TRADER’S TRIO SPECIAL

(BETTER THAN A BAKER’S DOZEN!)

BUY THREE MONTHS OF WEEKLY OPTIONS TRADING MEMBERSHIP FOR $357 AND GET A FOURTH MONTH FREE!

Search this site:

Nio Provides Traders With A

Double-Dip!

Unveils A New Power Plan!

And, “Weekly Options Members” Already Up 63%

Potential Profit!

More to Come?

April 19, 2021

Nio stock price bucked the trend of the day’s trading Monday by climbing into the green, and completing the day up 2.80%, which includes after-hours trading.

And, “Weekly Options Members” are now up potential profits of 63%, with the likely-hood of a lot more profits!

Therefore, more upwards movement is expected, and for those that have exited the trade, a new trade may be considered.

Nio Inc – ADR (NYSE: NIO)

The Actual Recommended Trade…..

** OPTION TRADE: Buy NIO APR 23 2021 36.500 CALLS at approximately $1.10.

(actually bought for $1.16)

Nio Double-Dip Explained…..

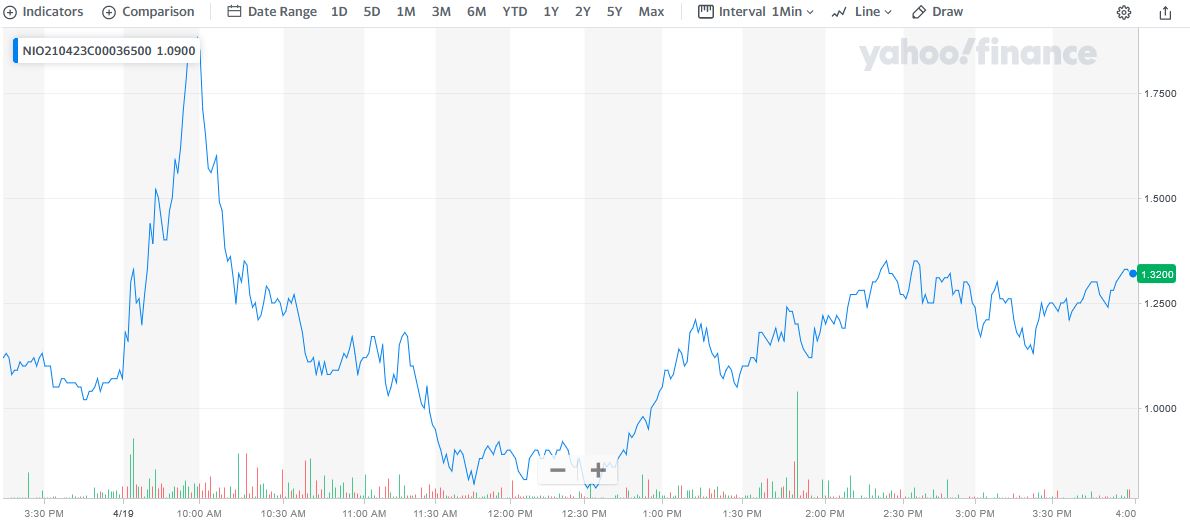

Weekly Options Members” entered a Nio weekly options trade on Monday, April 19, 2021 at 9:34am for $1.16.

By 9:59am (25 minutes later) the price of the option was resting at $1.89 – a nice profit of 63%.

The stock price of Nio pulled-back after this and provided another opportunity to enter the trade, at 12:31, for a cost of $0.79.

The price of Nio stock began to climb again after hours hitting $37.45, up more than 1.1%.

Therefore, if the market rallies Tuesday further profit can be expected.

TOTAL PROFIT FOR 25 Minutes of TRADING IS 63%

Prelude For Nio…..

NIO unveiled a new power plan for customers in Northern China and also showcased its upcoming ET7 sedan at the 19th International Automobile Industry Exhibition, widely known as Auto Shanghai 2021.

The plan is

a three-year initiative to add battery swap stations and various types of

chargers and charging stations in eight provinces and autonomous areas of the

country. NIO said in a statement, "The

Power North Plan will significantly better the power experience of electric

vehicle users in northern China."

The announcement of the plan came as the company presented its new ET7 luxury sedan at the Shanghai auto show. The high-end EV will be available next year, and is NIO's first sedan model, in contrast to its current SUV designs.

As announced at its launch in January, the ET7 will include the Nio Autonomous Driving, NAD, Aquila super sending system and Adam super computing platform.

The interior of the car is available in three new themes: storm gray, sand brown and edelweiss white, and the exterior comes in cloud white, deep black, star gray and southern star.

Also, Nio Life presented the Blue Sky Lab, a fashion project based on automotive industry recyclables that reuses the materials left from the car production to create a series of fashion products.

Why The Trade Recommendation On NIO?

Nio Inc – ADR (NYSE: NIO) has long been referred to as "the Tesla of China," and the company shows great promise in following in the footsteps of the EV pioneer.

NIO is a relatively small automaker right now, delivering just 7,257 vehicles in March. But those numbers are growing: NIO delivered more than 20,000 vehicles for the quarter, up 16% from the last three months of 2020.

What makes NIO intriguing is its upscale position in what is quickly becoming the world's most important auto market. NIO makes stylish, luxury vehicles with a strong reputation for technology, and NIO in China enjoys the same sort of word-of-mouth marketing from satisfied customers that Tesla benefits from in the U.S.

NIO only recently reached 100,000 total vehicles sold since its founding, but if all goes to plan it could sell that many in 2021 alone.

NIO, like Tesla, is valued at a premium to the incumbents. Its market capitalization is nearly $10 billion higher than Ford's, despite Ford selling more than 4 million vehicles annually. But as we've seen with Tesla, the market is more than willing to continue to pay up for rapid growth if a company is making inroads with its target audience.

NIO seems to be continuing its success, with the potential it offers and its initial progress in fulfilling that potential. The "Tesla of China" moniker is looking more prescient by the day.

NIO shares have soared more than 1,000% in the

past 12 months, but a more than 25% retrenchment since the start of 2021 has

more investors interested in the name. Considering the potential market, it's

not surprising that any bit of news with NIO garners much attention.

The Major Catalysts for This Trade.....

1. Ford and Nio Charging Network....

Ford (NYSE:F) said preorders are open in 20 cities in China for the locally made electric Mustang Mach-E. The surprise was that it is coordinating with NIO to allow Mach-E owners to use the NIO charging network, which would become a new source of revenue for the Chinese EV maker.

In a statement reported by CleanTechnica, Ford said: “Mustang Mach-E users can access over 300,000 high-quality public charging piles, of which 160,000 are fast charging, in more than 340 cities across the country through an exclusive APP. NIO's nationwide fast-charging network will also be accessible to Mustang Mach-E users.”

2. Signing Of A Strategic Partnership.....

NIO and Chinese state-owned oil and gas giant Sinopec Shanghai Petrochemical Company Limited (SHI) announced on Thursday the signing of a strategic partnership to build battery swap stations. Both companies posted news of their agreement on their Twitter feeds while sharing images of the unveiling of their new battery swap station 2.0 at Chaoying station in Beijing, which has now begun operating. It is the first second-generation battery swap station for the Chinese EV manufacturer, and its 201st overall, since the first was inaugurated in 2018.

Although the details and scale of the deal with NIO are not clear yet, Sinopec has stated that they aim to have 5,000 battery swap stations in their network by 2025, as they aim to transition to a higher presence in electricity and non-oil business. On NIO's side, the company’s goal, which it has described as conservative, is to have 500 battery swap stations by the end of 2021.

This is the largest so far, but not the only partnership of NIO’s in this space.

3. Agreement With Another State-Owned Infrastructure Company.....

A few weeks ago, NIO reached an agreement with another state-owned infrastructure company, Beijing Shoufa, to build stations in the Beijing area. NIO president Qin Lihong said on Thursday that they are aiming to add nearly 100 more third-party partners this year.

The idea of battery swap stations is that consumers can drive into the station with an uncharged battery and have it automatically replaced by a fully charged one in just a few minutes. The 2.0 version of these allows drivers to complete the battery swap without leaving their car and can perform up to 312 swaps per day.

A mass rollout of these stations is a key part of NIO’s BaaS strategy (battery as a service). With this model, customers do not purchase the battery with the car and own it, but rather pay a subscription fee to “rent” charged batteries and replace them as they become uncharged. By not including the battery, the initial purchase price of the vehicle is reduced by up to almost 20,000 USD. As more and more swap stations are deployed, the convenience gap between electric and petrol-fuelled vehicles could gradually disappear.

4. Moving Fastest.....

Though not the creator of the technology, NIO appears to be moving fastest towards dominating what could be the future of EV refueling, and it could be shaping up as a supplier of BaaS services to other manufacturers, increasing the scope of its business within the industry. The company already has an agreement with Ford Motor Company (F) to allow their Mustang-E in China to use these battery swapping stations too.

This step sets NIO apart from the competition and puts it on the road to be much more than an EV manufacturer, by also becoming a supplier of critical infrastructure in what will soon be the largest economy in the world.

5. Earnings.....

NIO’s next earnings report date is expected to be April 29, 2021.

For the full year, the Consensus Estimates are projecting earnings of -$0.37 per share and revenue of $5.21 billion, which would represent changes of +43.94% and +116.87%, respectively, from the prior year.

In the first quarter, the company delivered a record 20,060 vehicles, including its ES8, ES6 and EC6 models. The company has sold a cumulative 95,701 cars as of the end of the first quarter.

6. Pull-back Allows Come-back.....

NIO closed at $36.09 in the latest trading session, marking a +1.21% move from the prior day. This move outpaced the S&P 500's daily gain of 0.36%.

Coming into today, shares of the company had lost 17.29% in the past month. In that same time, the Auto-Tires-Trucks sector lost 1.39%, while the S&P 500 gained 5.21%.

7. Launch In Europe.....

NIO which has been sounding out plans to launch in Europe, is likely to make an official announcement concerning its European expansion plan on May 7 or 8.

Some services such as "one-click for power" will be chargeable in Europe, the outlet said in a tweet.

Nio is likely to set up European operations in the Norwegian capital of Oslo, and the first showroom will reportedly come in September, The company has reportedly hired Marius Hayler, the head of Tata-owned Jaguar Land Rover in Norway, as CEO of Nio Norway.

Reports of an imminent entry into Norway gain further credence following postings on Nio's LinkedIn page soliciting candidates for service technical support in Oslo.

Norway is the world leader in terms of EV adoption and sales penetration, partly supported by government incentives that make these vehicles more economical than internal combustion models in the Scandinavian country.

It is only logical that Nio has chosen Norway as its doorway into Europe.

8. Chinese Auto Sales.....

Vehicle sales in China for the month of March soared for the 12th straight month to 2.53 million units, per the China Association of Automobile Manufacturers (“CAAM”). Sales spiked 75% from the corresponding period of 2020, when the country’s vehicle demand was badly hit by coronavirus woes.

For the first quarter of 2021, sales surged 76% year over year to top 6.48 million units. The massive jump was due to lower severity of COVID-19 impacts, which crimped showroom traffic in the comparable year-ago quarter.

In fact, automakers in China suffered their bleakest ever quarter in the January-March 2020 period. However, thanks to supportive government policies, gradual reopening of economic activities and pent-up vehicle demand, China is now at the forefront of global auto market recovery.

9. China EV Market on Fire…..

Demand for new energy vehicles (NEVs) has been on the rise amid climate change concerns and favorable government policies. Importantly, the country projects electric vehicles (EVs) to account for 25% of new car sales by 2025.

Last April, the government of China announced plans to extend subsidies and tax breaks for NEVs such as electric or plug-in hybrid cars for another two years to spur sales. Buoyed by favorable government policies and improving consumer confidence and economy, China — world’s largest EV market — is seeing solid sales of zero-emission vehicles.

NIO delivered 7,257 EVs last month, skyrocketing 373% year over year.

10. The 19th Shanghai International Automobile Industry Exhibition.....

The 19th Shanghai International Automobile Industry Exhibition, named Auto Shanghai 2021, starts today at the National Exhibition and Convention Center. The event is open to the press on Monday and Tuesday, then to the public April 21-28.

The theme for the year's event is "Embracing Change," which will put the focus on electric vehicles, autonomous driving and connected cars.

Nio confirmed it will unveil a new Nio Power plan and also officially reveal the interior of the ET7, the EV maker's fourth mass-produced model.

The company also said it will release a series of initiatives and service solutions, and share the latest product development and progress.

11. Analysts Positivity.....

Wall Street analysts remain highly positive on the electric vehicle (EV) sector. Despite stocks like NIO losing momentum, the analysts are still shouting ‘buy’.

The NIO share price soared 1,210% last year on optimism surrounding its rising order book and flashy product launches. Tipped as a major competitor to Tesla, many believe NIO will be a long-term survivor of the 2020 EV mania.

Analysts are now pushing a target price for NIO of around $61 a share. That’s 57% up from today’s price, or up 14% from the beginning of the year.

The shares of Nio Inc have received a price target of $70 by Deutsche Bank. And Deutsche Bank analyst Edison Yu rated NIO with a “Buy” rating.

In a research report, Yu wrote that every major technology company is “now planning to build at least some part of the electric vehicle.” For example, Yu pointed out that Baidu, Foxconn, Huawei, and Xiamoni are among several companies getting into the Chinese electric vehicle market.

Summary.....

Nio is armed with the wherewithal to carve a niche for itself in the EV market. The company has been dynamic in responding to the evolving climate, and clear evidence was its ability to meet production targets in the first quarter despite constrained by the chip shortage that forced factory closure.

The company has made the concept of battery-swapping its own. Later this week, the company is set to announce a partnership with Sinopec Shanghai Petrochemical Co. SHI 0.16% to establish its second-generation battery swap station at the latter's gasoline stations.

Nio is all set to kickstart its European expansion, planning to set up its first showroom in Norway in September.

The company will commercially launch its recently announced ET7 sedan, which by the company's own account; will give an altogether different experience to users. A cost-competitive sedan, probably under a different brand name, is also in the offing.

Final Say.....

So, including the stock price movement within the after-hours trading, Nio is now up 2.80%. Therefore, it is very likely that the stock will continue to move north, based on the catalysts already mentioned, and, particularly if the overall stock market can regain its footing Tuesday.

Therefore…..

Will Nio Stock Price Continue To Climb?

Will We Recommend Another Trade On Nio Stock?

What Other Trades Are We Anticipating?

Do You Wish To Be Part Of This Action?

For answers, join us here at Weekly Options USA, and get the full details on the next trade.

Join us today and find out!

While there are many more areas that can help to explain option trading, this is a basic overview of what stock options are, and where and how they started.

Recent Articles

-

Weekly Option Trade Results

The results from recent trades offered through our membership service are listed on this page. -

Amazon Weekly Option Trade Delivers 318% Gain as Analysts Turn Bullish

Amazon.com, Inc. (NASDAQ: AMZN): Weekly Options Trade Delivers 318% Gain as Analysts Turn Even More Bullish -

Affirm Options Trade Soars 103% in 3 Days as Analysts Turn Bullish

Affirm stock surged after strong earnings, with a Weekly Options USA trade gaining 103% in 3 days as analysts raised price targets.

Back to Weekly Options USA Home Page from Nio Provides Traders With A Double-Dip!