TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

ON Semiconductor Stock Making Waves

Upwards!

Weekly Options Members

Are Up 100% Potential Profit

Using A Weekly Call Option!

ON Semiconductor Corp (NASDAQ: ON), the auto and industrial chip specialist, could see accelerating growth and profit expansion in the near future.

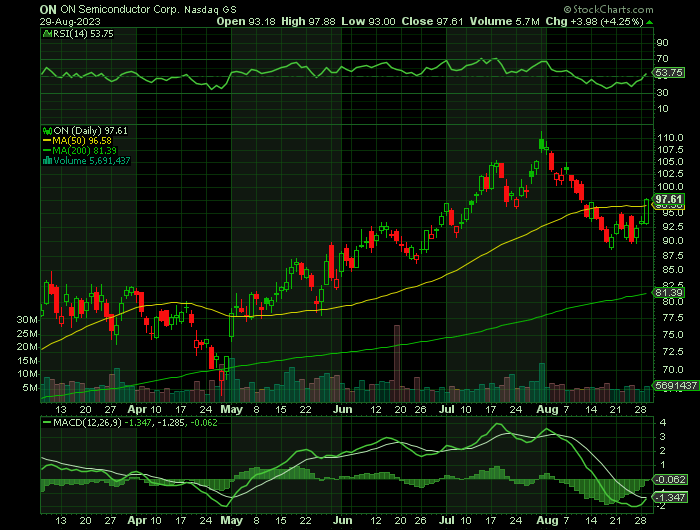

ON Semiconductor has been making waves in the stock market with a daily gain of 4.25%, and a 3-month gain of 12.73%. As well, it’s Earnings per Share (EPS) stands at 4.37.

The stock is up more than 50% this year.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 100%, using an ON Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, August 30, 2023

by Ian Harvey

ON Semiconductor Corp (NASDAQ: ON) has been making waves in the stock market with a daily gain of 4.25%, and a 3-month gain of 12.73%. As well, it’s Earnings per Share (EPS) stands at 4.37.

Technology-focused investors are excited about ON Semiconductor's silicon carbide technology. Industrial-focused investors are very interested in the company's focus on growing its intelligent power and sensing technology in key end markets like automotive (with a heavy focus on electric vehicles, or EVs) and industrial automation.

These end markets definitely make ON Semiconductor not the usual semiconductor conductor with heavy exposure to highly cyclical markets like consumer electronics.

The growth in EVs and industrial automation not only affords the company exciting secular growth markets but also offers an opportunity to expand revenue as these technologies use substantially more ON Semiconductor content.

ON Semiconductor exhibits strong financial health and profitability. Its growth ranks better than 72.4% of 768 companies in the Semiconductors industry.

Why the ON Weekly Options Trade was Originally Executed!

ON Semiconductor Corp (NASDAQ: ON), the auto and industrial chip specialist, could see accelerating growth and profit expansion in the near future.

While the stock is up more than 50% this year, it pulled back recently after its earnings report, and amid the general tech sector sell-off.

ON Semiconductor became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain.

The ON Weekly Options Trade Explained.....

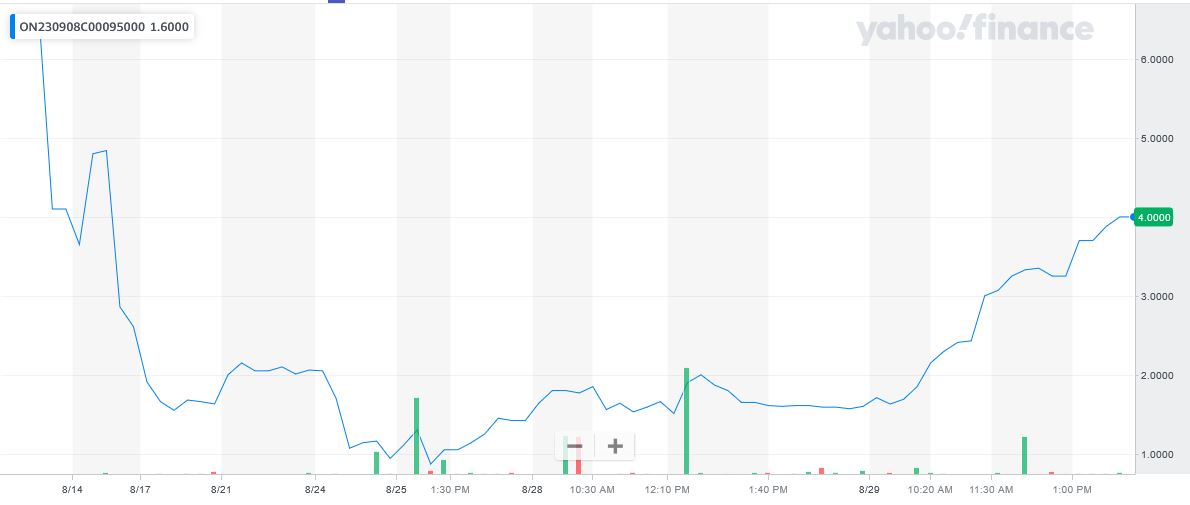

** OPTION TRADE: Buy ON SEP 08 2023 95.000 CALLS - price at last close was $1.63 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the ON Weekly Options (CALL) Trade on Monday, August 21, 2023, for $2.00.

Sold the ON weekly options contracts on Tuesday, August 29, 2023 for $4; a potential profit of 100%.

Don’t miss out on further trades – become a member today!

Further Catalysts for the ON Weekly Options Trade…..

There are potential catalysts on the horizon that could propel results skyward.....

Silicon carbide (SiC) is set for blockbuster growth in the years ahead. A material with high heat resistance and conductivity SiC is perfect for electric vehicles and infrastructure. Only a handful of players are investing in the novel material today in a big way and these companies could be set for big profits a few years out. One is On Semiconductor.

ON has probably been the fastest to ramp up its own SiC chip output. It was able to convert its existing fabs and expand them to accommodate SiC, rather than having to build entirely new fabs from scratch, as, say, Wolfspeed is doing.

Since SiC chips are ramping up in earnest and are somewhat complex to make, SiC margins are currently lower than the company's overall gross margins. However, that will eventually change, and ON's second quarter showed notable progress on that front.

In the second quarter, ON's SiC revenue grew a whopping fourfold over the prior-year quarter, while SiC gross margins doubled quarter over quarter. Importantly, Q2 also marked the first profitable quarter for the SiC business, achieving a "high-teen" operating margin even with startup costs factored in. That's quickly making progress toward ON's total 32.8% adjusted (non-GAAP) operating margin last quarter, which itself was dragged down because that very SiC revenue made up a larger part of the business.

However, ON eventually expects SiC revenue to exceed the company average, helping On reach its longer-term goal of 53% gross margins, up from 49.2% in 2022, along with operating margins of 40% by 2027.

Investors should expect SiC revenue to grow aggressively, as ON booked $3 billion of silicon carbide revenue under long-term service agreements (LTSAs) in the second quarter alone, bringing the lifetime total for SiC LTSAs to $11 billion. For reference, ON made $8.3 billion in total revenue last year.

In addition, several customers have even made pre-payments under some of that LTSA total, further de-risking that future revenue. And on the conference call with analysts, CFO Thad Trent said he expects SiC margins to be at the corporate average by the end of the year.

Other Catalysts.....

ON hasn't positioned itself as an AI stock, rather concentrating on the attractive automotive and industrial chip markets. But power efficiency isn't just a theme for electric vehicles and infrastructure; it's also important to AI servers, which suck up huge amounts of energy.

At its March Analyst Day, management put forward the prospect of increasing content in AI servers in the future, and it provided more color on the second-quarter call. Even though it doesn't make AI processors, accelerators, or high-capacity memory that will be in high demand, On does produce controllers, power converters, and e-fuse protection devices that can also be used in data center servers.

When asked on the recent conference call, CEO Hassane El-Khoury noted:

“... part of that focus on what we call driver and controllers is the server or the cloud infrastructure, which applies definitely to AI. [T]hat's the play we have there. ... We're going to -- we decided, we're doubling down, we're starting to run, and we're going to start delivering on that. That's going to be the winning formula for this new business also. So stay tuned for more updates as we get into Q4 or Q1 of '24.”

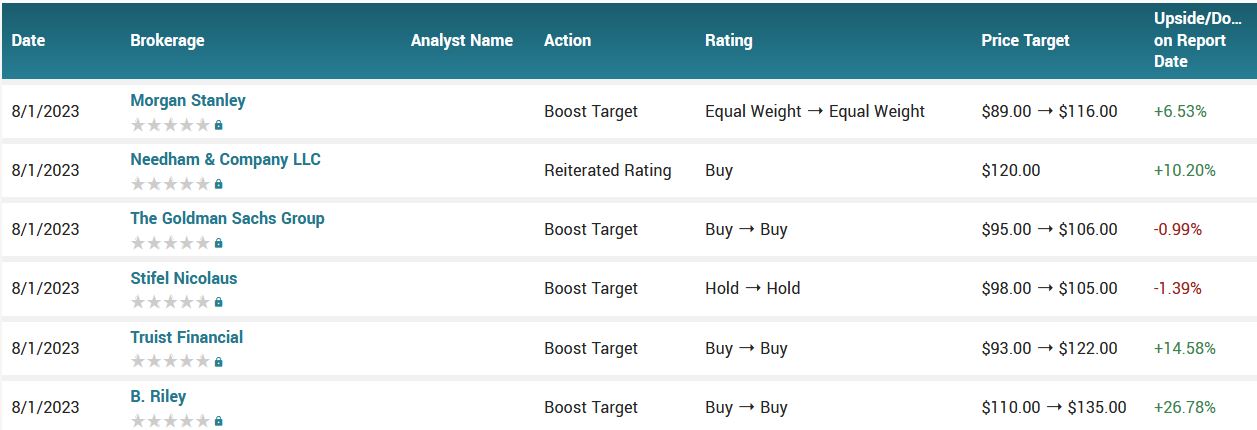

Analysts.....

According to the issued ratings of 27 analysts in the last year, the consensus rating for ON Semiconductor stock is Moderate Buy based on the current 9 hold ratings and 18 buy ratings for ON. The average twelve-month price prediction for ON Semiconductor is $109.31 with a high price target of $135.00 and a low price target of $65.00.

Summary.....

The company has made an impressive turnaround over the past few years under the activist investor-installed El-Khoury, and that transition continues.

Since the company's transformation is still in progress and the auto and industrial power chip segments are in relatively early stages of growth, On's stock looks attractive at around 18.5 this year's earnings estimates.

ON Semiconductor has a fifty day simple moving average of $96.40 and a two-hundred day simple moving average of $85.75. The company has a current ratio of 2.39, a quick ratio of 1.60 and a debt-to-equity ratio of 0.37. The company has a market cap of $39.54 billion, a price-to-earnings ratio of 21.09, and a price-to-earnings-growth ratio of 2.44 and a beta of 1.75. ON Semiconductor Corporation has a 12-month low of $54.93 and a 12-month high of $111.35.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from ON SEMICONDUCTOR

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.