TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Occidental

Petroleum Shares Are Starting To Climb!

AND, Members Make

Potential Profit of 84%,

Using A Weekly CALL Option!

On June 29, after the purchase of 2.1 million Occidental Petroleum Corporation’s shares, Berkshire Hathaway now owns 25% of the company.

It is a growing belief that oil prices will rally, given the correlation between crude prices and oil company stock prices, and buying the dip in Occidental Petroleum is a reasonable assumption. That's a fairly widely held view among oil market forecasters these days.

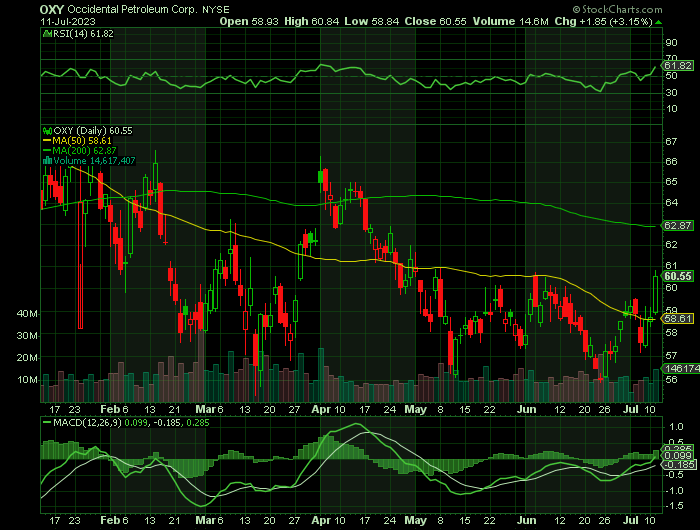

Since taking the weekly call trade on OXY there has been a steady jump in share price.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 84%, using an OXY Weekly Options trade!

Join Us And Get The Trades – become a member today!

Tuesday, July 11, 2023

by Ian Harvey

Buffett is buying the dip in Occidental Petroleum Corp (NYSE: OXY) because he believes oil prices will rally. That's not wild speculation, given the expectation that oil demand will soon rise past supplies.

The U.S. Energy Information Administration (EIA) recently published its short-term energy outlook. In that report, the EIA noted that OPEC plans to keep a lid on global production through next year. Meanwhile, the EIA sees global liquid fuel consumption increasing by 1.6 million barrels per day (BPD) this year and growing by another 1.7 million BPD in 2024.

With demand growing while OPEC holds back supplies, consumption should outpace supplies during the second half of the year, drawing down oil storage levels. This outlook led the EIA to conclude, "We expect these draws will put some upward pressure on crude oil prices, notably in late-2023 and early 2024. We forecast the Brent crude oil spot price will average $79 per barrel (b) in the second half of 2023 (2H23) and $84/b in 2024." That's above the recent price in the mid-$70s.

Here is what Smead Capital Management had to say about Occidental Petroleum Corporation in its Q3 2022 investor letter.....

“Our top-performing stocks in the quarter includes Occidental Petroleum (NYSE:OXY). Oil and gas have been the best game in the stock market town this year and it was a pleasant surprise to see home builders pick up even with dour news on interest rates and the economy. For the first three quarters of the year, we should change the name of our fund to the Jed Clampett Fund. Occidental Petroleum (NYSE:OXY), was one of the standouts. Up through the bear market came a “bubblin’ crude!”

Why the OXY Weekly Options Trade was Originally Executed!

Warren Buffett's Berkshire Hathaway disclosed in a filing late Wednesday that it purchased an additional 2,138,250 shares of Occidental Petroleum Corp (NYSE: OXY). Buffett's Berkshire acquired the additional shares between June 26 and June 28 for about $122.1 million. Berkshire's total ownership now stands at 224.1 million shares. The most recent purchase boosts Berkshire's stake in Occidental to more than 25% of outstanding shares.

Buffett's involvement with OXY began almost three years ago when Berkshire funded Occidental's takeover of Anadarko with $10 billion in equity. Buffett's company then began acquiring a stake in the oil company last year around the time when Russia invaded Ukraine, and the price of oil was rising.

At Berkshire's annual meeting on May 6, Buffett was full of praise for the oil company and its management. Notably, Buffett said that Berkshire had no plans to take control of the company. He said, "We're not going to buy control," and added, "We've got the right management running it."

After boosting its ownership stake from 23.7% to 25.1% in OXY, Buffett's Berkshire further cements its spot as the largest shareholder of OXY.

Since Buffett first began buying Occidental shares in early March 2022, the stock has risen over 53%. During that same period, the SPDR S&P 500 ETF Trust NYSE: SPY has risen close to 1.25%.

The OXY Weekly Options Trade Explained.....

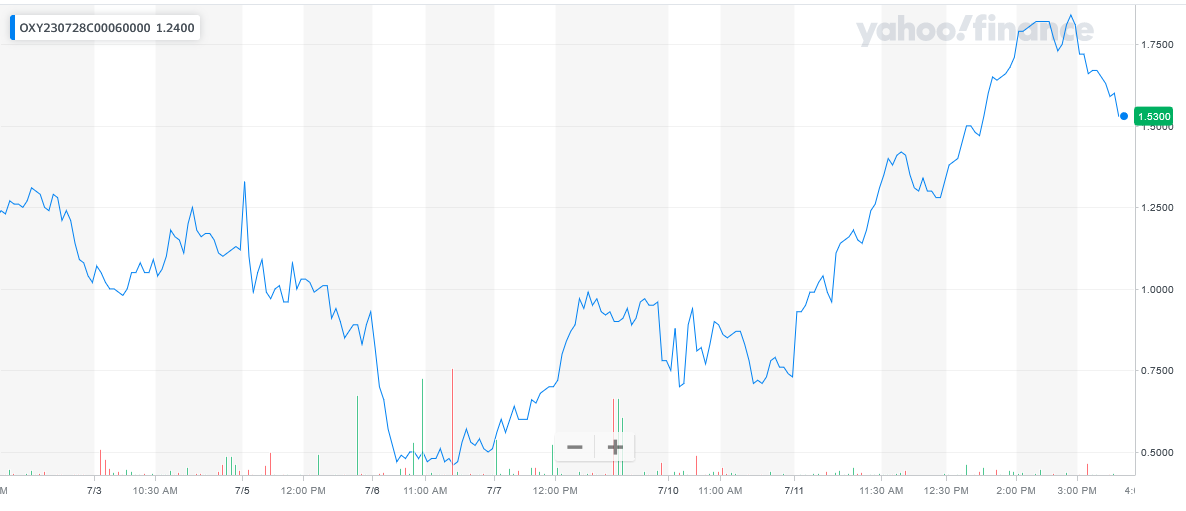

** OPTION TRADE: Buy OXY JUL 28 2023 60.000 CALLS - price at last close was $1.02 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the OXY Weekly Options (CALL) Trade on Monday, July 03, 2023, for $1.00.

Sold half the OXY weekly options contracts on Tuesday, July 11, 2023, for $1.84; a potential profit of 84%.

Holding the remaining OXY weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

Further Catalysts for the OXY Weekly Options Trade…..

Buffett's solid assessment of the company's management team, specifically in the leadership positions of OXY, is a crucial factor to keep in mind for investors. Occidental's valuation is also appealing, trading at a forward price-to-earnings ratio of approximately 12.09.

The demand for oil and gas is expected to rise in the upcoming years. This presents a significant opportunity for Occidental, particularly considering its substantial carbon capture and sequestration investments. Notably, the company focuses on direct air capture facilities, which extract carbon from the atmosphere.

Buffett's continued interest in Occidental is a positive factor, as he perceives the stock favorably and continues to add to Berkshire's already significant position.

Other Catalysts.....

The thesis behind higher energy commodity prices is twofold. First, there's Russia's invasion of Ukraine, which began in February of last year and has no clear end date. This ongoing war is clouding European energy supply needs.

The other catalyst for higher oil and gas prices is the COVID-19 pandemic, which reduced capital expenditures (capex) from global energy majors for the past three-plus years. Lower capex makes it tougher to quickly increase the supply of oil and natural gas. When the supply of a commodity is tight or constrained, it's not uncommon for the spot price of that commodity to find plenty of support or head higher.

Among integrated energy companies, few generate a higher percentage of their revenue from drilling than Occidental Petroleum. Even though the company does operate chemical plants, which can somewhat hedge crude oil price weakness, Occidental is among the most-sensitive oil stocks with regard to swings in the spot price of West Texas Intermediate (WTI) crude oil.

Insider Activity.....

Major shareholder Berkshire Hathaway Inc acquired 993,494 shares of the company’s stock in a transaction dated Monday, May 15th. The shares were purchased at an average price of $58.46 per share, for a total transaction of $58,079,659.24. Following the completion of the acquisition, the insider now owns 213,872,911 shares of the company’s stock, valued at $12,503,010,377.06.

Over the last 90 days, insiders have purchased 6,469,323 shares of company stock worth $376,269,362. Company insiders own 0.31% of the company’s stock.

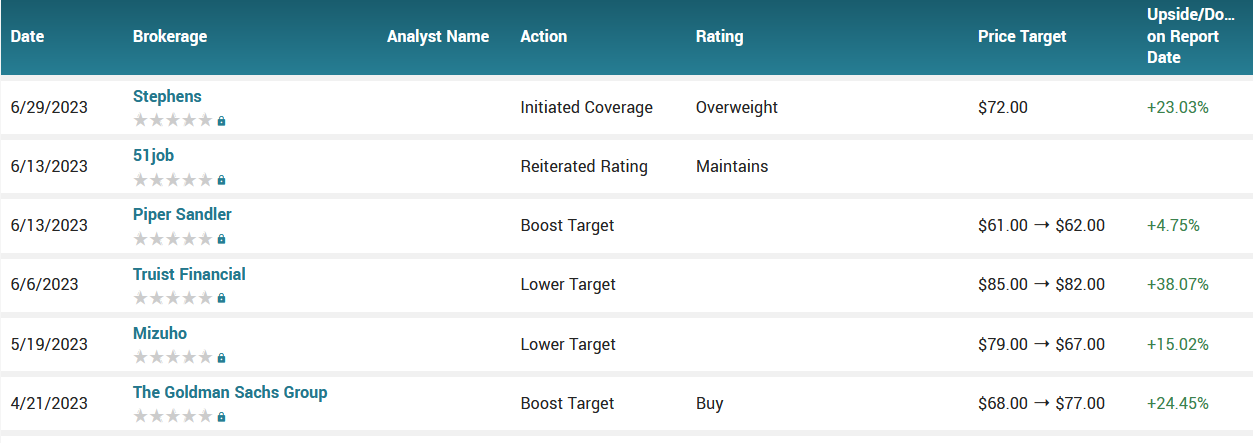

Analysts.....

Stephens started coverage on shares of Occidental Petroleum in a research note released on Thursday morning. The firm issued an overweight rating and a $72.00 price objective on the oil and gas producer’s stock.

According to the issued ratings of 21 analysts in the last year, the consensus rating for Occidental Petroleum stock is Hold based on the current 2 sell ratings, 10 hold ratings, 8 buy ratings and 1 strong buy rating for OXY. The average twelve-month price prediction for Occidental Petroleum is $70.29 with a high price target of $82.00 and a low price target of $60.00.

Summary.....

Occidental Petroleum has a market cap of $52.43 billion, a PE ratio of 6.74, a price-to-earnings-growth ratio of 0.55 and a beta of 1.78. The firm’s fifty day moving average is $58.88 and its 200-day moving average is $61.28. The company has a debt-to-equity ratio of 0.96, a quick ratio of 0.78 and a current ratio of 1.09. Occidental Petroleum Co. has a 52 week low of $55.51 and a 52 week high of $77.13.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from OXY

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.