TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Nutrien Weekly Put Option Provides

Opportunity

For 362% Potential Profit!

Members of “Weekly Options USA,” Using A Weekly Put

Option,

HaVE The Possibility To Make Potential Profit Of 362%,

After Reporting A Lower-Than-Expected

Quarterly Profit.

where to now?

Join

Us and GET FUTURE TRADEs!

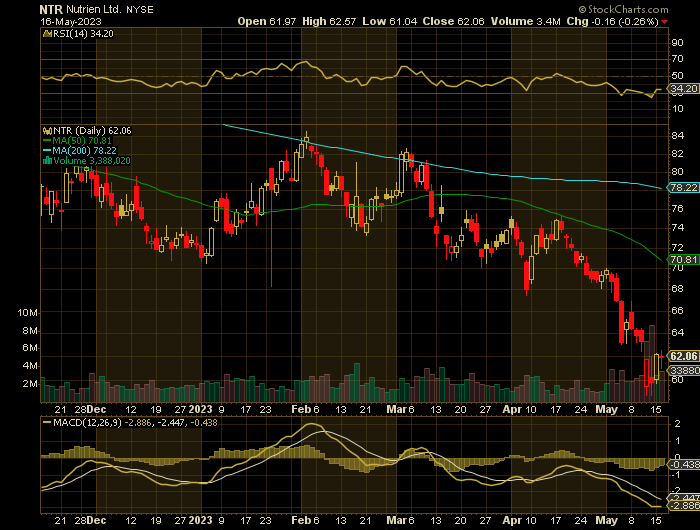

Shares of Nutrien Ltd (TSE: NTR) moved lower after reporting first-quarter 2023 profits of $576 million or $1.14 per share, down from $1,385 million or $2.49 in the year-ago quarter.

This set the scene for Weekly Options USA Members to profit by 362%, if taking the opportunity, using a NTR Weekly Options trade!

Join Us And Get The Trades – become a member today!

Wednesday, May 17, 2023

by Ian Harvey

Why the Nutrien Weekly Options Trade was Executed?

Nutrien Ltd (TSE: NTR) on Wednesday cut its forecast for 2023 earnings as elevated fertilizer prices owed to Western sanctions on Russia and Belarus weigh on demand.

U.S.-listed shares of the company fell 3.9% in extended trading as it also reported a lower-than-expected quarterly profit.

Though fertilizer prices have dipped from record highs scaled last year, farmers are holding back on purchases on expectations of a further decline.

The Canadian firm's North America potash sales volume dropped 30%, with prices averaging $401 per tonne during the reported quarter, 41% lower compared with last year.

The company cut its full-year adjusted earnings outlook to between $5.50 per share and $7.50 per share, from $8.45 per share to $10.65 per share forecast earlier.

Analysts on average expect a profit of $8.56 per share.

On an adjusted basis, the potash producer earned $1.11 per share for the quarter ended March 31, compared with estimates of $1.50.

The NTR Weekly Options Trade Explained.....

** OPTION TRADE 2: Buy NTR JUN 02 2023 62.000 PUTS - price at last close was $0.65 - adjust accordingly.

Obviously the results will vary from trader to trader depending on entry cost and exit price that was undertaken.

Entered the NTR Weekly Options (PUT) Trade on Thursday, May 11, 2023 for $0.65.

The NTR weekly options contract was bid $3.00; a potential profit of 362%.

The Earnings Report…..

Nutrien Ltd.

recorded first-quarter 2023 profits of $576 million or $1.14 per share, down

from $1,385 million or $2.49 in the year-ago quarter.

Barring one-time items, adjusted earnings per share (EPS) were $1.11. The

bottom line missed the Consensus Estimate of $1.54.

Sales decreased around 20.2% year over year to $6,107 million in the quarter.

The figure missed the Consensus Estimate of $6,672.9 million.

Nutrien's results were hurt by lower realized selling prices across its

segments and reduced sales volumes in Retail, Potash and Phosphate units. These

were partly offset by the lower cost of goods sold due to a decline in natural

gas costs and higher operating rates at its North American nitrogen plants.

Conclusion…..

Nutrien’s shares have plunged 40.9% in the past year compared with 38.4% decline of the industry.

Therefore…..

For future trades, join us here at Weekly Options USA, and get the full details on the next trade.

FINALLY.....

CLICK HERE and join our membership.

Back to Weekly Options USA Home Page from NUTRIEN

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.