TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Palantir

Technologies Inc Hit New Highs On Friday!

Weekly Options Members

Are Up 33% Potential Profit, Already,

Using A Weekly CALL Option!

Still Holding?

Palantir Technologies Inc (NYSE: PLTR) hit new highs on Friday as it continues its post-earnings rally.

The stock soared more than 20% after the data analytics and privacy software company reported higher-than-expected third-quarter earnings and sales on Nov. 2. Management also raised its full-year 2023 revenue guidance.

Shares are up around 218% this year, at new highs.

This set the scene for Weekly Options USA Members to profit by 33%, using a PLTR Options trade!

Join Us And Get The Trades – become a member today!

Saturday, November 18, 2023

by Ian Harvey

Palantir Technologies Inc (NYSE: PLTR) hit new highs on Friday as it continues its post-earnings rally.

The stock soared more than 20% after the data analytics and privacy software company reported higher-than-expected third-quarter earnings and sales on Nov. 2. Management also raised its full-year 2023 revenue guidance.

The company is focused on utilizing AI technology to drive its current earnings and sales growth, with its Artificial Intelligence Platform and its MetaConstellation satellites. PLTR stock is nearing levels it hasn't seen since November 2021.

Shares are up around 218% this year, at new highs.

Why the Palantir Technologies Inc Weekly Options Trade was Originally Executed!

Palantir Technologies Inc (NYSE: PLTR) is a leading software developer that helps organizations analyze massive amounts of data to make better decisions, and has been a clear benefactor from the intense investor interest in artificial intelligence (AI). The stock tripled from last year's lows, but the recent acceleration in revenue and profits makes this options trade applicable.

Like many other tech companies, Palantir experienced slower revenue growth earlier this year amid macroeconomic headwinds. What seemed to be holding the stock back more than anything else was weak profitability. But in early May the stock took off after Palantir said it expected to be profitable each quarter through the end of the year, and it hasn't looked back.

Revenue accelerated in Q3, up 17% year over year. Palantir is getting faster at converting new customers, and it nearly tripled the number of users on its artificial intelligence platform. It's also delivering this growth while still dealing with uncertainty in the economy, but it also expects accelerating growth from its U.S. government business, which is a catalyst.

The growing demand for its software platforms is causing profits to explode, with net income up 157% over the previous quarter. The strong momentum in customer demand could further push profits up and cause the stock to head higher in 2024 and beyond.

The stock has risen more than 130% so far this year. While some of that performance came from entering the year at a historic low, another part has come from strong execution.

The Palantir Technologies Inc Weekly Options Potential Profit Explained.....

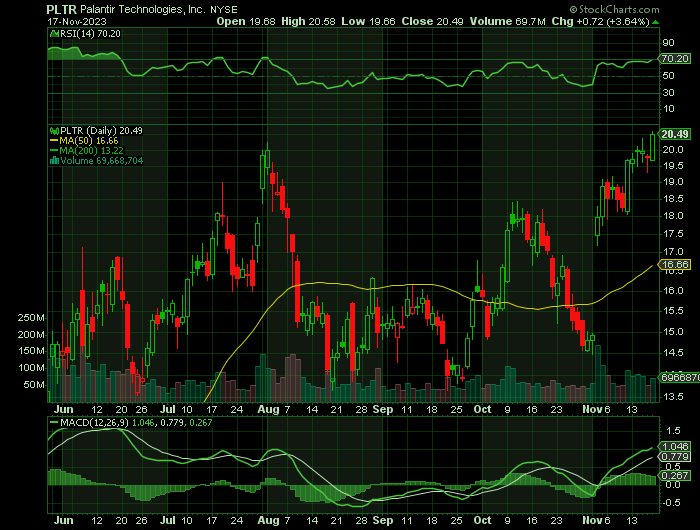

** OPTION TRADE: Buy PLTR DEC 22 2023 20.000 CALLS - price at last close was $1.25 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the PLTR Weekly Options (CALL) Trade on Friday, November 17, 2023 for $1.25.

The PLTR weekly options contracts hit a high Friday, November 17, 2023 at $1.66; a potential profit of33%.

Still holding for further profit!

Don’t miss out on further trades – become a member today!

About Palantir Technologies.....

Palantir Technologies Inc. is an SaaS company focused on AI and big data analytics. It was founded in 2003 in Denver, Co by well-known investors Peter Thiel and Stephen Cohen among others. The company’s goal is to augment human intelligence with data-gathering and analytic tools that can change the world for the better. As of 2022, Stephen Cohen, co-founder Alexander Karp, and Peter Thiel were president, CEO, and Chairman respectively.

Originally intended as a tool for the Federal Government, the company has since expanded to serve state and local governments as well as private corporations. The company’s name is based on J.R.R. Tolkien's Lord of the Rings trilogy. The palanteri are indestructible crystal globes used for seeing across great distances.

Today the company builds and deploys solutions for its clients based on three primary offerings. These are Palantir Gotham, Palantir Apollo, Palantir Foundry, and Palantir Metropolis. The goal is to generate alpha, or a competitive advantage, for its clients so they can succeed in a rapidly changing environment.

The company’s core offering is Palantir Gotham. Palantir Gotham was originally intended for the US intelligence community as a counter-terrorism tool but it has since been deployed by state and local governments as well as private enterprises as a global decision-making tool. Users are able to aggregate data from hundreds of inputs and funnel them into a single view for rapid decision-making and execution. The tool, which looks for and analyzes hidden patterns in deep data sets, has been used for “predictive policing” and has drawn some criticism because of it.

Palantir Apollo is an operating system designed to give continuous delivery and deployment of safe, secure Internet access across all operating environments. The system is 1 of 5 recognized by the Department of Defense as a Mission Critical National Security System and used by businesses and organizations for autonomous software deployment. Among its advantages, the system can speed up the development of new software by as much as 50% simply by securing access to sensitive information and networks.

Further Catalysts for the PLTR Weekly Options Trade…..

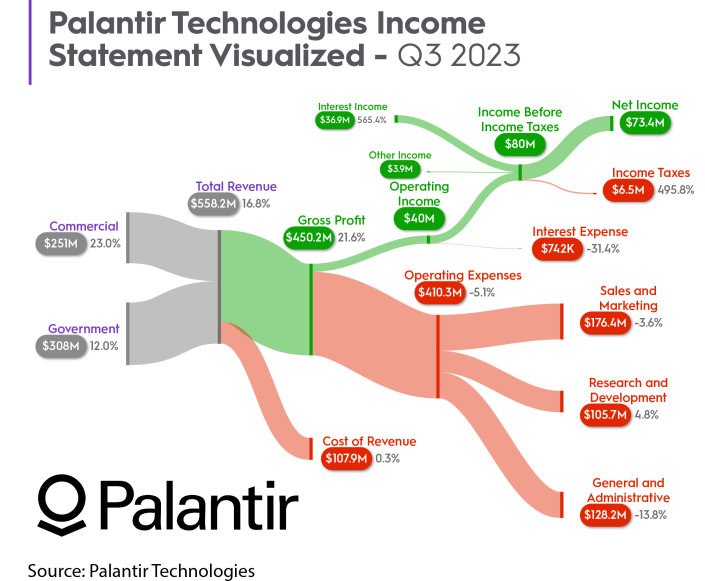

Palantir provides artificial intelligence-powered data analysis in order to help with organizational decision-making. Its business is split into two main parts: commercial and government. While it initially focused on government clients, that area's growth is relatively capped, so pursuing growth on the commercial side is critical. As you can see below, commercial revenue rose 23% in Q3 -- a massive win for Palantir.

Even more impressive was the U.S. segment where commercial revenue grew 33% to $116 million. This is a critical market, and signing new customers is paramount to Palantir's expansion. The company signed 20 new customers in Q3, increasing its total to 181 (up 37% from 132 last year).

Another noteworthy point from Palantir's earnings was that its operating expenses declined 5.1% from last year. Palantir's management is serious about increasing its profitability, and they have recently shown their ability to responsibly grow (or cut) resources when necessary. These improvements helped increase Palantir's operating margin from a 13% loss last year to a 7% profit this year. This helps separate Palantir from other software companies that can't (or don't want to) break even.

Other Catalysts.....

Palantir continues to power AI-assisted decision-making from war zones to factory floors to outer space.

The Denver, Colo.-based company has its hands in a wide range of industries, including defense, intelligence, energy, autos, data protection, health care, retail, semiconductors and more. Commercial and government clients include the likes of Airbus (EADSY), Ferrari (RACE) and the United Kingdom's NHS.

Palantir also offers MetaConstellation, harnessing the power of satellite constellations to empower decision-makers back on earth. MetaConstellation integrates with sensor constellations, optimizing hundreds of orbital, terrestrial, and aircraft sensors, as well as AI models. The platform enables users to ask time-sensitive questions across the entire planet.

The company also operates Palantir AIP, allowing clients to run large language models (LLMs) and other AI technologies safely and securely across their networks. Its Palantir Foundry platform enhances data-driven decision-making and situational intelligence to empower asset and risk management.

Analysts.....

According to the issued ratings of 15 analysts in the last year, the consensus rating for Palantir Technologies stock is Reduce based on the current 6 sell ratings, 6 hold ratings and 3 buy ratings for PLTR. The average twelve-month price prediction for Palantir Technologies is $13.25 with a high price target of $25.00 and a low price target of $5.00.

Summary.....

Palantir Technologies has a market cap of $43.41 billion, a PE ratio of 332.39, a price-to-earnings-growth ratio of 3.46 and a beta of 2.70. The business has a 50 day simple moving average of $16.38 and a two-hundred day simple moving average of $15.20. Palantir Technologies Inc. has a 1-year low of $5.84 and a 1-year high of $20.37.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Palantir

Technologies Inc

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.