TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Palantir Technologies Weekly Call Option Provides 117% Profit!

Join Us and Get the Trades!

The once-bearish Monness Crespi upgraded Palantir Technologies Inc (NYSE: PLTR) last Friday, boosting its rating from sell to neutral.

With Palantir a week away from announcing its first-quarter results, the timing of the upgrade is noteworthy.

On Monday Palantir Technologies Inc (NYSE: PLTR) reported first-quarter earnings that met analysts’ expectations whilst revenue topped Wall Street targets even though U.S. commercial sales growth slowed.

This set the scene for Weekly Options USA Members to profit by 117% using a PLTR Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, May 07, 2024

by Ian Harvey

UPDATE

On Monday Palantir Technologies Inc (NYSE: PLTR) reported first-quarter earnings that met analysts’ expectations whilst revenue topped Wall Street targets even though U.S. commercial sales growth slowed. The data analytics software maker's revenue guidance for Palantir stock came in slightly above expectations.

For the quarter ended March 31, Palantir earnings using generally accepted accounting principles, or GAAP, were 8 cents a share, up 60% from a year earlier. Revenue rose 21% to $634 million, the software maker said.

Analysts had predicted earnings of 8 cents a share on revenue of $615 million.

Denver-based Palantir said government revenue rose 16% to $335 million, vs. estimates of $322 million in sales. In addition, commercial revenue rose 27% to $299 million, topping estimates of $292 million.

In Q1, U.S. commercial revenue rose 40% compared with 70% in the fourth quarter of 2023. Palantir said it now expects "revenue in our U.S. commercial business to grow 45% or more in 2024 compared with 2023."

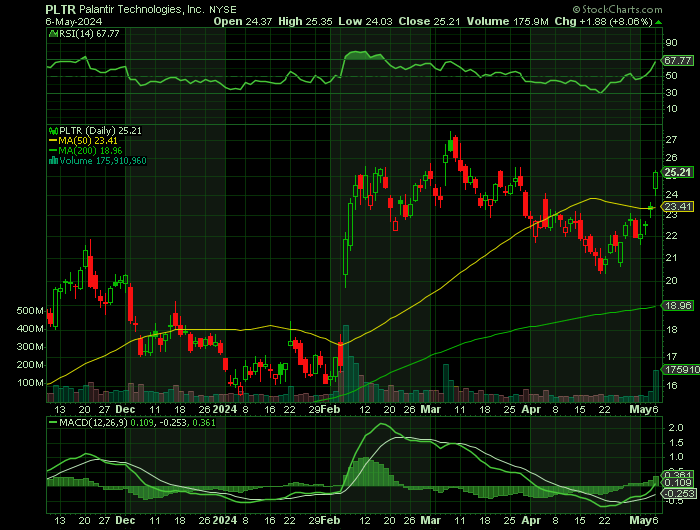

Heading into the Palantir earnings report, shares were up 44% in 2024. Palantir stock has jumped 233% over the past year amid buzz over generative artificial intelligence technology.

Why the Palantir Technologies Weekly Options Trade was Originally Executed!

The once-bearish Monness Crespi upgraded Palantir Technologies Inc (NYSE: PLTR) last Friday, boosting its rating from sell to neutral. With Palantir a week away from announcing its first-quarter results, the timing of the upgrade is noteworthy. The company's execution and government contracts remain spotty, and the stock isn't cheap. But with the shares pulling back in recent weeks, Monness Crespi isn't comfortable going into Palantir's upcoming financial update with a bearish rating.

Palantir, being one of last year's hottest stocks, got off to a strong start through the first two months of 2024. Palantir was nearly a four-bagger in those 14 months, up a wealth-altering 291%. With shares of the software developer for the intelligence community moving lower for the second month in a row, this seems to be an ideal time for this options play.

Momentum is on Palantir's side despite the recent downticks. After three years of decelerating top-line growth, Wall Street pros see the top line accelerating in 2024 because after a long history of serving the the U.S. military and Western allies with its big data analytics, Palantir is gaining ground with private companies. U.S. commercial revenue rose 36% last year, more than double Palantir's overall growth in 2023. That's just a fifth of the revenue mix at Palantir, but it's a segment that could be at the heart of the accelerating revenue in 2024.

The Palantir Technologies Weekly Options Potential Profit Explained.....

** OPTION TRADE: Buy PLTR MAY 24 2024 22.500 CALLS - price at last close was $1.68 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PLTR Weekly Options (CALL) Trade on Thursday, May 02, 2024 for $1.72.

Sold the PLTR weekly options contracts on Monday, May 06, 2024 for $3.73; a potential profit of117%.

(This result will vary for members depending on their entry and exit strategies).

Don’t miss out on further trades – become a member today!

About Palantir Technologies.....

Palantir Technologies Inc. is an SaaS company focused on AI and big data analytics. It was founded in 2003 in Denver, Co by well-known investors Peter Thiel and Stephen Cohen among others. The company’s goal is to augment human intelligence with data-gathering and analytic tools that can change the world for the better. As of 2022, Stephen Cohen, co-founder Alexander Karp, and Peter Thiel were president, CEO, and Chairman respectively.

Originally intended as a tool for the Federal Government, the company has since expanded to serve state and local governments as well as private corporations. The company’s name is based on J.R.R. Tolkien's Lord of the Rings trilogy. The palanteri are indestructible crystal globes used for seeing across great distances.

Today the company builds and deploys solutions for its clients based on three primary offerings. These are Palantir Gotham, Palantir Apollo, Palantir Foundry, and Palantir Metropolis. The goal is to generate alpha, or a competitive advantage, for its clients so they can succeed in a rapidly changing environment.

The company’s core offering is Palantir Gotham. Palantir Gotham was originally intended for the US intelligence community as a counter-terrorism tool but it has since been deployed by state and local governments as well as private enterprises as a global decision-making tool. Users are able to aggregate data from hundreds of inputs and funnel them into a single view for rapid decision-making and execution. The tool, which looks for and analyzes hidden patterns in deep data sets, has been used for “predictive policing” and has drawn some criticism because of it.

Palantir Apollo is an operating system designed to give continuous delivery and deployment of safe, secure Internet access across all operating environments. The system is 1 of 5 recognized by the Department of Defense as a Mission Critical National Security System and used by businesses and organizations for autonomous software deployment. Among its advantages, the system can speed up the development of new software by as much as 50% simply by securing access to sensitive information and networks.

Further Catalysts for the PLTR Weekly Options Trade…..

Expectations are high for Palantir. Analysts see revenue rising 19% to $625.3 million for next week's first-quarter report. They also see Palantir's earnings per share soaring 60% to $0.08. Those are ambitious targets, but reality has been more than up to the task, as Palantir has posted double-digit percentage beats on the bottom line in three of the past four quarters.

The company has an impressive earnings surprise history. Its earnings surpassed the Consensus Estimate in two of the past four trailing quarters and matched twice, delivering an earnings surprise of 10.4% on average.

Other Catalysts.....

The U.S. commercial division of the company is performing well, largely driven by AI-powered operating systems and bootcamps as the primary go-to-market strategy. Revenues for this segment increased 70% year over year in the fourth quarter of 2023, indicating substantial growth in the potential market. Commercial revenues experienced a 32% year-over-year increase. Total revenues rose 20%, and the adjusted operating margin saw a 1200 basis points growth compared to the year-ago quarter.

Growth Prospects.....

Artificial intelligence could eventually be everywhere, but few companies will build their AI applications from the ground up. Palantir Technologies plays a significant role in delivering turnkey applications. It operates three platforms, Gotham, Foundry, and AIP, where custom software can be built and deployed. Palantir built its business with the U.S. government but has since expanded to the private sector. Today, Palantir's revenue is roughly 50-50 split between public and private sectors.

Financially, Palantir is already in great shape. The company is profitable on a generally accepted accounting principles (GAAP) basis and generated $2.2 billion in revenue last year. It generates $697 million in annual free cash flow and has a fortress-like balance sheet with $3.6 billion in cash against zero debt. Again, this is a financially rock-solid business with much growth ahead. These aspects of a stock can create stellar investment returns for years.

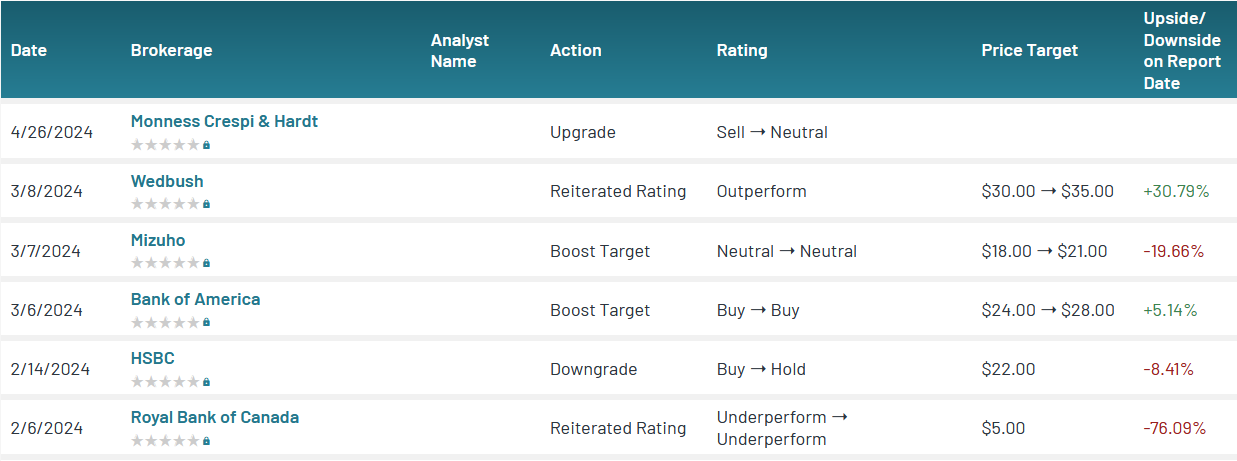

Analysts.....

Dan Ives, analyst at Wedbush is a bull on Palantir. He remains upbeat despite the stock’s impressive past-year run, which sent shares up more than 182%. Recently, Ives hiked his price target on PLTR stock to $35 from $30 over the firm’s growth prospects.

Notably, Ives remarked on the company’s AI abilities, going as far as to call the firm a “launching pad of AI use cases” and the “[Lionel] Messi of AI.” For those unfamiliar with soccer, Messi is one of the greatest players of all time. It’s quite a statement to compare PLTR stock to such a great in the realm of AI.

According to the issued ratings of 12 analysts in the last year, the consensus rating for Palantir Technologies stock is Hold based on the current 3 sell ratings, 6 hold ratings and 3 buy ratings for PLTR. The average twelve-month price prediction for Palantir Technologies is $18.35 with a high price target of $35.00 and a low price target of $5.00.

Summary.....

The stock gained 28% year to date, significantly outperforming the 6.4% rally of the industry it belongs to. PLTR is trading at a forward sales multiple of 16.93X, above its median of 14.38X over the last five years and the industry’s 6.91X.

Palantir Technologies has a fifty day moving average of $23.38 and a 200 day moving average of $20.16. The company has a market capitalization of $48.95 billion, a P/E ratio of 245.81, a P/E/G ratio of 5.60 and a beta of 2.78.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from PALANTIR

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.