TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Oracle

Earnings

Oracle earnings are due on Thursday, December 9, 2021, after the market closes.

expectations for ORACLE Earnings

Wall Street expects a year-over-year increase in Oracle earnings on higher revenues when it reports results for the quarter ended November 2021.

This software maker is expected to post quarterly earnings of $1.11 per share in its upcoming report, which represents a year-over-year change of +4.7%.

Revenues are expected to be $10.21 billion, up 4.2% from the year-ago quarter.

For the last reported quarter, it was expected that Oracle would post earnings of $0.97 per share when it actually produced earnings of $1.03, delivering a surprise of +6.19%.

Over the last four quarters, the company has beaten consensus EPS estimates four times.

About Oracle Corporation (NYSE: ORCL)

Oracle

Corporation (NYSE: ORCL) engages in the provision of products and services

that address all aspects of corporate information technology environments.

It operates

through the following business segments: Cloud and License, Hardware, and

Services. The Cloud and License segment markets, sells, and delivers

applications, platform, and infrastructure technologies. The Hardware segment

provides hardware products and hardware-related software products including

Oracle Engineered Systems, servers, storage, industry-specific hardware,

operating systems, virtualization, management and other hardware related

software, and related hardware support. The Services segment offers consulting,

advanced support, and education services.

The company was founded by Lawrence Joseph Ellison, Robert Nimrod Miner, and Edward A. Oates on June 16, 1977 and is headquartered in Austin, TX.

Influencing Factors for ORACLE Earnings

Oracle’s Cloud.....

Accelerated digital transformation along with the continuation of remote work and mainstream adoption of hybrid/flexible work model has likely helped drive demand for Oracle Cloud Infrastructure (OCI) services as well as the company’s other cloud-based applications.

In the last reported quarter, Oracle’s Cloud services and license support revenues (nearly 76% of total revenues) increased 6% year over year (up 5% at cc) to $7.371 billion.

SaaS, Iaas and PaaS.....

Strength in Oracle’s software-as-a-service (SaaS), infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) products will have influenced the future of Oracle earnings.

In the last

reported quarter, management noted that the company’s IaaS and SaaS business

now accounted for 25% of total quarterly revenues with an annual run rate of

$10 billion.

Fusion Human

Capital Management.....

Continued momentum in back-office cloud-based Fusion Human Capital Management (“HCM”) solutions along with NetSuite Enterprise Resource Planning (“ERP”) and Fusion ERP applications will affect the direction of the future of Oracle earnings.

The migration of several large-scale SAP clients to Oracle Fusion ERP cloud and

increasing deal wins in several verticals especially banking and healthcare may

affect future growth.

NetSuite ERP and Fusion ERP cloud revenues were up 28% and 32%, respectively,

in the first quarter of fiscal 2022.

Other Factors To Help Determine Oracle Earnings.....

- The robust adoption of Oracle’s next-generation autonomous database and Oracle Dedicated Region Cloud, supported by machine learning (ML) and Artificial Intelligence (AI) capabilities.

- Strength in the Oracle Fusion Cloud Supply Chain & Manufacturing (SCM) solution, integrated with new capabilities that help companies foster innovation and improve decision making.

Expenses and Competition....

These are a concern as they will affect Oracle earnings ----

- Oracle is suffering from higher expenses on product development, especially increased investment toward cloud platform, might have dented fiscal second-quarter performance, and

- Intense competition in the cloud computing market from the likes of Amazon Web Services, Azure platform and Google Cloud might have also limited margin expansion.

New Additions That May Help Oracle Earnings....

In August 2021, Oracle introduced the MySQL Autopilot feature for its MySQL Heatwave service at no added costs to the Heatwave clients. MySQL Heatwave is an in-memory query accelerator belonging to Oracle’s MySQL Database service.

Also, Oracle’s latest Exadata Cloud@Customer service offering is gaining considerable traction among on-premises clients. Higher customer acquisitions which includes independent software vendors (ISVs), is also likely to have helped the expected Oracle earnings.

Institutional Investors....

Bowling

Portfolio Management LLC cut its holdings in shares of Oracle by 0.7% during

the 3rd quarter, according to its most recent Form 13F filing with the SEC. The

institutional investor owned 53,719 shares of the enterprise software

provider’s stock after selling 353 shares during the quarter. Oracle accounts for

approximately 1.1% of Bowling Portfolio Management LLC’s holdings, making the

stock its 16th biggest holding. Bowling Portfolio Management LLC’s holdings in

Oracle were worth $4,681,000 at the end of the most recent quarter.

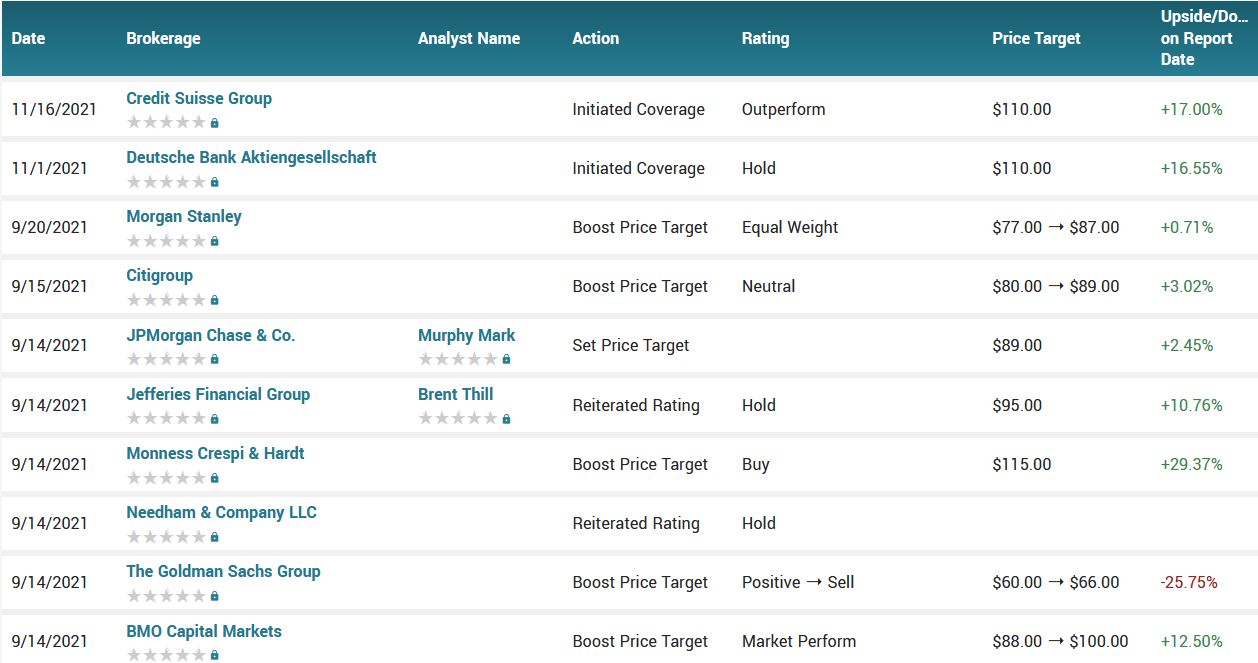

Analyst Thoughts about Oracle Earnings....

According to the issued ratings of 26 analysts in the last year, the consensus rating for Oracle stock is Hold based on the current 2 sell ratings, 16 hold ratings and 8 buy ratings for ORCL. The average twelve-month price target for Oracle is $84.96, indicating a potential downside of 3.72%, with a high price target of $115.00 and a low price target of $54.00.

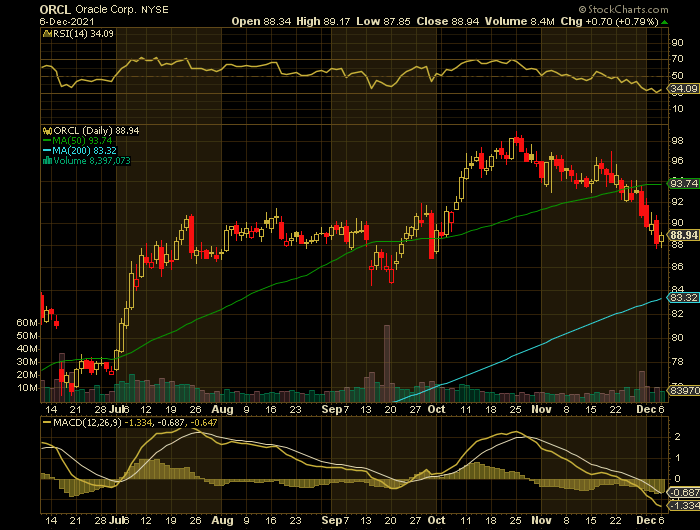

Summary.....

Oracle has a market capitalization of $241.78 billion, a price-to-earnings ratio of 18.73, a PEG ratio of 2.73 and a beta of 0.81. The company has a 50-day moving average price of $93.89 and a two-hundred day moving average price of $88.33. Oracle Co. has a one year low of $58.22 and a one year high of $98.95. The company has a debt-to-equity ratio of 12.77, a current ratio of 2.04 and a quick ratio of 2.04.

FINALLY.....

To see what we are proposing for Oracle Earnings CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from Oracle Earnings

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.