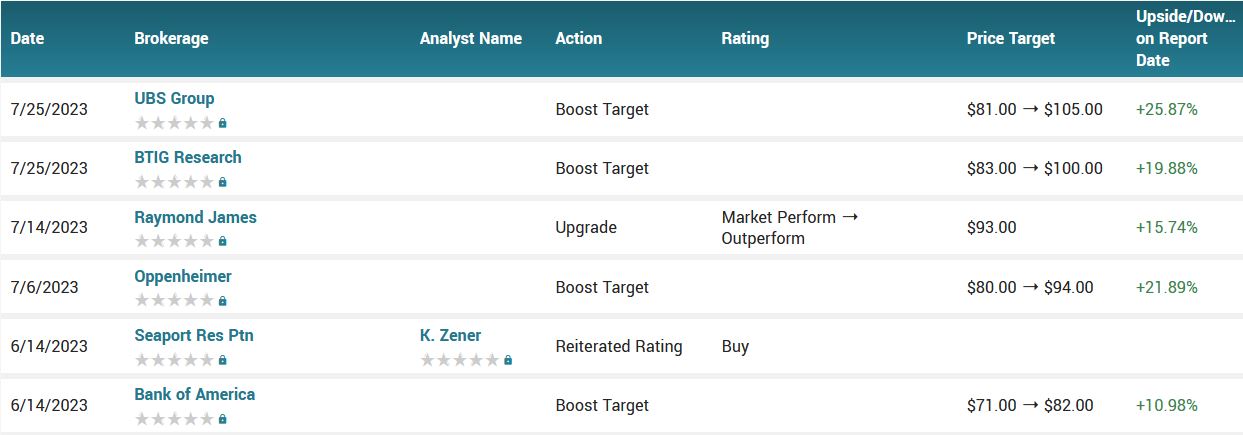

Analysts have a favorable attitude towards PHM…..

- UBS Adjusts PulteGroup Price Target to $105 From $81, Maintains Buy Rating.

- JPMorgan Adjusts PulteGroup's Price Target to $115 From $87, Keeps Overweight Rating.

- Raymond James Adjusts PulteGroup's Price Target to $105 From $93, Keeps Outperform Rating.

- Oppenheimer Adjusts PulteGroup Price Target to $110 From $94, Maintains Outperform Rating.

- BTIG Adjusts Price Target on PulteGroup to $100 From $83, Maintains Buy Rating.

- RBC Adjusts PulteGroup's Price Target to $90 From $68, Keeps Sector Perform Rating.

- Credit Suisse Adjusts PulteGroup's Price Target to $85 From $71, Keeps Outperform Rating.

Why the PHM Weekly Options Trade was Executed?…..

Executives at PulteGroup, Inc. (NYSE: PHM) say an ongoing lack of housing inventory is boosting their business.

PulteGroup saw new orders increase 24% during the three months ending June 30 compared to the same period in 2022, the Atlanta-based homebuilder announced.

Much of the increase is thanks to "move-up" buyers, those who move to upgrade their space, amenities or location. Orders from move-up buyers increased 33%.

"I think that the biggest driver is there's just such a shortage of supply and fewer options for that move-up buyer to choose from," Pulte CEO Ryan Marshall said in a conference call with industry analysts.

The PHM Weekly Options Trade Explained.....

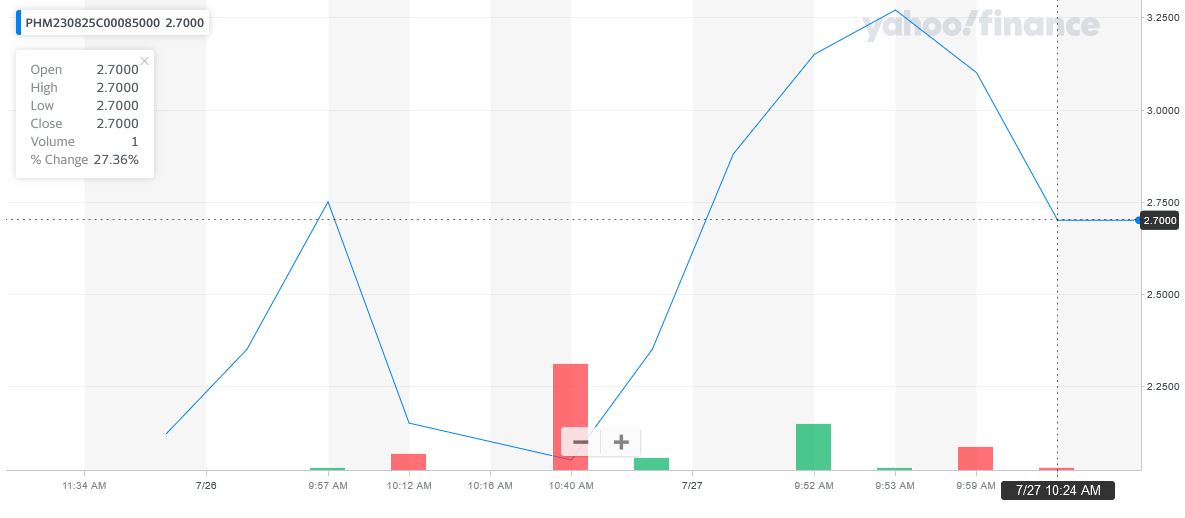

** OPTION TRADE: Buy PHM AUG 25 2023 85.000 CALLS - price at last close was $2.12 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PHM Weekly Options (CALL) Trade on Wednesday, July 26, 2023, for $2.15.

Sold half the PHM Weekly Options contracts on Thursday, July 27, 2023, for $3.27; a potential profit of 52%.

Holding the remaining PHM weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About PulteGroup.....

PulteGroup, Inc., through its subsidiaries, primarily engages in the homebuilding business in the United States. It acquires and develops land primarily for residential purposes; and constructs housing on such land.

The company also offers various home designs, including single-family detached, townhomes, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, American West, and John Wieland Homes and Neighborhoods brand names. As of December 31, 2022, it controlled 211,112 lots, of which 108,848 were owned and 102,264 were under land option agreements.

In addition, the company arranges financing through the origination of mortgage loans primarily for homebuyers; sells the servicing rights for the originated loans; and provides title insurance policies, and examination and closing services to homebuyers.

The company was founded in 1950 and is headquartered in Atlanta, Georgia.

Further Catalysts for the PHM Weekly Options Trade…..

Low housing inventory has been the dominant storyline of the pandemic-era housing market. Dwindling inventory was the catalyst for skyrocketing prices through early last year, and it propped up prices once rising mortgage rates began to impact homebuyer demand. Now, it's fueling sales of newly constructed houses and helping homebuilders rebound from a dismal end to 2022.

Inventory is now hampered by mortgage rates that are hovering between 6% and 7% for 30-year, fixed-rate loans. More than 90% of homeowners with mortgages in the U.S. have rates below 6%, according to a recent report from national brokerage firm Redfin Corp. (Nasdaq: RDFN). Many homeowners are reluctant to sell their houses because their next home purchase would come with a more expensive mortgage.

“High mortgage rates are a double whammy because they’re discouraging both buyers and sellers — and they’re discouraging sellers so much that even the buyers who are out there are having trouble finding a place to buy,” Redfin Deputy Chief Economist Taylor Marr said in the report.

Other Catalysts.....

PulteGroup reported impressive results in second-quarter 2023. Its earnings and revenues surpassed their respective Consensus Estimates and increased year over year. The upside was mainly driven by its solid operating model, which strategically aligns the production of build-to-order and quick-move-in homes with applicable demand across consumer groups.

Backed by its disciplined and balanced business model, the company witnessed solid gross closings, orders and margins in the reported quarter and posted a 12-month return on equity of 32%.

Adjusted earnings per share came in at $3.00, topping the consensus mark of $2.47 by 21.5% and increasing by 9.9% from $2.73 reported a year ago.

Total revenues of $4.19 billion also beat the consensus mark of $3.96 billion by 5.9% and increased 8% from the year-ago figure of $3.88 billion.

Analysts.....

According to the issued ratings of 16 analysts in the last year, the consensus rating for PulteGroup stock is Moderate Buy based on the current 3 hold ratings and 13 buy ratings for PHM. The average twelve-month price prediction for PulteGroup is $76.25 with a high price target of $105.00 and a low price target of $46.00.

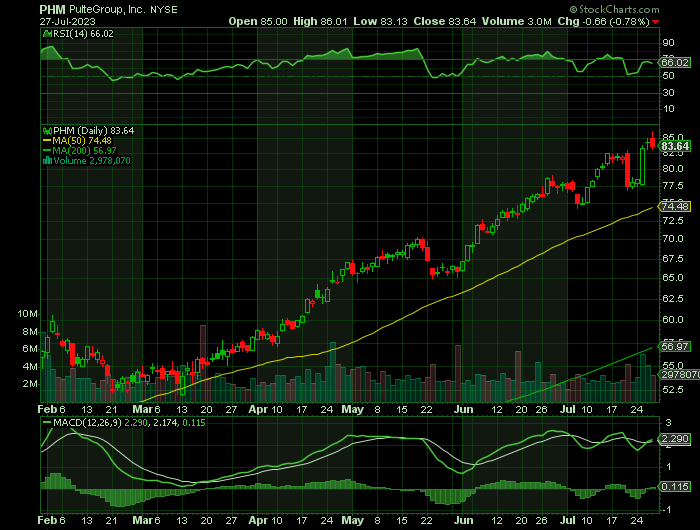

Summary.....

Shares of PHM stock traded up $4.79 during trading on Tuesday, hitting $83.32. 2,688,359 shares of the company were exchanged, compared to its average volume of 2,768,674. PulteGroup, Inc. has a twelve month low of $35.99 and a twelve month high of $83.87. The company has a debt-to-equity ratio of 0.22, a quick ratio of 0.70 and a current ratio of 0.70. The firm has a market capitalization of $18.60 billion, a price-to-earnings ratio of 7.12, and a P/E/G ratio of 0.52 and a beta of 1.36. The business’s 50-day simple moving average is $73.85 and its 200 day simple moving average is $63.18.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from PHM

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.