TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

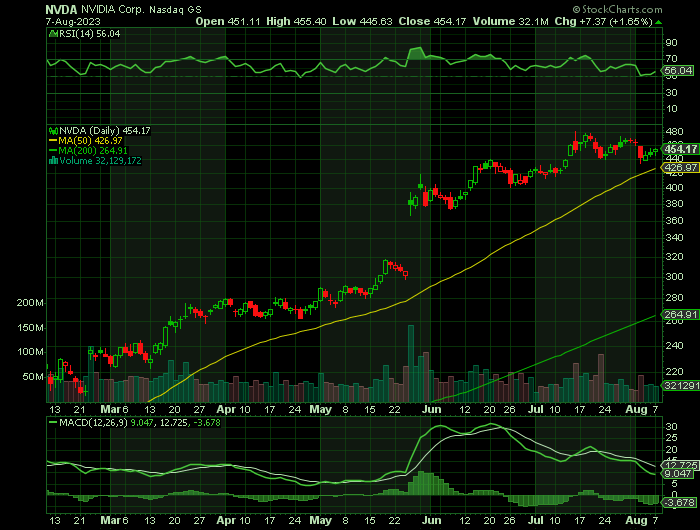

Nvidia

Stock Gains, Falls Back and Is Now Regaining!

Members Make

Potential Profit of 52%, in 3 Hours, Using A Weekly Call

Option!

Nvidia's stock has more than tripled due to its accelerating sales of high-end data center GPUs, which are used to process complex machine learning and AI tasks.

All of the leading "generative AI" platforms -- including ChatGPT and DALL-E -- currently use Nvidia's GPUs.

This set the scene for Weekly Options USA Members to Make Potential Profit Of 52%, using a NVDA Weekly Options trade!

Join Us And Get The Trades – become a member today!

Monday, August 07, 2023

by Ian Harvey

Analysts expect Nvidia's brisk sales of data center GPUs, along with the gradual recovery of its gaming business, to boost its full-year revenue and adjusted earnings by 61% and 138%, respectively, in fiscal 2024.

So, Wall Street analyst estimates just pushed next year's topline revenue another $2 billion higher to $57B in the past few weeks -- representing 33.7% growth.

That would represent a stunning acceleration from Nvidia's flat revenue growth and 25% decline in adjusted earnings in fiscal 2023.

Nvidia's near-term gains might be limited, but it could potentially double its share price again over the next few years if it remains the preferred chipmaker of the generative AI market.

Why the NVDA Weekly Options Trade was Originally Executed!

NVIDIA Corporation (NASDAQ:NVDA), a giant in data centers and gaming, continues to storm ahead. The chip giant is seen as one of the biggest winners of the AI boom.

In the tech industry's fierce battle for AI dominance, the advanced chips needed for generative AI, such as the ChatGPT chatbot, are key.

Nvidia delivered annual revenue of $4.3 billion in fiscal 2013 (which ended in January 2013 and coincided largely with calendar year 2012). By fiscal 2023, which ended in January of this year, Nvidia's annual revenue increased to $27 billion. The chipmaker's revenue has increased over 6 times over the past decade.

The good part is that the chipmaker is expected to sustain its terrific revenue growth in the future as well.

The NVDA Weekly Options Trade Explained.....

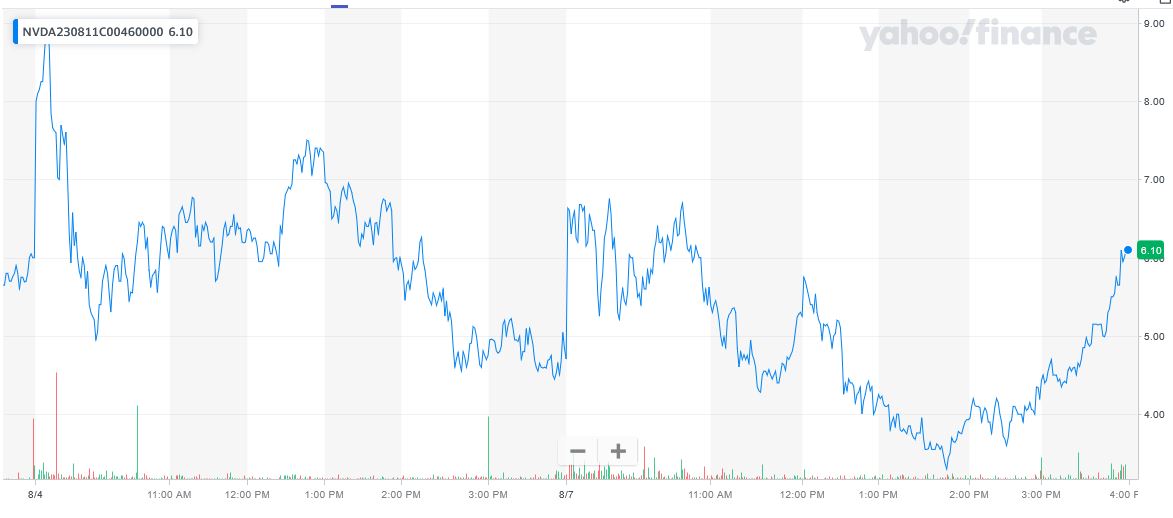

** OPTION TRADE: Buy NVDA AUG 11 2023 460.000 CALLS - price at last close was $6.00 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NVDA Weekly Options (CALL) Trade on Friday, August 04, 2023, at 10.06, for $4.95.

Sold half the NVDA weekly options contracts on Friday, August 04, 2023, at 12:46, for $7.50; a potential profit of 52%.

Holding the remaining NVDA weekly options contracts for further profit due to an expected surge after reporting positive earnings.

Don’t miss out on further trades – become a member today!

Further Catalysts for the NVDA Weekly Options Trade…..

In May, Nvidia Chief Executive Jensen Huang announced a new supercomputer, software and services for generative AI (artificial intelligence). Generative AI can create content, including written articles, from simple descriptive phrases by analyzing and digesting vast amounts of data. It can also write computer programming code.

For its latest quarter, graphics-chip maker Nvidia crushed Wall Street's targets on record data-center sales. Production is ramping up to meet huge demand for AI technology, CEO Huang said.

On May 24, the chip giant delivered a big beat-and-raise report. The Nvidia earnings report included a bullish, AI-fueled sales forecast.

The Santa Clara, Calif.-based company earned $1.09 a share on sales of $7.19 billion in the quarter ended April 30. Year over year, Nvidia earnings dropped 20% while sales fell 13%. But the results easily outpaced Wall Street's expectations.

In Q1, data-center sales rose 14% to $4.28 billion. Gaming-chip sales fell 38% to $2.24 billion.

Analysts expect Nvidia earnings per share to rebound 138% in fiscal 2024, on a 61% sales gain. Last year, Nvidia earnings fell 25%.

Its next quarterly report is expected on Aug. 23.

Nvidia's revenue is expected to jump 2.6 times over the next three fiscal years when compared to its fiscal 2023 revenue, clocking a compound annual growth rate (CAGR) of 38%.

Other Catalysts.....

On a fundamental level, Nvidia earnings are expected to return to growth. They should more than double this fiscal year, driven by booming chip sales for data centers and artificial intelligence.

The fabless chipmaker is expanding in other growth areas such as automated electric cars and cloud gaming as well. The adoption of the metaverse and cryptocurrencies could further stoke demand for Nvidia chips.

CoreWeave.....

Specialized cloud provider CoreWeave has raised $2.3 billion in a debt facility led by Magnetar Capital and Blackstone and collateralized by Nvidia chips, with the funds to be used to expand to meet rising AI workload, the company said on Thursday.

Nvidia-backed CoreWeave has seen a boost from the generative AI boom thanks to its purpose-built cloud infrastructure at scale. It has partnerships with AI startups and cloud providers, which it also competes with, to build clusters to power AI workload.

The company has unique access to the most advanced Nvidia chips that are in short supply, giving it an edge in competition with traditional cloud providers like Microsoft, Amazon and Google, which are facing supply restraints while working on developing their own chips.

Moving Ahead.....

Seventy percent of Nvidia's revenue opportunity will come from selling chips for various applications, and the good part is that the company dominates those segments. For instance, the company controls 84% of the market for gaming graphics processing units (GPUs), according to Jon Peddie Research. It already cornered a big chunk of the nascent cloud-gaming market as well, which has the potential to substantially boost its growth in the future.

Meanwhile, the company is also making solid progress in the automotive market by quickly building up a nice revenue pipeline.

In terms of data center chips, Nvidia sees a $300 billion revenue opportunity in enterprise and high-performance computing. AI is going to play a key role in this segment's growth, driven by the need for chips to train AI models and for running inference applications as well. Precedence Research estimates that the AI chip market could generate annual revenue of almost $230 billion in 2032, up from just under $17 billion last year.

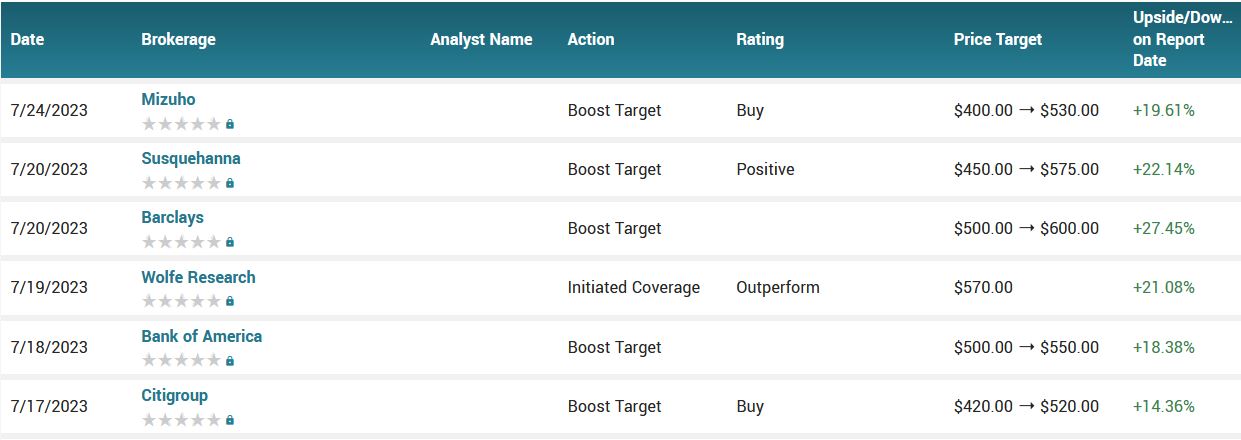

Analysts.....

Mizuho Securities analyst Vijay Rakesh is quite upbeat about Nvidia's prospects in the market for AI chips, pointing out that the company could generate $300 billion in AI-specific revenue by 2027 even if its share of this market dips to 75%.

According to the issued ratings of 38 analysts in the last year, the consensus rating for NVIDIA stock is Moderate Buy based on the current 1 sell rating, 5 hold ratings, 31 buy ratings and 1 strong buy rating for NVDA. The average twelve-month price prediction for NVIDIA is $425.00 with a high price target of $600.00 and a low price target of $185.00.

Summary.....

Nvidia's revenue has increased sixfold in the past 10 years, and there is a chance that it may grow at a faster pace in the coming decade.

The semiconductor specialist evolved significantly over the past 10 years. From being a supplier of graphics processors for personal computers (PCs) and smartphones a decade ago, Nvidia expanded its wings into multiple high-growth markets such as automotive, data centers, cloud computing, artificial intelligence (AI), digital twins, and cloud gaming.

As a result, it won't be surprising to see Nvidia replicate its outstanding run on the stock market over the coming years as well.

Nvidia has a five-year average price-to-sales ratio of 18.4. Assuming that multiple drops down to 10 after a decade, the company's market cap could jump to $2.5 trillion over the next 10 years based on revenue projections. That would be more than double Nvidia's current market cap. However, it won't be surprising to see this semiconductor stock deliver an even bigger upside since it could grow at a faster pace thanks to the trillion-dollar revenue opportunity it is sitting on.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.