TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Palo Alto Networks Weekly Call Option

Provides 192% Profit!

Join Us and Get the Trades!

Morgan Stanley analyst Hamza Fodderwala is maintaining an overweight (buy) rating on Palo Alto Networks (NASDAQ: PANW) shares with a $360 price target -- 22% upside from the current share price.

And Palo Alto still has an enormous opportunity to win more spending with existing customers.

The company's upcoming earnings release of Palo Alto Networks EPS is projected at $1.26, signifying a 14.55% increase compared to the same quarter of the previous year.

This set the scene for Weekly Options USA Members to profit by 192% using a PANW Weekly Options trade!

Join Us And Get The Trades – become a member today!

Friday, May 03, 2024

by Ian Harvey

UPDATE

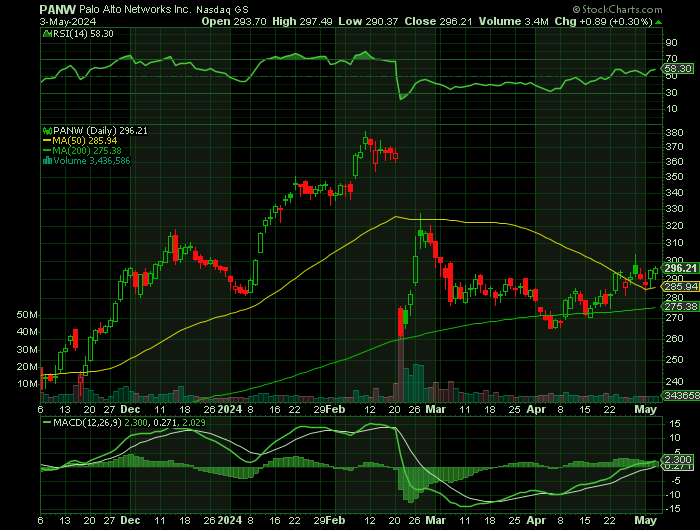

The share price of Palo Alto Networks (NASDAQ: PANW) reached $380 earlier this year but currently sits at $296.21.

The company continues to see strong demand for its cybersecurity solutions, and one analyst believes it's worth buying on the dip.

Morgan Stanley analyst Hamza Fodderwala is maintaining an overweight (buy) rating on the shares with a $360 price target -- 22% upside from the current share price.

Palo Alto's revenue grew 19% year over year in the January-ending quarter, with remaining performance obligations up 22%. But the solid top-line growth was overshadowed by management's guidance that calls for revenue to grow between 13% and 15% in fiscal Q3.

Importantly, this guidance doesn't reflect weak demand. Palo Alto's top 10 highest-spending customers grew their spend by 36% last quarter, and Morgan Stanley's research indicates that Palo Alto is competitively positioned to continue winning large deals.

And Palo Alto still has an enormous opportunity to win more spending with existing customers.

The company's upcoming earnings release of Palo Alto Networks EPS is projected at $1.26, signifying a 14.55% increase compared to the same quarter of the previous year. Simultaneously, the latest consensus estimate expects the revenue to be $1.97 billion, showing a 14.3% escalation compared to the year-ago quarter.

For the full year, the Consensus Estimates project earnings of $5.49 per share and a revenue of $8 billion, demonstrating changes of +23.65% and +16.07%, respectively, from the preceding year.

Now READ the previous article “115% Profit Using A Palo Alto Networks Weekly Option!”

Why the Palo Alto Networks Weekly Options Trade was Originally Executed!

It seems to be the right time is right to move into cybersecurity stocks amid high profile hacking incidents. Also, buzz surrounding artificial intelligence is driving investor interest in cybersecurity stocks. And, federal government spending on cybersecurity should provide a boost in 2024, analysts say.

"Cyber continues to be a top priority for companies, but spend scrutiny remains," said Jefferies analyst Joseph Gallo in a report. "(In a survey) Q1 performance across enterprise and federal was in line with expectations while small- medium-sized businesses surprised to the downside."

Some Wall Street analysts tout cybersecurity stocks with cloud-based platforms as the most likely market share gainers. Many companies aim to consolidate purchasing by buying from fewer security vendors, analysts say.

Palo Alto Networks Inc (NASDAQ: PANW) certainly fits this category, with the latest trading session seeing Palo Alto Networks ending at $275.62, denoting a +1.28% adjustment from its last day's close. The stock outpaced the S&P 500's daily gain of 0.03%. Elsewhere, the Dow saw an upswing of 0.41%, while the tech-heavy Nasdaq appreciated by 0.12%.

Coming into today, shares of the security software maker had lost 4.59% in the past month. In that same time, the Computer and Technology sector lost 0.55%, while the S&P 500 lost 0.9%.

Palo Alto Networks' sustained focus on enhancing product offerings and capabilities is a key driver of its growth trajectory. By continually innovating and expanding its cybersecurity solutions, Palo Alto Networks remains at the forefront of addressing evolving cyber threats and meeting the needs of organizations in an increasingly digital world.

Overall, Palo Alto Networks' relentless pursuit of innovation and strategic partnerships underscore its commitment to providing best-in-class cybersecurity solutions, driving growth and value for customers and shareholders alike.

Palo Alto Networks, in its upcoming earnings release is predicted to post an EPS of $1.26, indicating a 14.55% growth compared to the equivalent quarter last year. Meanwhile, the Consensus Estimate for revenue is projecting net sales of $1.97 billion, up 14.3% from the year-ago period.

PANW's full-year Consensus Estimates are calling for earnings of $5.49 per share and revenue of $8 billion. These results would represent year-over-year changes of +23.65% and +16.07%, respectively.

The Palo Alto Networks Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy PANW MAY 10 2024 290.000 CALLS - price at last close was $5.10 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PANW Weekly Options (CALL) Trade on Wednesday, April 17, 2024 for $5.40.

Sold half the PANW weekly options contracts on Tuesday, April 23, 2024 for $11.60; a potential profit of115%.

Sold the remaining PANW weekly options contracts on Tuesday, April 29, 2024 for $15.75; a potential profit of 192%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Palo Alto Networks.....

Palo Alto Networks Inc is a leading cybersecurity company that provides advanced security solutions to businesses, governments and organizations worldwide. Founded in 2005, Palo Alto Networks has become a market leader in next-generation firewall technology and cloud-based security solutions.

The company's mission is to protect its customers from cyber threats by providing innovative security solutions that are easy to use and deploy. Palo Alto Networks offers various products and services to protect networks, endpoints and cloud-based applications from advanced cyber-attacks.

Palo Alto Networks' flagship product is its Next-Generation Firewall (NGFW) which provides advanced security features such as intrusion prevention, application control and threat prevention. The NGFW is designed to provide real-time visibility and control over network traffic, enabling businesses to detect and prevent cyber-attacks before they cause harm.

In addition to its NGFW product line, Palo Alto Networks offers a range of cloud-based security solutions. Its Prisma Cloud platform provides comprehensive security for cloud-based applications and data. Palo Alto Network has also developed the Cortex XDR platform, which provides endpoint detection and response (EDR) capabilities. This platform allows businesses to detect and respond to cyber threats stopping a hacker before they reach critical infrastructure.

Palo Alto Networks' solutions are trusted by some of the world's largest and most security-conscious organizations, including government agencies, financial institutions and healthcare providers. The company has developed a reputation for delivering innovative and effective security solutions and it has been recognized by industry analysts for its leadership in the cybersecurity market.

Further Catalysts for the PANW Weekly Options Trade…..

Palo Alto Networks, Inc. PANW has unveiled significant advancements in cloud security operations through its Cortex XSIAM platform. The introduction of Cloud Detection and Response capabilities within Cortex XSIAM marks a pivotal moment in cloud security, offering the industry's first security operation center (SOC) platform optimized for cloud environments.

As organizations increasingly transition to the cloud, traditional SOC tools face challenges in addressing cloud-specific threats. Palo Alto Networks’ Cortex XSIAM for Cloud addresses this gap by providing comprehensive cloud security operations through a unified platform. This empowers SOC analysts with real-time monitoring and response capabilities tailored to the nuances of cloud environments.

Other Catalysts.....

The company's commitment to research and development enables it to introduce cutting-edge technologies such as Cortex XSIAM and Cortex XDR. Additionally, Palo Alto Networks' strategic partnerships with leading cloud providers like Google Cloud, Amazon Web Services and Microsoft Azure further bolster its product portfolio. These collaborations enable seamless integration with cloud infrastructure and offer customers enhanced security capabilities tailored to their specific cloud environments.

As organizations increasingly migrate their operations to the cloud, Palo Alto Networks' focus on cloud security solutions positions it well to capitalize on this trend. By offering comprehensive and innovative cybersecurity solutions across on-premises, cloud and hybrid environments, Palo Alto Networks is poised for sustained growth in the cybersecurity market.

Growth Prospects.....

In the latest reported financial results for the second quarter of fiscal 2024, Pao Alto Networks witnessed a year-over-year surge in revenues and non-GAAP EPS of 19% and 39%, respectively. The company’s strong quarterly performance reflects its sustained focus on product innovation, a shift in its business model to subscription-based services, building sales capability, platform integration and continued investments in the go-to-market strategy.

Moving Ahead…..

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Palo Alto Networks' EPS went from US$0.11 to US$7.05 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

Performance Obligations …..

Palo Alto’s remaining performance obligations (RPO) grew by 22% (Q2 2024), while its top-line has attained a boost of 19%. This indicates that Palo Alto is sharply locking future income streams from its current contracts, implying that growth will continue steadily in the upcoming quarters.

Also, Palo Alto emphasized its commitment to promoting client adoption of its integrated cybersecurity solutions while outlining its expedited platformization and consolidation plan. The startup wants to benefit from the cybersecurity market’s move toward platform-based solutions.

Analysts.....

According to the issued ratings of 39 analysts in the last year, the consensus rating for Palo Alto Networks stock is Moderate Buy based on the current 10 hold ratings and 29 buy ratings for PANW. The average twelve-month price prediction for Palo Alto Networks is $314.82 with a high price target of $425.00 and a low price target of $225.00.

Summary.....

Palo Alto Networks traded up $2.87 on Tuesday, reaching $275.02. The company’s stock had a trading volume of 3,626,704 shares, compared to its average volume of 5,653,573. Palo Alto Networks, Inc. has a twelve month low of $176.30 and a twelve month high of $380.84. The stock has a market cap of $88.86 billion, a PE ratio of 42.97, a PEG ratio of 3.80 and a beta of 1.19. The firm’s 50 day moving average is $302.23 and its two-hundred day moving average is $289.99.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Palo Alto Networks

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.