TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

NVIDIA (NVDA) Shares Provide 50% Potential Profit in 2 Hours!

Patience to Buy – Quick to

Sell

Members of “Weekly Options USA,”

Using A Weekly CALL Option, Make Potential Profit Of 50%,

As Artificial Intelligence Becomes A Key Driver Behind

The Surge Higher!

Where To Now?

Also, CFRA Research analyst Angelo Zino reiterated his buy rating on NVIDIA stock.

Among those semiconductor stocks, Nvidia has the strongest position in the burgeoning AI market.

This set the scene for Weekly Options USA Members to profit by 50%, using a NVIDIA Weekly Options trade!

Join Us And Get The Trades – become a member today!

Thursday, June 23, 2023

by Ian Harvey

In a Tuesday note, the global markets team at Capital Economics moved up its year-end forecast for the S&P 500 from 4,500 to 5,500 in 2024 and from 5,000 to 6,500 in 2025.

A key driver behind that surge higher will be artificial intelligence, it said.

"We think investors' enthusiasm about AI has room to grow even further over the next couple of years," Capital Economics senior markets economist Thomas Mathews wrote. "New technologies – even those that have turned out to be genuinely transformative – have often manifested in the inflation of 'bubbles' in stock prices in the past. We are increasingly of the view that we're seeing something similar now or, at the very least, that we are in a period in which enthusiasm about AI technology could grow further and provide a strong tailwind for equity indices more broadly. "

Mathews is the latest strategist to get behind what's become a growing consensus among firms discussing the outlook for US equities: AI will drive stocks higher.

Bank of America and RBC both referenced AI when boosting their 2023 year-end price targets for the S&P 500, while Goldman Sachs called the S&P 500 undervalued due to AI.

"We assume that widespread AI adoption occurs in 10 years and lifts trend real GDP growth by 1.1 percentage point for 10 years. In this scenario, earnings per share in 20 years would be 11% greater than our current assumption and the S&P 500 fair value would be 9% higher than today, holding all else equal," Goldman Sachs strategist Ryan Hammond wrote in a note on June 6.

The mentions of AI in Wall Street commentary have followed a first-quarter earnings season littered with the word.

There are companies that have laid out clear revenue streams like NVIDIA Corporation (NASDAQ:NVDA), whose current quarter expectations for $11 billion in revenue topped Street estimates for $7.2 billion.

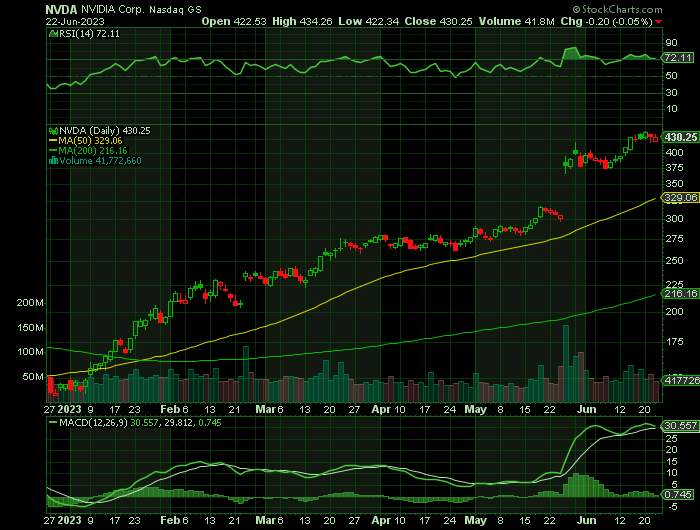

Nvidia fell 1.7% to $430.45 on Wednesday, off session lows. But the real divergence is in the charts. NVDA stock fell after hitting a record high Tuesday. It's still well above the 10-day and 21-day lines. Shares fell 1% early Thursday.

The NVIDIA Weekly Options Trade Explained.....

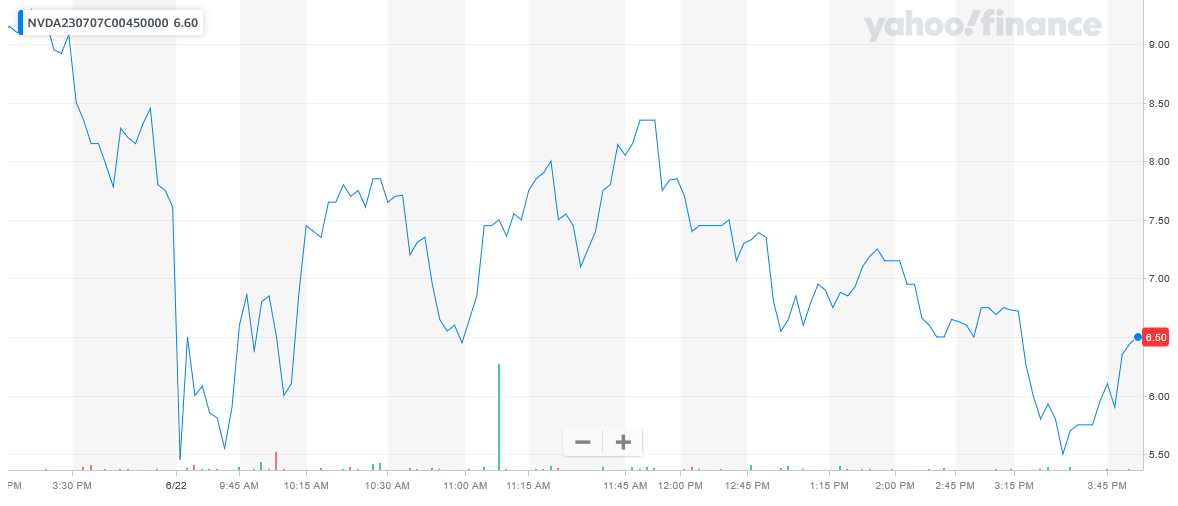

** OPTION TRADE: Buy NVDA JUL 07 2023 450.000 CALLS - price at last close was $7.61 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NVDA Weekly Options (CALL) Trade on Thursday, June 22, 2023, at 9:42, for $5.55.

QUICK TO SELL

Sold half the NVDA weekly options contracts on Thursday, June 22, 2023, at 11:47, for $8.35; a potential profit of 50%.

Holding the remaining NVDA weekly options contracts for further profit before expiry.

Don’t miss out on further trades – become a member today!

About NVIDIA.....

NVIDIA Corporation ranks among the world’s leading microchip manufacturers and is best known for its contributions in the fields of graphics and gaming. Its chips and related software power the fastest, highest-resolution graphics and are featured in a line of products that include solutions for all end-market uses. Along with gaming, NVIDIA microchips are used in visualization, datacenter, AI, and autonomous vehicles just to name a few.

NVIDIA was founded in 1993 by three friends and is headquartered in Santa Clara, California. The company was intended to focus on chips for the budding gaming and entertainment industry that was spawned by the rise of the personal computer and the Internet. At the time of its founding, there were less than 30 graphics-focused independent operators and that figure would more than double over the next few years.

NVIDIA launched its first product in 1995 called the NV1 and paved the way for 3-D games like Sega’s Virtual Fighter. The next big break came in 1996 with the launch of Microsoft DirectX Drivers which changed how Windows interfaced with games. The next year, in 1997, the company will release the world’s first 128-bit 3-D processor. It quickly gains acceptance gaming OEMs and more than 1 million units are shipped the first four months. Later, in 199, the company will invet the GPU and change the world of computing forever. The GPU will not only enhance the graphics capabilities of the PC but lead to accelerated-computing and AI as well. NVIDIA also held its IPO that same year.

Founders Jensen Huang and Chris Malachowsky are still in leadership positions. Mr. Huang has served as the company’s CEO, president, and board member since the company’s founding. Mr. Malachowsky serves as a member of the company’s executive staff and is a senior technology executive.

Today, NVIDIA Corporation is the only remaining independently operating graphics-focused microchip company in operation. The company’s business has evolved from the core gaming-oriented business to include graphics-oriented computing, and networking solutions in the United States, Taiwan, China, and internationally but gaming is still a pillar of the business.

NVIDIA’s Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and software solutions for gaming platforms. The company also offers the Quadro/NVIDIA RTX GPUs for enterprise-level workstation graphics, the vGPU software for cloud-based visual and virtual computing, and entertainment platforms for OEM auto manufacturers, and Omniverse software for 3-D world-building.

NVIDIA’s Compute & Networking segment provides a wide range of solutions for interconnect, AI/autonomous driving, cryptocurrency mining, robotics, Data Center platforms and accelerated computing. Products include Mellanox for networking and interconnect, Jetson for robotics and embedded applications, and AI Enterprise software among others.

Further Catalysts for the NVDA Weekly Options Trade…..

CFRA Research analyst Angelo Zino reiterated his buy rating on NVIDIA stock.

Among those semiconductor stocks, Nvidia has the strongest position in the burgeoning AI market.

"Nvidia has the greatest revenue representation tied to AI, followed by AMD, Broadcom and Marvell," Zino said.

He added, "We think Nvidia's GPUs (graphics processing units), software capabilities, recent entry into CPUs (central processing units), and expertise on the networking side make it poised to be a clear standout performer for years to come."

The emergence of generative AI as a killer application for artificial intelligence kicked off a massive upgrade cycle for data center hardware, Zino said.

Generative AI can create content, including written articles, images, videos and music, from simple descriptive phrases. Artificial intelligence systems analyze and digest vast amounts of data to create new works. Generative AI also can write computer programming code.

Meanwhile, Nvidia has transformed from a semiconductor company to a total systems provider.

"When all is said and done, we believe Nvidia will be viewed as the poster child for all things AI (similar to what Apple (AAPL) has meant to mobility, Amazon (AMZN) to e-commerce, and Netflix (NFLX) to streaming)," Zino said.

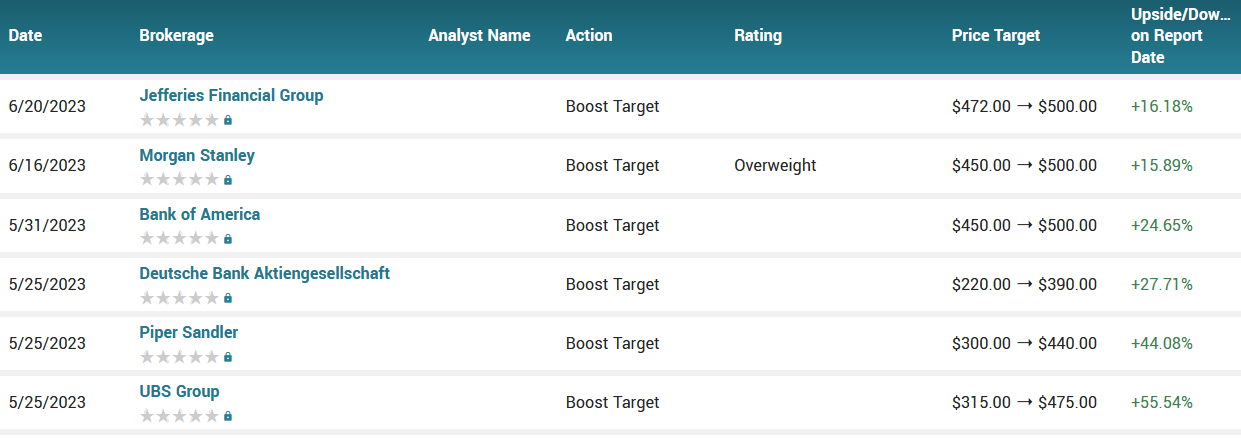

Zino has a 12-month price target on Nvidia stock of $480.

Other Catalysts.....

Nvidia's scorching stock rally just hit another milestone.

Shares in the Santa Clara-based chipmaker have extended their 2023 gains to an eye-popping 200% - meaning the price has tripled so far this year. They closed at a record high of $438.08 apiece on Tuesday. The rally has boosted the company's market value by an astounding $723 billion to $1.08 trillion.

The stock surge comes as investors pile into artificial intelligence-related companies including Nvidia, Microsoft and Alphabet following the smashing debut of OpenAI's human-like chatbot ChatGPT. Nvidia, specifically, has drawn fans as it dominates the market for high-intensity computing infrastructure that's required for AI projects.

The semiconductor firm entered the $1 trillion market-cap club for the first time last month, joining a band of other elite companies with sky-high valuations. The stock rally has also pumped up the wealth of the company's CEO Jensen Huang to $39.2 billion, making him the 34th richest person in the world, per the Bloomberg Billionaire's Index.

Morgan Stanley has named Nvidia stock its "top pick" and forecast this week that the company's shares could climb a further 15% from current levels.

Billionaire investor Stanley Druckenmiller, who has snapped up $220 million of Nvidia stock, has said the shares are worth holding onto for the next few years.

ESG Funds .....

Nvidia Corp.’s stratospheric ascent has lured at least 100 more ESG funds in recent weeks, transforming the company into one of the most popular stocks among asset managers who integrate environmental, social and governance metrics into their investment strategies.

There are now over 1,400 ESG funds directly holding Nvidia, according to data compiled by Bloomberg based on the latest filings. A further 500 are indirectly exposed, the data show. Nvidia shares hit a record high this week, bringing gains so far in 2023 to about 200%.

The company is now more popular among ESG investors than traditional green powerhouses such as Vestas Wind Systems A/S and Tesla Inc., according to the Bloomberg data. The funds analyzed are registered as either “promoting” ESG, making it their “objective” or simply marketing themselves as ESG.

Nvidia has become an “ESG darling,” said Felix Boudreault, managing partner at Montreal-based Sustainable Market Strategies. And that’s “not ludicrous,” because the company is “exemplary” when it comes to traditional ESG risk management, he said.

Daniel Klier, chief executive officer of sustainability data and technology firm ESG Book, calls Nvidia “one of the best-performing companies in the large-cap universe,” thanks to a high level of ESG disclosures and a business that’s aligned with the critical global warming threshold of 1.5C.

Peter Krull, partner and director of sustainable investing at Earth Equity Advisors, a Prime Capital Investment Advisors company, says Nvidia is “absolutely” a good sustainable investment. “They’re making the steps that big companies need to make to both be lighter on the planet” with their products, and contributing to innovation, he said.

Earnings.....

On May 24, the chip giant delivered a big beat-and-raise report. The Nvidia earnings report included a bullish, AI-fueled sales forecast.

The Santa Clara, Calif.-based company earned $1.09 a share on sales of $7.19 billion in the quarter ended April 30. Year over year, Nvidia earnings dropped 20% while sales fell 13%. But the results easily outpaced Wall Street's expectations.

In Q1, data-center sales rose 14% to $4.28 billion. Gaming-chip sales fell 38% to $2.24 billion.

Analysts expect Nvidia earnings to rebound 109% in fiscal 2024, on a 55% sales gain. Last year, Nvidia earnings fell 25%.

Analysts.....

"The AI hype surrounding the Tech sector is real and likely to propel future growth for many stocks within the space," BMO Capital Markets chief investment strategist Brian Belski wrote in a note that included an S&P 500 price target bump on June 5. "So, despite an extremely strong (year-to-date) sector performance, we believe the momentum, even if it slows a bit, is likely to persist for the foreseeable future."

According to the issued ratings of 37 analysts in the last year, the consensus rating for NVIDIA stock is Moderate Buy based on the current 1 sell rating, 6 hold ratings, 29 buy ratings and 1 strong buy rating for NVDA. The average twelve-month price prediction for NVIDIA is $383.19 with a high price target of $500.00 and a low price target of $133.00.

Summary.....

Nvidia stock rocketed in May on blowout earnings and strong guidance.

Year to date, Nvidia stock has skyrocketed 195%, after crashing in 2022.

Shares of NASDAQ NVDA traded down $7.63 during midday trading on Wednesday, hitting $430.45. The stock had a trading volume of 54,856,239 shares, compared to its average volume of 49,124,965. The company has a quick ratio of 2.79, a current ratio of 3.43 and a debt-to-equity ratio of 0.40. The stock has a 50 day simple moving average of $328.19 and a 200-day simple moving average of $249.89. The company has a market capitalization of $1.06 trillion, a PE ratio of 228.17, and a P/E/G ratio of 2.95 and a beta of 1.75. NVIDIA Co. has a 1 year low of $108.13 and a 1 year high of $439.90.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NVIDIA

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.